Despite a year of high political turmoil – which of course included the UK EU referendum and the US elections – emerging market assets proved surprisingly resilient to the various global events, even with rising core government yields in the second half of 2016. Given that starting valuations at the beginning of the year, both with respect to credit spreads as well as currencies, were pricing in quite a bit of negative news, this initial cushion allowed the asset class to navigate the year relatively well. The return of inflows into the asset class following the Brexit vote and the recovery of commodity prices, particularly oil, also helped spreads to tighten. Below, I give a run-down of the year just gone and highlight my key calls for emerging markets in the year ahead.

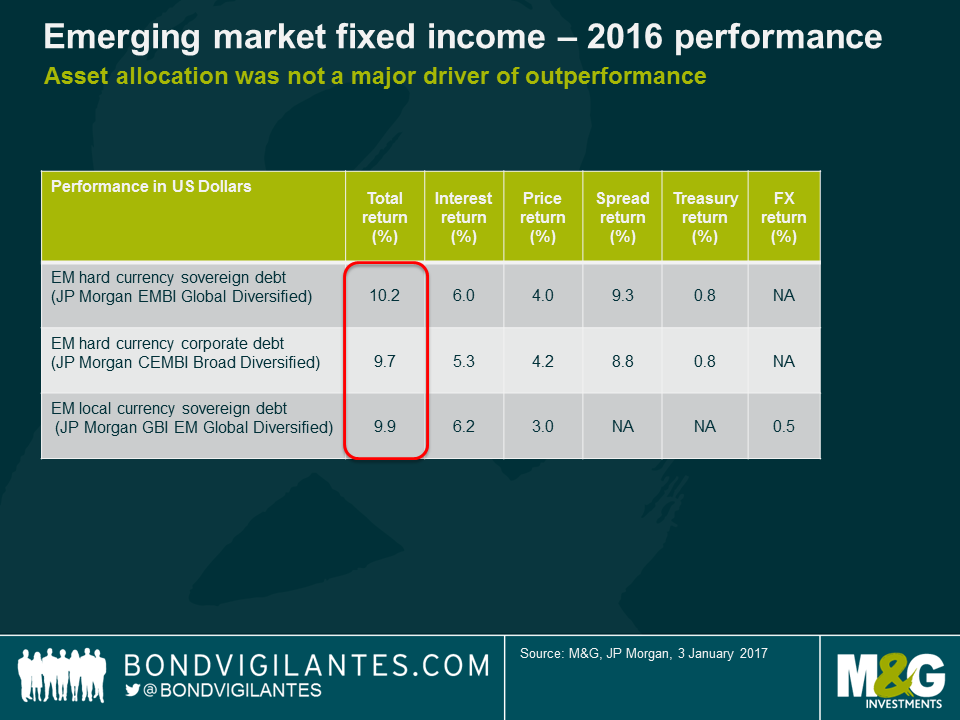

- Asset allocation was not a major driver of performance

Total returns were almost identical for hard currency, local currency and corporates in 2016. In last year’s outlook, I surmised that asset allocation would not be a predominant driver for the asset class and I expect this trend to continue into 2017. Instead, I expect that a call on beta and overall risk will be more important than the asset allocation given starting valuations being less generous this year, particularly in hard currency sovereigns and corporate spreads.

- Currency valuations provide some cushion to a stronger USD

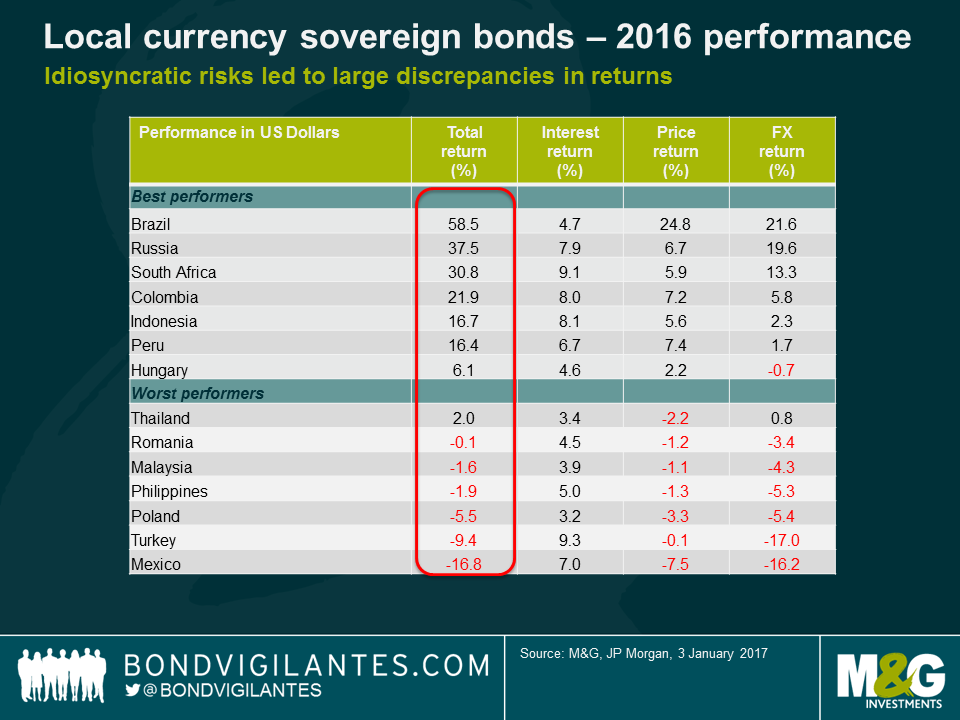

Currencies, for the most part, are in the range of fairly valued to somewhat undervalued and this provides a cushion for a stronger dollar environment, fuelled by higher rates in the US. The recent recovery in oil prices is additionally supportive for currencies such as RUB and MYR and there is quite a bit of bad news priced into MXN, but I do not believe there will be material changes to NAFTA from the upcoming US administration.

Higher oil prices take some pressure off the pegged Gulf cooperation currencies, as this will allow the region to continue borrowing at more favourable rates in the international markets, as tighter spreads partly offset higher US yields.

The current account adjustment is well underway (or complete in many EM countries), with some notable exceptions such as Turkey and South Africa. The big elephant in the room however is the Chinese Yuan Renminbi, which continues to be vulnerable to capital outflows and potentially negative news should the incoming US administration pursue unfriendly trade policies and/or name China a currency manipulator. While my base case scenario does not contemplate the floating of the currency in 2017, it remains a tail-risk to be mindful of.

Local markets produced a wide dispersion of returns, both in terms of FX returns as well as yields, but this dispersion should be much less pronounced in 2017.

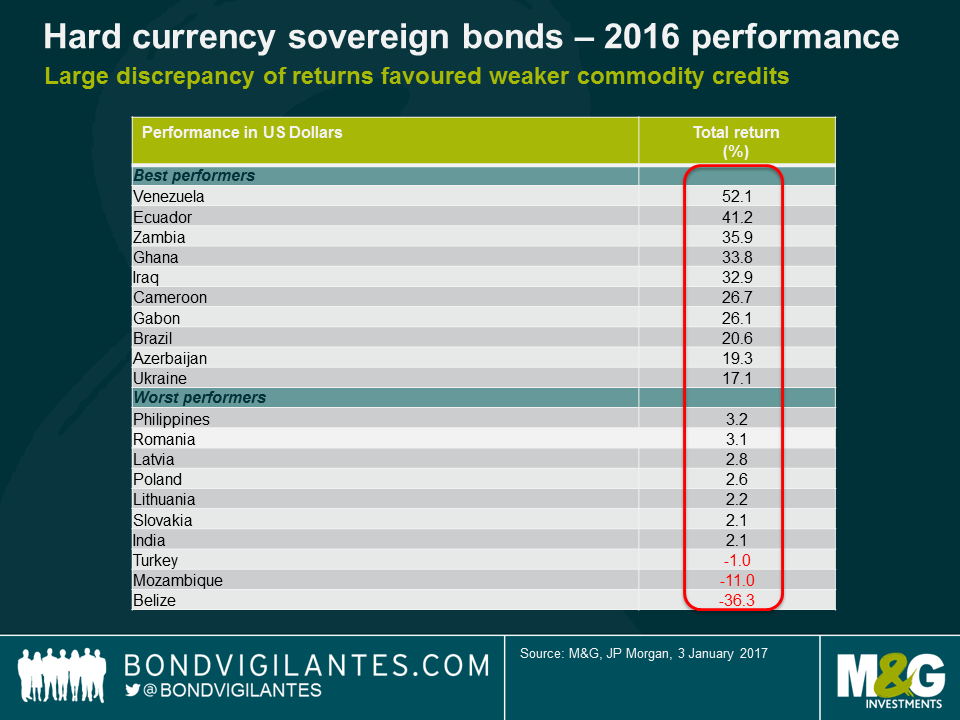

- Spreads tightened, particularly in commodity credits and Brazil

2016 proved to be the mirror image of 2015. In countries such as Brazil and Argentina, the recovery of commodity prices and perceived improvement in the political climate led to a large rally in these credits. In fact, with the exception of Ukraine, all top performers in 2016 were the previously weaker performing lower-rated commodity credits.

At the other end of the spectrum, Mozambique and Belize announced restructurings in 2016 and as such, the likelihood of any additional sovereign credit events is centred on Venezuela, which stands out as the binary call for 2017. The country, once again, will prove to be either the best performing credit if they do not default, or the worst if they do. With the prospect of political change and more pragmatic economic policies dimming, the chances of a Venezuelan credit event have increased in 2017, as rising oil prices are still not enough to close the financing gap. On the whole however, given that there are fewer sovereign credits at risk of default in 2017, return dispersion and bottom-up differentiation within emerging markets should therefore be less extreme this year.

Brazil will not be the outperformer in 2017 as existing valuations are priced for a perfect execution of policy. More importantly, the outperformers of 2016 will not generate double digit returns as this would require them to trade at unrealistic spread levels, i.e. some 200-300 bps of additional tightening. Instead, I expect more moderate mid-single digit returns, basically in line with the carry.

- Idiosyncratic risks continue with developed markets in 2017

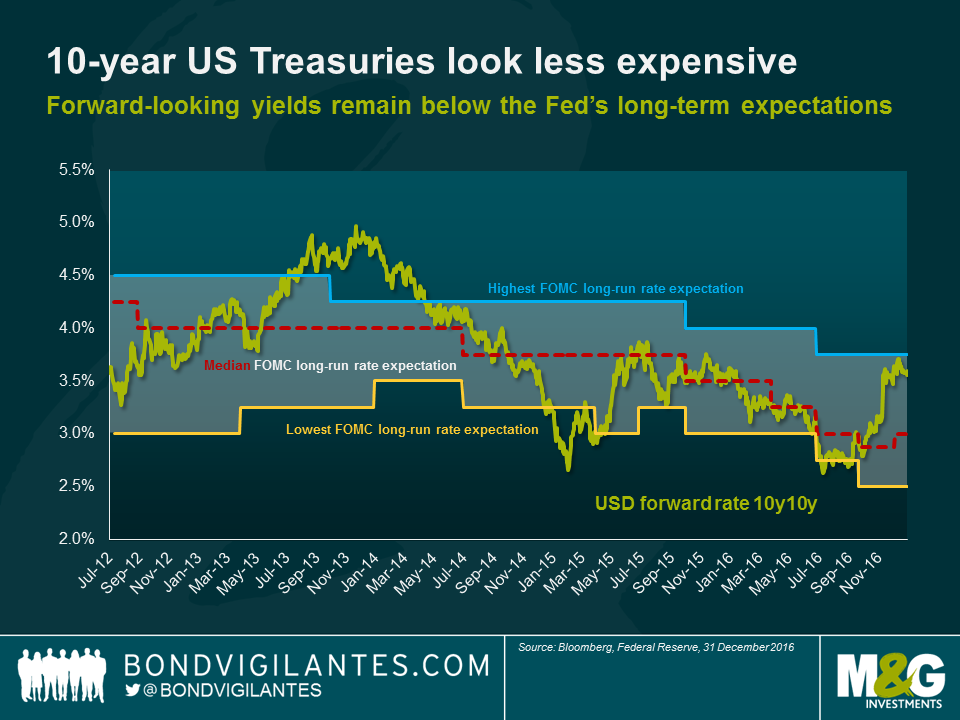

Politics and economic policy developments in the US, as well as key elections in Europe are the major foreseeable events to be digested in 2017. Monetary normalization continues in the US and treasury yields, while not cheap on a long-term basis, have at least adjusted closer to fair value in the near term and should prove to be less of a headwind to returns in 2017. This is relevant as spread returns should be much lower than 2016 as well.

I expect asset allocation between hard and local currency to remain a small driver in 2017. Bottom up hard currency and local currency selection will remain somewhat important, but with a much smaller return dispersion than in 2016. Instead, a call on beta and overall risk will be more important given starting valuations.

Before we get to the main event, I’d like to thank everybody who has made a donation to Cancer Research UK as a result of our 10th birthday celebrations. We are over the £10,000 mark now. We still have one box of our second Bond Vigilantes book left. If you’d like a copy, send your name and address to us at bondteam@bondvigilantes.co.uk and we will send them out on a first come, first served basis. And if you want good karma for the whole of 2017 you could also add a few quid to our Just Giving page. Thanks in advance!

https://www.justgiving.com/fundraising/bond-vigilantes-anniversary-book

Thanks very much for another bumper stack of entries to the annual Christmas quiz. This year’s winner, and new reigning champion is Francis Sutch of Julius Baer International Limited. Congratulations, we will be in touch to see where you’d like the £100 charity donation to go. You also win the new Bond Vigilantes book, called “Bond Vigilantes – Part II”. Second prize of two copies of the Bond Vigilantes book goes to Jake Lewis of Morgan Stanley.

1. What is permanently positioned to wipe out Scratchwood service station on the M1 should the need ever arise?

The guns of HMS Belfast on the Thames are pointed to achieve a direct hit on Scratchwood services.

2. Which popular pub name marks the boundaries of the ancient Soho hunting grounds in London?

The Blue Posts. There are three in Soho, one in St James and one in Fitzrovia, with another couple having closed down according to the Londonist website. Allegedly the royal hunting grounds of Soho were marked out by blue posts and pubs sprung up around the edges.

3. How far did it go? This is Bradley Wiggins’s hour record bike.

He rode 54.526 km around the Lee Valley velodrome in 2015 for a new record. It would have been further had there not been especially high air pressure that day.

4. Where might you catch instinct, valour and mystic?

Well if you got this, well done because I wrote mythic rather than mystic. These are all to be found in Pokemon Go. And they are the teams rather than what you catch. Maybe you catch them too? Who knows. Rubbish question, I hang my head in shame.

5. For the first time in four decades, nobody went up what in 2015?

Nobody made the summit of Everest, in part due to an earthquake which triggered an avalanche at Base Camp.

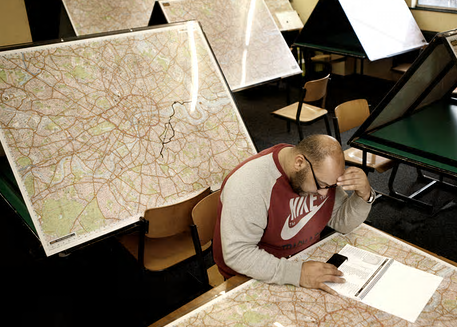

6. This place closed last year. Why?

It is one of the London taxi “knowledge” schools where black cab drivers learn the routes around the capital. Uber has meant that numbers enrolling for the gruelling process has collapsed, and this school closed.

7. What is one crore multiplied by one lakh in the Indian system (give answer in international figures please)?

One crore = 10,000,000. One lakh = 100,000. Answer is therefore 1,000,000,000,000.

8. Another pub question. This titled veteran of the Seven Years’ War is said to have given his troops help in buying public houses once they left his command, and they often named their pubs after him. Who?

John Manners, better known as the Marquis of Granby.

9. He didn’t know how the third world war would be fought, but he knew the fourth would be fought with bows and arrows.Who?

Well he actually said sticks and stones, but the answer was Albert Einstein.

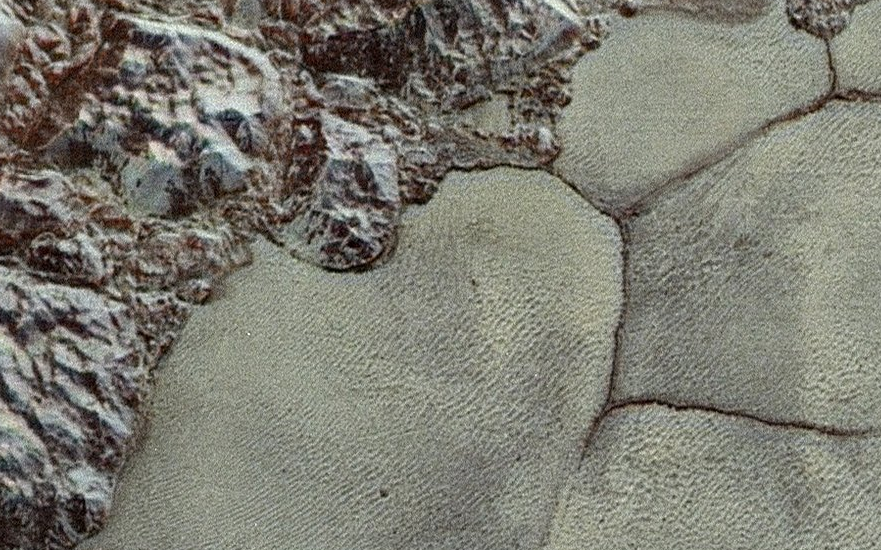

10. Where is this recent photo from?

Pluto, from NASA’s New Horizons mission.

11. What’s the most rectangular US state?There’s no purely rectangular state, partly because of the small errors and kinks caused by surveyors when the state markers were laid out.

Wyoming and Colorado come closest, but both are trapezoids rather than pure rectangles thanks to the method of transfering lines on a flat map onto the curved earth.

12. What was the most used hashtag on Twitter in 2016?

#Rio2016

13. Who was the world’s highest paid musician in 2016?

Taylor Swift, earning $170 million.

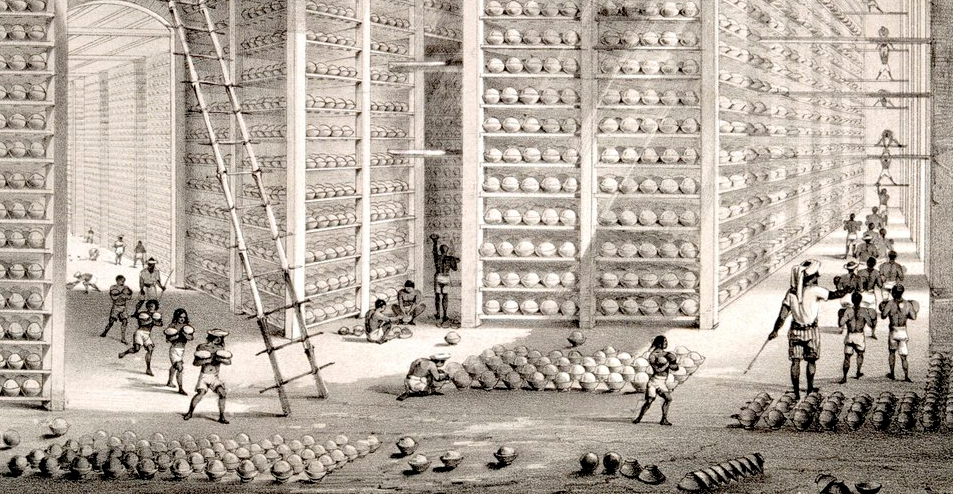

14. This is the East India Company’s storage room in Patna in 1850. What’s being stored?

Opium.

15. Which road runs the entire length of Manhattan and dates to the first Dutch settlement?

Broadway.

16. Its name very roughly translates to Milky Way 2 in English, and it is the fastest in the world (almost twice as fast as Titan in the US). What is it?

It’s a Chinese supercomputer, Tianhe-2.

17. Whose tattoos?

David Beckham.

18. Whose tattoos?

Amy Winehouse.

19. Whose tattoos?

Mike Tyson.

20. According to the census of which year, when did the number of British people living in towns and cities exceed those living in the countryside?

1851.

Thanks as always for taking part, and have a great 2017.