Will the EU Recovery Fund kickstart the green bond market?

The EU’s €750 billion recovery fund can be considered a major political achievement for the bloc. It’s good news for investors too, as the announcement helps to contain EU break-up risk as a result of Covid-19.

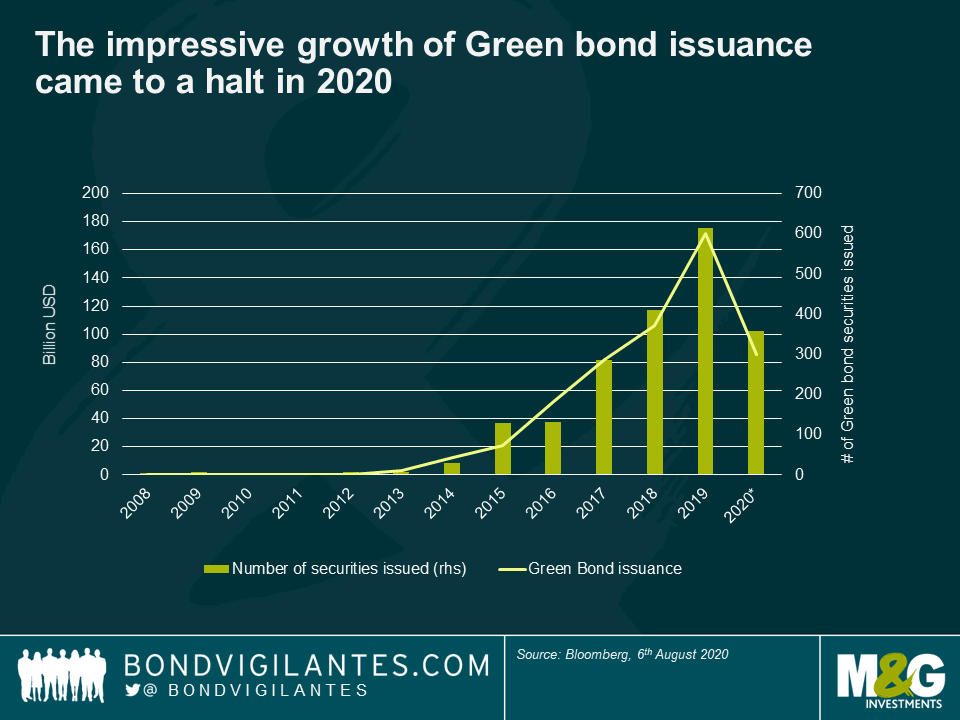

The plan has also received a positive reaction from green investors: the recovery fund can direct resources not only to hard-hit sectors, but also to sectors not directly affected by the virus, such as green technology and infrastructure. It is not yet clear how much of the EU’s future issuance will be dedicated to green bonds, but I would not be surprised to see the EU use its flexibility to help drive its target to become the first carbon neutral continent by 2050. This would certainly give a much needed boost to the green bond market, whose year-on-year growth story came to a halt in 2020.

Green bonds could serve as an attractive risk-free asset with a pickup

I would expect to see a good level of market interest for EU green bonds (subject to pricing), with demand coming predominantly from passive investors and investors with strict mandates for high quality assets. EU green bonds are anticipated to have a AAA credit rating and could therefore offer an interesting alternative to existing risk-free assets, such as German bunds. However, while the EU will become a sizable issuer of debt over the coming years, the total amount of EU bonds outstanding will still represent just a small fraction of outstanding German bunds.

I would therefore expect EU green bonds to trade with a small liquidity premium over bunds. There is also an element of redenomination risk embedded in bonds issued by the EU, which should also be reflected in some spread premium. EU green bonds might therefore appeal not only to sustainable bond investors, but also to portfolio managers looking for risk-free assets with a small yield premium. Furthermore, with the possibility of the ECB using its asset purchasing scheme to pursue green objectives, we could also see an interesting technical factor at play.

A catalyst for further issuance

How governments spend money is always a political decision. Since green bonds specifically address issues of ethical finance and long-term sustainability, they might help to increase the willingness for an increase in debt levels as a way to stimulate economic growth through investing in environmentally-friendly projects. Therefore, I would expect to see more countries join the current green bond leaders found in France, Belgium, the Netherlands, Chile and Ireland. Apart from Germany, which plans to issue its first green bund via syndication in September this year, Spain and Denmark have also recently shown interest in issuing green bonds. After all, green bonds are a way both to promote environmental objectives and provide economic stimulus.

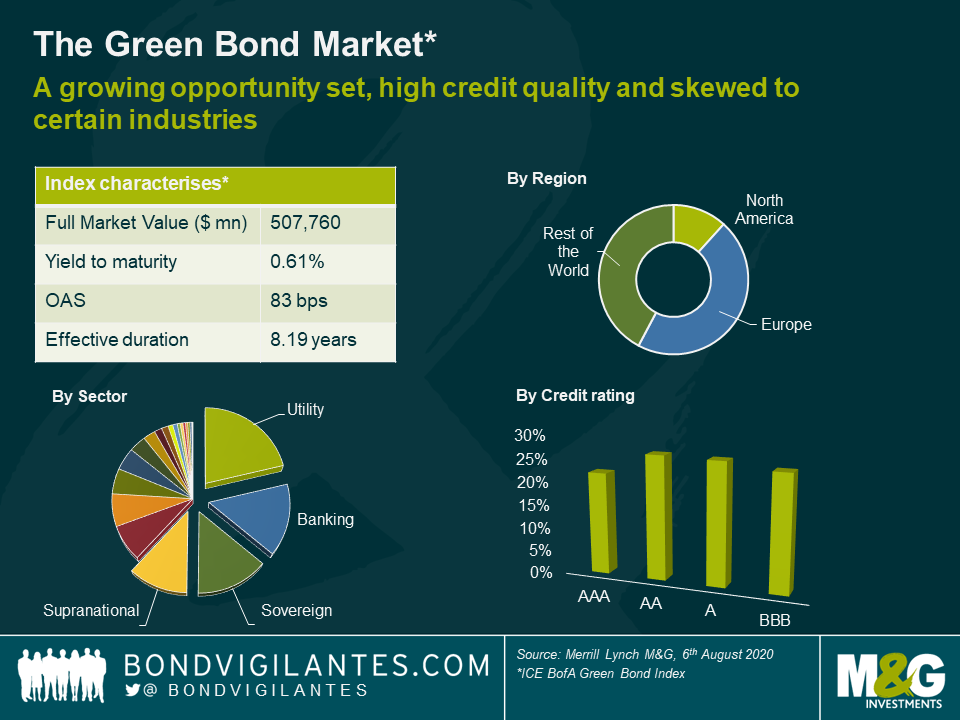

From a bond investor’s perspective however, what is needed is a more diversified green bond market. Taking the Merrill Lynch Green Bond Index as a proxy, the limitations faced in constructing a portfolio come to light (see chart below). Fifty percent of the Green Bond index is rated AA or higher. When looking at the sector breakdown, 49% of the issuers are either sovereigns or quasi-sovereigns, with utilities and banks claiming 21% and 16% of the remaining index weight respectively. The key will be to deepen and diversify the market further. As things stand today, there are still challenges from a risk-return perspective, as it is hard to build a liquid and well-diversified portfolio with sufficient credit risk with only green bonds. Doing a quick Bloomberg search, there are currently only 55 bonds (from 36 issuers) with a high yield Bloomberg composite credit rating.

That said, corporations are becoming more aware of the possibilities that the green bond market offers. Just this year, we have seen BBVA issue its first CoCo green bond. Arguably, this opens up a debate over whether a bond should be used as capital instrument as well as a green-financing tool. In my view, it all comes down to the use of proceeds and transparency, and we can expect the EU taxonomy to provide greater clarity in this area.

We could see green EU bonds as early as 2021

So when will investors be able to integrate the EU green bonds into their portfolios? For now it is hard to say. As far as the Recovery Fund deal is concerned, there are still some hurdles to overcome in the form of parliamentary ratification. Assuming all goes well, the first batch of issuance is scheduled for early 2021, but it is not yet clear whether this will include EU green bonds. Assuming it takes 2-3 months to prepare issuance, we could get more information on this as early as Q4 this year. Before that, the EU may start to issue bonds for the SURE (Support to mitigate Unemployment Risks in an Emergency) programme as soon as September. However, I think it’s unlikely those instruments will be issued as green bonds given that their proceeds will be used to address the immediate challenges of the pandemic, rather than to fund environmentally-friendly projects.

Another point to consider is that the technical working group, which is assisting the EU Commission in the development of the EU taxonomy as well as the EU green bond standard, is still defining the screening criteria for certain segments of the market. Therefore, we might need to wait a bit longer until we see green bonds issued in scale by the EU. Nevertheless, according to Morgan Stanley research, the EU could potentially issue a total of between €800-900 billion by 2025 if all monies were to be fully utilised and disbursed. Part of this new issuance will almost certainly come to market as EU green bonds.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox