The US economy is not heading for recession, as it’s not FIRING on all cylinders!

There is currently a lot of concern regarding the US economy and its ability to withstand the collapsing price of oil and mined commodities, the Chinese slowdown, and the recent quarter (yes, quarter) point rate rise – or given the current market mood, its ability to cope with a doubling of the Fed funds rate! Whilst high yield spreads are close to recessionary levels, this is skewed by the energy sector. The manufacturing side of the economy is in clear decline, but the services sector is more significant for US growth and is performing much better (although the non-manufacturing ISM is well off its recent highs). The US yield curve is some way from being inverted, which has historically signalled recession, although it has been flattening and needs to be steeper. We think the Fed remains on track to continue raising rates as it should be focused on the data that points to a strengthening labour market.

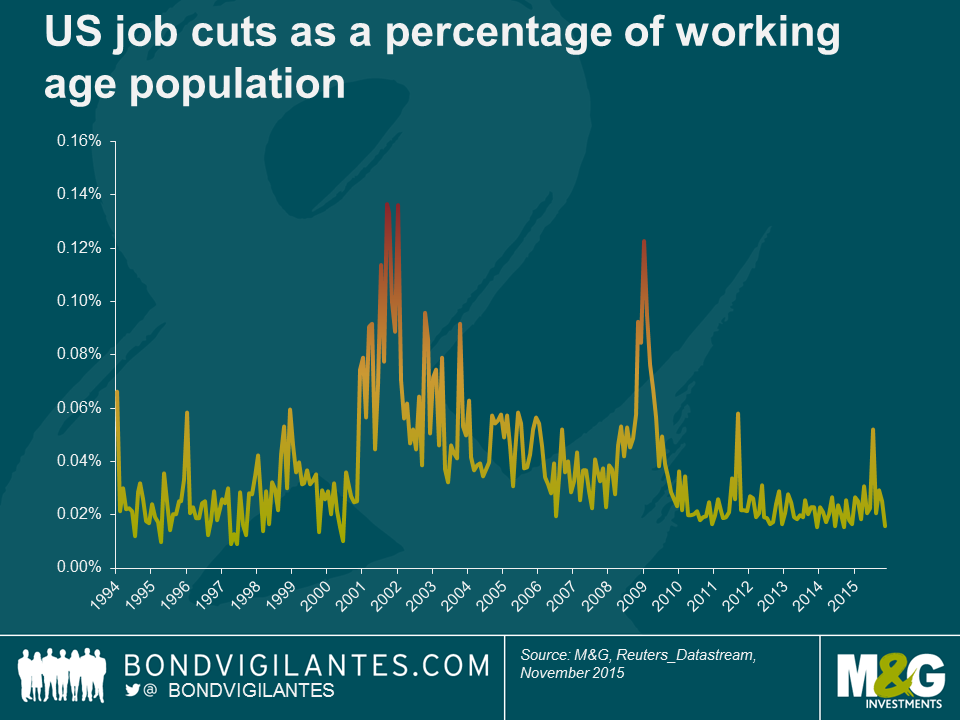

If the outlook from an economic and industrial output perspective were grim then companies would be shedding labour in the most traditional manner, by firing people. The graph below shows that the private sector is firing the lowest percentage of the working age population in the past 15 years. This is a sign of continued labour market strength, and the low level of job cuts points to a continuing trend of healthy employment numbers.

When analysing labour market and economic strength economists talk about the level of natural unemployment. In that context one can imagine there should be a natural rate of job cuts below which the economy cannot go. After all, there will always be some employers in difficulty, and thus requiring to shed labour. From the chart above one could infer that the natural rate is around 0.02%, meaning in this context the US labour market continues to look strong.

If the US economy was going to be pushed into recession then surely we would have had some signs by now, because oil has been in a bear market for more than a year, the Chinese stock market in a bear market for nine months, the mined commodity market in a bear market for two years, and the minor move in rates was fully anticipated (and delayed).

The economic reality is that falling oil prices help the economy, falling commodity prices are a supply rather than a demand issue, the Chinese economy is not a significant input into the US economy, and interest rates and Fed policy remain exceptionally accommodative. The stock markets, commodity markets, and the economy do not always move in tandem. The Fed should not focus on these indicators. Its mandate is not to support the stock market or the commodity market, but to support the labour market. The Fed should therefore remain vigilant, and not get sidetracked by noise that has little effect on the long term outlook for inflation, or the short term outlook for the labour market.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox