The coronavirus crisis is having a profound and lasting effect on the global economy, with the vast majority of countries expected to get back to their 2019 level of economic output only in 2022. The consequences of the crisis are not just limited to the economy and to changes in human behaviour. In many countries of the CEE/CIS region, the crisis has coincided with election cycles and will lead to significant changes in political landscapes over the years to come.

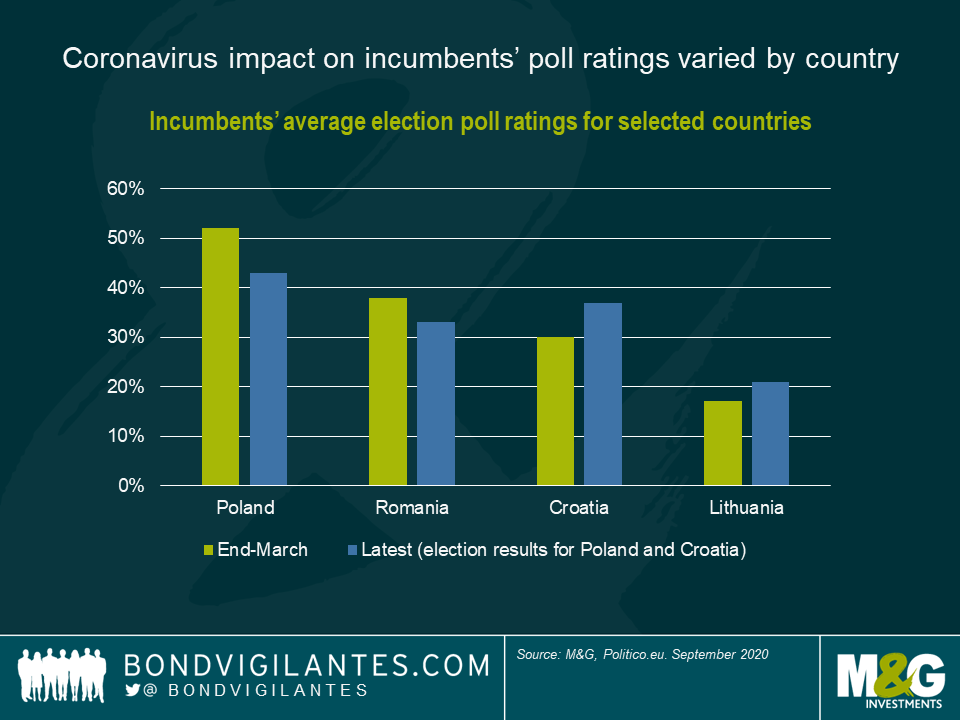

Naturally, this crisis has presented a significant challenge for incumbent governments and presidents trying to maintain their popular support levels. Election date shifts due to the epidemiological situation only added to complications in some countries. During a crisis of this scale and uncertainty, some policy mistakes were perhaps unavoidable. As a result, in many countries people have blamed the authorities for their economic and social troubles, even with the huge fiscal and monetary support packages provided. Consequently, what seemed before the crisis to be an easy road to victory for the incumbents has turned out to be quite the opposite in some cases. For example, in Poland’s July elections the incumbent president Duda managed to defeat his main opponent only in the second round with a minimal lead (51% vs 49%), despite consistently polling at least 20 percentage points above his main opponent up until late May. In North Macedonia too, the ruling party barely managed to secure a win, and at certain cost: to obtain a coalition majority of just a few seats in parliament, they had to agree to a transfer of the prime ministerial post to an Albanian minority party at least three months before the next parliamentary elections.

Interestingly, the crisis has not led to the falling popularity of the incumbent government everywhere – in some cases quite the contrary. For example, in Lithuania a robust policy response to the health crisis (resulting in one of the lowest number of cases per population in Europe) helped the ruling party to improve its position in the polls ahead of parliamentary elections in October. Some other governments tried to capitalise on providing generous fiscal support (including direct cash payments to the people) by holding elections shortly afterwards, while the epidemiological situation was still relatively benign following the initial strict lockdowns. In particular, this cunning strategy was successfully implemented in Serbia and Croatia. In Serbia, the ruling coalition was able to strengthen its parliamentary majority significantly compared to the previous elections, scoring more than 70% of the vote. To be fair, this result was also made possible by very impressive economic achievements in previous years, as well as some opposition parties having decided to boycott the election.

In Croatia, the ruling party also managed to improve its popularity shortly before the vote, resulting in a stable coalition government instead of the unstable populist-led coalition predicted by many experts. Conveniently, the election was held before the main tourist season began, which subsequently led to a significant spike in coronavirus cases and painful economic losses from a slump in foreign tourist arrivals. The importance of this factor for popular support was vividly demonstrated later in Montenegro, another country with a huge dependence on tourism. In contrast to Croatia, the ruling party did not manage to engineer early parliamentary elections before the tourist season, and its choice to hold them in late August proved to be unfavourable. After declaring itself completely virus-free in May, Montenegro has experienced a second wave of the virus since late July and partial lockdown measures were re-introduced. While economic problems accumulated in previous years have also played a role, this was perhaps the decisive factor causing the ruling party narrowly to lose the election to a united opposition for the first time in 30(!) years. Tourism impact could also prove crucial in Georgia, which will hold its parliamentary elections in October. According to the World Travel and Tourism Council, the direct and indirect contribution of tourism amounts to a huge 34% of GDP in Georgia (compared to “only” 22% in Montenegro and 25% in Croatia). This places the country among the most exposed in the region and the opposition is clearly trying to capitalise on the significant loss of tourist revenues due to the crisis.

Perhaps the most well-publicised example of coronavirus impacting the political landscape significantly is Belarus. The local authorities decided not to impose any lockdown at all in response to the crisis. In fact, Belarus was the only country in Europe continuously running its football championship (with spectators allowed in the stadiums), while president Lukashenko even called coronavirus a “psychosis”. This strategy somewhat limited economic losses at first, but resulted in a high number of cases per capita, and ultimately backfired when Belarus failed to receive any crisis-related financial support from the IMF. While the IMF readily deployed funds without any conditions to all countries in need (even to those without a realistic possibility of a near-term IMF programme), it was reluctant to support a country which did not introduce any significant health and safety measures. What is more, parts of the ruling elite as well as ordinary people in Belarus were also seemingly upset with the government’s handling of the crisis, which added to previous years of weak economic growth. This contributed to a somewhat unexpected and rapid heating up in politics just a couple of months ahead of the presidential elections in August. After what has been deemed by most observers to be the falsified victory of the incumbent, large scale protests are continuing in Belarus now. This may ultimately result in the ousting of president Lukashenko, who has been in power since 1994.

The Belarus situation is clearly a warning to another long-standing leader in the region facing re-election this year – president Rakhmon has governed Tajikistan since 1992. Tajikistan remains one of the poorest countries in the world with very weak institutions (including its healthcare system) and high public debt levels. In contrast to Belarus though, the government was prudent enough to engage quickly with the IMF and receive some emergency crisis-related funding. While the chances of any political change this October are very slim, the example of Belarus shows that people’s needs cannot be fully ignored in times of crisis, even in autocratic regimes.

Considering potential economic consequences, arguably the most crucial election in the region this year will take place in Romania in December. Significant deterioration in fiscal deficit and public debt levels in recent years put Romania on the brink of losing its long-held investment grade status. Since March, support levels for the current market-friendly government fell as it tried to juggle between the necessity to provide large, crisis-driven fiscal stimulus and the equally urgent need for fiscal consolidation. So far the government has narrowly survived the no-confidence votes in parliament, but the upcoming election will be the true test of its viability in the medium term. All three main rating agencies currently have negative outlooks on Romania’s BBB- credit rating, and it is uncertain whether they will even have the patience to wait until December in a hope of swift post-election policy reversal.

One of the most important elections for the region (and perhaps for EM as a whole) this year will actually take place outside it. In November, the US will choose its president. The handling of the coronavirus outbreak is clearly undermining Trump’s support levels, and the long-term implications for the region in the case of a Biden victory could be significant. While a possible reduction of US protectionism and trade war rhetoric could be positive for the global economy and EM, the implications for particular countries could differ. In particular, a Biden administration might step up sanctions pressure on some countries like Russia and Turkey in response to their human rights violations and military interventions. Many observers perceive it is likely to adopt a more structured approach to foreign policy, in place of the “deal-making” attempts (largely based on personal relationships with foreign leaders) favoured by president Trump.

In any case it is clear that, like its economic effects, coronavirus-related political volatility is unlikely to end in 2020. Arguably, 2021 may prove to be an even more difficult year for incumbent authorities facing re-election, particularly as they are likely to be running out of policy responses and resources to mitigate the negative impacts of the crisis. Unless healthcare and economic situations improve markedly, people across the world might start losing trust even in the most popular governments and presidents.

Last week saw the first ever issuance of a Sustainability-Linked Bond (SLB) from an emerging market issuer. Brazilian pulp & paper producer Suzano issued US$750 million of Jan-2031 bonds at a yield of 3.95%. The bond coupon (3.75%) is subject to a sustainability performance target and shall increase by 25bps per annum from July 2026, if the issuer does not meet its target in 2025. It is different to a green bond. Green bond proceeds have to be used for environmentally-friendly projects. Sustainability-linked bonds can see their proceeds used for general corporate purposes.

It is only the second time in bond history that a company has used such a structure. Last year, Italian energy company Enel issued the first ever bond featuring a coupon increase (also 25bps) in the event of not meeting a sustainability performance target.

Suzano’s official rationale for using a similar structure is to reduce greenhouse gas (GHG) emissions intensity as “a key strategy for the company to mitigate climate change and address the climate crisis”. The fact that a Brazilian company innovates on the sustainable front may have come as a surprise to many investors, after Brazil and its President Jair Bolsonaro were centre stage of global criticism last year when parts of the Brazilian Amazon forest were devastated by flames. Listening to Suzano’s Chief Financial Officer, it might well be another reason why they issued the bond: “The fires and deforestation are caused by criminals, and we want to make sure that everyone understands that Suzano has a completely different story.”

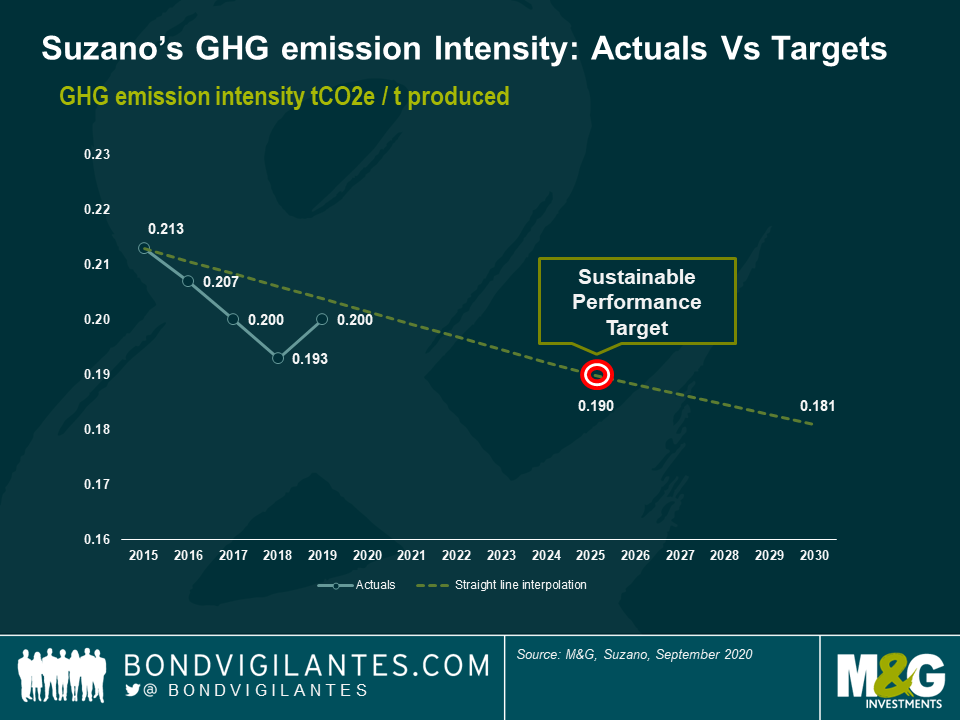

The company’s key performance indicator for GHG emission will be measured as tonnes of CO2 equivalent (tCO2e) per tonnes produced of paper and pulp, per year. The Sustainability Performance Target (SPT) is a reduction to or less than 0.190 tCO2e/tonne produced as measured by the average of years 2024 and 2025. As can be seen in the chart below, the company has set the baseline as their 2015 performance of 0.213 tCO2e/tonne produced. Reaching their target by 2025 would therefore correspond to a 11% reduction in GHG emission intensity since 2015.

However, looking behind the surface, the company reached 0.193 tCO2e/tonne produced in 2018, very near their 2025 target which all of a sudden looks considerably less ambitious. During the conference call to bond investors, the company claimed that 2018 was an exceptional year in terms of production (the denominator of the performance target ratio). But last year Suzano was already very close to the 2025 target with 0.200 tCO2e/tonne. Sceptics may also be worried that if the company falls short of the target, it would be incentivised to increase production (denominator) in order to meet objectives. Management reassured investors by saying the goal clearly was to improve efficiencies of processes and energy procurement (i.e. the numerator) rather than inflating production, the latter being demand driven.

Another source of disappointment came from the fact that the bond coupon was linked to the GHG emission intensity target only. A common pitfall in the green bond market has been to overlook a company’s overall ESG credentials, just because they issue a green or sustainability-linked bond. We think an issuer’s ESG profile prevails over an instrument’s E, S or G structure and we do not buy green bonds of environmentally-unfriendly issuers in our emerging market corporate ESG-dedicated fund. Why is GHG emission intensity more important to a pulp producer than water management or industrial waste? Suzano’s water stress credentials are good but its toxic emissions & waste intensities are fairly weak. An ambitious target would have included the latter.

Suzano said that GHG emissions remained the key material topic for stakeholders and that the ICMA Sustainability-Linked Bond Principles recommended to use KPIs that have at least three years of history, which wasn’t available for other KPIs although the company kept the door open to issuing new sustainability-linked bonds with different KPIs in the future.

We did not participate in the new sustainability-linked bond issue as pricing was not in line with our expectations and our views of the company’s credit profile (including ESG credentials) and sector. The investment grade bond priced at 3.95% with little to no new issue premium, perhaps as a result of strong demand from ESG funds (the book was said to be $7 billion for a $750 million bond). Whilst it is good practice to perform in-depth due-diligence and challenge management teams on new bond structures, we also need to give credit to Suzano who is one of two pulp and paper issuers to have a green gas emission target in the developing world: there are only 8 globally.