High yield floating rate note case study – an oasis of calm within the desiccated desert of duration

We’ve seen a swift and rapid re-pricing of the bund curve in recent weeks, highlighting again the risk to capital that bond investors face when yields start to rise. All major bond markets in Europe have been impacted to some degree. Nevertheless one corner of the bond market has remained very resilient: floating rate notes.

We have highlighted before how these instruments have some potentially useful features in a rising yield environment, most notably a very low sensitivity to moves in government bond markets. To put it another way, a bond with little or no interest rate duration has been a good bond to hold over the past few weeks.

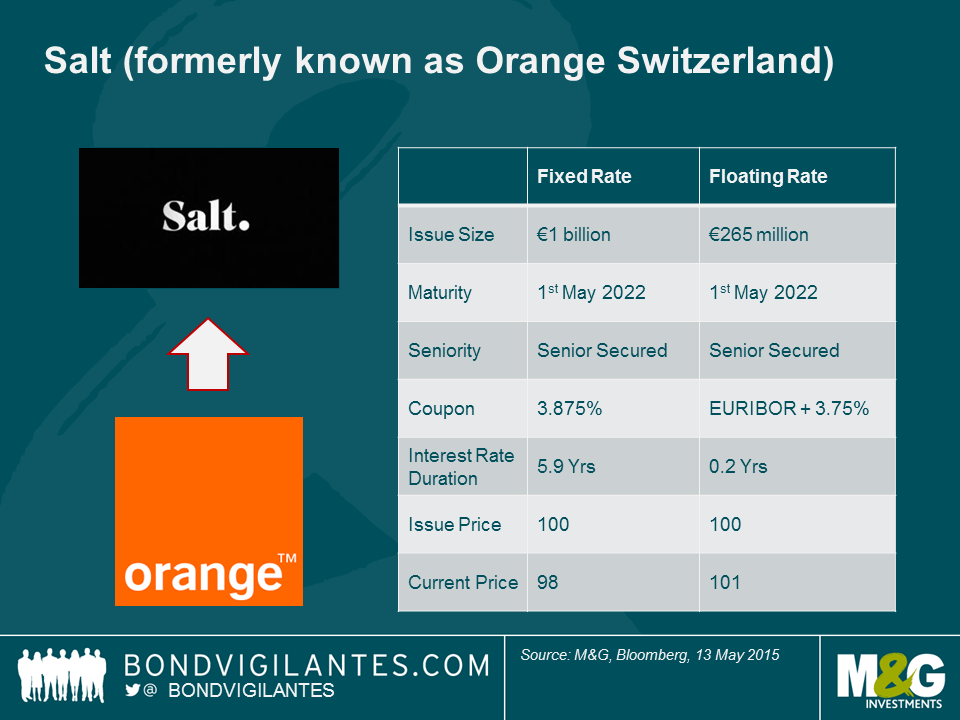

We can see this in action by looking at two bonds recently issued by the Swiss mobile phone business Salt (formerly known as Orange Switzerland). The company refinanced its debt in April, issuing four different bonds. The two of interest here are identical in many ways – they are both denominated in euros, both are senior secured instruments, both have the same maturity date – except for one very important difference: one has a fixed 3.875% coupon, the other has a variable coupon that resets every three months to the prevailing three – month EURIBOR rate plus a fixed margin of 3.75%.

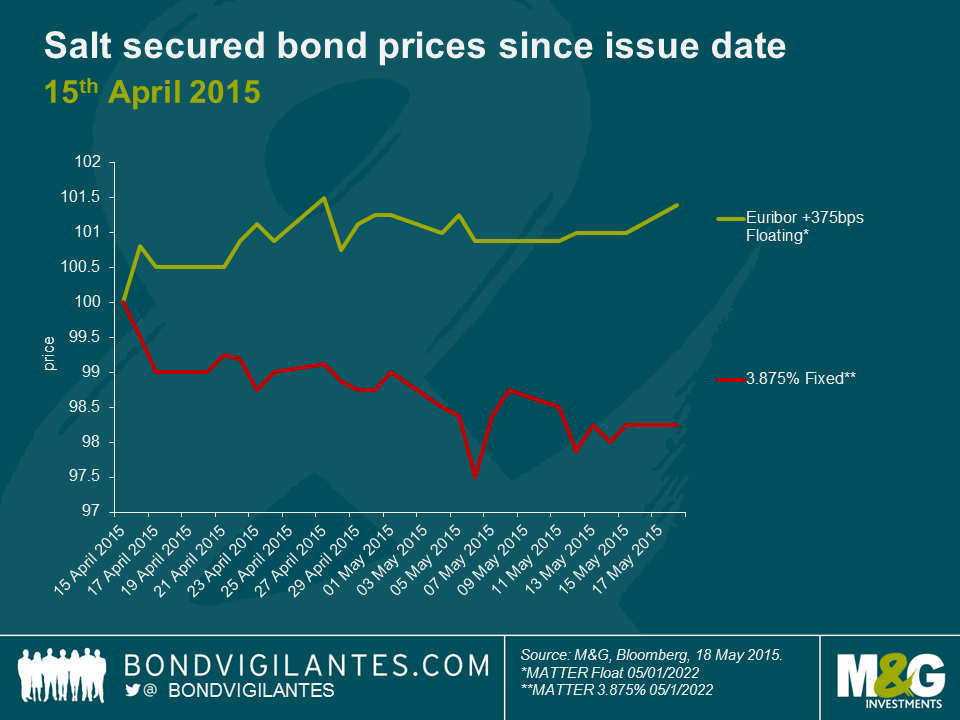

Both instruments have the same credit risk associated with them (the risk that Salt defaults on its debt obligations), but the move from a fixed coupon to a floating coupon drastically changes the bond’s sensitivity to moves in the wider government bond market (this is the interest rate duration number in the table above – it drops from almost six years, to close to zero). The impact of this small but important difference can be seen in the relative price performance of the bonds in the month following their issue.

As we can see, the floating rate bond has effectively been immune to the move in the bund market, and in fact it has traded up by around 1%. In contrast the fixed rate bonds have suffered and seen a 2% capital loss. This difference in interest rate sensitivity has meant a 3% relative differential in capital return over the space of just a few weeks.

We can see that in recent weeks floating rate bonds issued by companies have been well worth their salt.

Full disclosure: M&G funds own bonds issued by Salt

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox