Clouds in the Valley – Dispatches from a tech conference

I was recently in San Francisco for an internet and technology conference. An array of senior tech managers spoke about their firms’ prospects, priorities and where they see opportunities. Twitter’s Jack Dorsey aside, the overwhelming focus of every session I attended over the three days was cloud computing.

Cloud computing is essentially the move away from users buying, owning and maintaining their own computer systems to a more on-demand, rental model. In the past we would buy a desktop computer, install our software and store our information on the hard drive (sat under the desk). We would use the processing unit to run the software and our calculations for us. If we owned more than one computer we could link them up – maybe via a central server – to create a network, allowing multiple users to share information, software and processing power. Moving an IT system into the cloud removes the headache and cost of buying and maintaining your own infrastructure.

Not only does operating in the cloud reduce costs, it also increases flexibility. If you need more processing power or increased storage capacity you can just give your cloud provider a call and they can (within reason) instantly meet your needs by flicking a few switches. Think of a retailer who experiences much higher traffic on their website around Christmas; if they have a cloud based infrastructure they need only pay for the extra capacity for the month or so that they need it. There’s no need for them to house and look after a large server farm, operating below capacity, for the other 11 months of the year.

As well as supplying hardware, software as a service (SaaS) is also a growth area which many of us may be more familiar with. Spotify, Hotmail, Gmail and Salesforce (currently building the tallest office in San Francisco) are some well-known examples. The benefit of SaaS is that the providers can make updates and fix bugs as and when they need to. Rather than a licencing agreement specific to one device, users pay a monthly/annual subscription fee to access the software on the cloud. This means they can access it from anywhere on multiple devices and they always have the most recent version.

Unsurprisingly, Silicon Valley start-ups were the first to embrace cloud technology when Amazon (AWS) began renting out its spare server capacity back in 2006. But now the industry is growing with non-IT focussed businesses becoming comfortable with the technology. AWS have maintained the first mover advantage, but they have some serious competition in the form of Google, Microsoft and Alibaba. All three are dedicating huge resource to their product and making an immense effort to sell their services, at an enterprise level, to CEOs and CIOs (chief information officers) of large firms.

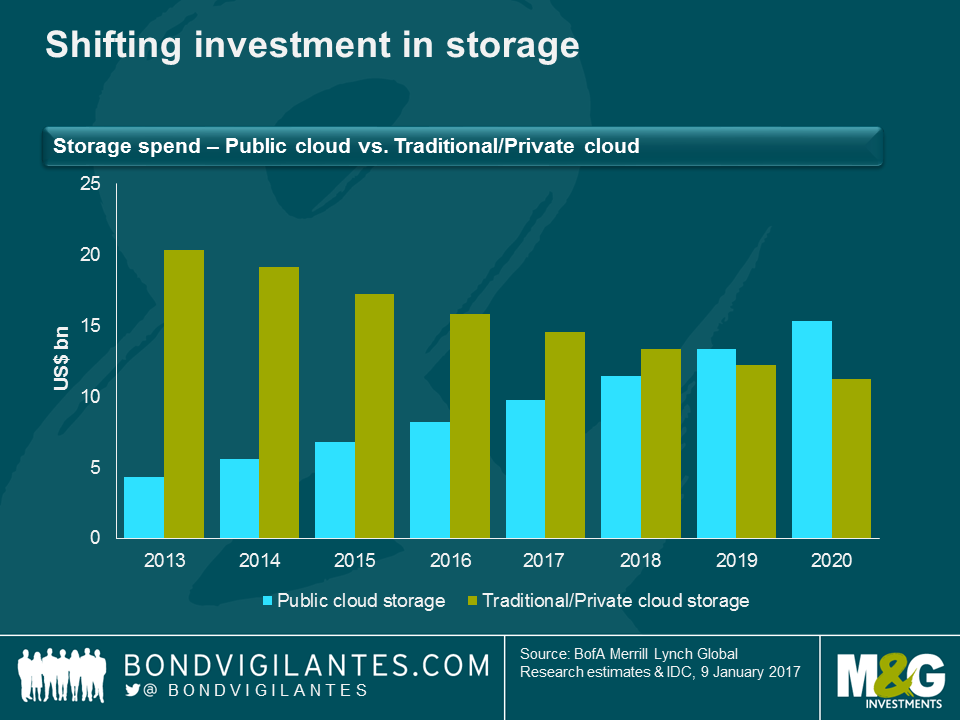

There was a lot of discussion of hybrid models (i.e. companies having both cloud and on-site infrastructure) which I think sounds most realistic in the near term, as firms will take time to get comfortable with the new technology. The chart below, from BofA Merrill Lynch, shows their estimates of how the balance of investment will shift over the coming years within the storage segment.

I think data security and reliability (as AWS’s problems last week demonstrate) will be chief among CEO/CIOs’ concerns, but assuming these can be overcome the general direction of travel is clear. Not being in the cloud put firms at a competitive disadvantage as their capex costs will likely be higher. I’m not convinced that real GDP statistics have been fully capturing the value of productivity gains from technological progress over the past couple of decades. Therefore I think it unlikely that, at a macro level, cost savings in the corporate sector will feed through to official growth, inflation and productivity numbers. Going forward however, if the majority of IT infrastructure investment is conducted by cloud companies in the future, the corresponding investment contributions to GDP will presumably accrue to those nations that host the cloud providers and/or the server farms.

What I am sure about is that a fundamental shift in how we store, share and process data raises questions over how to think about the tech giants providing these services. I’m confident this will be a high growth, high profit area in the years to come. But once the world is using the cloud for all its computing needs, and the large profit margins have been competed away, will it become sensible to think of them less as growth companies and more as utilities? In any industry when one earns monopolistic or oligopolistic power, increased scrutiny and regulation is sure to follow.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox