Trump should reappoint Yellen. Also: credit spreads are tight, Tesla, Laffer’s napkin and other stuff.

- The Fed Chair choice should be obvious for Trump. Yellen all the way. I don’t understand why he would choose Taylor.

President Trump is likely to announce his choice for the next Fed Chair by the end of this month. Whilst current Chair Janet Yellen is still in the running, she has been slipping down the betting over the past few weeks. There are three good reasons why (from his perspective) Trump should re-appoint Yellen to the position.

- If it ain’t broke, don’t fix it (jobs strong, volatility low, stocks high).

- Yellen is by far the most dovish of all the candidates. Trump wants the economy running HOT.

- Yellen is sackable. She’s not a friend of the family (like Warsh) and she’s a Democrat and part of the Washington swamp that Trump campaigned against. So she is perfectly placed to take the blame on the day that the stock market falls.

Yet over the weekend “people familiar with the matter” suggested to Bloomberg that Trump “gushed” over Stanford University economist John Taylor, having interviewed him in the past week. Presumably Trump is aware that the famous Taylor Rule would likely result in the Fed hiking rates much more aggressively than the market currently expects (if you assume a neutral rate of 2% the Fed Funds rate might currently be at over 3.5%. Many believe the neutral rate is much, much lower nowadays, but even then a “rules based” Fed seems more inflexible than a businessman like Trump might desire).

Whilst he’s surging, Taylor’s not yet overtaken Powell at the bookies. But at 10-1 Janet Yellen is now a firm outsider. If I were Trump she would be my pick.

- Credit spreads are nearing their pre-Great Financial Crisis lows, despite what the headline spread suggests.

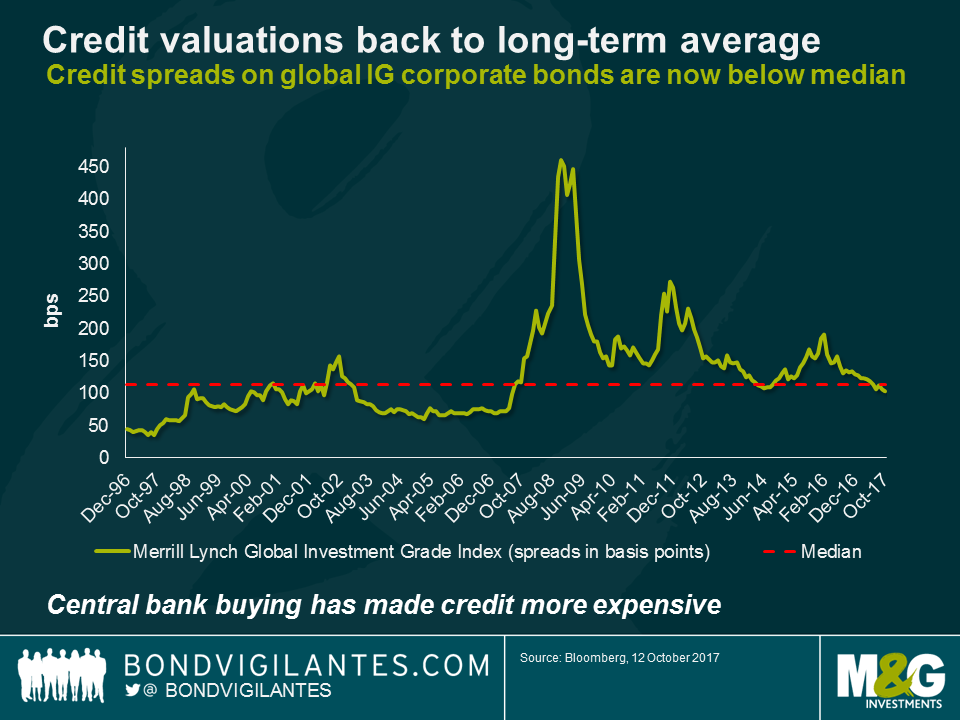

If you just looked at the overall global investment grade universe spread level, you could take comfort that despite the rally in corporate bond prices in the past couple of years (and particularly post the ECB’s decision to buy credit in its QE programme), valuations are simply back to their long term average.

Unfortunately the global investment grade bond universe has changed dramatically since the financial crisis, to an extent that makes this long term average almost meaningless. The quality of investment grade credit has seen significant deterioration in recent years. Partly this has been voluntary, with companies believing that adding leverage to their balance sheets can enhance equity returns (as well as taking advantage of the so-called “tax shield” of interest deductibility), but it also reflects the wide-scale credit downgrades that banks and financial institutions experienced during and after the credit crisis. For example, the issuer rating of Barclays Bank in 2007 was Aa2 with Moody’s, but today it is Baa2. Looking at the market as a whole we can see that in 2000, the nascent Eurozone credit market contained under 10% in BBB rated securities, and the US credit market a little over 30%.

Today, global credit markets are almost 45% exposed to BBB rated issuers, and trending higher. Remember also that credit ratings are not linear, but exponential – as you move closer to the boundary with high yield the risk of default increases significantly. Today’s global credit market has a much riskier credit profile than it did a decade ago.

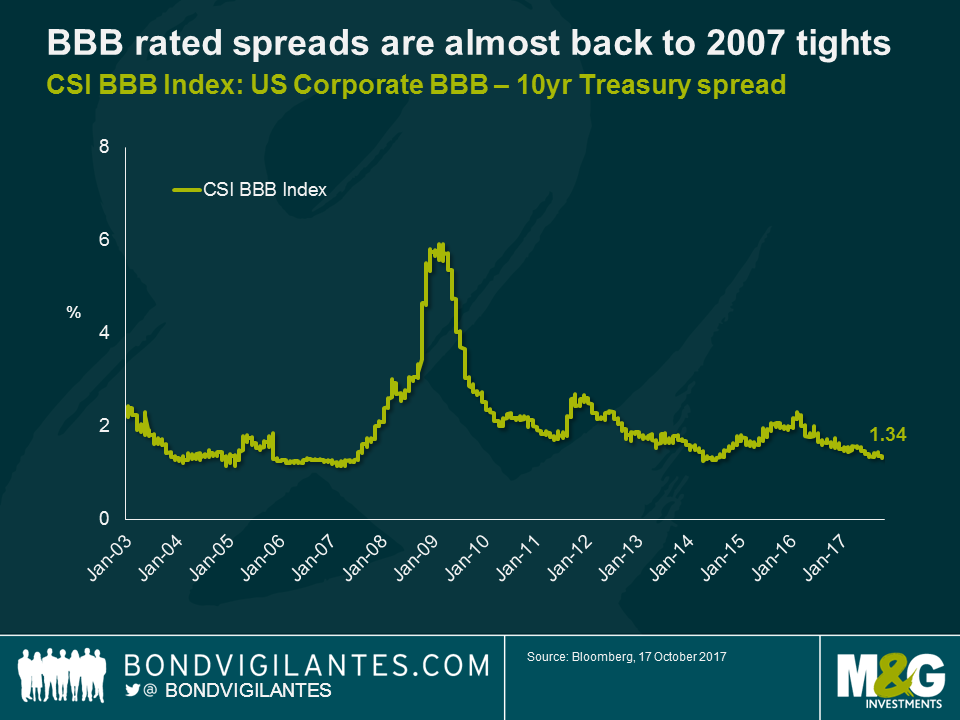

If we just look at the global BBB credit index spread, it’s clear that at 134 bps we are now near the 120 bps low spread that we saw in 2007, the peak bubble year before the GFC, and well below the average 200 bps spread that BBB rated assets have paid since 2002.

So rather than being “fair” value, global credit has moved into expensive territory. There are some good reasons for this, including the aforementioned QE buying of credit by the ECB, the fact that default rates remain very low (for all credit including high yield the default rate could be 1.5% for 2017, compared with over 2% in 2016), and the ongoing, huge, demand from US investors in particular for income producing assets (look at ETF flows into US$ IG funds). But the plain fact is that this is a market where credit quality has deteriorated, and the rewards for risk taking are much lower than they were.

- The Bank of Japan is bullish on growth, but it’s all about the deflation mind-set for prices.

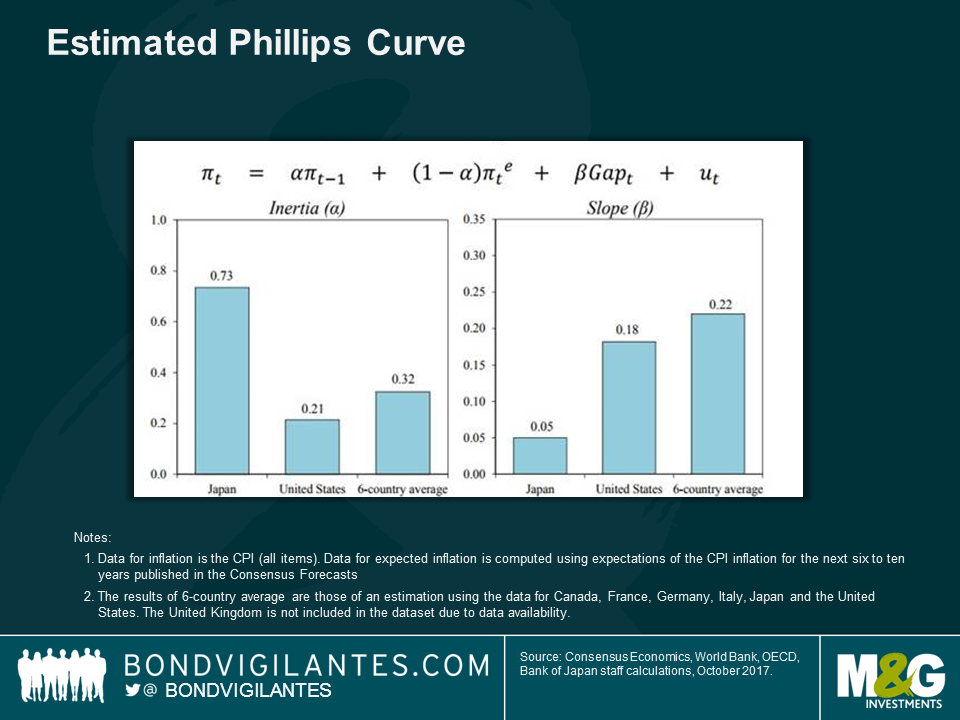

The Deputy Governor of the Bank of Japan, Hiroshi Nakaso, was in London a couple of weeks ago, with an upbeat assessment of the potential growth of the Japanese economy. You can see his slides here. Of Abe’s “3 Arrows” (fiscal policy, monetary policy and structural reform), the speech sensibly seemed to suggest that only the latter would really have any impact on Japan’s growth prospects. In particular Nakaso was bullish on the prospect for labour force growth from the elderly and non-Japanese workers (Japan’s female participation rate is now above that in the UK and US). But on the monetary policy side I thought the below slide was interesting. It shows a Bank of Japan decomposition of Japan’s Philips Curve compared to other nations. Firstly we should note that Japan’s Philips Curve is MUCH flatter than those in the US and elsewhere (right hand chart). Its unemployment rate has fallen to 2.9% from 5.5% with virtually no wage growth. But secondly we should be worried about the left hand chart. The “inertia” shows that low inflation in Japan is largely driven by the fact that inflation was low in past periods. In other words the expectations element of the Philips Curve is much more important in Japan than in the US or elsewhere, and shows how important it is that a) Japan breaks the psychological mind-set of stagnant prices (through wages policies? By hiking rates to show the economy has healed?) and b) that western central banks don’t allow deflationary mind-sets to develop here too.

- The first cyber-attack? In the French government bond market (in 1834).

I really enjoyed this article by Tom Standage in the Economist’s spin-off magazine, 1843. The Blanc brothers, bankers in Bordeaux, bribed operators of a system of mechanical telegraph towers to introduce deliberate errors into messages sent over the network which indicated the previous day’s bond market movements. This allowed them to trade bonds before the news arrived through other means, perhaps days later. The scam worked for a couple of years before the brothers were caught. They were prosecuted, but not convicted as “there was no law against misuse of data networks”. Worth a read.

- Tesla and “Damaged Goods”.

Whilst we are on the subject of technology, everybody’s favourite car manufacturer (stock up around 66% this year so far) made the news during Hurricane Irma with “an unexpected lesson in modern consumer electronics along the way” (Guardian article here). Cheaper models of Tesla cars were remotely given an extra 30 miles of charge through a software upgrade, to help their drivers get safely away from Irma’s path. These cars have exactly the same battery as the more expensive models, but software limits them to 80% of the range.

“Damaged Goods” is a 1996 MIT paper which showed how tech companies may “intentionally damage a portion of their goods to price discriminate”. In some cases companies may add additional technology to, say, a printer in order to slow it down relative to its more expensive offerings, meaning that the cheap version costs more to produce than the expensive one. Tesla’s gesture was obviously a good thing to have done, but it did bring the concept of “Damaged Goods” back into the public gaze.

- The UK’s net international investment position is just a bit lower than previously thought…

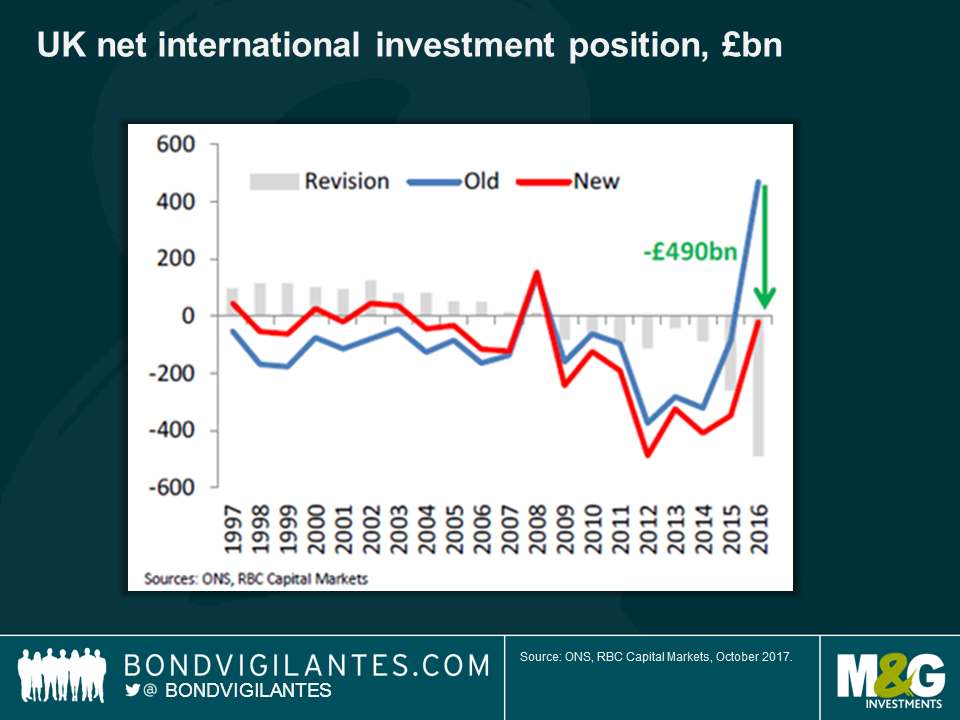

The Daily Telegraph published this article yesterday suggesting that the UK is nearly half a trillion pounds “poorer than previously thought”. Thanks to ONS revisions to the data, a substantial positive position in the UK’s net assets owned overseas has turned into a deficit of £21 billion. In other words the total value of UK investments abroad is worth less than overseas investments in the UK. The chart below, from RBC, shows the extent of this revision, but also that UK investments abroad have jumped in the past year or so. This jump is due to the post-Brexit collapse in the pound making the UK’s overseas assets appear more valuable in sterling terms. As Peter Schaffrik of RBC says “the revision for 2016 doesn’t create a new problem, it serves as a reminder to refocus on an existing one”. As we have a deficit on our international investment position it becomes difficult to generate enough net foreign income to reduce the size of the UK’s large current account deficit. Another sterling depreciation needed?

- Laffer’s napkin.

Art Laffer, the economist who is credited with the idea that cutting taxes would result in higher tax revenues and hence lower government borrowing as stronger economic growth increases the size of the cake is back in the news. Whilst the theory hasn’t necessarily stood the test of time (under Reaganomics debt to GDP increased dramatically as the President cut taxes), the current US President was tweeting approvingly about Laffer yesterday, and Trump wants to see aggressive tax cuts in the US as soon as possible.

Laffer is in the news for another reason, as our colleague Anjulie Rusius discovered in Washington D.C. this weekend at the IMF/World Bank meetings. Bored of Washington, as it’s possible to be after more than an hour or two in the place, she headed to the Smithsonian Museum as she has always wanted to see the famous napkin on which Laffer scribbled his “curve” over dinner back in the day. Literally as she was googling it on her way to the museum, the New York Times ran a story claiming that the Smithsonian’s napkin is a copy, recreated years later. She went anyway (what else is there to do in D.C. once you’ve been to the air and space museum?).

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox