IMF and World Bank meetings 2016: China, Japan, UK and Europe

Last year we blogged with our key takeaways from the IMF and World Bank meetings and this year is no different. Claudia Calich and I tag-teamed between the Washington based events, participating in the many wide ranging discussions that took place, so we’re doing the same here. Claudia will be providing the emerging market coverage, while I share some insights from developed markets, alongside discussion on China.

1) China: Taking a backseat after driving markets last year

In contrast to last year, conversations on China stirred surprisingly little concern. After the large market movements and bouts of volatility experienced in August 2015 and earlier this year – triggered by China’s FX rebalancing, rising corporate defaults and accelerating capital outflows – the concerns about a “hard-landing” appear to have abated. Instead, much was made of the improvement in central bank communication and the currency having been relatively stable versus the target basket this year. Sentiment also remained positive regarding China’s rebalancing towards a service economy, which has been gaining traction, as the credit expansion and increasing consumption share of GDP has provided a floor to growth, offsetting any investment slowdown. This sentiment coincides with the uptick we’ve seen in the Li Keqiang Index this year (the oft regarded “better” proxy of Chinese economic growth).

The country is not without its foibles, but given that China has an array of policy tools, expectations are that these should alleviate any macro shocks. Policy will therefore focus on growth stabilisation in order to maintain momentum into the Party Congress leadership transition which takes place in October next year. After a period of stability, it is hoped that structural reforms (e.g. with respect to state-owned enterprises and banks) will take centre stage.

2) Japan: The ongoing broadening of QE

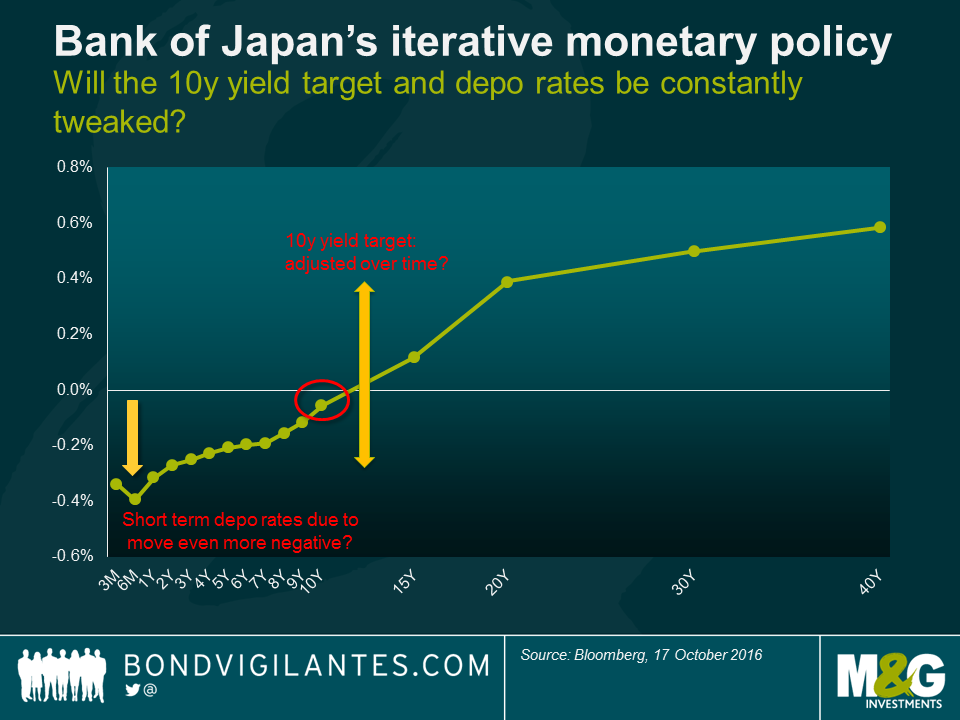

Discussions surrounding Japan focused on the efficacy of the newly unveiled “QQE plus yield curve control” policy, where the Bank of Japan is shifting focus away from the monetary base towards an aim to keep 10 year yields at around its recent level of 0%, as well as a commitment to overshoot its 2% inflation target. My gut feel is that the goalposts will continue to be a lot more flexible compared to the comparatively fixed targets of the western world. In pursuit of its objectives, I expect Japan’s monetary policy to continue to be a creative work in progress (we’ve already had Quantitative Easing, Quantitative and Qualitative Easing (QQE), QQE + Negative Interest Rate policy and now QQE + YCC). Indeed my main takeaway is that it’s all up for negotiation. The BoJ won’t sell JGB’s if it needs to drive the 10 year yield up, but will instead purchase less via its QQE programme. This suggests that the current target of ¥80tn of annual JGB purchases will have to formally change over time. Short term rates could be adjusted lower into negative territory should inflation expectations fall. It also felt as though the 10 year yield may be a moving target which evolves over time. The longer term aim is clearly to engineer a steeper yield curve, but it will be interesting to see whether the BoJ are successful, especially since it’s been difficult enough for the developed world to generate 2% inflation in recent years, let alone an overshoot.

3) UK: Uncertainty and politics dominate

If I was given a dollar every time I heard the political buzzwords “Brexit” and “Trump”, I’d have returned with a lot more than a $2 tin of IMF branded mints. It is however understandable that these were the issues at the forefront of investors’ minds, especially since the meetings took place during the final month of the US election campaign and at a time where sterling lost 2.5% of its value against the dollar (given Theresa May’s conservative party conference comments resulting in heightened fears of a “hard Brexit”, or as HSBC preferred to call it: a “continental Brexit” versus a “full English Brexit”). The concern that the UK might not get its way in negotiations is a view I’m sympathetic to. Certainly, discussing this issue in Washington meant that I could get more of a birds-eye, non-UK view. Stating it simply, the UK will be negotiating against a bloc of 27 EU member states and if the UK is to be granted any type of concession, unanimity amongst the 27 is required; this is a high hurdle. Other discussions concerned the potential period of stagflation the UK may find itself in, given the 18% deprecation we’ve seen in sterling versus the dollar since the referendum, teamed with the ongoing uncertainty which may harm growth and investment going forwards.

4) Europe: Will continue to muddle through, but more must be done

The IMF recently revised this year’s growth forecast for Europe from 1.6% to 1.7% and 1.5% for next year, the slowdown in 2017 being Brexit related. Although there have been murmurs that the ECB may be about to taper, the view was that monetary policy has been sufficiently accommodative and will remain so due to the stubbornly low rate of inflation which is forecast to remain below target at 1.1% next year. Taper talk seemed very much off the table.

With regards to fiscal policy, the challenge is that there is very little fiscal space available; even if Germany were inclined to do more, it was argued that there would be little impact on the rest of Europe, especially the periphery, since trade links are so weak. Attention should instead turn to structural reforms. Key concerns surround issues that have been in play since 2021/12; namely high debt burdens, NPLs, refugee and immigration. The cohesion of the EU could also come under the spotlight given Brexit negotiations as well as the political events on the horizon in Italy (referendum on Senate reform on 4 Dec) and the 2017 elections in France and Germany.

The meetings were a great one-stop-shop, hearing from a variety of central bankers, ministers and economists, covering the most pertinent issues. Anecdotally, learning about the culinary preferences of some of the world’s most influential policy makers was also memorable. For the record, Mark Carney favours pizza, Wolfgang Schäuble likes French food, Yi Gang likes everything and I rather liked Christine Lagarde’s response to where she would like to go for dinner; “I will take YOU for dinner and I will cook”. Key takeaway: the IMF and World Bank conferences definitely provided food for thought.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox