COVID-19 and the Chinese renminbi: room for further strength, but near-term upside may be limited

While many emerging market currencies have posted lackluster returns this year, the Chinese renminbi has been a clear outperformer, having appreciated by 5.9% against the US dollar in 2020.

There are a few important drivers that explain the currency’s appreciation this year. First of all, China has handled the COVID-19 virus better than most other countries and, as a result, has suffered to a lesser extent economically. While most countries will post negative GDP growth figures this year, China is predicted to grow by 2.0% in 2020 and another 8.1% in 2021 (Bloomberg survey of 67 economists, November 2020).

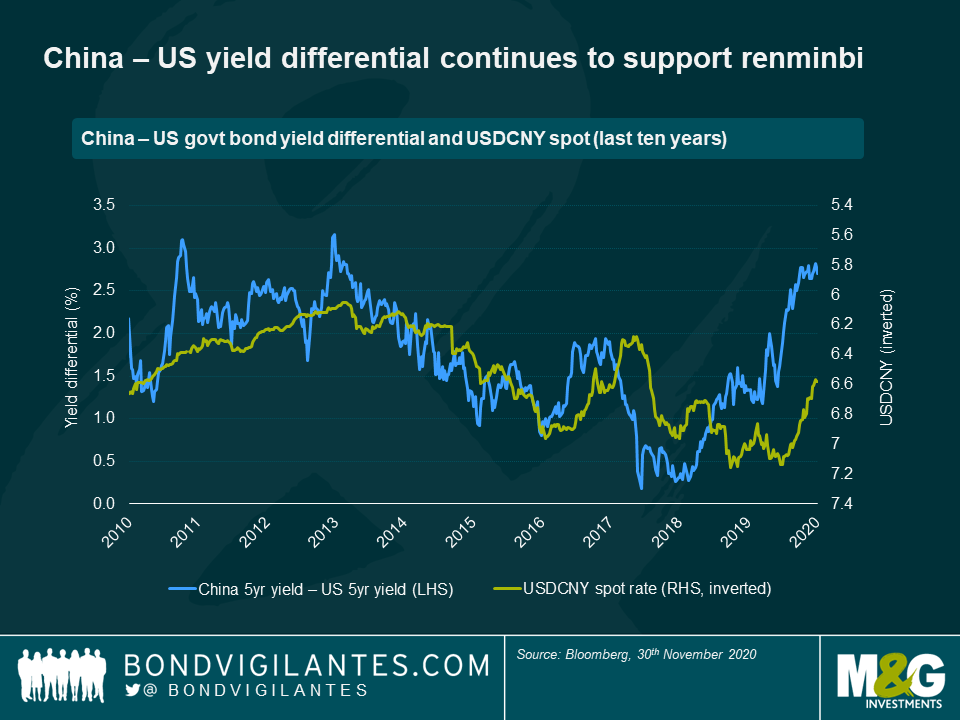

This more positive economic backdrop has also allowed the PBoC (People’s Bank of China) to enact more conservative monetary policy than most of its peers. While, at the onset of the pandemic, the PBoC cut the reverse repo and MLF rates and also reduced the reserve requirement ratio for banks, in more recent times it has normalized policy as economic growth has rebounded. As a result, after reaching a low point of 1.8% in April, five-year Chinese government bond yields have now risen to 3.2% while US Treasury yields remain at very low levels. As the PBoC aims slowly to reign in credit growth and tighten policy further in 2021, the US-China yield differential is likely to remain elevated, continuing to support the renminbi.

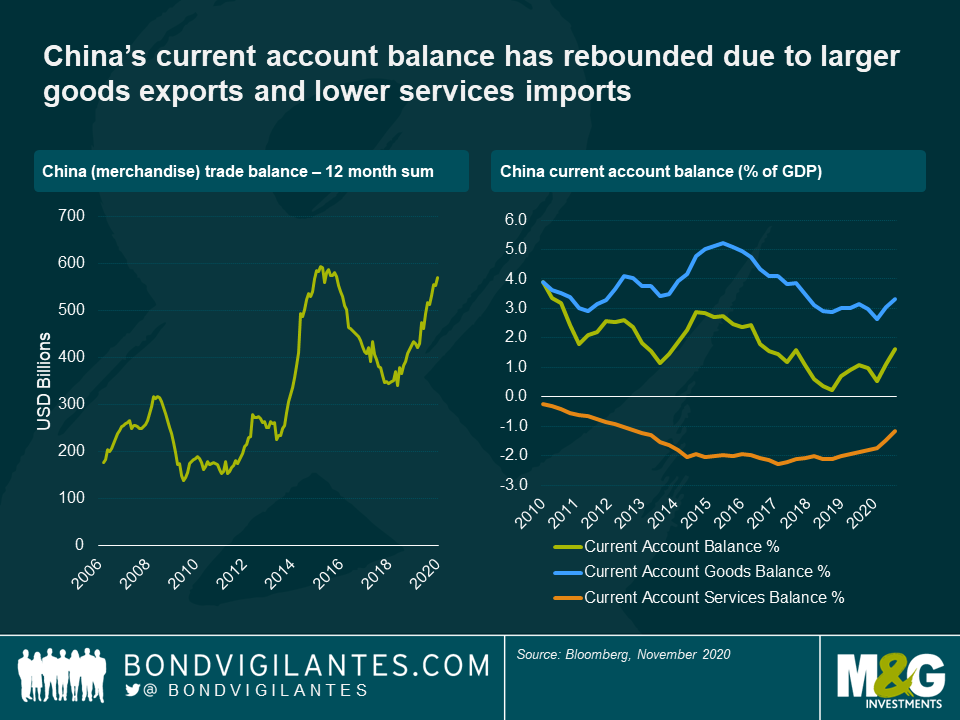

The COVID-19 pandemic has also provided a boost to China’s balance of payments. China’s goods exports have risen over the course of the year as demand for Chinese medical and electronic equipment has increased. These higher exports have contributed to China’s trade surplus reaching its highest level in five years.

China’s persistent services deficit has also improved considerably this year, as many of the services China typically imports from the rest of the world (such as tourism and travel) remain unavailable. This has caused the current account balance, which has been on a structural decline, to rebound recently from its lows.

Looking at China’s financial account, while net foreign direct investments (FDIs) have been broadly stable in recent years, the gradual liberalization of China’s bond markets and recent index inclusions (a topic I addressed previously) have contributed to record portfolio flows recently. Deutsche Bank estimates that there have been $116 billion in inflows to China’s bond markets this year, almost twice those of last year. Given the recent announcement by FTSE that it will include Chinese government bonds in the WGBI indices by October 2021, these flows are likely to persist in the near term, especially considering that foreign investors still make up only 3% of China’s $15 trillion bond market.

Taking a longer term view, while financial market liberalization will be extremely gradual in China and is likely to trigger bouts of volatility—for example with the recent increase in state-owned enterprise (SOE) defaults—the potential for further portfolio inflows remains enormous. Morgan Stanley estimates that, over the next decade (2021-2030), portfolio bond and equity flows into China will amount to at least $180 billion per year. These flows should therefore almost entirely offset the recurring $200 billion on average of “errors and omissions” that leave the country each year. On the whole, China’s balance of payments position therefore remains robust and supportive of the currency.

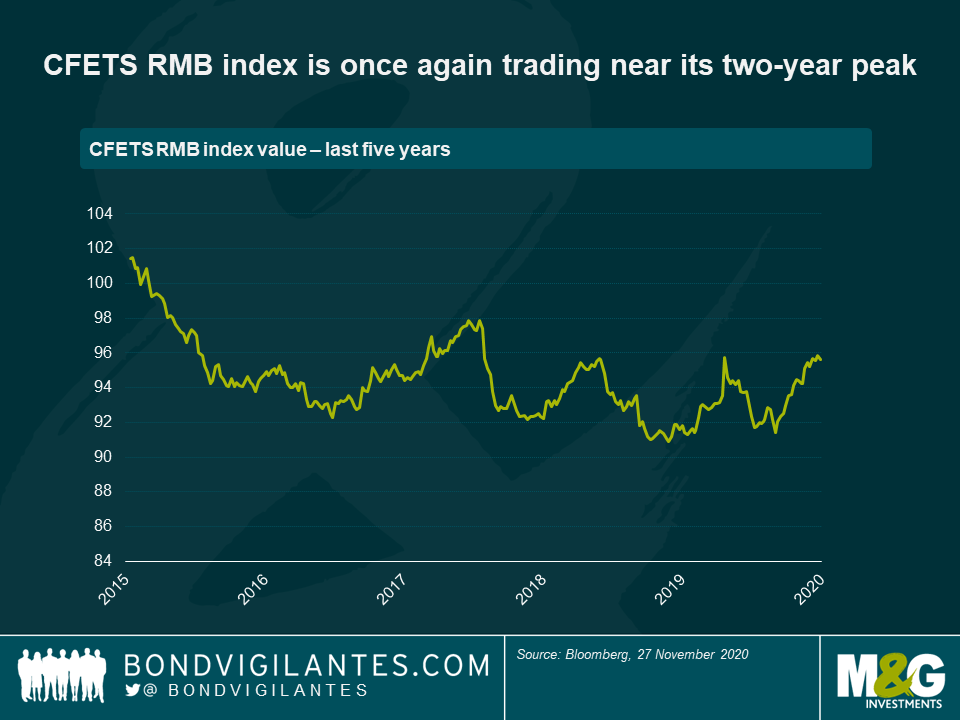

Of course, there are also risks to the view of further renminbi appreciation. One fairly obvious obstacle is that the currency has already appreciated by almost 5% (using the CFETS basket—China’s Foreign Exchange Trade System basket of currencies) since the lows in July, a relatively sharp move by historical standards. As a result, the CFETS RMB Index is now close to 96 once again, a level that had triggered the PBoC to intervene recently by allowing more outbound flows through the Qualified Domestic Institutional Investor (QDII) scheme, cutting the risk reserve ratio for FX forwards from 20% to 0%, and phasing out the countercyclical factor in the USD/CNY daily fixing. While these adjustments can be considered as gradual steps towards further market liberalization and in line with the PBoC’s pledge to intervene less in the future, they can also be interpreted as signals that the central bank remains committed to preventing the renminbi from appreciating too quickly.

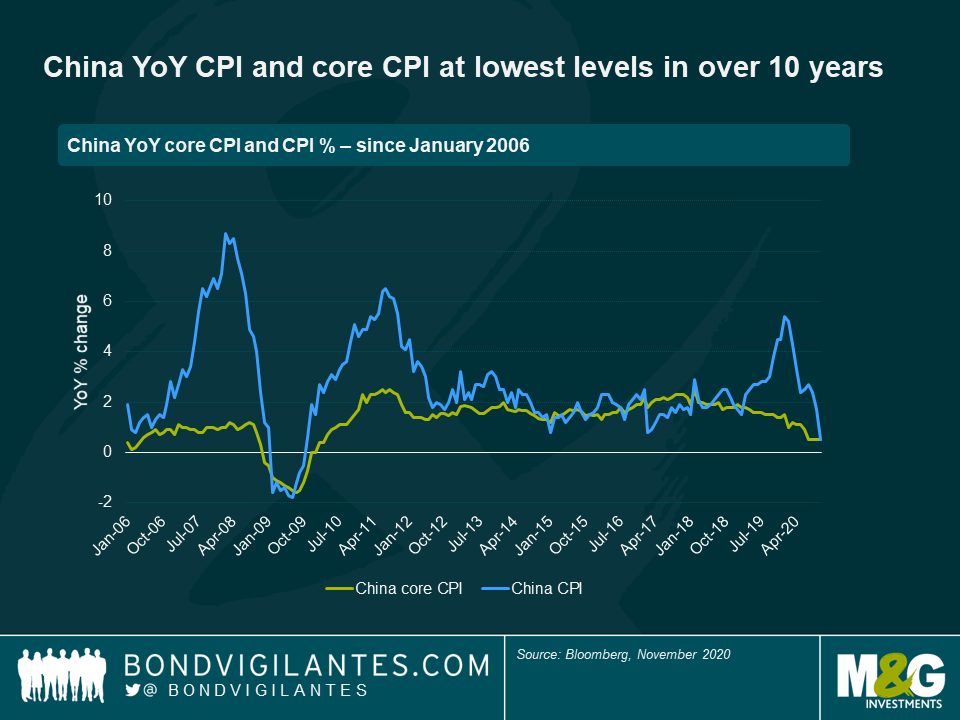

Another risk to further renminbi strengthening would be a deterioration of the inflation outlook. The African swine flu reduced pork supply significantly in 2019, leading to high levels of food inflation which peaked in January 2020. Since then, food inflation has started to come down while service and producer prices remain depressed due to the pandemic. The combination of these factors have caused China’s CPI and core CPI indices to reach a ten-year low. While the relationship between inflation and the currency historically is tenuous, an episode of persistent deflation in China would probably be a hindrance to CNY strength.

Another major unknown for the renminbi remains how the Biden administration will work with China. Biden’s US election victory makes it possible for the US and China to collaborate once more, especially in areas such as the COVID-19 pandemic and climate change. On the other, the Biden administration may be tougher on other issues, such as human rights and technology. On trade, the president-elect will also not want to appear to be too soft on China, which he considers as a competitor. A roll back of previous measures and tariffs is therefore unlikely in the short term. Finally, one can also make the argument that Trump’s unilateral approach to dealing with China was not the most efficient, and that a coalition comprising the US and its historic allies could have greater sway in reshaping global trade rules over the next decade.

In summary, while the Chinese renminbi’s strength and resilience this year is in large part backed by fundamentals, further significant appreciation may be more difficult to achieve given recent strong performance and the PBoC’s more hawkish stance. In addition, uncertainties around inflation and Biden’s stance towards China could also weigh on the renminbi. As a consequence, for investors seeking exposure to Asia, currencies like the Singapore dollar, the Malaysian ringgit, the Thai baht or the Indonesian rupiah may represent a better alternative to the renminbi. These currencies will still benefit from Asia’s strong growth recovery in 2021, while potentially being less constrained in their upside.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox