It’s a knockout – why the gilt and currency markets have no love for Carney’s forward guidance

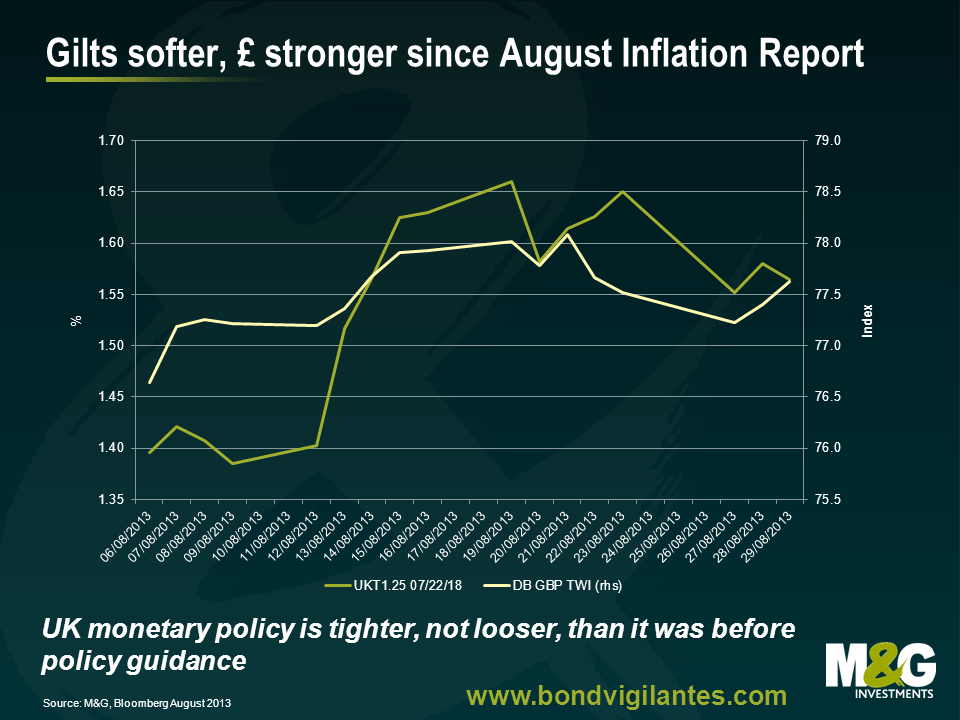

Millwall FC wasn’t the only team to trek up to Nottingham yesterday from London and to come back empty handed (at the hands of the mighty, mighty Forest). Team Carney from the Bank of England also had an unproductive time of it in the East Midlands as the new Governor gave his first speech in the role to the CBI, Chamber of Commerce and the Institute of Directors. Since the publication of the August Inflation Report, in which the Monetary Policy Committee delivered its framework for forward guidance, the markets have done the opposite of what the Bank had hoped for. The gilt market has sold off – not just at medium and long maturities, which are largely outside of direct Bank control and are more dependent on global bond market trends, but also at the short end, where 5-year gilt yields have risen by 20 bps in under a month. There has also been a de facto tightening of UK monetary conditions through the currency. Trade weighted sterling is 1% higher than it was before forward guidance came in. Both the gilt market and the pound went the “wrong” way as Carney discussed forward guidance yesterday afternoon. The Overnight Index Swaps market (OIS), which prices expectations of future official rate moves, fully prices a 25 bps Bank rate hike between 2 and 3 years’ time.

So why don’t markets believe Mark Carney? In yesterday’s speech he was clear that the UK’s economic recovery was “fledgling”, and weaker than recoveries elsewhere in the world. He spent some time discussing how a fall in unemployment to the 7% threshold would mean 750,000 new jobs having to be created, which would take some time, possibly three years or longer. And even if growth picked up, it didn’t necessarily follow that jobs growth would be strong. But two things led gilts lower yesterday afternoon. Firstly there was the announcement that UK banks would be able to reduce the amount of government bonds that they hold as a liquidity buffer so long as their capital base is over 7% risk-weighted assets – potentially triggering sales of tens of billions of gilts over the next couple of years. But more importantly, Carney’s attempted rollback from the “knockouts” stated in the Inflation Report was not strong enough.

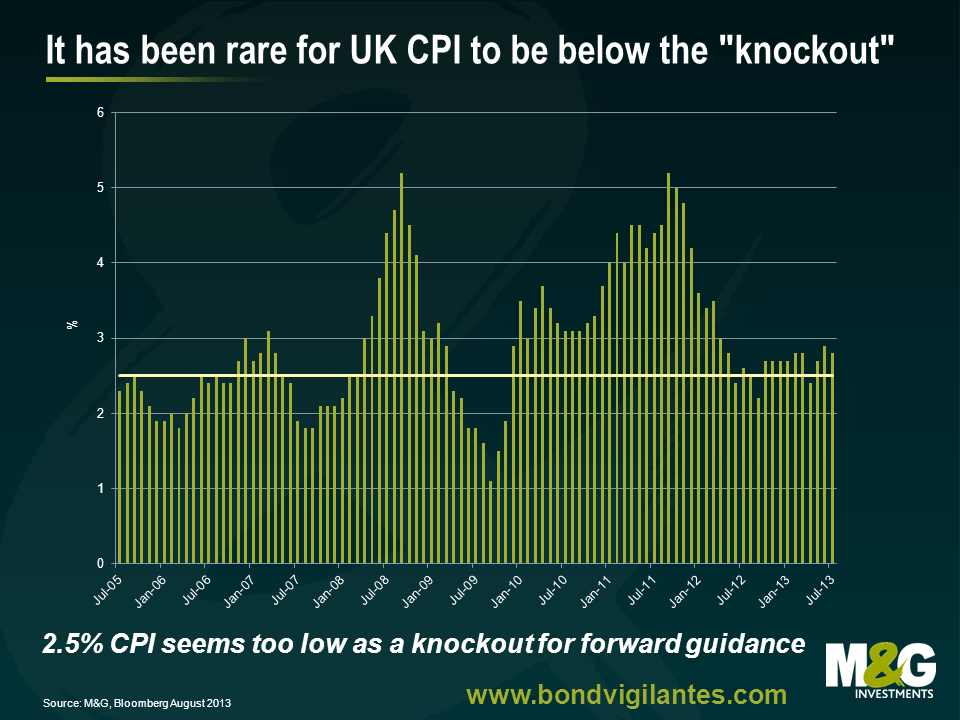

On page 7 of the Inflation Report, after detailing the forward guidance linking rates and asset purchases to the 7% unemployment rate, there are three “knockouts” which would cause the guidance to “cease to hold”. The first knockout is the most important. If CPI inflation is, in the Bank’s view, likely to be 2.5% or higher in 1 1/2 to 2 years’ time then the unemployment trigger becomes irrelevant. The other two knockouts were that medium term inflation expectations become unanchored, and that the Financial Policy Committee judges that the monetary policy stance is a significant threat to financial stability.

So for all the talk of the UK’s weak economy, and the accommodative stance that the Bank will take to allow the unemployment rate to fall to 7%, perhaps over many years, don’t forget that if CPI inflation looks likely to be at 2.5% or higher, the MPC will ignore the jobs market promise. Since the middle of 2005, UK CPI has been at or above 2.5% most of the time, through a strong economy and (for longer) the weak economy. Since the start of 2010 there have only been 3 months of sub 2.5% year-on-year CPI. And in 2008 and 2011 the year-on-year rates exceeded 5%.

Of course, the Bank of England can forecast inflation to be whatever it likes over the next 1 1/2 to 2 years. Its inflation forecasts have famously been awful for years, always predicting inflation would return to 2% when it always was much higher than that. But it will be important for Carney to earn some credibility here in the UK, and the days of the Inflation Report’s “delta of blood” inflation forecast always showing a mid point for future inflation of 2% must surely have ended when Mervyn King left. What does the outside world think about the prospects of UK inflation being below 2.5% in the future? Here the news is better – the consensus broker economic forecast is for CPI to fall to 2.4% in 2014 and 2.1% in 2015. And the implied inflation rate from the UK index-linked gilt market is for an average of 2.8% per year over the next five years on an RPI basis, which given the structural wedge between RPI and CPI suggests that the market’s CPI forecast is somewhere below 2.5%. M&G has launched a new Inflation Expectations Survey, together with YouGov. We should have August results shortly, but in our last release we saw that 1 year ahead UK consumer expectations of inflation ran at 2.7% (a fall from 3% a quarter earlier) and 5 year ahead expectations were at 3%. Higher than the 2.5% target, but consumer expectations are often higher than the market, and the 3% level has been stable (well “anchored”).

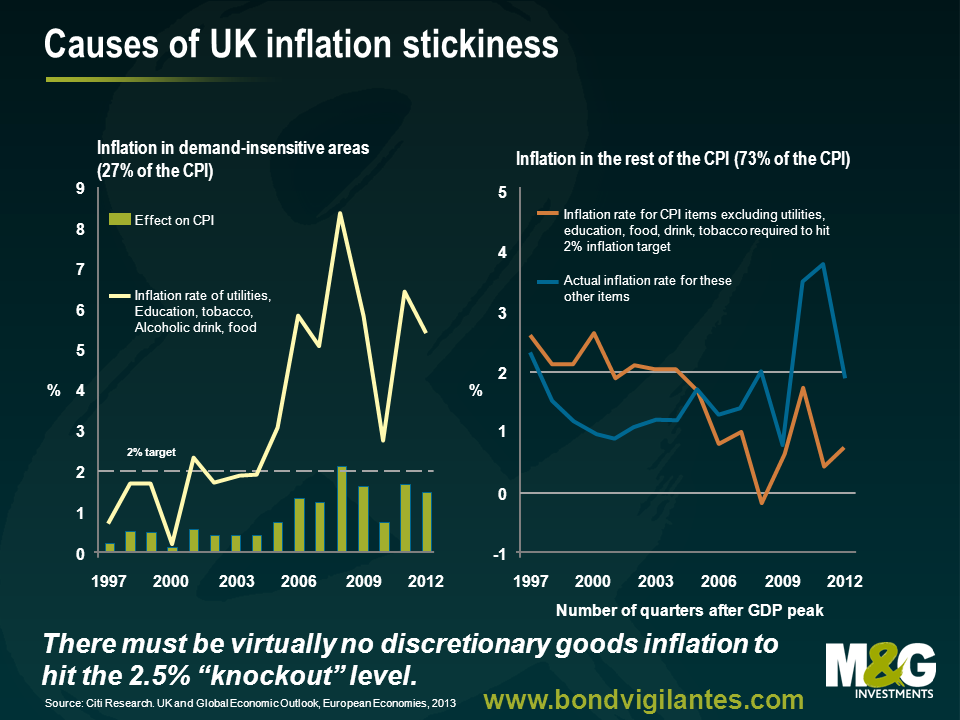

But as we have seen, UK inflation has been notoriously sticky. Not because consumers are demanding more goods than the shops can supply (although there has been some long awaited good news from the retail sector lately, with sales stronger), as in general real incomes have been squeezed and discretionary spending has been hit. But because non-discretionary items, like food and energy costs, have substantially exceeded the inflation rates of consumer goods. Add to this administered prices relating to public transport costs or university tuition fees and we can see that the UK’s “inflation problem” is potentially something that a monetary policymaker can only influence by forcing discretionary spending into deflation. The chart below shows that so long as the non-discretionary basket of goods keeps inflating at around 5% per year, there must be virtually no inflation in discretionary goods in order to get below Carney’s 2.5% knockout.

So it is going to be tough for the market to believe that the CPI inflation “knockout” won’t have a decent chance of coming into play well before the 7% unemployment threshold is reached. I think Carney missed an opportunity to move away from the knockouts yesterday – he certainly didn’t use the term again, and implied that the gilt market’s move lower was driven by international developments and over-optimism about the prospects for a quick fall in UK unemployment. But the three knockouts were almost dismissed in the sentence “provided there are no material threats to either price or financial stability” rather than given the prominence that they were in the Inflation Report. But it looks as if the gilt and currency markets need something stronger if they are to produce the monetary easing that, from Carney’s bearish analysis of the UK economy, it still needs.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox