Panoramic Weekly: October pest

In true market fashion, both stocks and bonds suffered in October, hit by concerns about the effects of rising rates and trade wars on economic growth and corporate profitability. The past month brought evidence of a slowdown, particularly in Europe and Asia: third quarter GDP growth in the Eurozone came in below expectations, dragged down by Italy’s flatness, while in Asia, Industrial Output in Japan dropped by 1.1% in September and, in South Korea it fell by the most in almost one decade. China’s October Manufacturing PMI was below forecasts, helping push the renminbi down to 6.97 units per US dollar, the lowest in one decade. Wall Street corporate earnings disappointed, sending leading equity indices 8% lower in a month in which even German Chancellor Angela Merkel quit: she won’t be running as party leader again, after 12 years in office. The Bank of Canada hiked rates and oil, against such backdrop, plunged to $66 per barrel, down from $76 only earlier this month. Global corporate credit spreads widened. For a truly scary overall picture don’t miss this year’s M&G’s scary charts – they may keep investors up at night this Halloween.

While traditional safe-havens such as German bunds, the US dollar and the yen rose, October’s winners included some unusual suspects, given recent troubles: The Argentinean peso, the Brazilian real and the Turkish lira all surged against a rising dollar as the 3 countries deliver on their promises to fix their economies: the IMF approved an expanded $56bn credit line for Argentina, while Turkey maintained interest rates at 24%, a move that has allowed the lira to recover about half of this summer’s losses. The Brazilian real rallied to 3.7 units per dollar, up from 4.2 in September, after the victory of far-right leader Jair Bolsonaro in Sunday’s general election. The currencies of Chile, Colombia and Mexico sharply fell in October along with oil and leading commodity prices, such as copper, given the global gloom. The UK was another recently-troubled winner – see below.

Heading up:

UK – a farewell to austerity? UK gilts and inflation-linked debt were among the top performers over the past five trading days, up 0.8% and 2.3%, respectively, after Chancellor Hammond proclaimed the end of austerity in his Budget speech on Monday. Increased tax in-take expectations and lower borrowing needs (after 10 years of record low rates) led to the good news. Gilt yields rose (but not enough to offset October’s general drop), while inflation expectations also jumped, making inflation-protected securities (or “linkers”) the best-performing asset class among the 100 tracked by Panoramic Weekly – they are up 2.3% over the past five trading days and 3.7% in October. Hammond’s better-than-expected growth forecasts for next year, plus the ongoing Brexit challenges are expected to generate inflation which, as seen on the chart, is the main driver behind the increase in Britain’s nominal yields. Since mid-July, gilt yields have increased by 26 basis points (bps), but more because of higher inflation expectations (14 bps), than because of an increase in real rates (11bps), which are generally driven by real growth. For a real check of Britain’s recent budget, read M&G Anjulie Rusius’ “Is UK austerity over? Cue the autumn budget.”

EM inflation-linked – month’s winners: Emerging Market (EM) inflation-linked bonds were the month’s best-performing asset class, among PW’s 100 asset class universe, led by Brazilian debt. After peaking at 10.7% in January 2016, Brazilian price growth plunged to less than 3% just 16 months later, hit by a severe recession and a series of rate hikes in late 2015. After a year of relative stability, Brazil’s inflation started picking up in June this year as the country returned to growth. But inflation-protected securities have come up even more as pro-growth far-right leader Bolsonaro led recent election polls. His victory, on Sunday, has raised hopes about the country’s future growth – as well as questions about a potential disappointment, given the high expectations and his lack of Parliamentary experience.

Heading down:

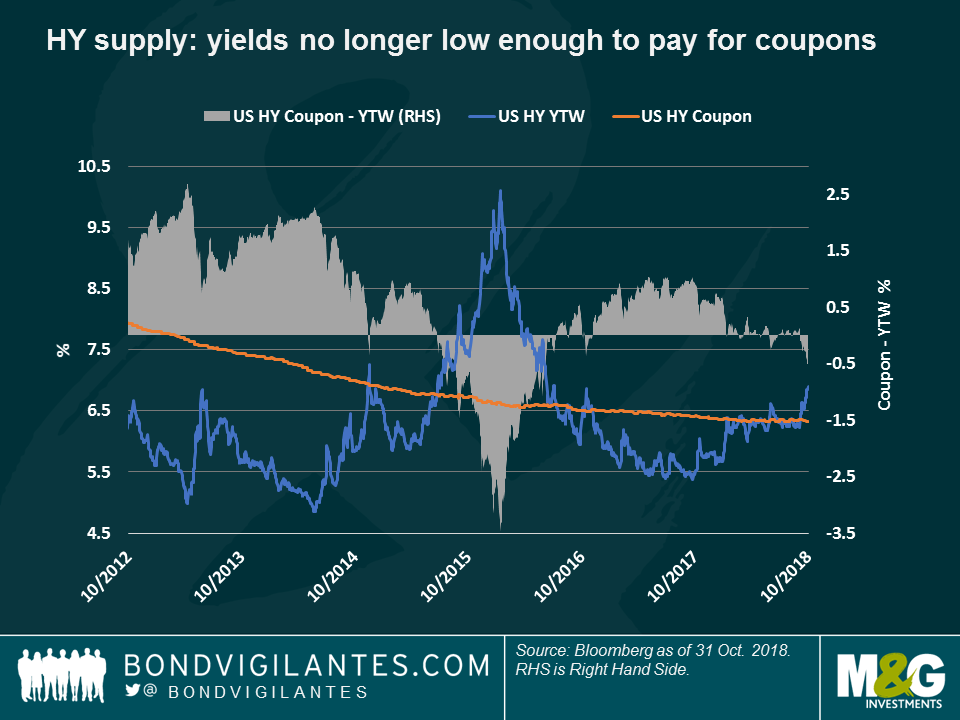

High Yield supply – just can’t afford it: The dearth of US High Yield (HY) supply this year has made investors smile, as this technical factor has supported low spreads and kept HY returns in positive territory, unlike much of the Fixed Income universe. But HY companies aren’t smiling as much: according to Credit Suisse, US HY yields (at 6.9%) have substantially climbed above the average coupon they pay investors (6.3%) making the security practically inviable as, unlike before, borrowing costs are no longer low enough to facilitate coupon payments. As seen in the chart, this has only happened during periods of stress, as it did in late 2015, when a credit bear market was formed amid low growth and plunging oil prices. As seen in the second chart, low supply is shrinking the asset class, especially relative to its Investment Grade peers, whose market volume has swollen over a decade of low rates. For more on the effect of low rates and the subsequent increase in debt, see Lu Yu’s “Beware of the Debt Binge.”

Oil – ignoring Trump: Oil prices plunged almost 10% in October, dragged down by growing uncertainty over the global economic outlook, and also on reports that China and India, major buyers of Iranian oil, would continue importing from Iran despite the forthcoming US sanctions on the Middle Eastern country. The sanctions had helped fuel a rally in September, which has now almost been totally wiped out. News that Mexico’s new President wants leading oil company Pemex to favour domestic supply over international shipments also weighed on the price. The drop is a relief for many as a spike in oil prices preceded 11 out of the last 12 US recessions – click here to read more.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox