The ECB may lower rates, but the Swiss shouldn’t follow suit

Expectations are high that European Central Bank (ECB) president Mario Draghi will announce additional easing measures at the next monetary policy meeting on Thursday this week. If the ECB decides to provide further stimulus via extended (or expanded) QE and/or lowers its negative deposit rate further, the Swiss National Bank (SNB) has some thinking to do. I am probably not the only Swiss person concerned that Switzerland faces -1.4% deflation and is struggling to keep its exchange rate competitive. Since the SNB ended its EUR/CHF 1.20 peg in January this year, a sharp appreciation of the safe-haven currency was unavoidable. The EUR/CHF exchange rate is now a bit less than 1.10, still high for the franc if we consider a purchasing power parity of roughly EUR/CHF 1.25. The consequences of this can be seen in Swiss local newspapers, which just reported that another traditional company has gone bust as a result of the strong franc. This is not an isolated case and is not surprising, given that Europe is Switzerland’s number one trading partner with roughly half of Swiss exports going to the Eurozone. With that dependency, if the ECB lowers its deposit rate, there are obvious expectations that the SNB would follow suit and further cut its already negative rate of -0.75% on sight deposit account balances for banks and other financial market participants. In my view, though, the following points need to be kept in mind as they make such an SNB move far less certain:

Remember the banking crisis

Switzerland has experienced problems in the past from overly long phases of too loose lending standards. The last scenario that comes to my mind is the banking crisis in the 90s, in years where credit lending increased significantly by historic standards, especially compared to economic activity. A banking crisis is more severely felt in Switzerland compared to other countries because of the size of its banking sector. Around 275 banks have legal status in the country and the sector contributes around 6% to Swiss GDP (with inclusion of the insurance sector this rises to more than 10%). Importantly, regional banks in particular rely heavily on their interest margin business. The SNB has warned more than once in its financial stability report that banks with a focus on their home market may have too little diversification and high interest risk on their balance sheets. The latest SNB financial stability report indicates that direct interest rate risk in domestically focused banking books is at a high level, resulting from a mismatch between the maturities of assets and liabilities. Lower deposit rates make it even more attractive for banks to lend excess reserves on at relatively comfortable spreads instead of holding them at the SNB at negative rates. Based on the aforementioned SNB report, in 2014, for 42% of new mortgages granted by domestically focussed banks, the imputed costs would exceeded the general limit of one-third of gross wage or pension income. This, together with a very high proportion of loans that would be affected in the short or medium term if rates were to then rise, points to affordability risk in the Swiss mortgage market. Too low a deposit rate could encourage more and more private sector leverage and increase the possibility of another banking crisis, a consideration that the SNB will be well aware of.

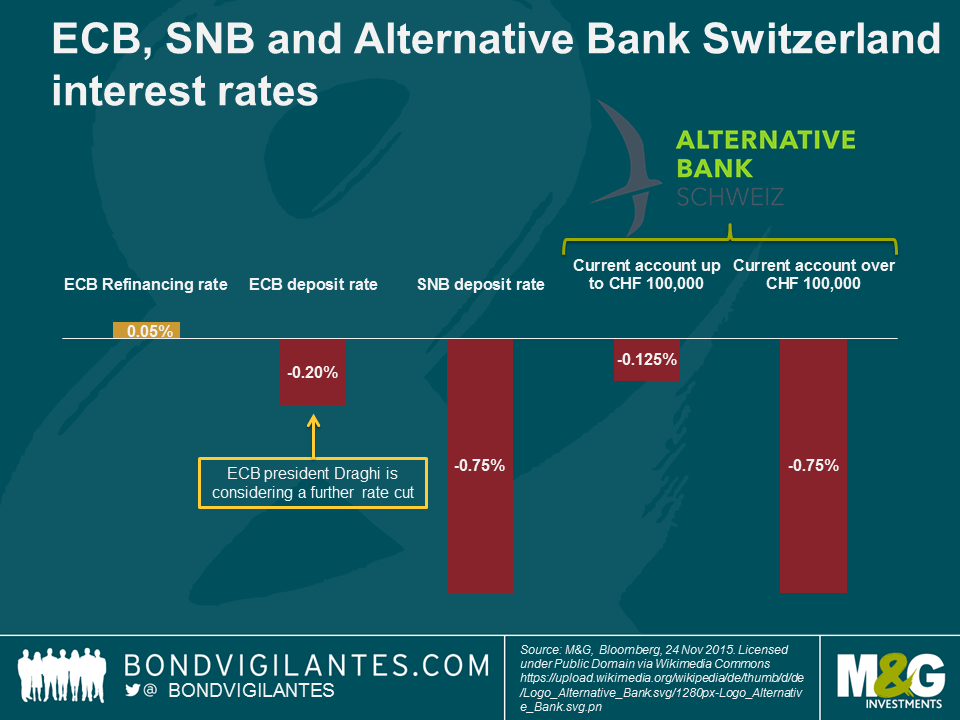

Banks are starting to pass on negative interest

Whilst the big Swiss banks have already introduced an individual deposit charge for large account balances held by corporate and institutional clients in reaction to the SNB’s negative deposit rates, banks so far have been reluctant to pass on negative rates directly to depositors. This may reflect the fear of losing customers in a competitive landscape. However, this trend could be ending given the environment for interest margin business is getting tougher and tougher as margins have shrunk considerably. Indeed, the Alternative Bank Schweiz has just become the first bank in Switzerland to announce negative interest rates of -0.125% on its current accounts for individual personal customers with effect from 1 January 2016. For savings over CHF 100,000, the bank will pass on the whole negative interest rate of -0.75%. Lowering deposit rates further could incentivise other banks to follow, which might encourage people to store their money in a safety box or elsewhere. Would you be happy to pay monthly fees for a bank account that is charging you a negative interest rate at the same time? As Richard wrote here, storing cash is risky for individuals (money is not insured and can be stolen) and costly for the economy as the money stuffed under the mattress cannot be lent on. The big CHF 1000 Swiss bank note doesn’t help either and makes it even easier to store Swiss Francs.

The euro is important, but…

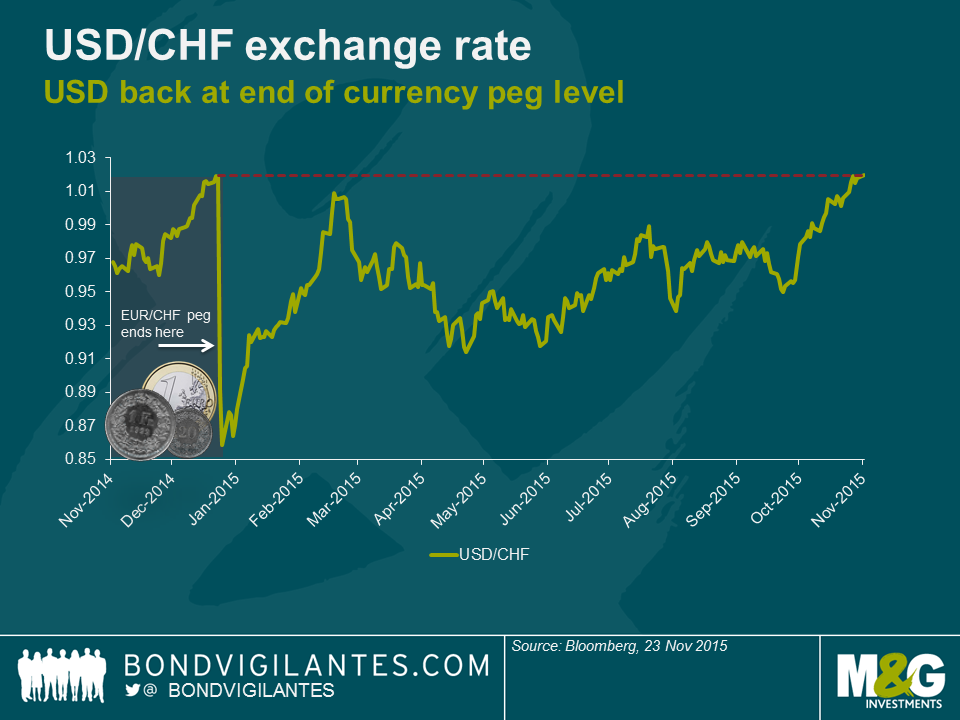

…there are other major currencies for the SNB to focus on as well. It’s true that most Swiss exports go to the Eurozone, but an even higher volume is imported every year from Europe. If we consider net exports (exports – imports) the most important countries are China, India and the US. Following a hawkish tone from the US Federal Reserve in October, and recently released FOMC minutes that confirm this stance, market expectations for a US rate hike in December received a sizeable boost. Furthermore, the US dollar has rallied more than 7% vs the Swiss franc since mid-October, making Swiss products cheaper for the US. As the chart shows, the greenback is now back at a level when the SNB abandoned its currency peg. As the Chinese renminbi is closely linked to the US dollar, similar movements have resulted in a CNY/CHF exchange rate that is only marginally lower compared to the start of the year when the Swiss currency peg still was in place. This significant decrease of the CHF exchange rate versus its major trading partners will be welcomed by the SNB as it reduces the need for further stimulus.

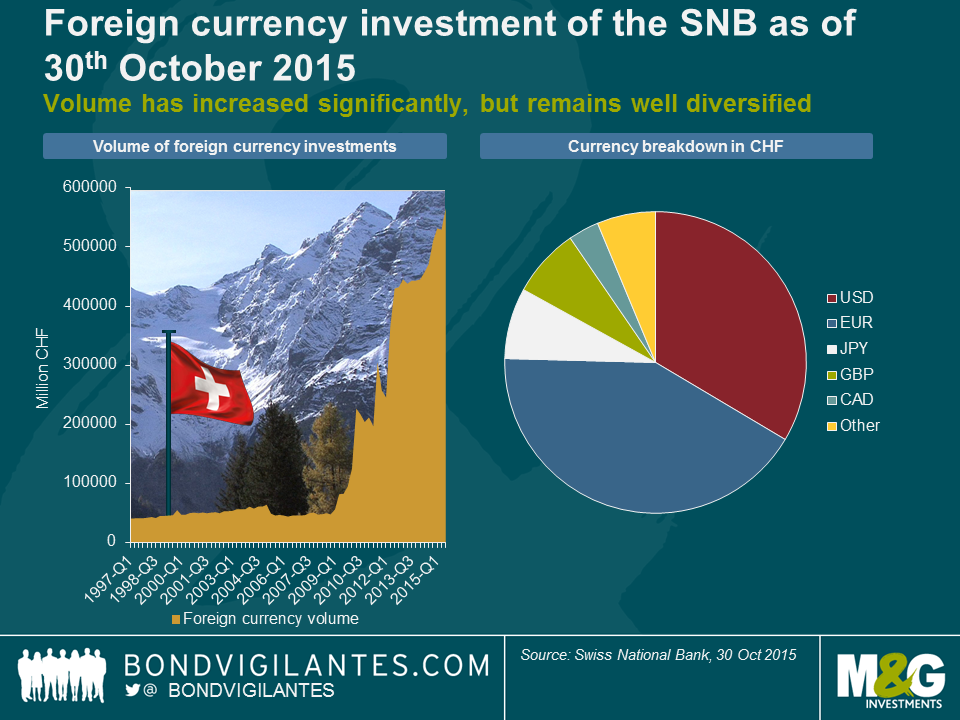

Further market interventions more likely than a rate cut

Looking ahead and trying to anticipate the SNB’s next steps, it’s worth mentioning that despite all the headwinds, the Swiss economy has proved surprisingly resilient with still positive annual growth. I think global growth will help Switzerland get through this difficult time as it reduces the impact of an overvalued CHF. The franc’s recent falls versus the USD and CNY also give the Swiss authorities more room to breathe and eases some of the currency valuation pressure. The size of the SNB balance sheet looks quite scary as a result of market intervention, with foreign reserves accounting for more than 80% of Swiss GDP (to put that in context, the UK’s foreign reserves represent approximately 6% of UK GDP). However, rather than pure size, diversification remains key as the SNB cannot hedge exchange rate risk against the CHF without neutralising the impact of its monetary policy. In my view, the SNB did a decent job over the past challenging years in managing to diversify its euro currency exposure by reallocating across other currencies.

That said, I think the SNB can and surely will intervene in the market if necessary, but will do that by further buying of euros rather than lowering its deposit rate more into negative territory. The latter action would expose the Swiss economy to a bigger extent to the widely unproved and unconventional monetary policy instrument of negative interest rates. In addition, I don’t think a deposit cut by the ECB in December is a given. Remember the ECB’s December meeting will take place two weeks before the Fed decision, and I can see Mario Draghi wanting to keep some powder dry should the euro appreciate versus the dollar in case the Fed decides, against market expectations, to keep rates unchanged. All in all, a busy year-end beckons for central bankers.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox