With zero yields, the advantages of bonds over cash are gone

When investors buy or sell financial assets they try to analyse likely outcomes. This basically revolves around three main issues.

- What is the capital upside?

- What is the capital downside?

- What income is earned from the security?

The dramatic fall in bond yields means that this traditional approach to investing will have to be examined.

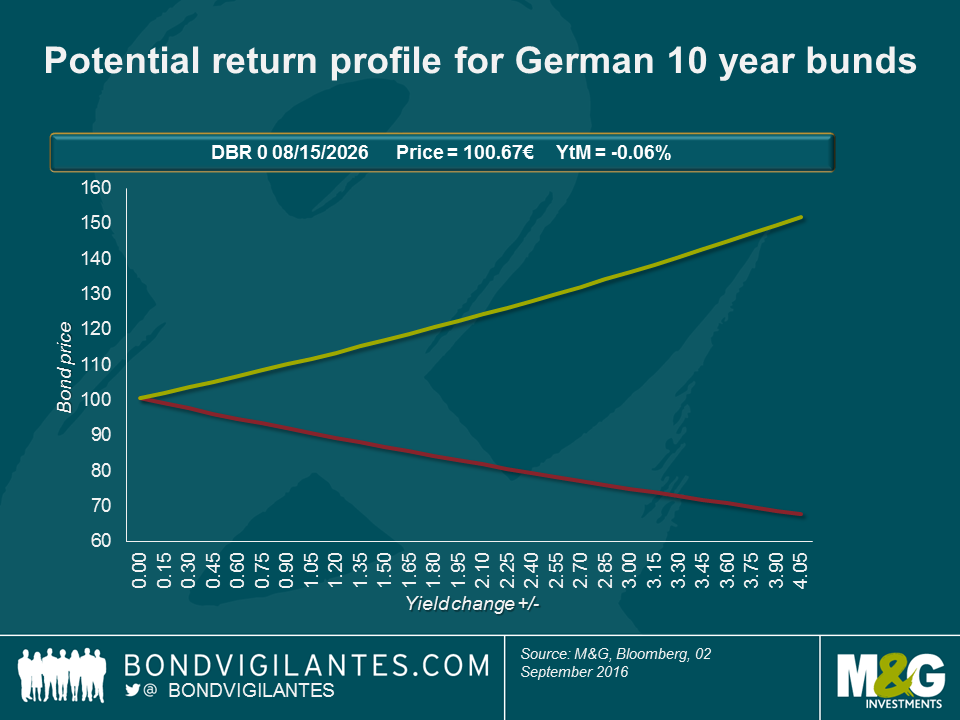

One way to do this is to model real world outcomes. Below is a depiction of how the German bund 0 percent 2026 will move in price given different yield scenarios. Assuming the current yield is zero the price is 100, if interest rates were to fall -4 percent the price of the bond will increase to 151.9 , and if rates were to rise by 4 percent the price will to fall 67.8. It is possible to plot the theoretical capital upside and downside, and given that it is a zero coupon security it will earn the investor no income over its life.

The above approach is the traditional way an investor would analyse a bond, however one has to remember that investors can think of cash as a strong bond alternative. When holding physical cash, the investor knows the capital upside and downside are both zero, and the income returned by physical cash is zero. Cash is the ultimate low volatility security, but earns the investor no income.

This lack of income has given bonds an historical edge over physical cash. Investors were happy to take extra income and potential capital gains and losses in bonds versus cash. Developed bond markets are now at the point where the income on a 10 year bund and a 100 euro note is exactly the same (zero) and the yield advantage of owning a 10 year bund is gone. However, the potential capital gains and losses of owning a bund still exist. Consequently, at these low yields I believe the upside for bunds versus cash is limited.

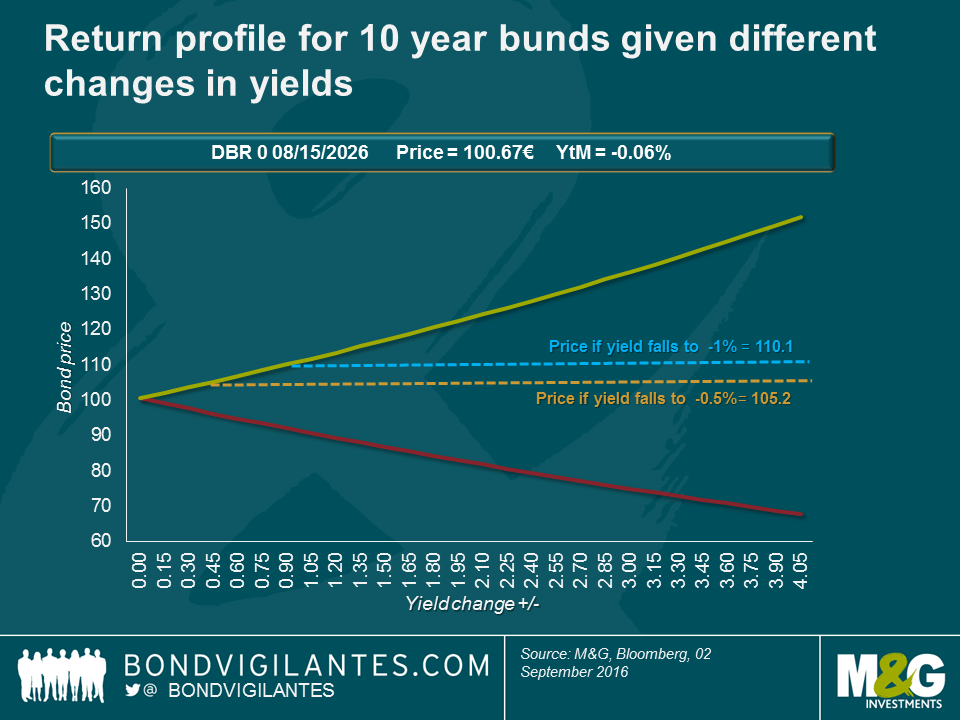

When faced with a greater return and less volatility why would investors buy a negative yielding bond rather than hold cash? One advantage government bonds have over cash is safety, they are harder to lose, steal, and be destroyed. And there is a greater cost in holding cash due to its physical nature. This risk can be removed via secure storage, traditionally in a vault. This means that a holder of cash would become indifferent when the costs of holding cash is the same as the negative yield earned on bonds. If we assume this is around 1 percent, then the below graph illustrates that investors would be willing to hold a bond yielding less than zero to maturity even with the potential risks to capital.

Markets are dynamic, and if this negative yield environment persists, market structures will probably evolve to potentially provide more interesting ways to store cash. One solution would be for a bank to issue an ETF based on negative yielding cash, akin to other physical ETFs. As opposed to commodity or equity backing, the ETF would have cash stored safely at a variety of locations, where security would be strong and access would be hard to achieve. The ETF provider could then charge the client a fee (say 1 percent per annum) for depositing the cash, incur low costs of storage of let’s say 0.5 percent, and earn 50 basis points of return. Such an ETF would allow both small and large transactions, and allow customers from individuals to institutions to store their money efficiently at a zero rate before fees.

In theory, the upside in bonds is limited by the physical alternative of cash. Therefore the risk reward of owning bonds is skewed. Below the zero line the upside is limited, while the downside still has the ability to hurt.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox