The Israeli Shekel: Flying under the radar

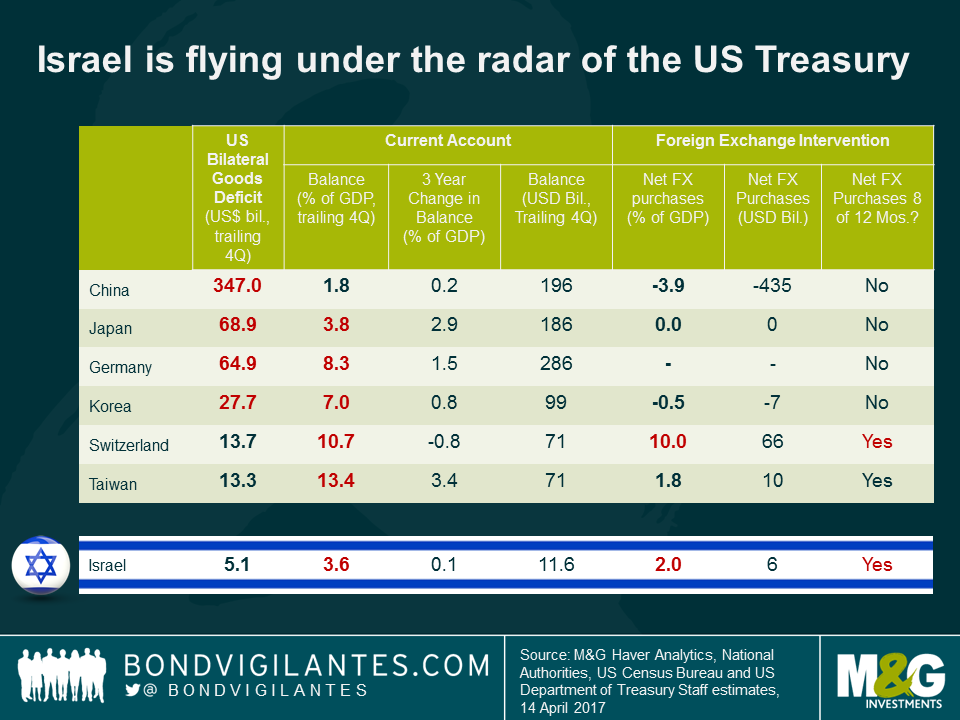

Though the recent US Treasury report did not name any country as a currency manipulator (see more details on this in Mario’s blog), the monitoring list centres on larger economies that meet the following criteria:

- The country has a significant bilateral trade surplus with the United States defined as more than USD 20 billion.

- The country has a current account surplus of at least 3% of GDP and would therefore receive heightened analysis from the U.S. Treasury.

- A persistent, one-sided currency intervention in excess of 2% of a country’s GDP over a 12-month period could be a sign that a country is manipulating its currency.

Because Israel is a much smaller economy (estimated $318 billion at the end of 2016) and not a major trading partner with the US (bilateral trade surplus is far less than $20 billion), it is not included on the monitoring list. Anecdotally however, if one were to examine the other factors that are part of the monitoring criteria, Israel would likely have joined the club.

The Bank of Israel conducts monetary policy using a combination of interest rate and currency interventions. Inflation and inflation expectations are now approaching the lower end of the 1-3% target (after a two year deflationary period) and the economy is growing at a solid pace. There is room for monetary policy to remain accommodative, but I think it unlikely that interest rates will be reduced into negative territory from the current 0.1% base rate, now that inflation is heading in the right direction.

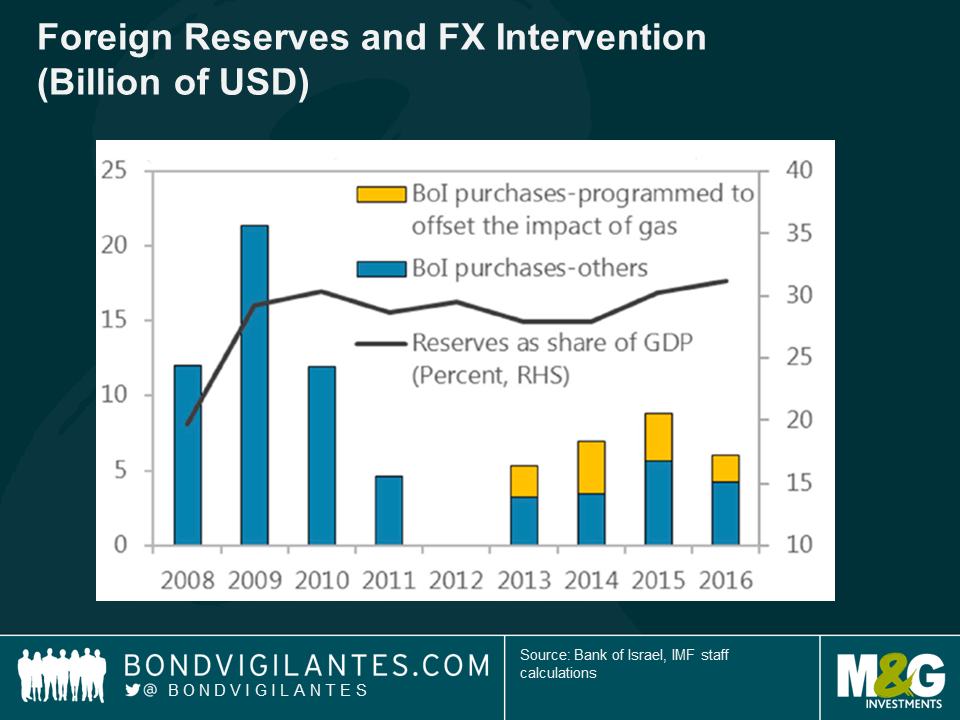

The Bank of Israel perceives the Shekel to be moderately overvalued and has been intervening in the currency markets to smooth the appreciation and in more recent years, to neutralize the flows coming from gas exports, in others to mitigate the risk of Dutch disease. The IMF, on the other hand, believes that the currency is roughly in line with fundamentals. There are, however, conflicting results depending on the FX model methodology used, as it is often the case when attempting to model currencies. Some models suggest a 15% undervaluation, while others suggest a modest 4% overvaluation. See page 50 here for more details.

The Shekel could be an interesting opportunity for currency investors (not concerned over additional USD strength) that believe that the favourable trends in the balance of payments remain intact, that the Bank of Israel will not increase the pace of currency interventions and that there is no scope for additional monetary easing.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox