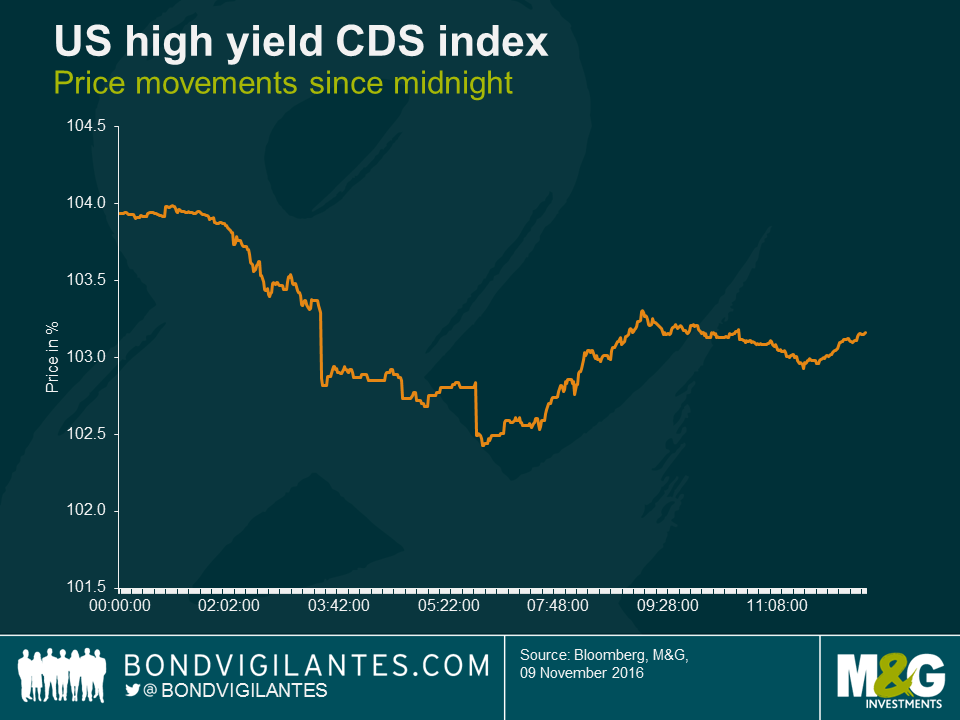

As James mentioned this morning the European high yield markets’ response to the Trump election victory has been fairly benign. The U.S. high yield market, as one would expect, has been a bit more pronounced, although not as severe as European equities or S&P futures. The U.S. CDX Index, a CDS index of U.S. high yield issuers much like Europe’s iTraxx Crossover, initially dropped nearly two points or 1.3% but has since recovered, currently down about half a point or 0.5%.

We will have to wait for the U.S. market to open fully to see how this will play out over the course of the day, but it’s worth noting that individual sub-sectors will react differently to the result. We would highlight health care as one sector in particular to keep an eye on. The Trump victory will likely create volatility both positively and negative in this sector.

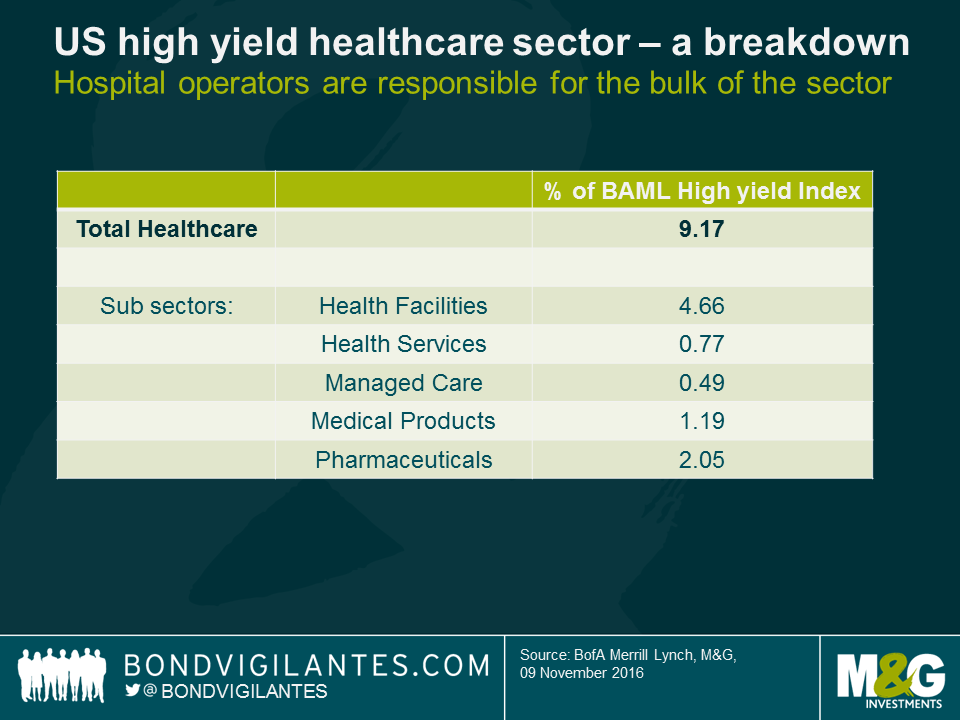

With a Trump presidency and Republican Congress there will undoubtedly be renewed calls for the repeal of, or at least significant adjustments to, the Affordable Care Act (ACA) or Obamacare. This could lead to negative pressure on hospital operators, which make-up a meaningful percentage of the broader U.S. high yield index (nearly 5% of the Bank of America U.S. High Yield Index). Theoretically, these operators could see an increase in the number of uninsured patients under such a scenario. In addition, the uncertainty about the future of the ACA could lead to negative pressure on U.S. managed care companies. Although the majority of these companies are investment grade, there are a handful of high yield issuers that could be affected.

Conversely, it is expected that there will be less pressure on drug pricing and costs under a Trump administration and Republican congress. This could serve as an uplift for high yield specialty drug manufacturers in particular. Further, there is likely to be bi-partisan support for the faster approval of generic drugs, which would benefit generic manufacturers, albeit to the potential detriment to branded manufacturers.

Trump has also called for direct price negotiation of Medicare Part D drugs, and for drug re-importation, which could translate into modest negatives for pharmaceutical manufacturers. These policies have not been a focus of Trump’s campaign and are not anticipated to gain much traction in Congress.

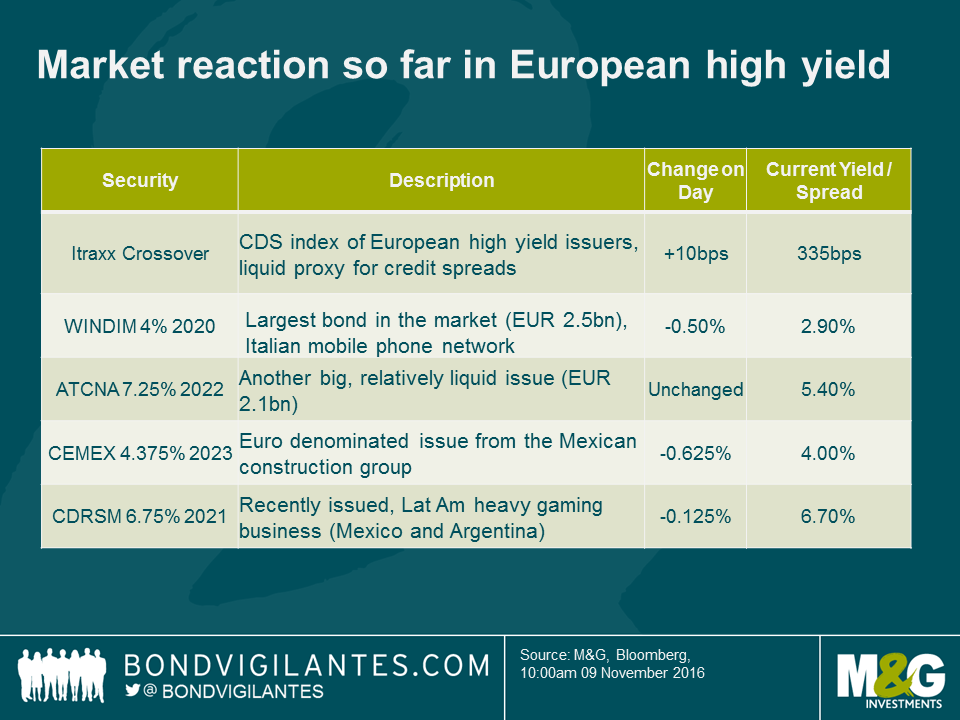

After the surprise election result, market reaction within the European high yield market has been surprisingly muted. Here are a few key moves that show how the news is being digested.

In general, the market seems to be pricing in little to no impact for European risk premia, and even for the more potentially directly impacted companies in Latin America, the re-pricing has been very mild.

It seems investors are looking through any short term uncertainty and seeing looser fiscal policy as a boon to nominal growth, something that should be positive for most high yield businesses. Cemex, for example, has a major presence in the US domestic market – in one of those ironies, it could end up being a major supplier to a Trump infrastructure programme.

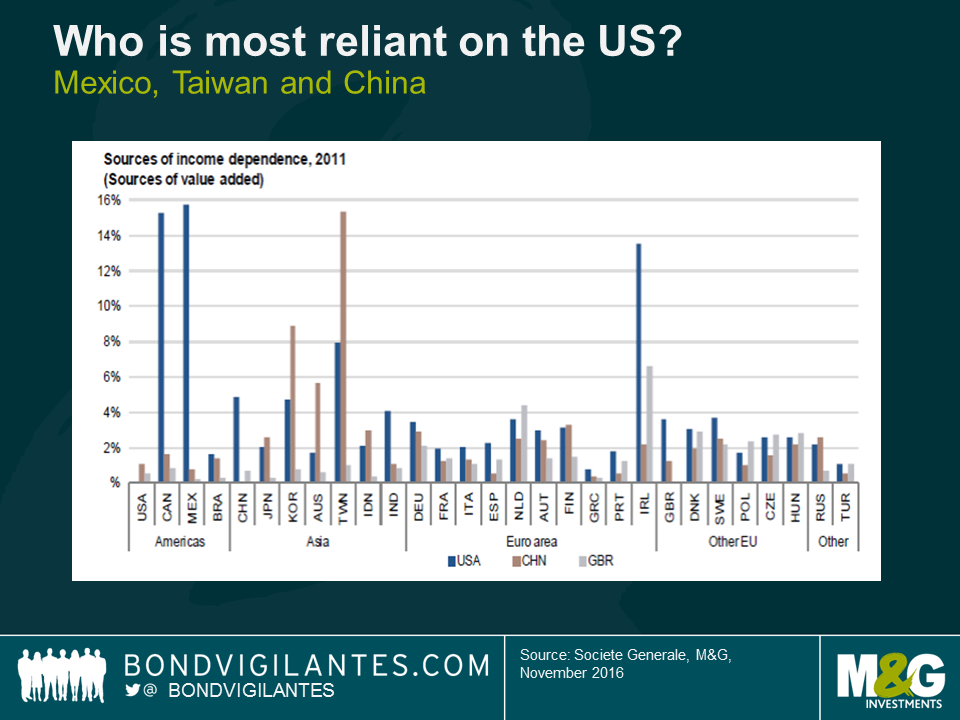

Today’s US election result has several implications for emerging markets. At a first glance, the outcome is clearly negative, given the potential downside risks from increased trade protectionism, anti-immigration measures, large fiscal expansion and steepening of the US yield curve and uncertainty in terms of foreign policy.

These risks are already being reflected in asset prices. Since the result, Mexico is one of the largest underperformers due to its deep trade and economic ties to the US. Another region which could suffer is Central America. If Trump goes ahead with all of his proposals during the campaign and manages to overcome the logistical nightmare of having all illegal immigrants deported, remittances from these immigrants will come to an end and that will certainly have an impact on their home countries’ economies. In Central America, countries seeing the largest impact would be the smaller ones, such as Guatemala, El Salvador and Honduras, where unauthorised remittances from the US could account for as much as 5.6%, 8% and 13.2% of their respective GDPs, according to our estimations. These countries have a much higher share of remittances vs. GDP and current account receipts because their share of illegal immigrants is higher in comparison to the size of their economies and population (see my previous blog on this topic here).

However, as is always the case, volatility creates opportunities. There are several countries that are relatively closed economically, such as India and Brazil, that have relatively low trade or immigration ties with the US. Countries within Eastern Europe are much more dependent on Europe than the US for their exports or financial channels. In this respect, they will be much more impacted by the upcoming Italian, French and German political events than the US election. Russia may benefit from today’s result should the US start easing financial sanctions. Finally, commodity credits such as Sub-Saharan African issuers are much more dependent on China as a driver for commodity demand or for financing than the US. In terms of relations with China, imposition of trade tariffs and whether the US Treasury will name China as a currency manipulator will be the key events to watch.

We will look to selectively increase exposure to countries that have relatively looser ties with the US and whose asset prices have been unduly punished or for assets that have severely underperformed, such as the Mexican Peso, which is finally pricing in a lot of negative news after a 50% depreciation in the last two years.

As Donald Trump delivers his victory speech, and is set to become America’s 45th President, here’s a quick update on what we’re seeing in bond and currency markets since you went to bed. For bonds, the impact has so far been relatively modest; it’s been equity markets where moves have been stronger (the Nikkei is down 5%). Last night the Mexican peso was the barometer of the likely outcome, at first rallying but then rapidly retreating. It’s now 10% lower against the US$, which itself is weaker on expectations of fewer Fed hikes. The DXY USD index is 0.8% lower overnight, with the yen – a traditional winner in “risk off” episodes – two percent better.

As expectations of a Trump win grew last night, the US Treasury market rallied aggressively. You might think this perverse given that Trump has openly discussed “haircutting” Treasury investors, but this is a flight to quality response. The Fed was seen as nailed on for a 25 bps hike in December, but the uncertainty impact of a Trump win makes this much less likely (and will Janet Yellen still be head of the Fed under a Trump regime?). The implied probability of a rate increase has fallen from over 80% to 50%. Rate expectations have fallen for 2017 too. 10 year US Treasury yields plummeted by 14 bps from 1.88% to 1.74% as the election outcome became clearer, but have subsequently risen back to 1.81%. Overall, we have seen a relatively modest 5 bps fall in the US 10yr yield.

There’s been more impact in the shape of the US yield curve. Longer dated USTs have sold off, with the 30 year yield 5 bps higher. We know very little about Trump’s economic policies, but a fiscal stimulus through tax cuts and infrastructure spending seems likely (we could compare his likely policies to those of Ronald Reagan in his first term of office). Government borrowing is likely to rise in the medium term, and that often results in yield curve steepening. We should also remember that the US bond market is heavily owned by foreigners, including nations like China where Trump has made unfriendly comments. 50% of the US Treasury market is owned by overseas investors (China owns 19%, Japan 18%), and 30% of America’s corporate bond market is foreign owned. Foreigners – and especially China – have already turned heavy net sellers of USTs over the past six months. Bunds have rallied by 5 bps too.

Elsewhere in fixed income markets, we have seen little response in credit markets compared to equity markets. There’s been an initial widening in the CDX IG US$ credit index of maybe 5 bps to 80 bps, and the European iTraxx high yield index is 17 bps wider. These are very modest moves, although as you’d expect there’s been little traded in the physical credit markets yet, and liquidity will be poor today. We saw a price in Cemex, the high yield Mexican cement manufacturer, that was about 1 point lower than yesterday. This doesn’t seem much and who knows if you could sell your bonds there. US bank names are around 12 bps wider in spread, peripheral European banks 20 bps wider. CoCos are marked down 2 to 3 points.

The big implication for investors of what happened last night is this: with no income growth for most populations in developed world economies since the Great Financial Crisis (with the exception of the 1%), the established parties and candidates are being heavily punished in elections. It doesn’t stop here – we have a referendum on the Italian constitution next month, and many more European elections in 2017 (could Marine Le Pen be elected President in France?). I saw a statistic this morning where across the G7, 65% of parents believe their children will be worse off than they are. Having seen the electoral shifts in the UK with Brexit and now the US, do established political parties react by promising significant fiscal expansions? Could last night’s vote trigger the end of global austerity?

