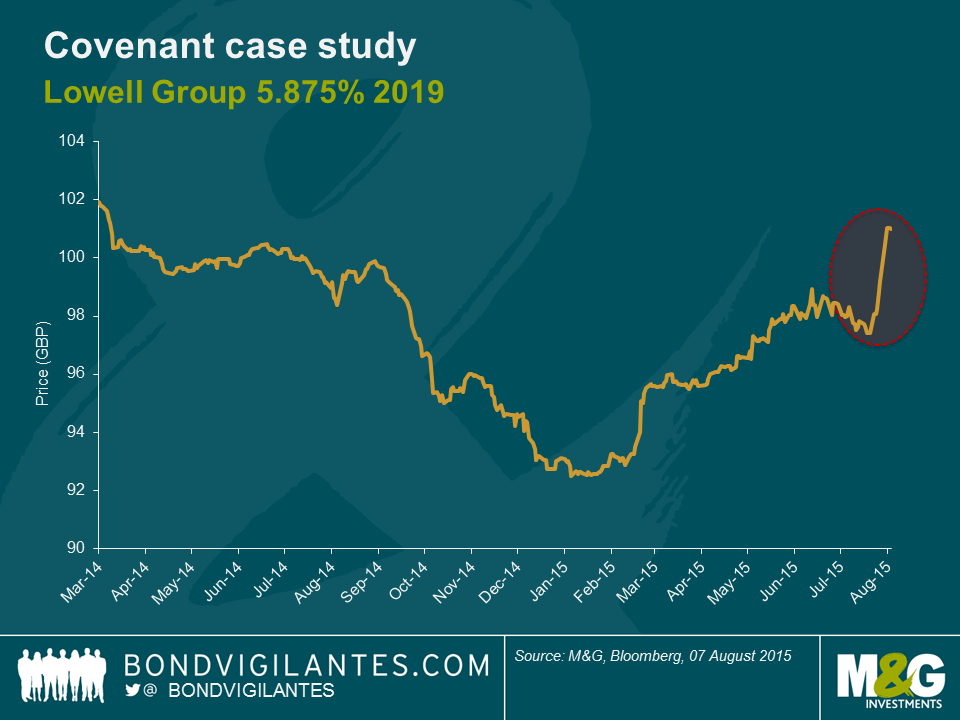

We’ve written in the past about some of the concerns we have over the gradual weakening of bond covenants (the legal language that protects the right of bondholders) over the past few years. However, today we have seen a real world instance of a bond covenant kicking in to the benefit of existing holders, namely the change of control. This illustrates how and why such covenants can help protect the interests of investors.

It was announced this morning that Lowell Group, a specialty financial services business in the UK, will merge with a German competitor. As part of the deal there will be a change of ownership. Consequently, the “change of control” language will be triggered. This gives the bondholder the right but not the obligation to sell back the bonds to the company at a price of 101% of face value.

The company’s GBP 5.875% 2019 bonds have been trading below this level since mid-2014. Following today’s news we can see in the chart below that the price has risen up by a little over 3% to this 101 level. As the new combined business will be more financially leveraged, it is fair to say that without this covenant the bonds would most likely have fallen in price to reflect the increased credit risk of the combined entity. This clearly demonstrates the economic value that this covenant can have.

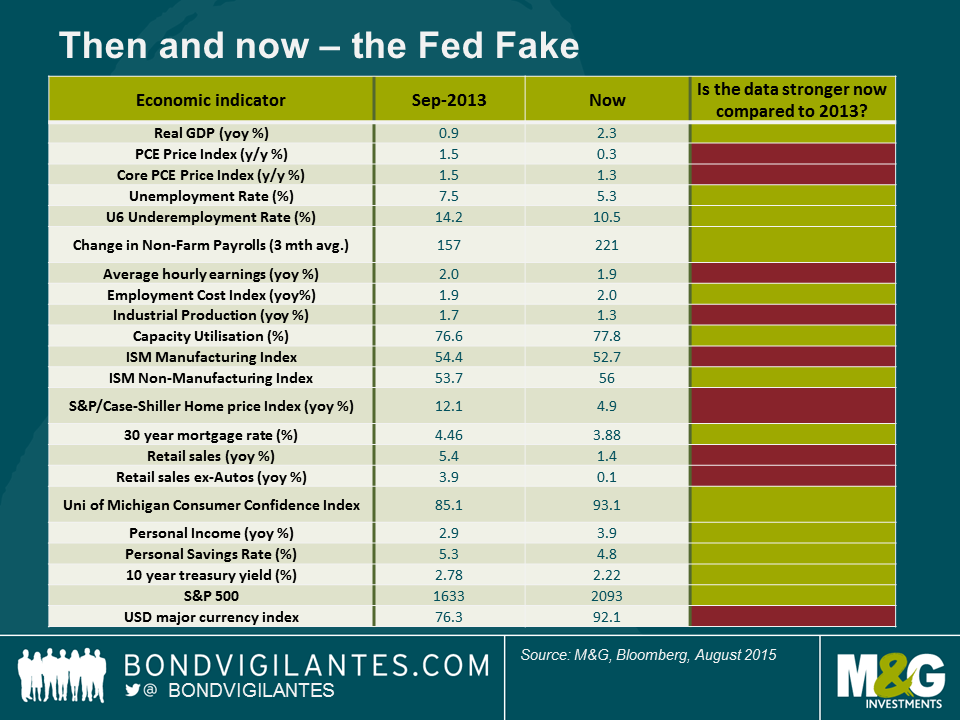

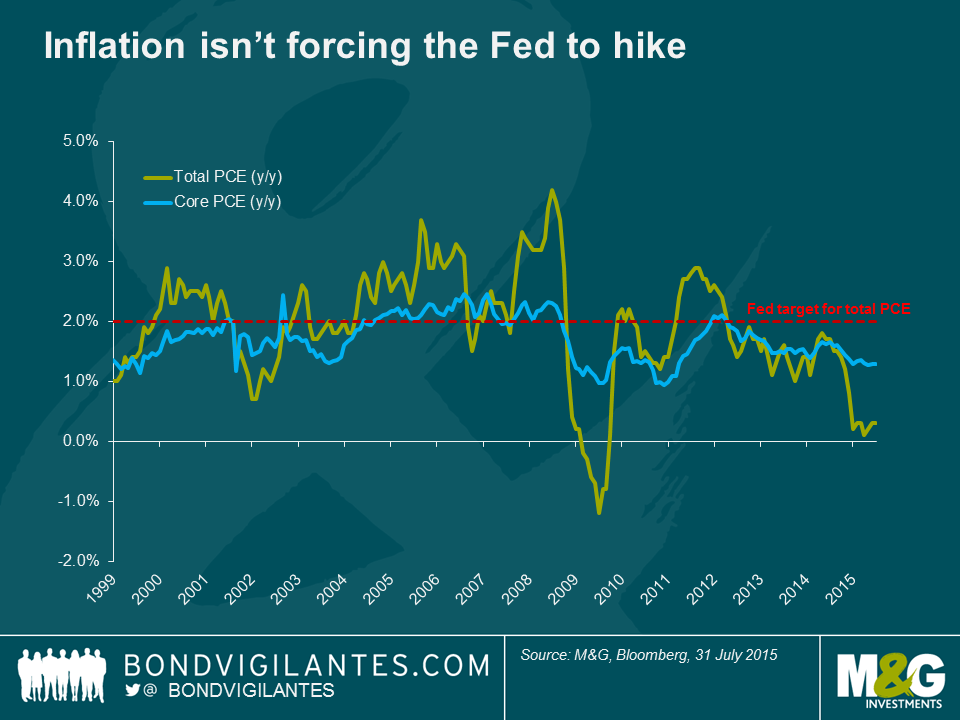

Thirty-five out of forty-one economists surveyed by Bloomberg currently expect the FOMC to hike the Fed Funds rate on September 17, thereby starting a period of policy normalisation. Most have pointed towards the July FOMC statement which noted better data on net in June and suggested some progress toward the conditions for lift-off. Those economists forecasting a rate hike will tell you that the US economy is rebounding from the winter soft patch, the labour market continues to improve and core inflation is relatively sticky (core PCE is 1.3% y/y), giving the FOMC comfort to begin the long process of unwinding ultra-easy monetary policy.

Markets on the other hand are pricing in a 50% chance of a rate hike. September is clearly not a done deal, particularly after the soft ECI report released last Friday. The 0.2% rise in the ECI through June broke an acceleration in wages and salaries that had begun a year ago. For an FOMC that is keenly monitoring labour market conditions, the weak ECI data put some doubt into the thinking of economists.

It was only a mere two years ago that many economists were kicking themselves for predicting that the Fed would taper its QE programme of asset purchases. At the time, there was an overwhelming consensus that Ben Bernanke had signalled a taper as early as May 2013 and many had factored this in to their forecast. Of course the Fed did not act, there was a lot of soul searching amongst the financial economic community, and a catchy phrase was coined (“Fed Fake”) to make light of how wrong most economists were.

The Fed has continually told us that monetary policy is data dependent and not predetermined. This Friday’s employment report will be extremely important in determining whether the Fed actually hikes or not – the decision appears to be that close. But can we learn anything from how the Fed behaved in September 2013, when it chose to surprise the markets and maintain QE?

Looking at a number of domestic economic data points it appears that the US economy is on a firmer footing compared to September 2013. Growth is solid, the unemployment rate is low, consumer confidence is higher and the ISM suggests that the economy will continue to expand. Unfortunately for those calling for a rate hike, inflation is much lower, core retail sales are flat and the US dollar will act as a headwind for US companies for the foreseeable future. Additionally, the global economic backdrop is weaker than 2013 given the concerns around Chinese economic growth and associated EM weakness, the risk of spillover effects in Europe coming from uncertainty around Greece, and a potential British referendum on Europe in 2016.

This analysis suggests that a Fed rate hike in September is not a given. Economists surveyed by Bloomberg are probably finding some comfort in going with the crowd. I believe that whether the Fed hikes or not is less important than determining where the terminal Fed Funds rate is in a potential rate hiking cycle. Fed tightening in this cycle will likely be unusually slow, cautious and well communicated to markets. If this is the case, then the reaction in bond markets would likely be relatively benign compared to prior Fed rate hikes. In order to see bond yields move much higher, a reassessment of inflationary expectations would be required. A rising US dollar, benign wage growth, high consumer debt levels and falling commodity prices suggests to us that this is unlikely to occur in the short-term. As a result, any market reaction to a rate hike in September will likely be muted compared to the historical experience.

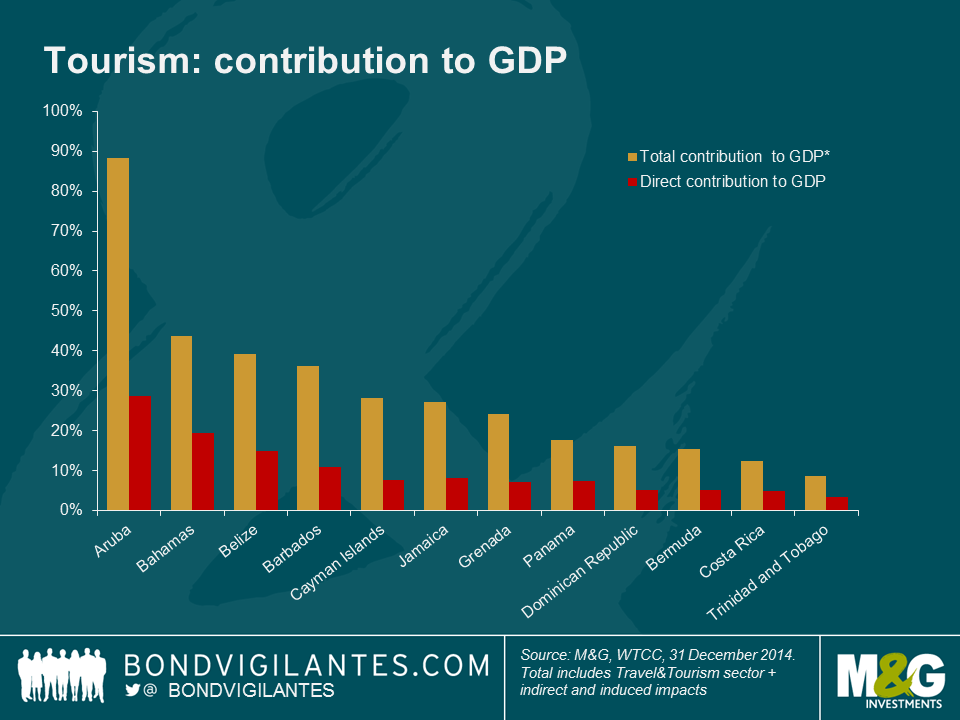

It is August and I should be enjoying a beach holiday, rather than being stuck in London under temperamental weather. To mitigate my despair, I decided to write some blogs on the topic of tourism. Given the ongoing normalisation of US-Cuba relations, I have been looking at the impact that this unprecedented shift in policy could have on the region. Although the embargo and travel restrictions remain in place and still need to be modified by the US Congress, an eventual lifting of sanctions would be a watershed event for the region. US Secretary of State John Kerry could take a few days off in Cuba after his visit this month and see first-hand the challenges and opportunities on the island.

The IMF published a solid assessment in 2008 on the implications for the Caribbean of opening US-Cuba tourism, which had a few notable findings. The liberalisation of US-Cuba tourism is expected to increase arrivals to the Caribbean by an estimated 10%. However, the impact on individual countries differs markedly depending on the composition of their existing tourist base. For example, countries that have the majority of tourists coming from the US are the ones that will stand to lose the most as these tourists head to Cuba instead. In the short-term, Cuban infrastructure could hit capacity constraints with the flood of new visitors. As the increase in number of US tourists displaces non-US tourists, the tourists could decide to holiday at other islands instead, resulting in a benefit from the Cuban effect, such as Dominican Republic.

The direct and indirect impact of tourism varies per country, as typically the smaller economies have less potential to diversify. For every Bermuda (insurance) or Cayman Islands (financial services), there are other countries that are struggling to diversify.

While financial investment in Cuba remains difficult given the lack of tradeable assets (to say that defaulted Cuban loans trade by appointment is an understatement), those seeking to benefit from the opening up of the Cuban economy and an increase in tourism could look to real estate related investments as the logical alternative. The increase in trade and tourism with the United States will not only benefit Cuba, but also its neighbours, which are mostly small open economies that depend on tourism to various degrees.

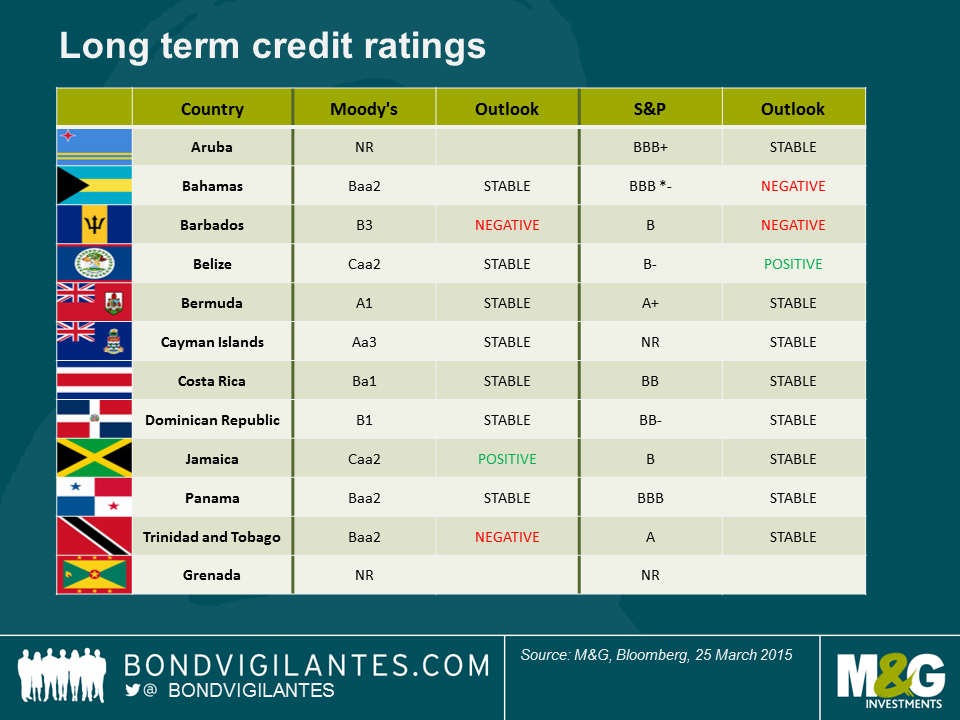

This shows that investors should not paint countries in the Caribbean with the same brush and this can create mispricing and opportunities in the marketplace for assets.

With that in mind, I see the credit trends and ratings skewed to the downside in countries like Aruba and The Bahamas as they continue to struggle to diversify their economies. As debt levels creep up there are also other likely losers from the Cuban opening. On the other hand, I am comfortable with credits such as Dominican Republic, which surprisingly may even benefit from the normalising of US-Cuban relations.