US inflation expectations are rising fast, but inflation is rising faster

2015 saw global inflation risk premia collapse, led by the developed world. US, UK and European annual inflation rates spent most of the year at or around zero with numerous dips into negative territory. Short dated breakevens correspondingly fell to levels that we last saw during the financial crisis (well, to be fair, they went far lower back then, but we are still at crisis levels today), and bond valuations in large parts of the world were supported by the lowflation and secular stagnation conditions that prevailed.

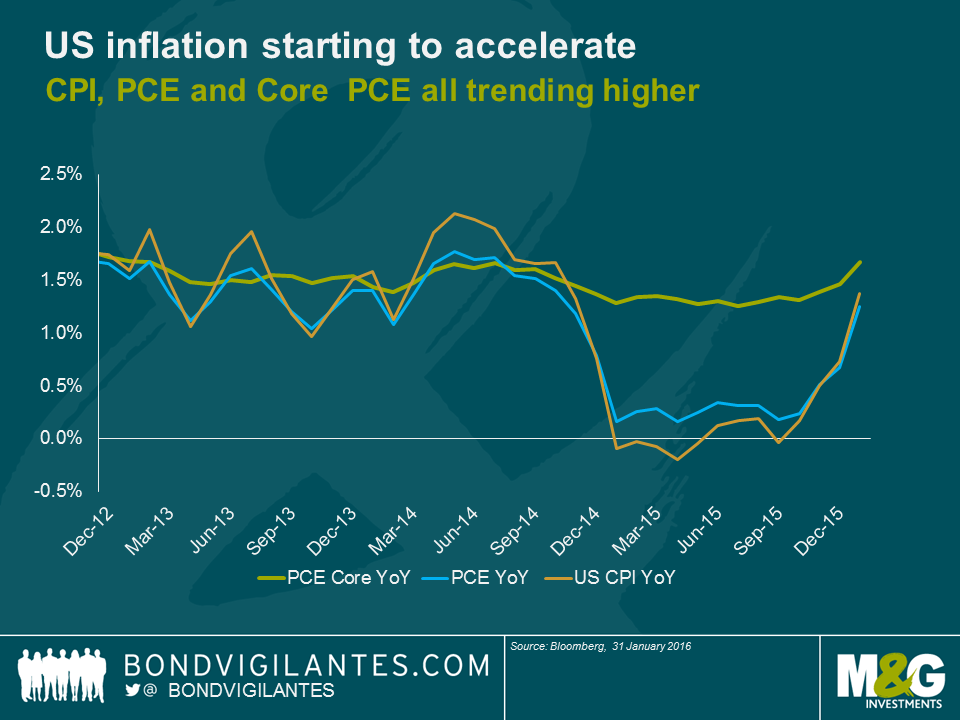

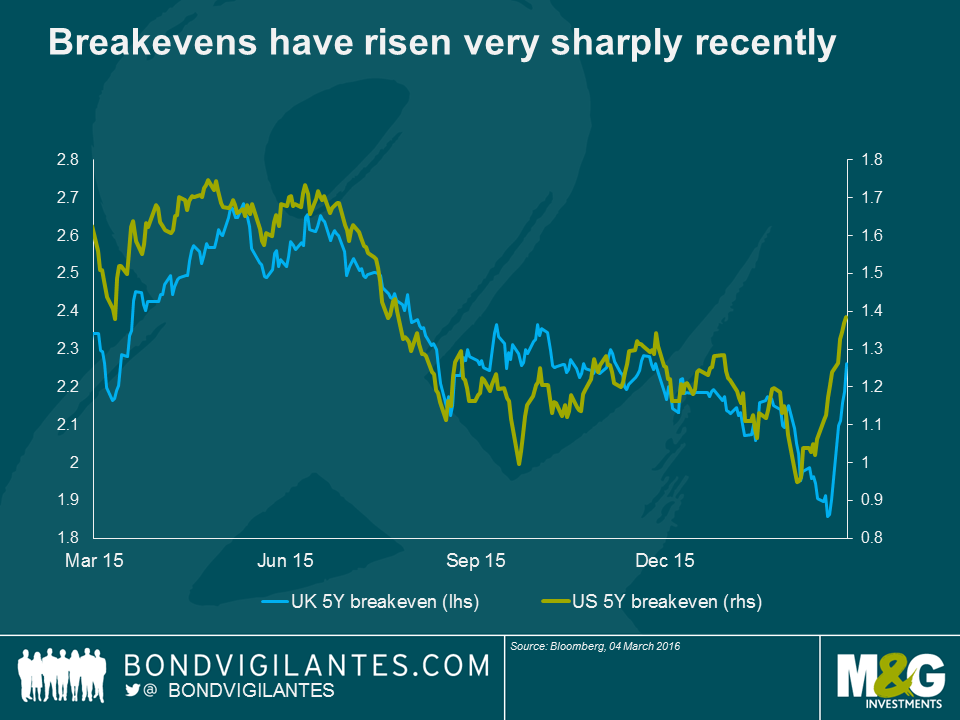

Looking back, three months of inflation releases ago (October 2015) US CPI was 0.1% year over year, the PCE deflator (i.e. the rate the Fed actually tries to target at 2% – see my recent blog) was at 0.2% and fears of deflation were rife on the back of ongoing energy and commodity price collapses, concerns of a Chinese hard landing, the coming interest rate hiking cycle and (related) strong US dollar. The start of 2016 came with a new list of deflationary forces to panic about: a renewed collapse in oil (where the second year halving in price we had once written off suddenly became much more likely), concerns of further Chinese devaluation, and growing fears that the US might even be entering a full blown recession. As a result of such deflationary noise, 5y breakevens hit post-crisis lows of 0.95% in early February.

But the inflation picture looks to have changed over the past few months. CPI is now 1.4% and Core PCE is at 1.7%, not far off the desired 2% and already above the level the Fed had it peaking at at the end of 2016.

Inflationary forces are broadening and accelerating, and it is happening fast. Recent data has shown that goods prices, in spite of the strong dollar, are now rising. Furthermore, ‘sticky’ components of inflation, the major part of which is services, are seeing price rises pick up too, currently running at 2.5%. Rental costs continue to be a source of rising prices and, interestingly, medical costs are now showing signs of life after a period of stagnation early in Obamacare’s life.

It’s true that energy costs remain a drag (and February will be a more negative month for energy contribution than January was), but in a few months’ time (provided the oil price stabilises around current levels) the negative base effects will progressively fade away. When this happens, the rebound in US inflation will exceed that seen in Europe or the UK. In addition the US labour market is tighter than anywhere else and wages are starting to behave as though the NAIRU has been reached.

Three months ago inflation was closer to zero than to target. Today it is closer to target than to zero, and is trending higher. The bond market is clearly taking notice. As the chart above shows, US 5 year breakevens are up around 40 basis points over the past three weeks, and UK 5 year breakevens are up a similar amount. A lot depends on the oil price in the near term, but if inflation numbers continue to repair back towards target, then it seems likely to me that breakevens can go further than they have done so far; perhaps significantly so.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox