After the December rout, where is the value in EM corporates?

It’s this time of the year when banks and other investment research providers have released their outlooks for the coming year. For the EM corporate bond asset class, Asia was forecast to be the best performer in 2015, with most top picks being in India and China.

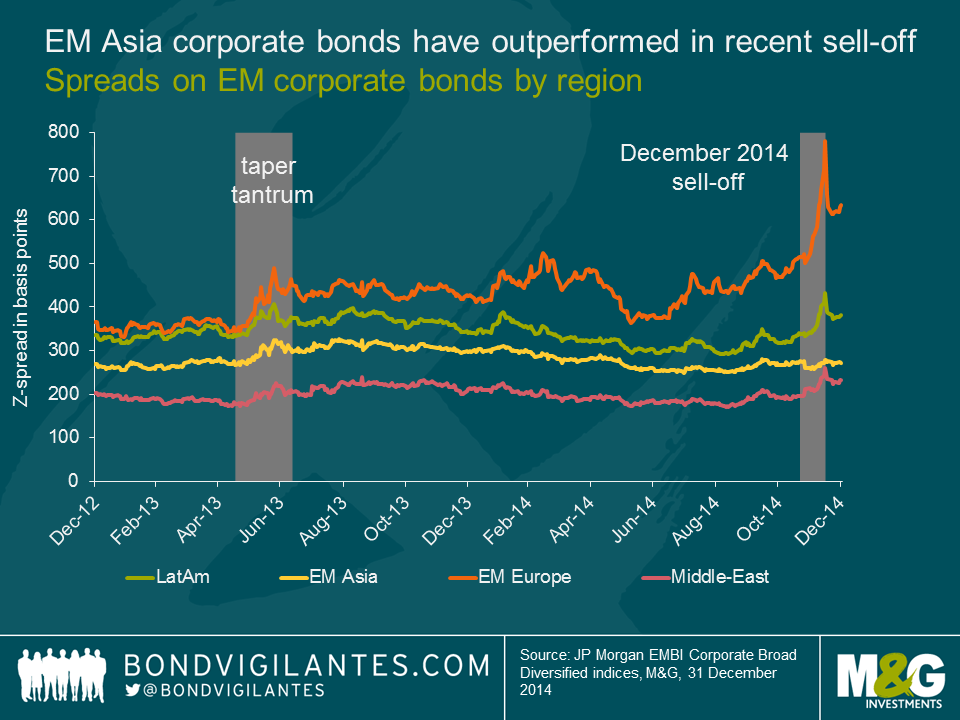

Most 2015 outlooks were released in late November or early December, when EM USD corporate bonds were boasting a solid 6.1% total return YTD (as at 26 November 2014). Since then, the deteriorating macro-economic dynamics in EM (slower growth, oil price decline and the Ruble turmoil) and a spillover effect from a weak US high yield market resulted in the largest EM spread widening since 2011. The index performance halved to 3.0% total return YTD as at 15 December, although it subsequently rebounded to about 5.0% as at year end. The sell-off saw a harsh repricing of bonds in Latin America, EM Europe, Middle East/Africa and…. that’s it. Asia was very resilient, unlike in previous sell-offs, as the chart below demonstrates.

In light of such major changes in the EM corporate bond markets in December since the sell-side released its 2015 outlooks, do Asian corporate bonds still look attractive on a relative basis?

Macro-economic risks: Asia is the least exposed, large downside risks in EM Europe, and increased risks in Latam and Middle East.

There is no doubt that Asia still faces significant macro risks in 2015, in particular China’s slower growth and shadow banking concerns, as mentioned by Jim in his recent video. However, on a relative basis, Asia is likely to be the least exposed to macro downside risks within the EM asset class. Latin America has its own problems with Brazil’s low growth and corruption scandals, potential or actual defaults of Venezuela and Argentina, low commodity prices, etc. Significantly lower oil prices are also affecting the Middle East and Russia, the latter being additionally hit by economic sanctions from the West due to its involvement in the Ukrainian crisis.

Not only does Asia face fewer macro-economic risks but some countries, such as India or Indonesia, are also likely to benefit from lower oil prices.

Valuations: Latam and EMEA have repriced, Asia is broadly unchanged.

While the recent EM sell-off has spared Asia, it has nevertheless led to a significant repricing of Latin American corporate bonds.

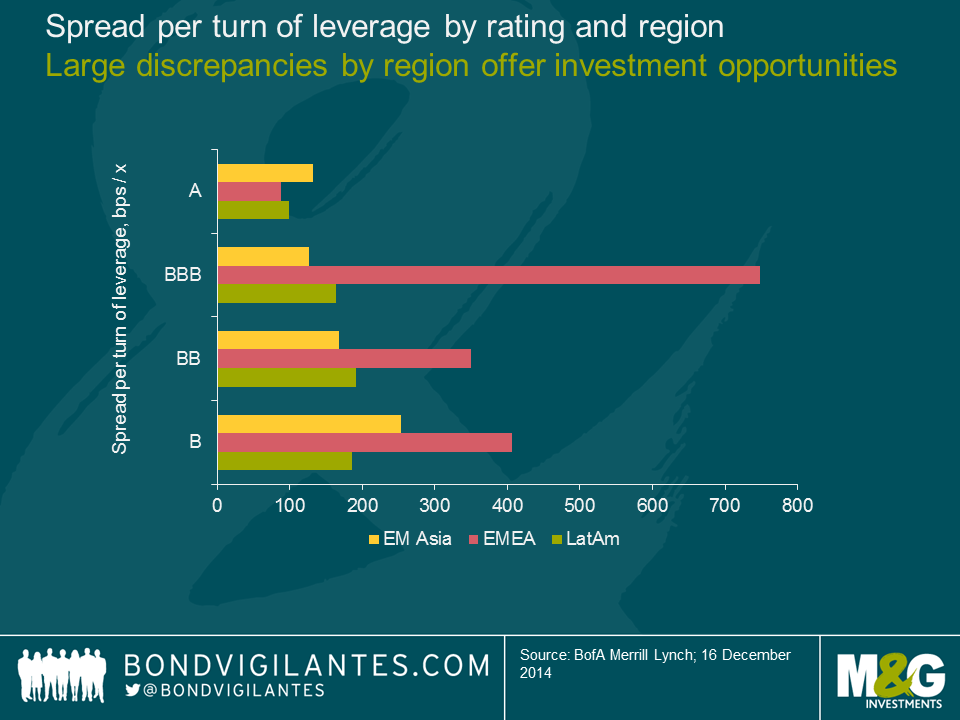

Looking at average spreads per turn of leverage (read spreads on a debt-adjusted basis), Latam bonds look attractive in the BBB and BB rating categories, while Asian corporate bonds offer more leverage-adjusted spreads than Latam bonds in the B category. It’s worth noting that B-rated issuers in Asia are, in my view, less transparent than Latin American issuers and that China’s enterprise bankruptcy law (EBL) still lacks testing for offshore bonds. This is important as default rates in Asia are expected to increase to 2.5% in 2015, from 0.9% YTD 2014.

EM Europe corporate bond spreads look optically attractive (especially in BBB rated bonds) as spreads of a number of Russian and Ukrainian bonds reached distressed levels in 2014, whilst the region has low leverage ratios in general. However, EM Europe’s massive macro downside risk makes corporate fundamentals of less importance given many predict a default in Ukraine in 2015 and it’s uncertain in which direction oil prices and the Ruble will go next. On top of this, spreads also reflect the extremely poor market liquidity in the region

In the Middle-East, a few credits were unduly punished by the oil sell-off in the region and the repricing of some bonds has made them attractive on a selective basis.

Market technicals: the supply/demand dynamic will support Asia

With more than $170bn of US$ corporate bonds issued in 2014, Asia accounted for half of the 2014 global volume of issuance. China alone was c. 30%, according to JP Morgan. Going forward, the market expects Asian issuers to increase their share of global corporate bond issuance, with new records likely to be hit in 2015. One of the main risks for Asia is therefore a lack of demand to match the expected record supply numbers. However, unlike Latin America, Asian bonds are less sensitive to outflows from the US markets and Asia has built over the past years a larger local investor base that is expected to be a strong source of support to absorb the supply in 2015. For those not convinced yet, just look at how Asia was resilient during the December 2014 EM sell-off.

Conclusion: Asia likely to be resilient and Latam a volatile outperformer in 2015.

I believe the recent EM sell-off has in a sense reshuffled cards for 2015 as (i) it has generated more investment opportunities in Latin American corporate bonds and (ii) it has demonstrated Asia’s increasing resilience to other EM regions’ shocks. In my opinion, the spread widening in EM Europe corporate bonds has not been a major game changer for next year as geopolitical risks in Russia, hence also Eastern Europe, will continue going forward.

For 2015, I expect Latin American corporate bonds to be a driver of outperformance following the December 2014 sell-off while in the meantime being very volatile as the repricing of the region also reflects increased macro downside risks. Country and security selection will be key in Latin America.

Asian bond spreads do not look as attractive compared to corporate fundamentals; therefore, I would not expect a major spread tightening in the region in 2015, in particular in HY credits. However, Asia remains, in my view, the least exposed to macro downside risk and will likely be supported by positive market technicals throughout the year. As such, Asia’s increasing resilience to EM risk aversion might well be a good hedge to the rest of the EM asset class should bouts of volatility resurface in the marketplace.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox