Negative interest rates in European ABS

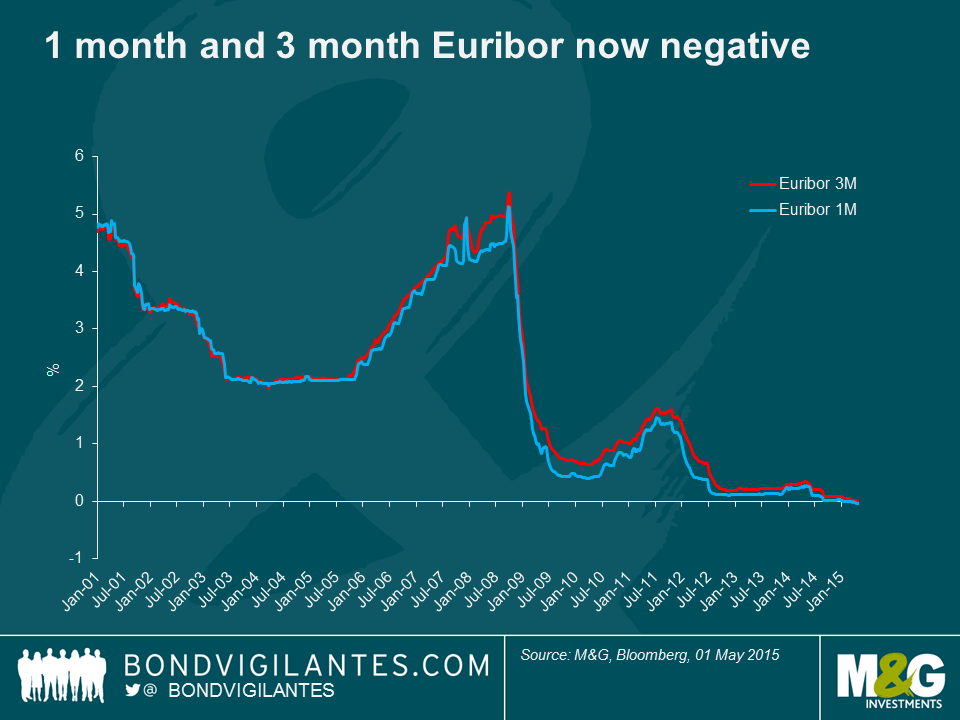

Negative interest rates have become increasingly prevalent in Europe owing to the expansionary monetary policy measures with a number of central banks implementing negative base rates (Switzerland, and Sweden). Two weeks ago 3 month Euribor, (the reference rate for the majority of Pan-European Asset-Backed Securities (ABS)), followed 1 month Euribor (largely the preserve of most European Auto ABS transactions), into negative territory. Where the reference rate has turned negative, noteholders can expect to receive the net amount (i.e. the positive coupon on the notes offsets the negative reference rate).

The concept of negative interest rates wasn’t previously envisaged by the authors of securitisation documentation. The working assumption in the market is that interest payments to noteholders will be floored at 0% – we saw the first confirmation of this theory when issuers of two Spanish transactions issued an investor notice that they will apply a coupon of 0% instead of the negative coupon that would result from applying Euribor. In addition, Moody’s canvassed legal practitioners in most European jurisdictions and concluded that that the consensus, as far as note interest goes, is that there is a real or effective floor as there cannot be a payment obligation of the noteholders to the issuer implied by negative interest rates on the notes.

In contrast, ancillary monetary obligations (swaps, account banks etc.) are not usually floored at zero. For instance, under a typical fixed floating swap (a derivative instrument that enables the parties involved to exchange fixed and floating rate cash flows), the issuer would pay the fixed rate payments received from the collateral pool and receive floating rate payments from the swap provider (which are then passed on to noteholders). If the 3 month Euribor plus spread becomes negative , the issuer could also end up paying on the floating leg of the swap (which does not typically have floors). The read through to cross currency swaps involving euro liability payments against non-euro denominated assets could result in similar issuer special purpose vehicle (SPV) shortfalls.

This misalignment introduces negative carry whereby the issuer’s cashflows are less matched than before the negative rates situation. As ancillary monetary obligations rank as senior costs within a SPV cash flow waterfall (the senior classes have first claim on the cash that the SPV receives, and the more junior classes only start receiving repayments after the more senior classes have been repaid), this therefore reduces cashflows to subordinated noteholders, or at best reduces excess spread which otherwise would flow back to the originator.

On the whole, for legacy transactions with little excess spread and/or credit enhancement, the negative impact can be significant as Euribor gets increasingly into negative territory as the issuer may have no way of recovering shortfalls in cashflows.

For most ABS deals in 2015, new offer documents have seen language inserted to either floor the interest rate at 0% or floor the reference index at a predefined rate.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox