Panoramic Weekly: 2008-2018: Don’t look back in anger

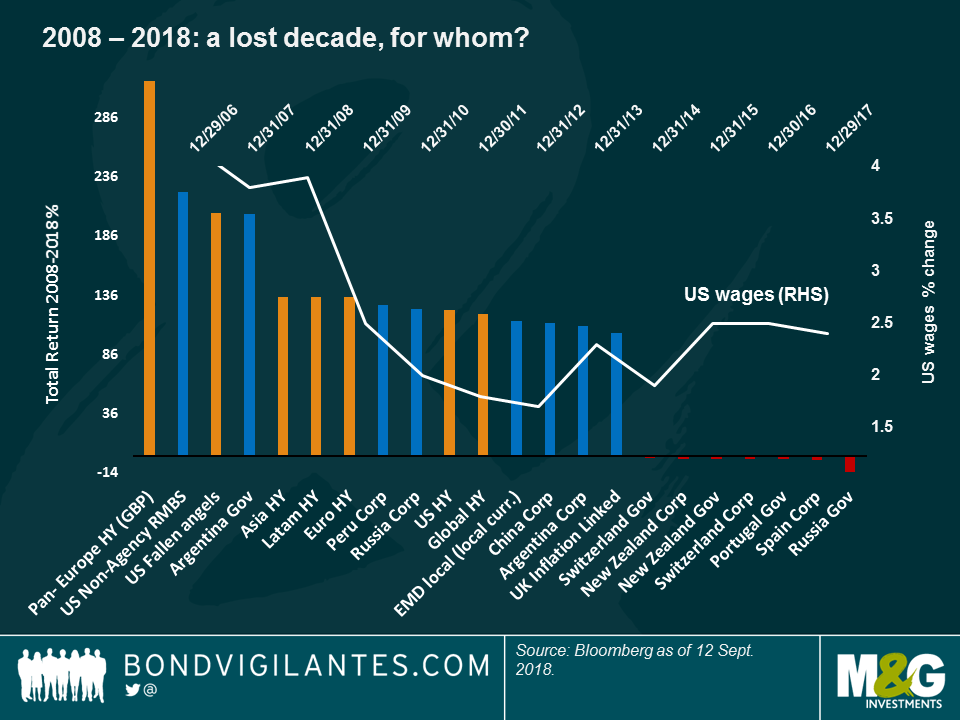

Few people would have guessed right after the collapse of Lehman Brothers, ten years ago this week, that a golden decade for bond investors laid ahead – but it has happened: as many as 92 of the 100 fixed income asset classes tracked by Panoramic Weekly have delivered positive returns, with 17 of them offering triple-digit returns. The 2008 crisis’ most-battered asset classes, such as High Yield (HY), performed best – see below.

The same “trouble shines” pattern played out over the past 5 trading days, as currently beleaguered asset classes performed best following overall positive global data. Argentinean and Turkish bonds and currencies rallied as investors expect an imminent rate hike in Turkey, and as they also welcomed Argentina’s balanced budget plans for 2019. Italian government bonds gained after government officials committed to fiscal discipline, while sterling strengthened on hopes the country will strike a Brexit deal soon (more below).

Most other fixed income asset classes dropped, as sovereign yields spiked: the 10-year US Treasury note leapt to 2.96%, from 2.86% only last week, after hourly wages unexpectedly rose in August by the most since 2009. China posted higher-than-expected import and export growth, while Japan’s second-quarter GDP grew 3%, above forecasts. The optimism drove oil prices back to the US$70 per barrel level for the first time this month.

Heading up:

Global High Yield – winning the lost decade: HY dominates the best-performing bond asset class rank over the past ten years, as seen on the chart below. Rising from the ashes, low-rated bonds have come back from record low levels, which partially explains their extraordinary performance. After ending 2008 at a whopping spread of 1,662 basis points (bps) over US Treasuries, US HY spreads have come down to 330 bps, not a bad rally. The top-performing HY asset class, however, has been in Europe: the GBP-denominated Bloomberg Barclays Pan-European HY index has returned 317% since Sept. 2008, helped by favourable currency moves: UK companies, which at present account for 75% of the index, may have benefited from sterling’s 2008 plunge when translating their foreign earnings back into pounds. Ten years on, the currency has yet to fully recover against the dollar and the euro. In Asia, HY was underpinned by China’s massive stimulus in 2008-09, while Latin American HY names have benefited from a global recovery, better corporate governance and overall improving fundamentals. Some investors, however, question whether the moderate growth and low inflation backdrop that has fuelled HY over the past decade is sustainable. Some doubt it, arguing that growth needs to be more inclusive in order to persist. As seen on the chart, while investors have generally done well over the past decade, those on US salary income haven’t fared as well. Some are still looking back in anger and populism is on the up.

UK – Guess who’s growing: After two years of dismal prospects and headlines following Britain’s decision to leave the European Union (EU), the country has had a rare week of positive news: the EU’s chief negotiator Michel Barnier said that reaching a Brexit deal could be realistic within 6 to 8 weeks; economic growth rose 0.6% between May and July, the fastest pace in one year and a half; and even wage growth accelerated by 2.9%, slightly above expectations. Sterling gained 1.15% against a rising dollar over the past 5 trading days, the best-performing developed currency. Some investors, however, are concerned about the stability of Prime Minister Theresa May’s government – certain media speculated this week that Tory party rivals are plotting a leadership challenge in order to get a less compromising Brexit deal. More to come.

Heading down:

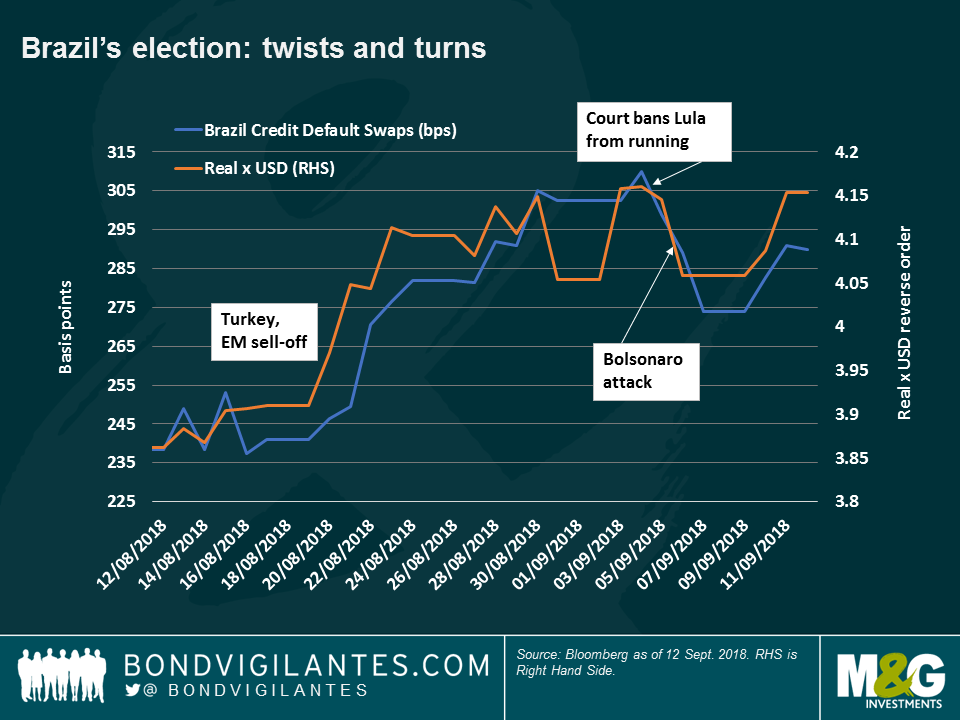

Brazil’s uncertainty – more certain: Brazilian bonds and the real rose over the past 5 trading days as the October election looms and recent polls show increased preference for far-right candidate Jair Bolsonaro. After being stabbed last week, the recovering leader has gained some sympathy votes, extending his advantage over other candidates: he now has 26% of vote intention, up from 22% earlier this month. The dramatic event led to lower Credit Default Swap (CDS) prices, or the price investors pay to protect themselves from a potential sovereign default, as seen on the chart. Markets are now betting on a second and final election round (on Oct. 28) between Bolsonaro and Alckmin, which is not perceived as a market-unfriendly outcome: while Alckmin has publicly committed himself to fiscal discipline, some of Bolsonaro’s advisors have reiterated plans to privatise state assets, including crown jewel Petroleo Brasileiro SA (Petrobras) or lender Banco do Brazil. Both candidates have condemned the country’s soaring debt – the government’s total gross debt to GDP reached 74% last year, up from 51% in 2011. As the election nears, the uncertainty, and its premium, seem to have eased.

German wheels – taking a break: Europe’s momentum has been abating throughout the year, but nothing like the Industrial Production (IP) index of the region’s powerhouse to confirm it: Germany’s IP fell by 1.1% in July, the second consecutive monthly drop. Exports fell 0.9%, the most since February, raising questions about the effects of the ongoing global trade wars. European exporters are also suffering from a rising euro: although the currency has weakened 3% against the US dollar so far this year – it strengthened 15% in 2017. Some investors believe that disappointing European data may delay the European Central Bank’s plans to withdraw its monetary stimulus and hike rates.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox