Shaky foundations: the European high yield construction sector

Guest contributor – Saul Casadio (Credit Analyst, M&G Investments)

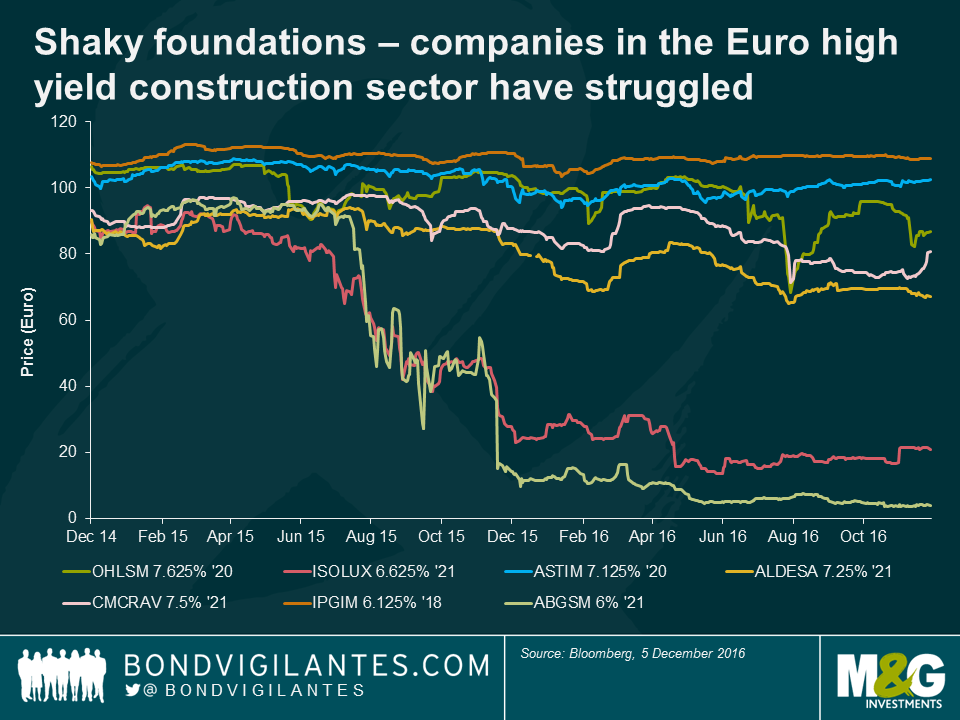

While European High Yield has delivered a robust performance over the last two years, returning on average 4.9% per year, one part of the index has significantly lagged. Over the same period bonds issued by construction companies have returned an average annual return of -18.4%. The chart below shows that, out of seven issuers in the sector, only two are currently trading above par, two have already restructured inflicting heavy losses on bondholders and the remaining three are trading well below par. In this post I investigate the reasons why the construction sector has performed so poorly compared to the rest of the market.

The use of a leveraged capital structure to fund a construction business has always been questionable. A leveraged capital structure needs a relatively stable cash flow throughout the economic cycle in order to be sustained. Construction companies, instead, experience a volatile and unpredictable cash flow. In addition, the construction business is highly dependent on the banks’ willingness to provide guarantees for the completion of works, something that is ultimately reliant on good credit ratings and at odds with a leveraged capital structure.

There are a number of analogies with a shoddy building project which explain the underperformance of the construction sector over the last two years.

The foundations were weak – Construction is a tough business. As works are typically awarded through a tendering process, a construction business operates in almost perfect competition. Entry barriers are limited to technical credentials and project size. It is not uncommon in some markets to tender for projects on a no-profit basis in anticipation of moving back into profit through modifications during execution, which is obviously a very risky way of generating profits and prone to litigation risk. Furthermore, construction works carry a significant degree of execution risk depending on the contract type (fixed-price vs volume based) and it is not uncommon for fixed-price projects to generate significant cash losses.

An unstable cash flow also compounds the fragility of the business foundations. Construction works typically feature a lumpy cash flow profile, given advance payments and final settlements. This translates into volatile working capital and gross debt. Changes in payment and collection terms, advance payments, and delays due to litigation could generate significant debt swings.

Measurements were inaccurate – reported EBITDA, one of the main key performance indicators used by investors, is only an approximate indicator when it comes to construction. The accounting method used for construction works (i.e. percentage of completion) provides flexibility in terms of profits (or losses) recognition throughout the life of a project. I would argue that cash generation is a better indicator as the cash flow statement is less subject to accounting management.

Calculations were wrong – investors calculate net leverage to assess credit risk, but this calculation is misleading in construction. Construction companies typically carry a high cash balance, but only a small fraction is available at the corporate level, as most is trapped in project companies to fund construction works. Gross leverage is a more accurate measure of credit risk in construction. Furthermore, most construction companies fund themselves through various forms of non-recourse financing, typically reported off balance sheet, possibly something not all investors spotted in the footnotes where these items are reported.

Modifications made measurement even more inaccurate – Given the challenging fundamentals of the business, a number of construction companies, looking for better ways to make money, have invested in build-operate-transfer (BOT) projects, effectively retaining the ownership and the economic benefits of the asset for a certain period of time in lieu of cash payments. This has only compounded the measurement problems discussed above as bondholders had recourse only to the construction business (and not to the concession assets), but numbers were reported only on a consolidated basis, impairing the ability of investors to monitor the operating performance of the construction business.

Suspicion of corruption – headlines of alleged cases of corruption have hit construction more than other sectors, and trading levels have reflected investors’ aversion to corporate governance issues.

A collapsed building is not worth much – Recoveries for restructured bonds have been low so far as trading performance deteriorated sharply during restructuring talks. Construction requires ongoing strong banking support to fund working capital requirements and to get guarantees necessary to tender for new works. Both are hard to get when a company is in the midst of a restructuring.

On the back of losses suffered on a few deals, investors have reassessed the credit risk of the sector and, judging by current trading levels, it would be hard to imagine a new high yield construction deal coming to the market any time soon. If that day comes again, investors should be mindful that building a leveraged capital structure on these shaky business foundations brings significant structural risk.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox