Lower for longer – the path to Fed tightening

The disclosure of the latest Federal Open Market Committee (FOMC) meeting minutes last night has pushed the US bond market to new lows for the year, further extending the current bear market in world government bonds. Looking at what the Fed is doing is nothing new. Back in the day when I first started, we had dedicated teams of Fed watchers, trying to work out its next move, as rate changes were frequent and unpredictable. The current policy is to make less frequent changes and be more transparent. So what does the FOMC’s forward guidance by providing its internal thoughts tell us today?

The committee knows that what is discussed will affect the markets, so a stylised version of its discussion needs to be produced. The release of the minutes is a manufactured and glossy disclosure of its work presented to make the FOMC look good and influence its followers. So what was the message from last night?

Well, it is more of the same about the need to tighten as we previously blogged here. The Fed continues to follow the script. The basic scenario is that they need to get the party goers out of the bar with the minimum trouble. This is why the Fed is keen for us to see that they discussed reducing the unemployment threshold at the last meeting. This is akin to saying ‘drink up’ to a late night reveller, with the hint that once they’ve done so there is a chance the bar staff will pour them another drink.

The Fed wants a steady bear market in bonds in this tightening cycle as it is still fearful over economic strength and fortunately inflationary pressures remain benign. This is very different from major tightening cycles in the past such as 1994, when the Fed was more keen to create uncertainty and fear in the bond market as they wanted to tighten rapidly and were still fearful of inflation given the experience of the 70s and 80s.

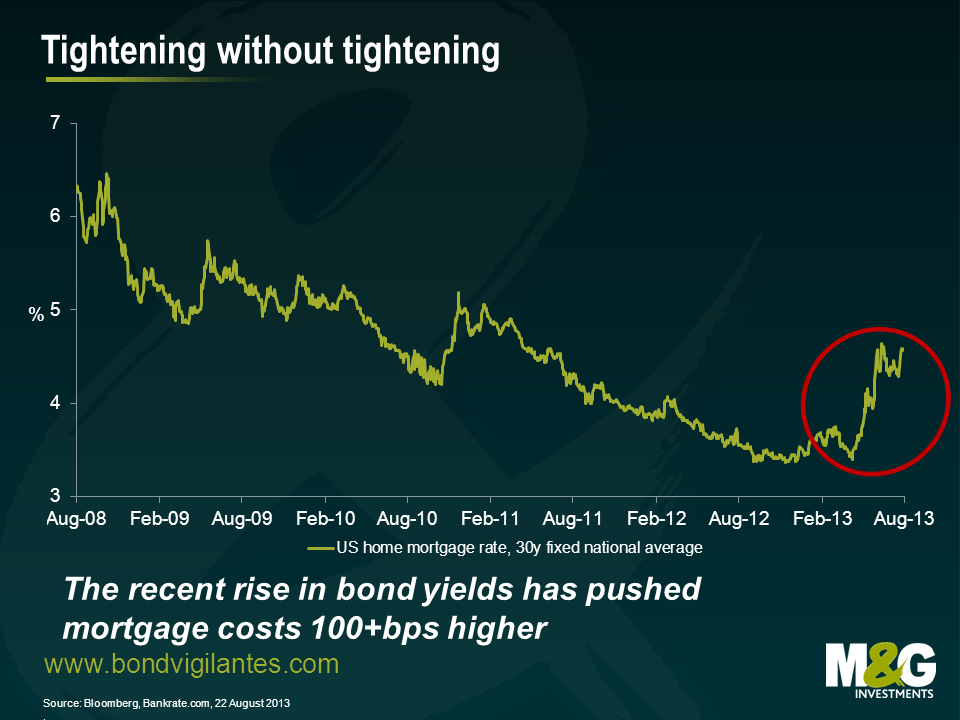

So when will official interest rates go up? Strangely you could argue that the successful creation of a steady bear market in bonds extends the period they can keep rates on hold. Monetary tightening via the long end reduces the need for monetary tightening in the conventional way. For example, as you can see from the following chart, the 100bps or so sell-off in 30 year treasuries since May has translated into a similar move higher in mortgage costs for the average American.

If the Fed has its way in guiding a steady bear market in bonds, then bizarrely short rates could indeed stay lower for longer.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox