Financial conditions suggest the case for more hawkish Fed than inflation dynamics would suggest

Guest contributor – Jean-Paul Jaegers, CFA, CQF (Senior Investment Strategist, Prudential Portfolio Management Group)

A lot has been written on the recent softness in US inflation data, as headline inflation pulled back, with a similar trend in core inflation. Admittedly, a number of unusual factors have partly been a driver behind this, although more importantly there is quite some persistence in the broad-based softness in inflation. In recent communications by the Federal Open Market Committee (FOMC) members (more specifically by Chair Yellen) the uncertainty in the outlook for inflation has been highlighted and only part of the recent softness in inflation was deemed transitory. Interestingly, in Fed communications there is more and more reference to “financial conditions”. This is important.

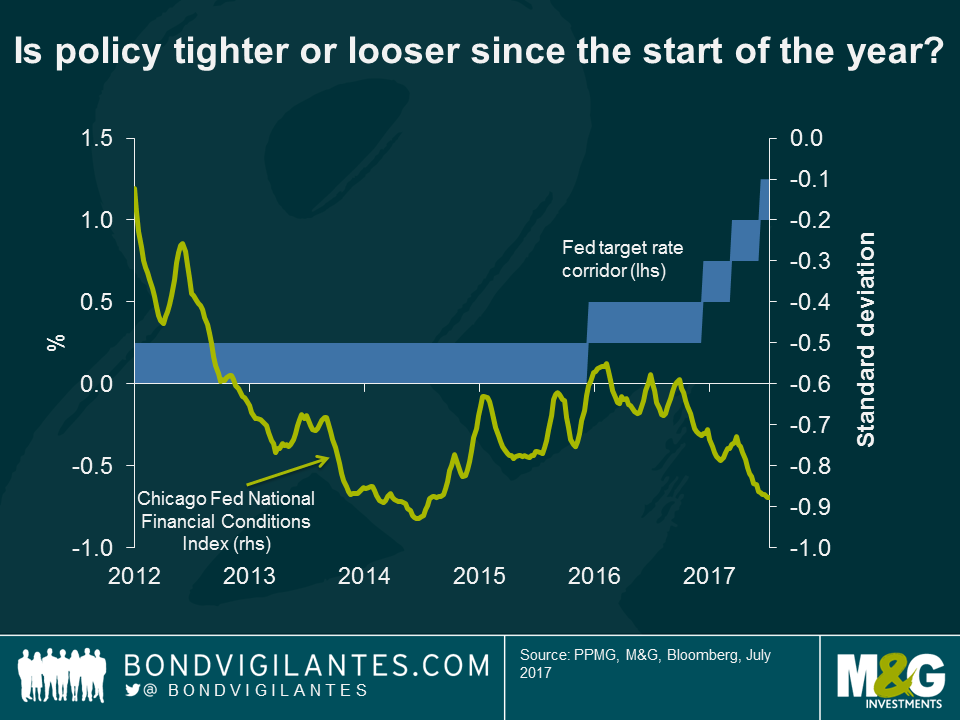

The policy rate set by the central bank indirectly impacts the economy, not directly. It is therefore important to assess financial conditions in order to assess the impact that a central bank’s monetary policy stance is having on the real economy. The chart below illustrates that although the policy rate corridor has been raised, financial conditions have eased over that same period. Thus for the real economy, one could possibly argue that Fed policy has so far had limited direct impact.

The Fed has been referring in minutes that “a few” members of the FOMC are more worried about the risk of financial stability than Chair Yellen. And potentially, easier financial conditions may at the margin encourage the Fed to lean a bit against asset price bubbles.

Central bankers have made relatively explicit statements that as financial conditions have become easier, policy needs to be tightened in order to have the appropriate effect on the economy. This would be an important nuance as a continuation in easing of financial conditions (i.e. lower USD, higher equity prices, lower interest rates, etc.) could potentially strengthen the case for a continuation in tightening either via the policy rate or through balance sheet adjustment. Thus if the Fed were to start focussing more on financial conditions and financial stability, it may potentially sound more hawkish than inflation data and dynamics would currently suggest. Central banks want this tightening to come about gradually, but the brief history of unconventional monetary policy suggests that asset re-pricing tends to occur abruptly.

How could this potentially impact the investment landscape? For fixed income investors, the narrow spreads for high yield bonds might be something to shy away from as the volatility may pick up for risk assets. More focus on the risk of financial instability, in the absence of inflation picking up will likely result in a flatter yield curve (due to a flatter term premium and absence of an inflation risk premium). For equity investors that have so far enjoyed a ‘Goldilocks’ environment of stable growth, monetary accommodation and low inflation, this may be something to monitor. Looking at history, the track record of central banks addressing worries about potential financial instability has often been less impressive, as the transmission mechanism and policy dynamics are extremely hard to control and assess. Now is the time to keep an eye on the developments in financial conditions, as year-to-date the market has experienced quite an easing, and this has sparked enough interest in the Fed that it has featured as an important undercurrent of recent communications.

This content is prepared for information and does not contain or constitute investment advice. Neither PPMG, nor any of its associates, nor any director, or employee accepts any liability for any loss arising directly or indirectly from any use of this material.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox