Premier League footballers are making currency calls, like rappers and models in 2007. Are they right to avoid GBP?

According to recent reports, leading foreign football players in the English Premier League are looking to get paid in euro rather than sterling. Since the UK referendum result in June last year, sterling has fallen by 12% against the euro, so it is unsurprising to see that some players have questioned the denomination of their salaries. It is not the first time that global stars have asked to be paid in a particular currency. In 2007, rapper Jay-Z flashed €500 notes in his video clip for “Blue Magic”, hip-hop group Wu-Tang Clan preferred euro to greenbacks in payment for their new album 8 Diagrams, while model Gisele Bünchen asked to be paid in euro rather than US dollars for any promotional deals.

We think there are a number of good reasons to expect euro to strengthen further against sterling from current levels, so this may be a trend that football clubs should get used to as they search for footballing talent in a global marketplace.

The impressive performance of the UK economy post the referendum result has surprised the Bank of England and professional economic forecasters alike. Indeed, the Bank of England was so pessimistic about the prospects for economic growth that it quickly cut the base rate to a record low of 0.25% and embarked upon yet another round of quantitative easing. With the benefit of 20/20 hindsight, this pessimism was misplaced. The key factor in this outperformance was the fact that in the real world, nothing had changed. Businesses retained access to the single market and the depreciation in sterling meant that exports were suddenly much cheaper in the international market. The UK consumer, spurred on by lower interest rates and a robust labour market, felt confident enough to continue to spend freely as evidenced by one of the lowest savings rates in the EU.

Dependent upon the prospect of how Brexit negotiations progress, the UK economy could continue to surprise on the upside in the short-term, as businesses look to stockpile inventories and consumers seek to purchase items before the UK leaves the single market. If it begins to appear increasingly likely that the UK will fall back upon World Trade Organisation rules, then the rational action will be for consumers to bring forward consumption before the imposition of tariffs forces the prices of European imports higher. In this scenario, consumption and inventories generate higher economic growth, despite the impact that a weaker currency has on import price inflation. The better than expected performance of the economy, coupled with and higher inflation and interest rate expectations, has seen sterling rally in recent weeks.

It appears that the confidence in the UK economy is misplaced and the medium term outlook for UK growth and sterling is more challenging. The squeeze on real incomes is likely to intensify given anaemic wage growth, while the propensity to invest amongst the private sector is likely to weaken throughout the Brexit negotiation process.

However, it is extremely difficult to estimate the impact of Brexit on the real economy, given the uncertainties around the UK’s future relationship with the EU If we look beyond the UK there are signs that growth and interest rate differentials are now starting to shift against the UK in favour of Europe and the US respectively.

In Europe, there are signs of a broad based recovery in euro area sentiment. Euro area PMIs and consumer confidence have been marking multi-year highs across the region, and with political risk diminishing after the French election, it appears that Europe is likely to generate a robust economic performance in 2017. The European economy will likely remain in this current goldilocks patch for the next 18 months – growth is solid, inflation is low, and the ECB remains extremely supportive through ultra-easy monetary policy. On this last point, the more solid footing of the European economy will likely give the ECB more confidence to begin tapering quantitative easing and possibly hike the deposit rate later this year. As these expectations become more entrenched in markets, this will provide a tailwind for the euro. This is especially the case against sterling, where the Bank of England remains firmly on-hold.

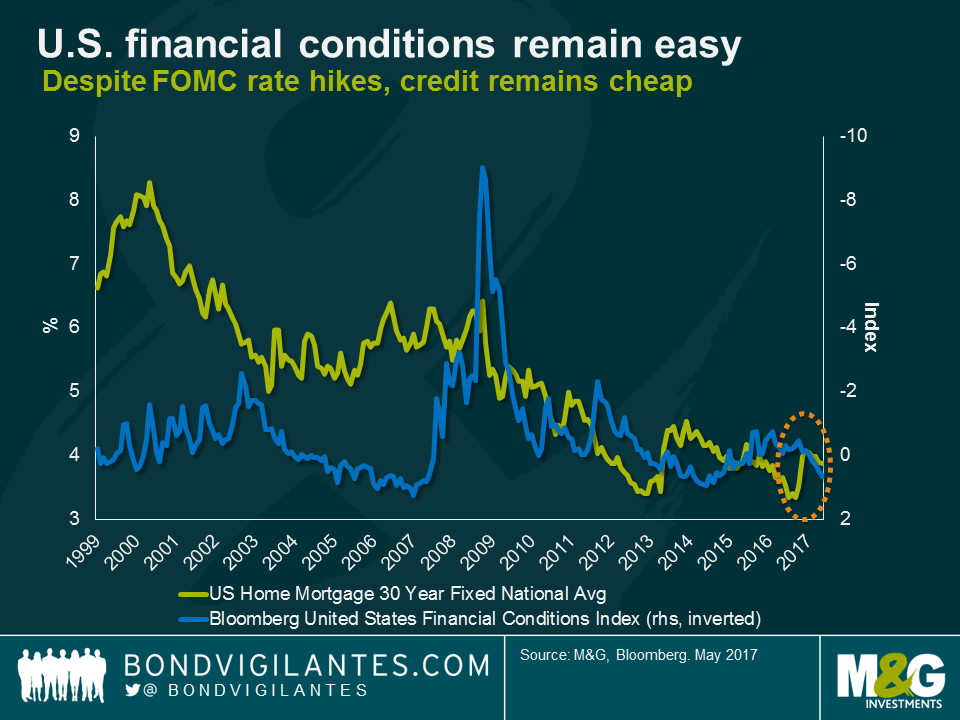

Turning to the U.S., uncertainty abounds around the new administration’s fiscal plans. In recent months, the market has reassessed the prospects of tax reform, leading to a fall in the 10-year treasury yield and dollar. Moving beyond this, it is clear the economy is on a sound footing and important tailwinds support growth. Firstly, the labour market is currently operating at close to full employment, as indicated by a 17-year low unemployment rate of 4.3%. This suggests we are likely to see rising wages (and inflationary pressure) as the demand for workers grows. Secondly, energy prices have firmed, which should support energy-related capital expenditure in the coming 12 months. Thirdly, consumer and business confidence are at robust levels, indicating an expanding economy. Fourthly, financial conditions remain historically easy despite the Fed rate hikes that we have witnessed in the last year. And finally, home builder sentiment is around levels last seen in 2005, indicating that the contribution from construction spending to economic growth will accelerate in year-end. Even before we know the details of the administration’s fiscal plans, it appears that we will see at least two more rate hikes from the FOMC this year, intensifying the decoupling of growth and interest rates relative to the UK.

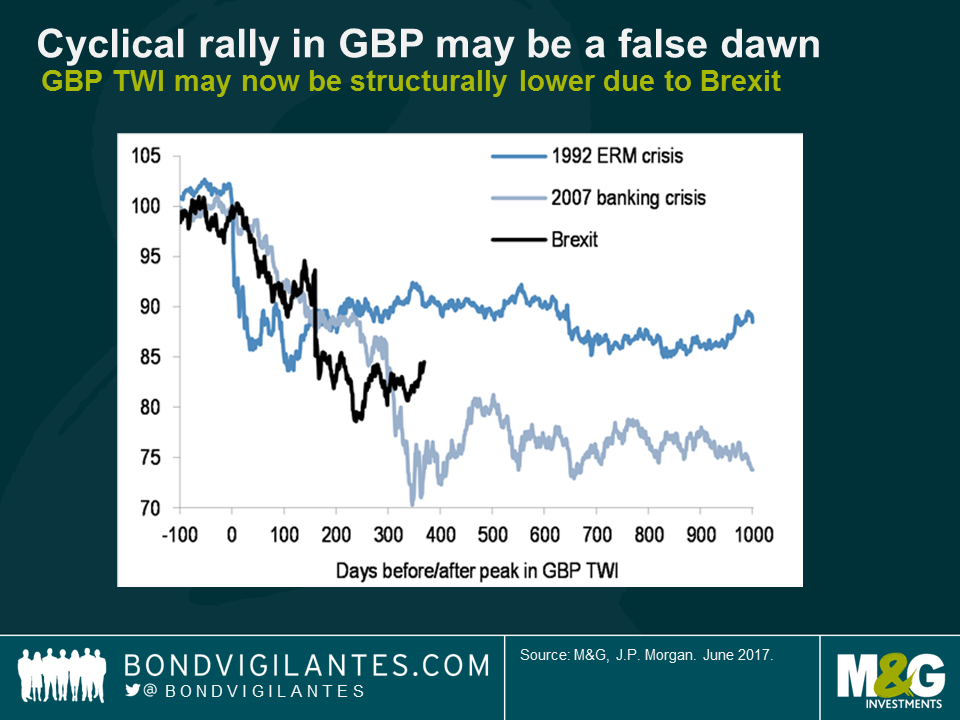

Historically, sterling tends to remain depressed after significant events like the 1992 ERM crisis and 2007 GFC. From this perspective, the recent rally in sterling appears cyclical rather than structural. The currency will likely to continue to be volatile into and after the election, while on a longer-term basis more fundamental factors like interest rate differentials will dominate the direction for sterling. The footballers of the Premier League who are signing 3-5 year contracts may be right in asking to paid in euro rather than sterling.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox