Reverse Yankees, i.e., bonds issued by US entities in currencies other than USD, have become an integral part of the global investment grade (IG) corporate bond universe, particularly in the European IG space. For treasurers of US companies the issuance of EUR-denominated Reverse Yankees offers several advantages:

- In case a US firm reporting its results in USD has operations within the Eurozone, and thus EUR-denominated revenues, EUR bonds provide a natural currency hedge. All else being equal, if the EUR depreciates against the USD, the company’s financial reports will show declining revenues but also declining interest expenses and outstanding debt levels, and vice versa.

- Although there are significant overlaps, the pools of investors, both retail and institutional, active in the USD and the EUR corporate bond markets are not congruent. Therefore, by issuing EUR bonds in addition to their USD bonds, US companies get access to a broader range of creditors, thus diversifying their investor base.

- Core European interest rates are lower than US rates and also credit spreads are on average tighter in EUR than in USD at the moment. Hence, US companies can often get away with paying lower coupons when issuing bonds in EUR rather than in USD, which reduces their interest expenses.

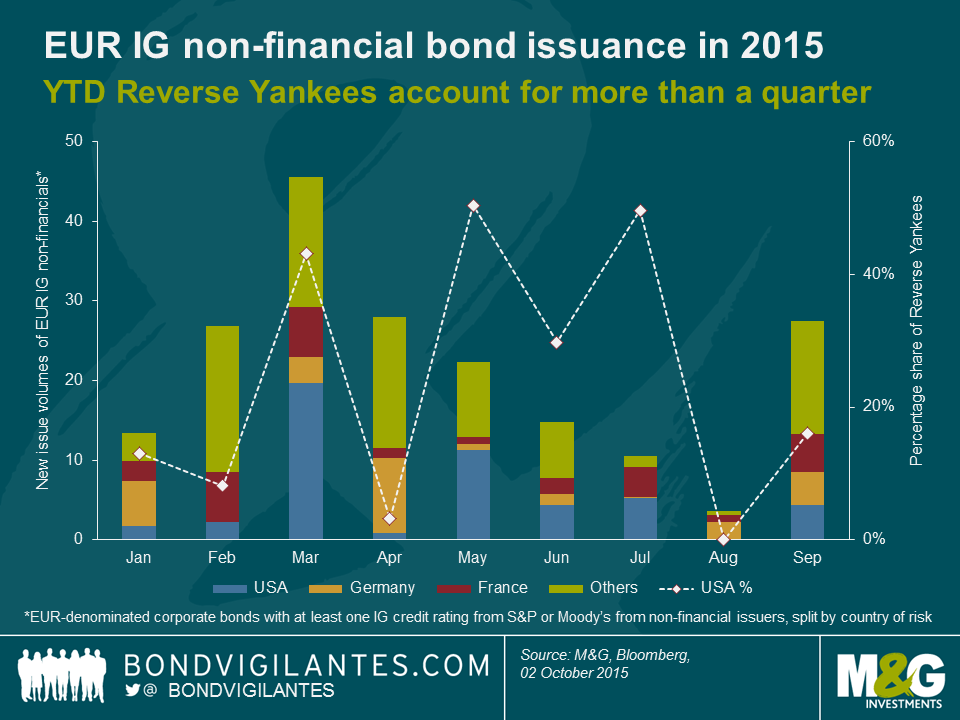

The appeal of EUR-denominated Reverse Yankees from an issuer’s perspective has led to impressive new issue volumes this year, as shown in the chart below. Out of the EUR 193bn of EUR-denominated IG-rated non-financial corporate bonds issued year-to-date (YTD) more than a quarter (EUR 50bn) have been from US companies. This amount easily exceeds new issue volumes both from German (EUR 27bn, 14%) and French (EUR 28bn, 15%) companies by more than EUR 20bn each. In absolute terms, March was the record month this year for Reverse Yankee issuance so far with nearly EUR 20bn being printed. Percentagewise, May and July take the top spots with volumes of Reverse Yankees accounting for c. 50% of total monthly EUR IG non-financial issuance.

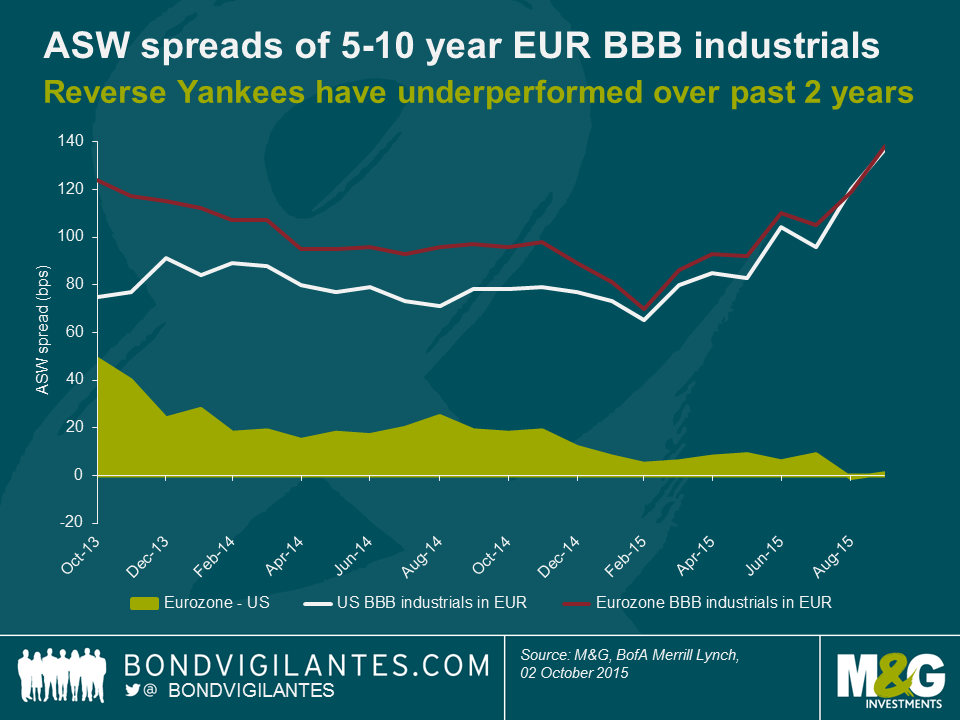

How have Reverse Yankee bonds performed relative to comparable bonds from Eurozone corporate issuers? The following chart shows the evolution of asset swap (ASW) spreads of EUR-denominated BBB-rated corporate bonds with 5-10 years to maturity, issued by US and Eurozone industrial companies.

Over the past two years, EUR Reverse Yankees have underperformed compared to bonds from Eurozone issuers. In October 2013, investors could earn nearly 50 bps when switching from Reverse Yankees into Eurozone BBBs. This spread differential has disappeared by now. The spread convergence can at least partially be explained by improvements in the European periphery leading to a tightening of Eurozone spread averages. Investors holding Reverse Yankees however have not been able to reap the benefits of the repricing of peripheral risk as US industrials spreads stayed relatively flat until the beginning of 2015. From then on, both US and Eurozone industrials have experienced spread widening, mainly driven by risk-off sentiment and heavy new issue volumes in the EUR IG corporate bond market.

This last point is probably the biggest risk for Reverse Yankees going forward. Interest rate cycles are continuing to decouple between the US and the Eurozone as the Federal Reserve is likely to hike rates in the near future, whereas the ECB is going to carry out its Quantitative Easing (QE) at least until September 2016. This divergence of central bank policies could make it even more attractive for US companies to issue significant portions of their debt in the EUR bond market which would put further upward pressure on credit spreads of outstanding Reverse Yankee bonds. Furthermore, the ECB might very well decide in the future to extend the scope of QE by adding more and more European corporate bonds to its shopping list. Most likely, Reverse Yankees would be left out in the cold which would lead to further relative underperformance.

Does this mean that we shun Reverse Yankees altogether? Certainly not. Despite their specific risks, Reverse Yankees are interesting securities from an investor’s point of view. For one, they enable investors to take exposure to US company credit risk without having to buy USD-denominated securities. European bond investors who are unable or unwilling to buy USD bonds can use Reverse Yankees to increase their pool of accessible credits and diversify their portfolios. Furthermore, valuations of Reverse Yankees relative to comparable bonds from European companies have become more compelling, as discussed above. Spread levels can be particularly appealing when the US bond issuer is only little-known amongst the majority of European credit investors. In these cases, the issuer will often find it necessary to pay a generous credit spread to get the order book filled. This “lack of knowledge” market inefficiency creates attractive opportunities for investors who are more familiar with the universe of US corporate bond issuers.

One of the key objectives of modern monetary policy is to anchor inflation expectations, because managing inflation expectations is the first step to managing inflation.

The extent to which inflation expectations are anchored can have direct implications for the performance of inflation and the broader economy.

Where inflation expectations are not very well anchored, falling (or rising) inflation can create uncertainty about future prices, driving consumers to delay purchases and, as a result, slow down economic activity. On the other hand, when inflation expectations are well-anchored supply-driven price shocks (such as sharp increase or decrease in commodity prices) are less likely to modify consumer habits in the short-term, reducing the scope for economic instability.

Well-anchored inflation expectations are therefore key for central bank policy framework today and reflective of a credible monetary policy. In this vein, The Q3 2015 edition of the M&G YouGov Inflation Expectations Survey finds that central bank credibility remains high across the UK, Europe and Asia. In the UK, consumers reported that one in two of them are “fairly or very confident” the Bank of England will achieve price stability over the medium term (3-5 years). Furthermore, all European countries reported long-term inflation expectations at or above the ECB’s long-term inflation target.

Over the short term, expectations appear to have stabilised across most regions after hitting record lows in 2014. An uptrend is particularly notable in the UK where the forecast for inflation over 1 year has risen by 0.3% to 1.5%. We also note a positive trend in net income expectations as labour markets continues to tighten in many countries.

New for this quarter, we introduce three new questions to assess public sentiment towards sovereign bailouts, house price growth and internet shopping.

Some of the key highlights are:

- Consumers remain broadly optimistic on house price growth over the next 12 months

- There is a low level of support for sovereign bailouts across the UK and most European countries

- Online shopping has become increasingly popular with 7 out of 10 respondents having bought online at least once over the last month

The full report and data from our Q3 2015 survey is available here. In addition, we regularly tweet inflation updates via our @inflationsurvey Twitter account.