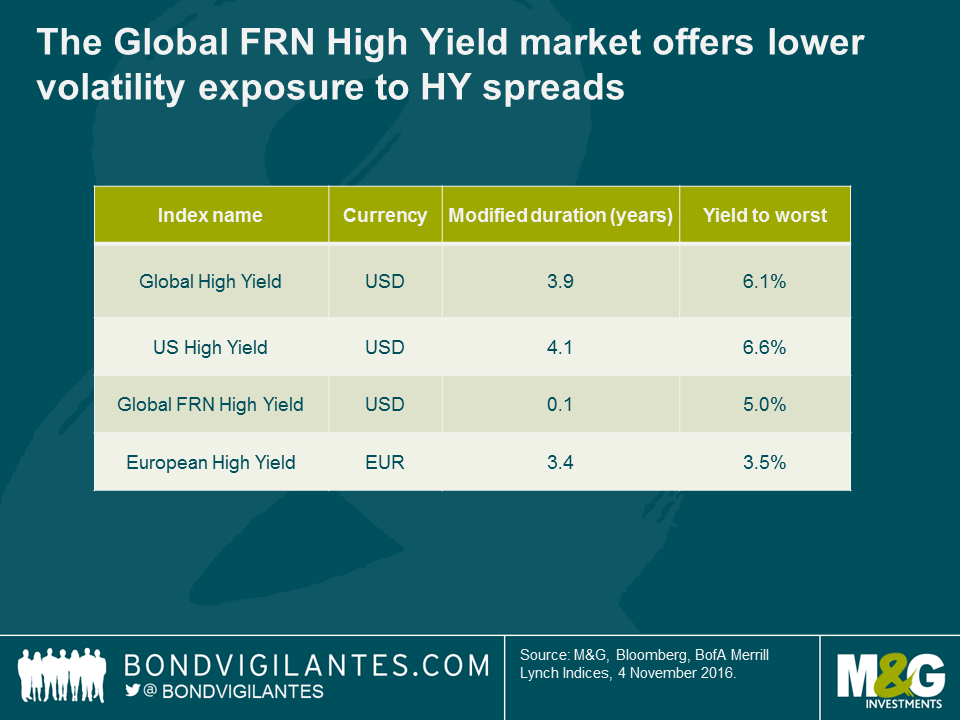

With the market currently pricing in an 84% chance of a US interest rate hike in December it appears likely that there is some pressure for bond yields to move higher on a medium term view. This is on top of the re-pricing that we have already seen in risk-free assets like US Treasuries over the course of the past four months. High yield assets are not immune from the laws of bond maths, with longer duration assets suffering in the current rising yield environment. In my opinion, there are four reasons why high yield investors should be looking to the floating rate note market to help manage their exposure to interest rate risk at this point in the cycle.

- New Issuance helping to diversify and grow the market

The High Yield FRN market is seeing a pick-up in new issuance and supply at the moment. As a relatively small but developing area of the bond market this is important, as this allows investors increased choice and diversification. The chart below shows a selection of new issue deals we have seen over the past few weeks.

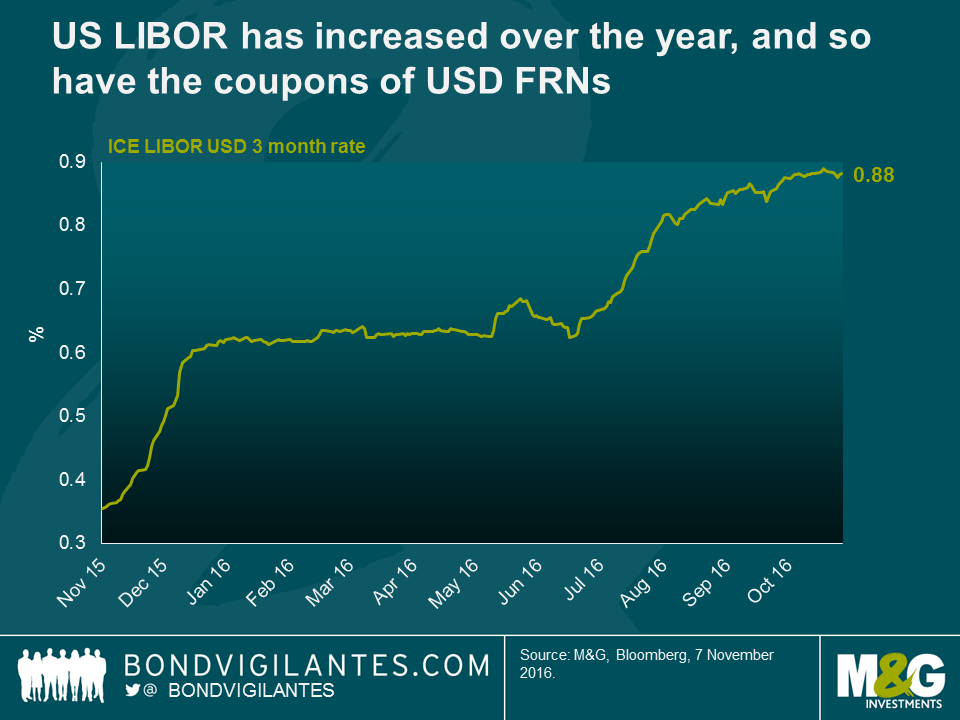

- USD FRN investors benefitting from rising USD LIBOR rate

For US dollar investors, floating rate notes have benefitted greatly from the re-pricing of risk in money markets. As US LIBOR has increased over the year to c. 0.90%, so have the coupons of all USD floating rate portfolios, with no associated hit to capital values. Further interest rate hikes from the Fed over coming months could see subsequent increases in USD LIBOR going forward.

- Risk-adjusted value supports FRNs versus fixed high yield

As shown in the table below, the high yield floating rate market offers similar yields to the conventional US and European high yield markets today, but with much less interest rate risk (i.e. close to zero) and lower volatility in periods of risk aversion. We believe this feature makes this part of the market more attractive on a risk-adjusted basis for investors who are looking for lower volatility exposure to high yield credit spreads.

- Capital preservation if government bond markets continue to sell-off

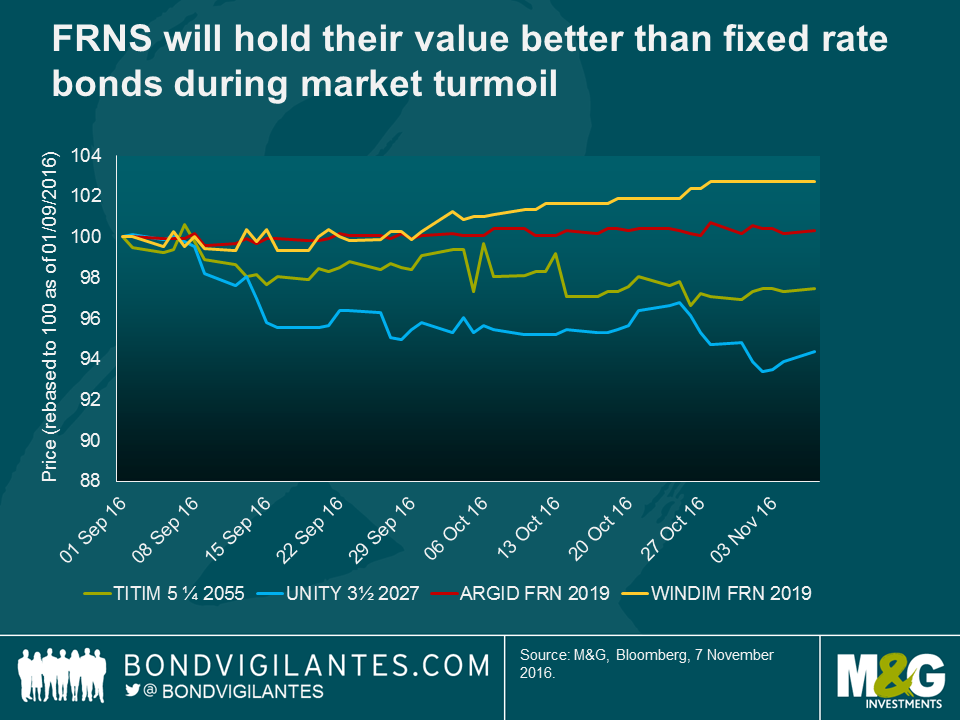

If government bond markets continue to weaken, FRNs will hold their value better than fixed rate bonds. This has indeed been the case over the past 3 months, even for high yield bonds. The chart below illustrates in practice how floating rate bonds have held up, or even marginally increased in value, over the past few months. On the other hand, longer-dated conventional high yield fixed rate bonds such as those issued by Telecom Italia (TITIM) and Unity Media (UNITY) have fallen in price by several percentage points due, largely, to their much greater sensitivity to government bond market volatility.

Last week, the Federal Open Market Committee (FOMC) decided that despite low unemployment and a sustained increase in breakeven inflation expectations since September, it was appropriate to maintain the Fed Funds rate between 0.25-0.50%. In trying to understand this action, and why the Fed is happy to wait until December to hike rates, a number of theories have been suggested by the financial community. These include:

- The FOMC is waiting for the election to be out of the way for political reasons, before enacting further tightening;

- The FOMC is refraining from tightening as even though the Fed Funds rate is low, it should have gone negative after the crisis but was constrained by the zero bound;

- The economic cycle is already a long one and the FOMC are worried about potentially tightening policy into an economic downturn;

- The FOMC genuinely don’t know that they are making a policy mistake and are underestimating the build-up in inflationary pressures.

From reading my opinion in previous blogs you will find that I agree with the reason number 4. A tight labour market, developing wage pressures, and the dissipating deflationary impacts of a collapsing oil price, suggest to me that the US economy needs higher interest rates.

What is less well known than the official Fed Funds rate, is that under the surface there has actually been a steady tightening of policy in the real world that the FOMC has been happy to accept.

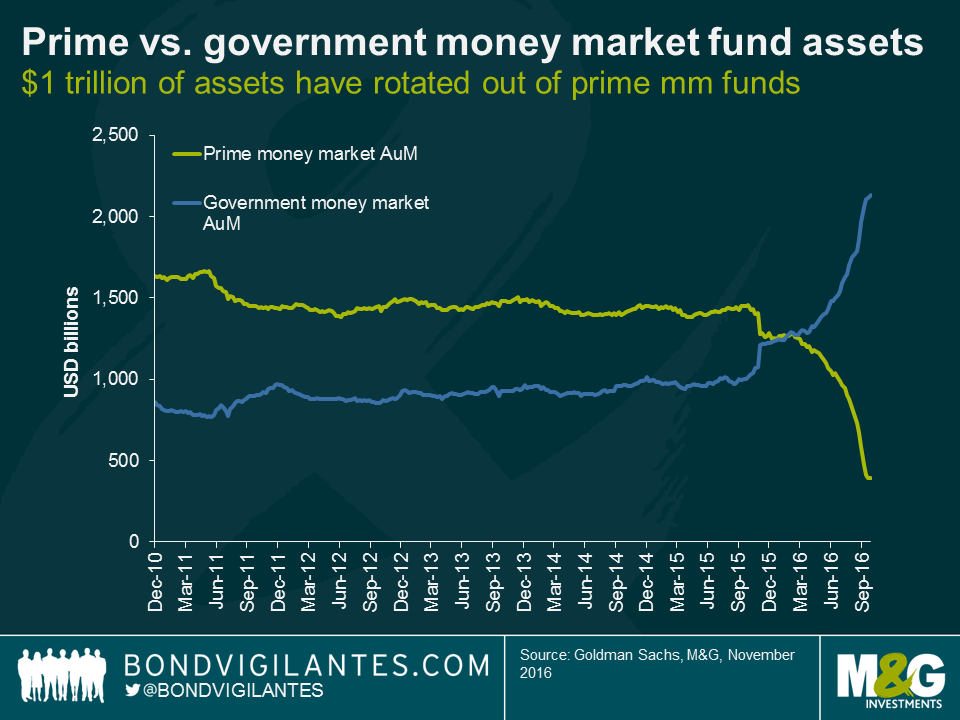

As a result of regulatory changes, money market reforms that require non-government funds to be market-to-market to protect investors came into effect in October. The rule changes were designed to make money market funds more resilient to market volatility and to provide greater protection for investors in a fund that “breaks the buck” (has securities repriced to below par). Of course, investors prefer return without risk, and these reforms mean that price volatility now explicitly sits in the non-government money market. Not surprisingly, short-dated risk-free money has dashed from prime commercial paper funds (that now have a floating net asset value) to treasury funds that do not have an explicitly variable net asset value. According to Lotfi Karoui and Marty Young at Goldman Sachs, assets held in prime money market funds have fallen by almost $1 trillion over the past year and rotated into government money market funds.

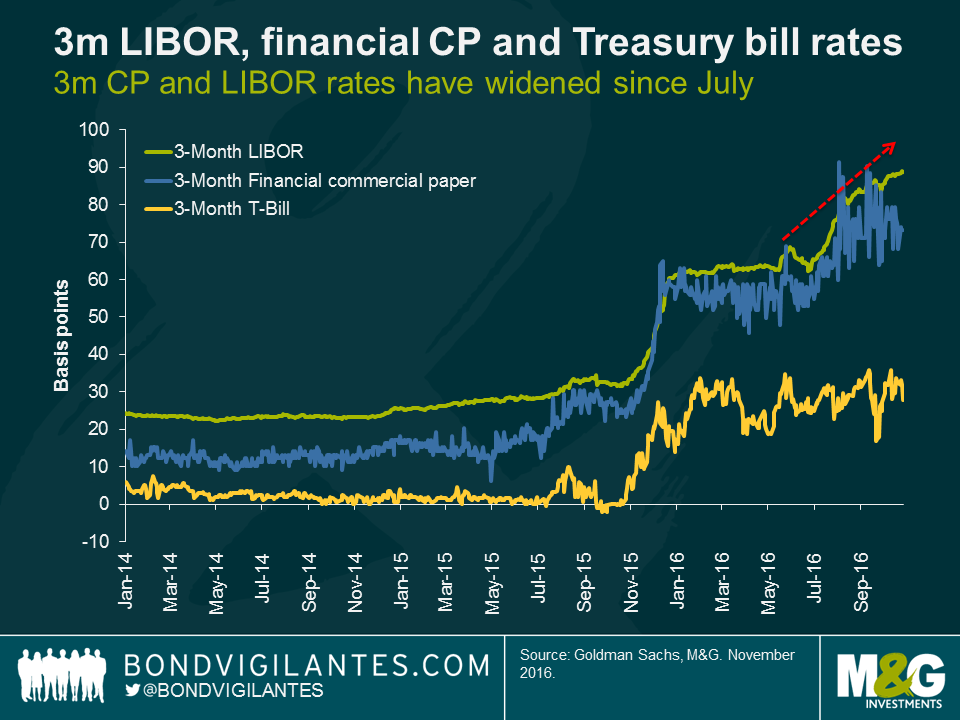

This means that despite no official headline tightening, real short-term funding costs as measured by LIBOR have increased by almost 30 basis points since June, leading to significantly higher funding costs for banks and other commercial paper issuers.

Investors always focus on conventional headlines, but it often helps to look at the real narrative. Money market reform is doing the FOMC’s job for them, which is a form of unconventional interest rate tightening. Consequently, the FOMC may be more hawkish than economists think as they are happy to accept this market tightening, which has had a similar impact on LIBOR as a traditional move in the Fed Funds rate. This effective tightening of policy means that maybe the FOMC’s views and my own are now less far apart than one might think.

This week on M&G Investments’ BVTV:

1. The Bank of England changes its tune;

2. Treasury yields and a potential Fed rate hike;

3. The world turns to the 45th POTUS race.

Tune in for the charts and articles that are making headlines in bond markets.

We are now less than a week away from the US presidential election, with the latest polls suggesting the race to become the 45th President of the United States is neck and neck. Bond and currency managers around the world are currently trying to assess how a win for either candidate might affect their portfolios. Here is my best estimate as to what might happen.

A Clinton win

A Clinton victory is seen by the markets as a continuation of the current US political environment, particularly if the Republicans retain control of the House of Representatives. This would be the most benign scenario for bond and currency markets as measured by price volatility. Following a Clinton win, the bond market would likely price in a higher probability of a move in interest rates, with the removal of perceived political uncertainty paving the way for a Fed rate hike in December. The US dollar stands to be the main beneficiary of this change in market pricing in the immediate future, though any gains are likely to be measured.

In a Clinton win scenario, bond prices across the Treasury curve would likely remain under pressure in the coming weeks given the high chance of a rate hike, rising inflationary pressures, and the possibility of an easier fiscal policy stance by a Clinton administration. A Clinton win is not likely to radically alter bond investors’ or economists’ views on the outlook for the US economy. If Clinton is able to implement easier fiscal policy in the US in the medium term, US growth and inflation would likely increase, meaning a rise in term premiums and a steeper yield curve.

A Trump win

A Trump victory would result in heightened volatility across a number of markets given the uncertainty around what the implications are for the US economy. Following the result, risk aversion would likely increase meaning a rising US dollar, lower bond yields and a weaker US high yield corporate bond market. In the fixed income universe, emerging market bonds and currencies would likely be hit the worst in this environment given Trump’s tough stance on China and Mexico. This market reaction could look similar to previous US risk-off events such as the 2008 financial crisis, the 2011 loss of the US government AAA rating, and the 2013 taper tantrum. The market reaction to a Trump victory might put the Fed off from hiking interest rates in December. Alternatively, should the Fed push ahead with a rate hike in an uncertain political and market environment, we may see an adverse reaction in markets similar to the 2015 rate hike.

Turning to credit markets, Trump’s proposal of a repatriation tax holiday would likely be positive for US investment grade corporate bonds at the margin and may lead to a reduction in corporate bond issuance. It is estimated that companies hold almost $1trn offshore, with around 60% denominated in US dollars. The big question is how companies would use this cash: will they pay out special dividends to shareholders? Will they increase capital expenditure and expand their operations? High yield companies would be less affected, as most companies have domestic sources of revenue.

Over the medium term, Trump’s proposals on large tax cuts for all is the equivalent of a large Keynesian injection of cash into the economy which would benefit economic growth but also raise inflation. The implementation of trade barriers would also be inflationary, as import prices rise from current levels. Immigration reform means the already tight US labour market would tighten further, leading to higher wages. Fed policy would need to counteract the rise in inflation, meaning much higher interest rates and a bear market for bond markets. The US treasury market would return to a world of higher yields and a much steeper yield curve. In this environment, the US dollar would likely strengthen given the contrasting monetary policy stance with other developed market economies. A Trump win would be good for government bonds in the short term, bad for bonds in the long term.

The bottom line

A Clinton victory would likely result in lower volatility in the near term relative to a Trump victory. In the immediate aftermath of a Clinton win, there may be some slight risk-on moves from investors but over the medium term much will depend upon the make-up of the United States Congress. Credit markets should prove to be relatively resilient, given that default rates are expected to remain low and the Fed remains cautious in removing policy accommodation, thereby reducing the chances of a policy error. A Trump victory would be seen as a risk-off event in the short-term, resulting in lower treasury yields, a higher US dollar and weaker risk sentiment towards emerging market assets. Given both candidates are advocates of an easier fiscal policy stance, government bond prices are likely to come under pressure in 2017 under both scenarios. Over the longer term, like a Clinton win scenario, the policies that Trump is able to implement given the make-up of Congress will be key to determining the outlook for the economy and consequently bond and currency markets.

The residential mortgage backed securities (RMBS) market has had a good run of late, so is the sector still good value and is there room for it to rally further?

The short answer: Yes.

The longer answer: There are a number of factors that should prove supportive for RMBS going forward, a few of which are discussed below.

- Structure

The Big Short has been available on Netflix for a couple of months now, so I’ll assume that readers are already fairly familiar with mortgaged backed securities. What the film failed to mention however, was that these instruments are typically floating rate assets and are therefore a natural hedge to interest rate increases, as coupons reference LIBOR benchmarks. An additional feature is that they typically amortise: every month the cash value of bonds outstanding falls, as the mortgage loans backing the bonds are amortising (capital is repaid along with the interest). This means that the size of the universe shrinks naturally and investors are returned cash that they need to find a home for. This supply and demand dynamic may prove supportive for the asset class – more on this later.

- Relative pricing

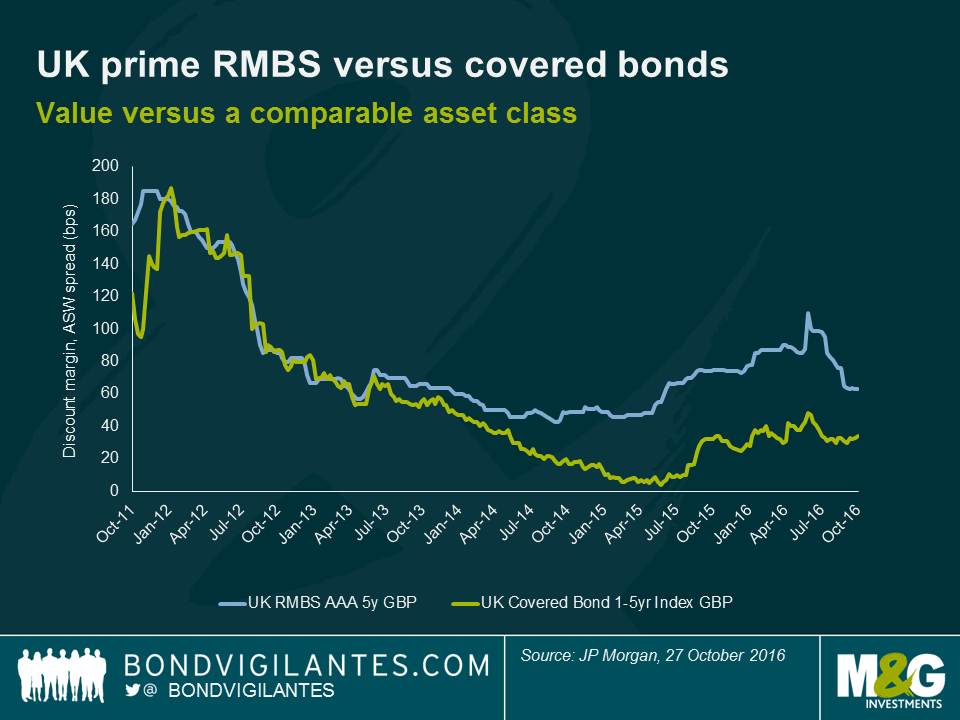

When it comes to spread levels, the RMBS sector continues to look attractive when compared to corporates. At the top end of the market, AAA rated bonds backed by UK prime mortgages (standard loans that high street banks provide) offer around a 30bp premium to covered bonds of similar maturities, even though these are backed by practically the same collateral.

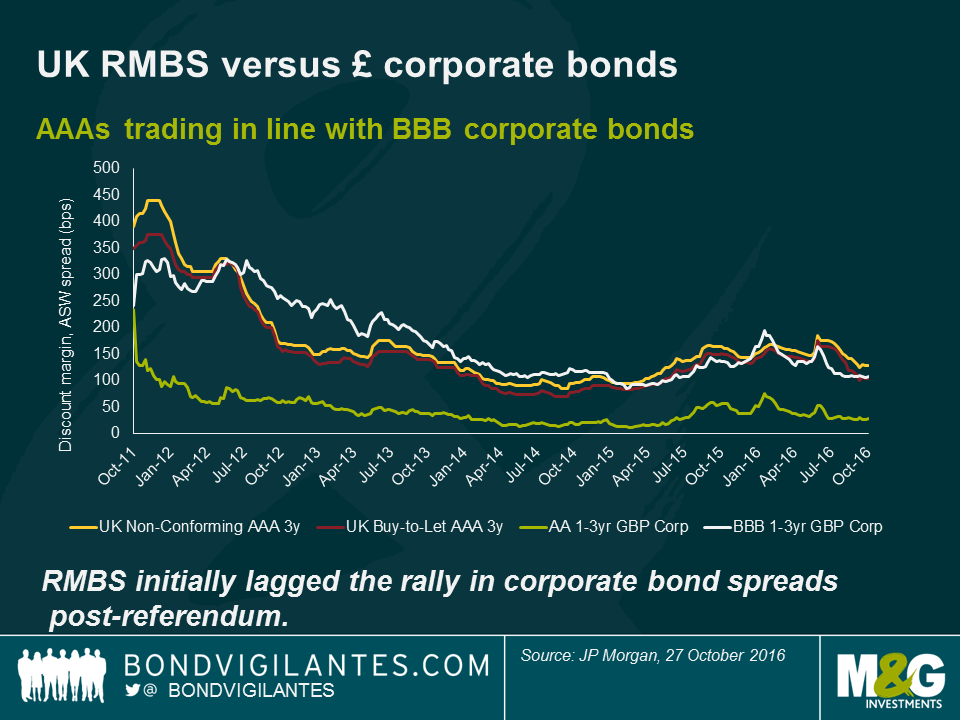

The non-conforming and buy-to-let (NC & BTL) sectors are riskier due to the profile of the underlying borrowers, and so offer a higher credit spread. Even after the recent rally in RMBS however, the spreads on AAA rated NC and BTL bonds continue to trade closer to BBB corporate spreads than those of bonds with a similar rating (we’ve used AA’s in the chart below due to the scarcity of AAA corps).

We are mindful that some of this extra spread may be attributed to a relative illiquidity premium (it would be remiss not to acknowledge that these RMBS bonds can be less liquid than comparable corporate bonds), but they are far from being untradeable. Liquidity is however something to keep an eye on, particularly given the expected lower net issuance going forwards, which leads nicely on to the third point.

- Supply and demand dynamics

There has been markedly less supply of UK RMBS since the inception of Bank of England’s Term Funding Scheme (TFS), which allows banks to borrow close to the 0.25% base rate to fund lending to the real economy. One long-time issuer has explicitly announced that they will no longer be issuing RMBS as it makes less economic sense for them to do so. Instead, they prefer to use the TFS for their funding needs. Something similar is happening in the Eurozone with the ECB’s TLTRO diminishing a comparable pool of European assets.

On the demand side, the ECB is having an influence on the market by buying RMBS as part of its QE program. This has resulted in a tightening of spreads of both the bonds they are buying and those that they aren’t as investors move into other areas of the market. As yet, the Bank of England hasn’t been buying the asset class as part of its own QE program, but it is currently buying corporates. It’s perhaps therefore not a huge leap to imagine the BoE’s list of eligible assets widening to include RMBS, if they feel more monetary easing is necessary. A further source of demand for UK RMBS has come from large institutional investors entering the market in recent times, presumably to take advantage of the relatively wider spreads and the strong credit quality.