Falling consumer and oil prices may not provide the boost to growth many are expecting

The spectre of deflation currently haunts central bankers around the world, though many of us would question whether the true effects of falling prices are being felt in the real economy and more importantly in consumers’ wallets.

According to the results of the M&G YouGov Inflation Expectations Survey over the past two years, European consumers often believe that inflation in one and five years’ time will run well above the official inflation rate. There is a reason consumers often think “felt” inflation is higher than the “real” measure.

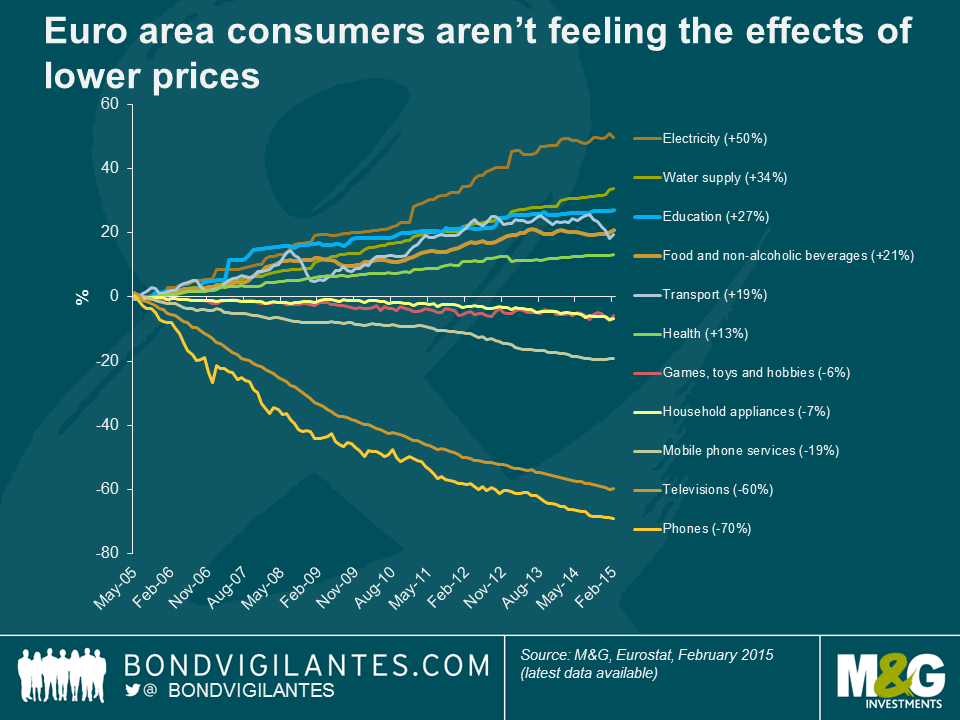

The chart below highlights the difference in the prices of “needs” versus “wants” over the past decade for euro area consumers. As can be seen, the prices of “needs” such as electricity, water and food have increased by between 20-50%. In contrast, the prices of “wants” such as phones, televisions, and games have fallen and are actually cheaper.

From this analysis, it appears consumers are entirely rational in estimating that inflation is higher than the officially reported measure. This is because individuals and families are reflecting their actual cost of living, rather than a basket of goods and services. The majority of their incomes (which have risen by only 8.5% over the past 5 years) are spent on the staples of modern life and as these staples have been appreciating in value, household finances have come under sustained pressure.

This potentially has implications for those anticipating that falling prices will result in an improvement in the real spending power of European consumers. If the prices of “needs” remain sticky or increase further then it appears unlikely that the ECB will be able to generate a consumer-led economic recovery. Whilst a fall in the oil price should help ease electricity and gas prices, energy companies often buy their supplies up to three years in advance to ensure supply. Consequently, moves in wholesale prices do not feed through immediately to retail prices. When it comes to energy prices, what goes up doesn’t necessarily come down. In addition, fuel for cars represents only 4.5% of the Euro area Harmonised Index of Consumer Prices (HICP) basket. The falls that we may see in fuel and energy prices will certainly increase consumer disposable income, but will it enough to repair household balance sheets that have suffered from limited real income growth since the financial and European crises?

Next week, with the release of the Q1 2015 M&G YouGov Inflation Expectations Survey, we will see whether consumers are still “feeling” higher inflation. Unfortunately for policymakers, the fall in the inflation and oil prices may not be the boost to growth many are hoping it could be.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox