Fossil fuels – The end is nigh

There’s no doubt that the oil industry has seen better days. Adding to present-day woes of price levels of $30-40 per barrel are questions about the long-term viability of the industry’s business model as a whole. Take for example the Rockefeller dynasty and Saudi Arabia, two names synonymous with gigantic fortunes built on oil. Well, the Rockefeller Family Fund just announced its intent to divest from Exxon Mobil, a direct descendant of John D. Rockefeller’s Standard Oil, and from other firms related to fossil fuels, stating that it made “little sense – financially or ethically – to continue holding investments in these companies”. Saudi Arabia made public its plans to launch a US$ 2 trillion investment fund, setting the course for the country’s post-oil future. Admittedly, it’s only anecdotal evidence but maybe the writing is indeed on the wall for the oil industry.

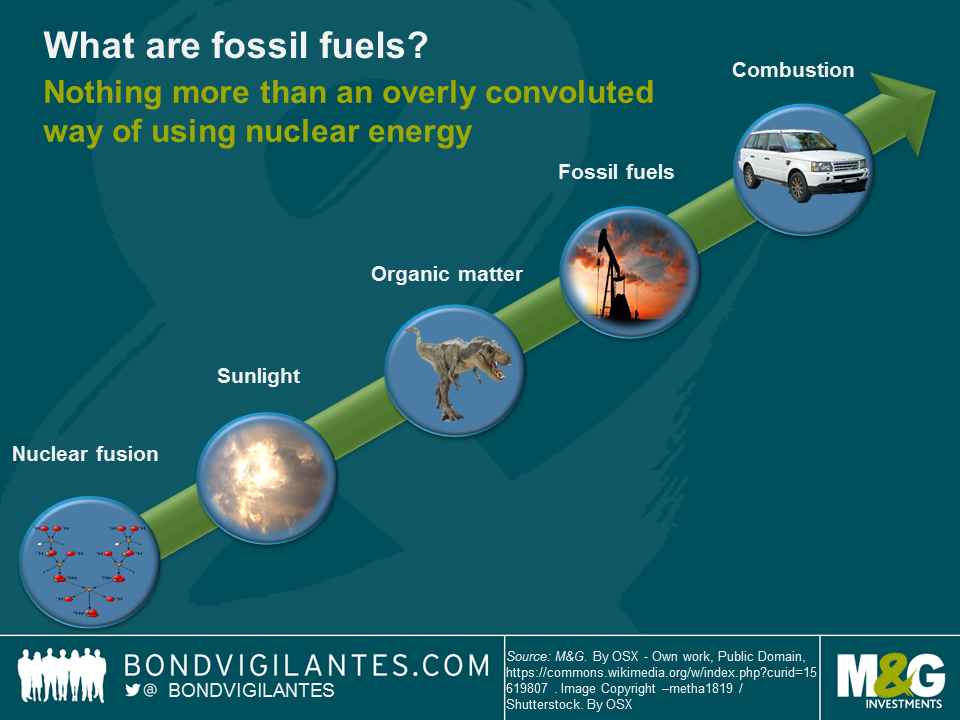

To be honest, as a chemist by training it has always puzzled me how fossil fuels have managed to acquire such a dominant position within the global energy landscape in the first place. They really aren’t such an obvious choice, when you think about it. At the core of it, burning fossil fuels is merely a long-winded and inefficient way of using nuclear energy (see chart below).

As a by-product of nuclear fusion processes in the sun, electromagnetic radiation (i.e., sunlight) is emitted. On earth, plants convert the energy contained in sunlight into chemical bonds by building up complex hydrocarbons that are metabolised (ie eaten) by animals and converted into further biomolecules. After plants and animals die, their organic matter is converted under certain circumstances over tens of millions of years into fossil fuels. In that sense, fossil fuels are renewable energy carriers, albeit running on an extremely long time-scale. We then dig up these fossil fuels, process them and eventually burn them in order to convert the energy stored in their chemical bonds into mechanical energy or heat. The whole process is hopelessly inefficient as energy is “lost” (not actually lost but partially transformed into rather useless energy forms, such as waste heat) at every single energy conversion step. The last step is particularly horrific as combustion engines have efficiencies well below 50%. And that’s not a problem that could be “engineered away” but a necessary consequence resulting directly from the laws of thermodynamics. Let’s stop there…

Oil has further severe disadvantages, for instance:

- Finite supply as the rate of consumption is so much higher than the rate of reproduction

- Environmental impact of extracting, transporting and burning oil (spillages, soil and ocean contamination, CO2 emissions, etc.)

- Complex infrastructure (pipelines, oil tankers, refineries, petrol stations, etc.) that is expensive to build and maintain

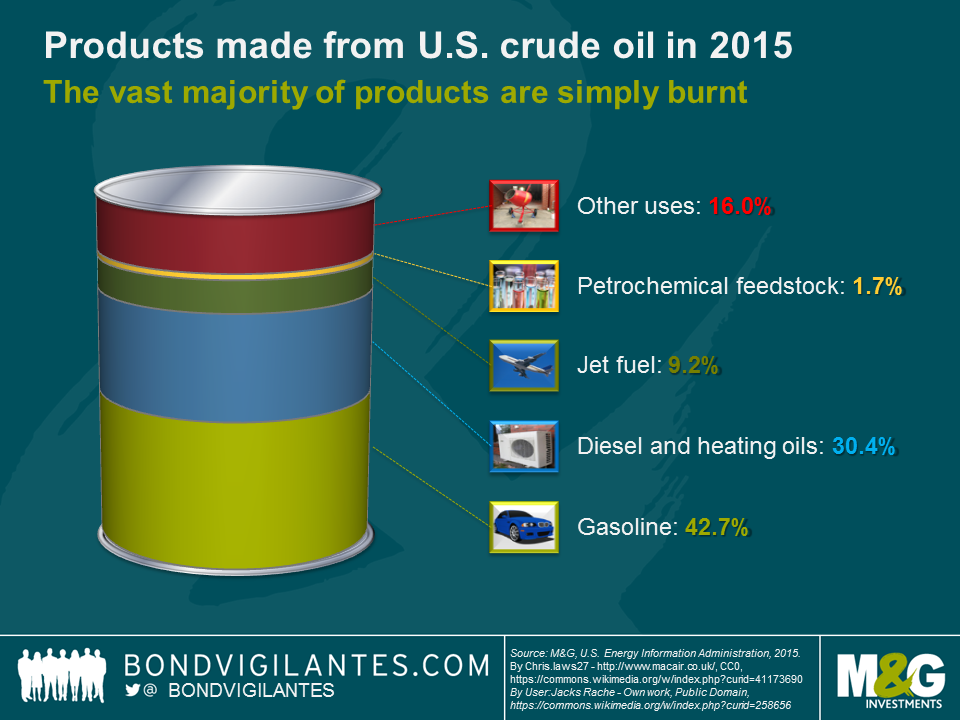

And there are opportunity costs to be considered. If we are willing to accept all the disadvantages of oil, shouldn’t we then at least try to make the best of it? Using the complex mixture of organic molecules as precursors in sophisticated polymer synthesis would be sensible from a chemist’s point of view. However, petrochemical feedstock only accounts for a small fraction (c. 2%) of products made from a barrel of U.S. crude oil (see chart below). More than 80% of the products (gasoline, diesel, heating oil and jet fuel) are simply burnt in combustion engines or furnaces, which, quite frankly, is pretty wasteful and savage.

But why are fossil fuels, and oil in particular, still so prevalent? Why are the vast majority of cars still propelled by internal combustion engines and not by electric engines? The key is energy storage, the one area where fossil fuels excel. This has profound practical implications, particularly for applications in transportation. Vehicles using oil-based fuels are relatively light. For any given range they need to carry around only a relatively small quantity of fuel. That’s the main bottleneck of “Electro Mobility” at the moment. One kilogram of electric batteries can only store a small fraction of the energy that is contained in one kilogram of gasoline, diesel or jet fuel. As long as batteries cannot be recharged while driving (still a long way off), users of electric vehicles either have to accept a smaller range or they have to carry lots of batteries, which increases weight and thus reduces efficiency.

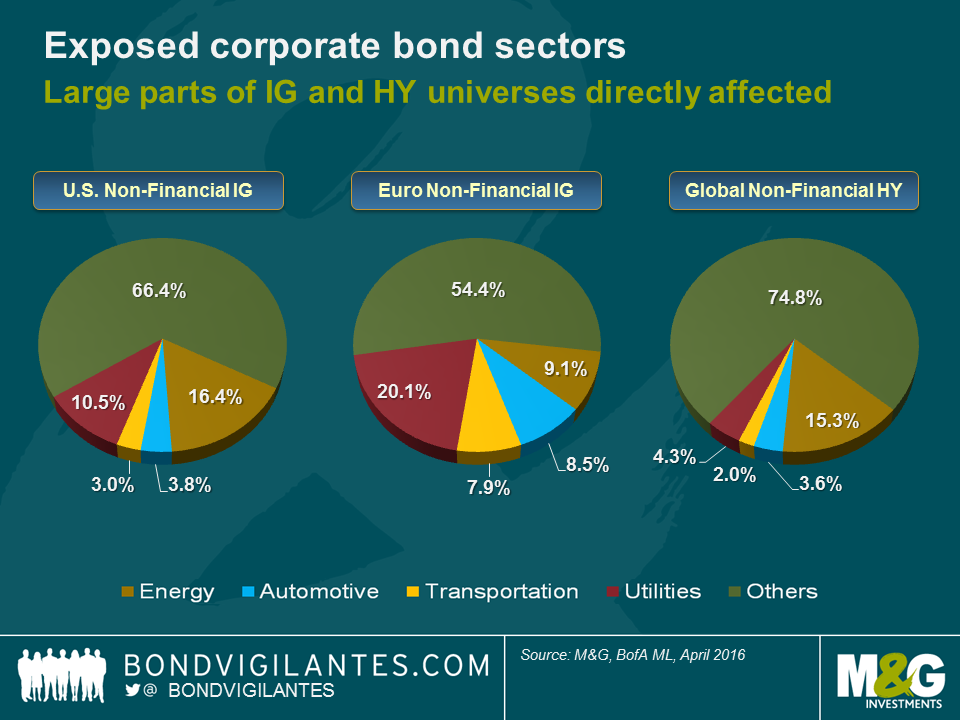

Significant resources are currently committed to electric battery research to drive technological progress. As a consequence, batteries are catching up fast with fossil fuels (see Jim’s blog). Simultaneously, renewables, solar energy in particular, are becoming more and more cost-efficient. As soon as the energy storage gap is sufficiently small, we will reach a tipping point as there will no longer be any good reason to rely on fossil fuels. As with other large-scale technology disruptions in the past, the consequences will be significant (see chart below).

In the non-financial corporate bond space, the sectors most directly affected by the end of the fossil fuel age (energy, automotive, transportation and utilities) account for roughly a third of the U.S. investment grade (IG), nearly half of the European IG and around a quarter of the global high yield universes. There will also be ripple effects on other corporate sectors (e.g., chemicals), as well as on government bonds of petroleum exporting countries. Since energy costs are a meaningful part of price indices, there will be an impact on inflation break-even rates. And the list goes on. These developments won’t occur overnight, of course. But it is our job as long-term bond investors to think long and hard about this topic now and the opportunities and threats that go along with it.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox