The Venezuelan cash crunch: exporting passports as a palliative?

Venezuela’s cash flow crisis has been well covered. The recent default on its sovereign debt and likely default on the debt issued by its state-owned company, Petroleos de Venezuela SA (PDVSA), combined with collapsing imports attest to its ongoing cash crunch and humanitarian crisis. ¹

A change of economic policy however, would alleviate the crisis and improve the patient’s health. This could include measures such as:

- A better environment for the private sector

- Unification of the currency regime

- Securing foreign financing to resume capital expenditure in the oil sector where production has been falling at a rate of 10% per year

- Asset sales to reengage the private sector and increase non-oil production

- End of monetary financing of the budget deficits and hyperinflation

- Removal of oil price subsidies and price controls on essential goods

- Resuming the dissemination of government statistics

- Resuming a dialogue with the IMF and other multilateral organisations

- Debt restructuring in combination with the above

- Free and fair elections

In practice, none of the above measures are likely to be adopted under the status quo. Instead, new creative ideas continue to be announced by the government, including the upcoming issuance of a new cryptocurrency, the ‘petro’, to be backed by oil in an attempt to alleviate its current cash crunch.

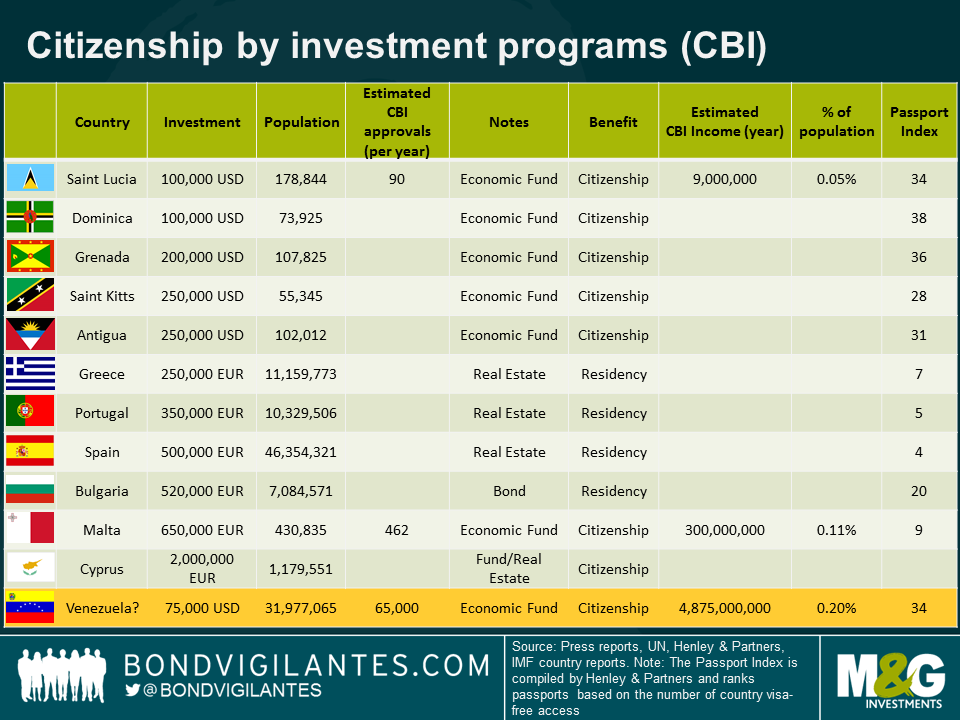

An alternative creative idea that I have come up with, is the establishment of a citizenship by investment program (CBI), similar to the existing ones below.

The requirements for each country vary, sometimes including residency conditions, but always requiring an investment into a government run fund, real estate and/or bonds. Some countries provide temporary residency, with an eventual citizenship possible though not automatic (i.e. certain EU countries with the exception of Malta and Cyprus). The revenues from such programs can be material. Dominica’s, for example, exceeds 5% of GDP, while St Kitts has fallen to around 4% (revenues were over 12% of GDP at inception).

A Venezuelan passport is attractive as it entitles the holder to visa-free travel to over 130 countries, including the European Union and it ranks a not-too-shabby 34th place globally, ranking higher than Peru, Colombia and Panama. See other rankings for passports here. I assume that a Venezuelan program would not require residency in the country but would require a monetary contribution for the equivalent of $75,000. This level is slightly lower than that of its neighbouring Caribbean countries due to perceived higher risk (e.g. additional US sanctions or controversy, risk of changes on visa requirements (i.e. EU’s Schengen area) if the vetting process is perceived to be too lax, past controversies in alleged sales of passports to terrorists, etc). I also estimate the external financing gap for Venezuela in 2018 at around $4.9 billion. This assumes an oil price of $50 for the PDVSA mix and total production of 2 million of barrels per day. Given that a large portion of the production is already pre-committed to China, Russia and Cuba and assuming domestic oil consumption of around 500-600,000 barrels per day, the actual amount of oil that is exported at market prices is roughly only a third of total production. It also assumes that no further payments will be made on its bonded external debt (Venezuela and PDVSA).

Assuming that each Venezuelan passport raises $75,000, if Venezuela grants 65,000 citizenship applications, it could close its financing gap for this year. Putting the amount into context vis-a-vis the country’s population, that is higher than the estimated amount of passports sold by Saint Lucia or Malta, but not scandalously so. Is this idea feasible? Probably not, but given the desperate cash crunch in Venezuela, one must think outside the box.

[1] Technically, the bonds issued by PDVSA are still trading with accrued interest. The bonds issued by the sovereign, are trading without accrued interest, which is how defaulted instruments normally trade.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox