The lesson the Japanese economy has for the developed world

One of the most commonly reported themes in financial markets today is the fear of disinflation/deflation, and how monetary authorities need to take economic action to avoid becoming the “next Japan”. In February I commented on the fact that the fear of disinflation and deflation is not as logically straight forward as you may think. I think the common assumption that developed economies do not want to end up like Japan is also worth investigating.

Japan is commonly seen as the modern poster child of ineffective monetary and government policy. The policy errors of the Japanese authorities in the 1990s are seen as having resulted in a depressed economy that has stood still over the last 25 years. This view has partly come about as financial markets often simply judge an economy by observing how its equity market performs. Given the crash in the Nikkei from over 40,000 in the early 1990s to around 16,000 today, equity market performance as a measure of Japanese economic health has become engrained in the market’s psyche.

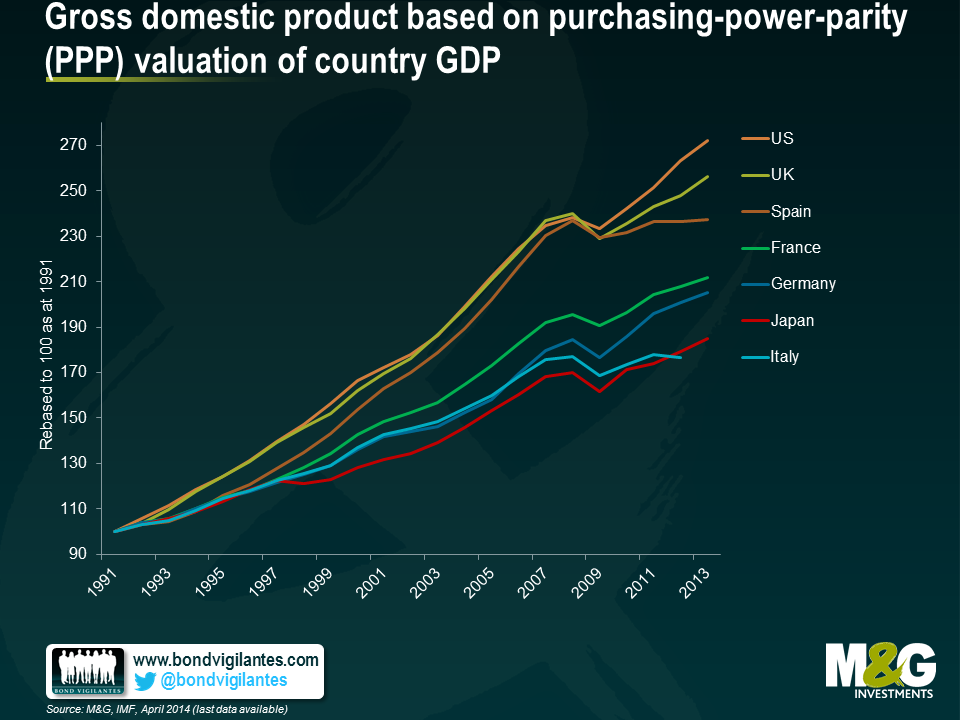

In reality the strength of economies should be measured by their economic output and not equity market performance. In this regard, at first glance the national data bear out that Japan has lagged most countries in terms of nominal and real economic growth.

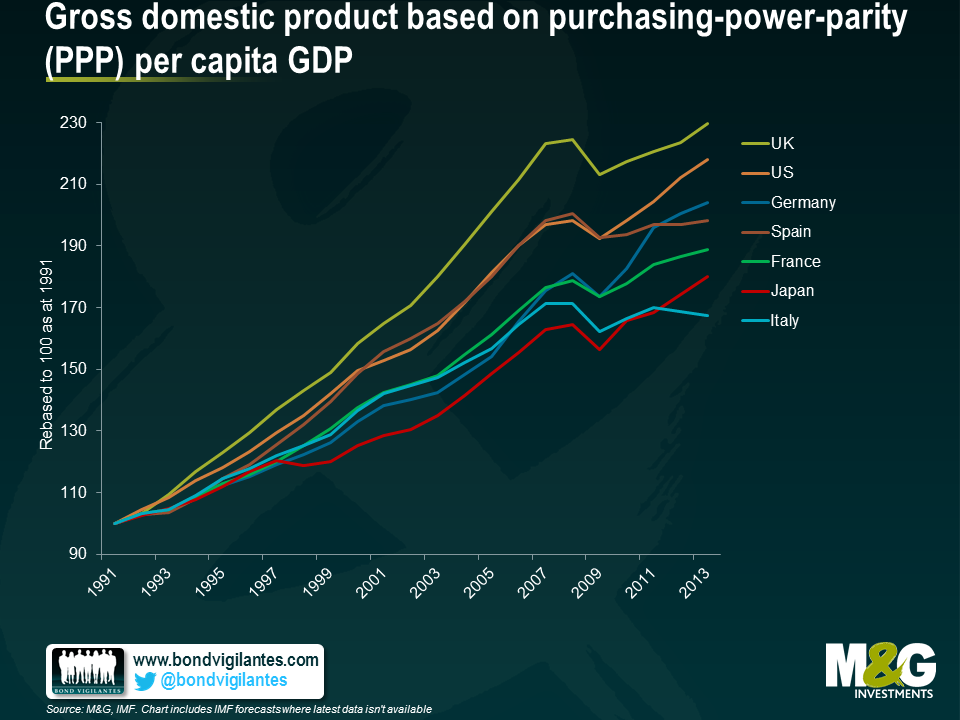

The simple measures of nominal and real GDP are often regurgitated as to why we do not want to end up like Japan. But from an economist’s point of view, what matters most is GDP per head. The fact that one country grows more than another is not to be celebrated economically if it is in fact engendered solely by an increase in population.

Below is a chart of real GDP per capita. It shows that Japan has not been an economic failure from a local point of view. Rather, the Japanese economic experience has actually been quite positive in terms of increasing living standards for the average Japanese citizen over the last 25 years.

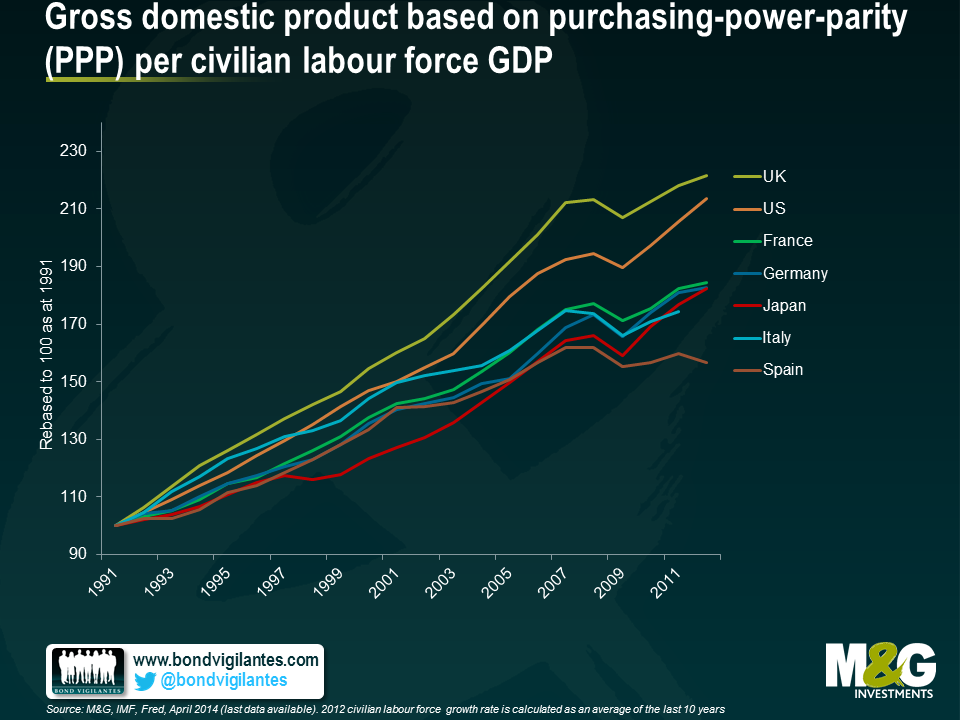

However the chart above shows Japan still lagging; no wonder economists still fear a Japanese outcome. Nevertheless I believe that a truer measure of GDP should not only be correlated to the number of people in its national boundaries, but should be seen in the context of the shifting function of the long term demographics of the population. A country with a baby boom will experience strong GDP in the boom, and weaker GDP at the end of a population bulge. Workers retire; consumption and investment fall. In order to take into account the true GDP per head, one has to put this into context, by looking at the size of the working population, not just the size of the actual population. Below we chart GDP per head of working population. This adjustment allows a fairer reflection of GDP per head, with the Japanese situation improving on a relative basis again.

What lessons can we learn from Japan ? Firstly it is not as bad as it looks given the true potential GDP per head of population. In fact monetary and fiscal policy has worked in Japan. Low inflation and the zero bound of monetary policy is something we and policy makers naturally fear. Maybe we fear it too much based on simple analysis of headline numbers.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox