We are now 18 months into the Fed’s tightening cycle and many market participants, including us, have been surprised by the resilience of credit spreads, particularly in the high yield (HY) market where the option-adjusted spread for the Global HY index has dipped to the low 400s (bps), one of the tightest levels of post Global Financial Crisis observations.

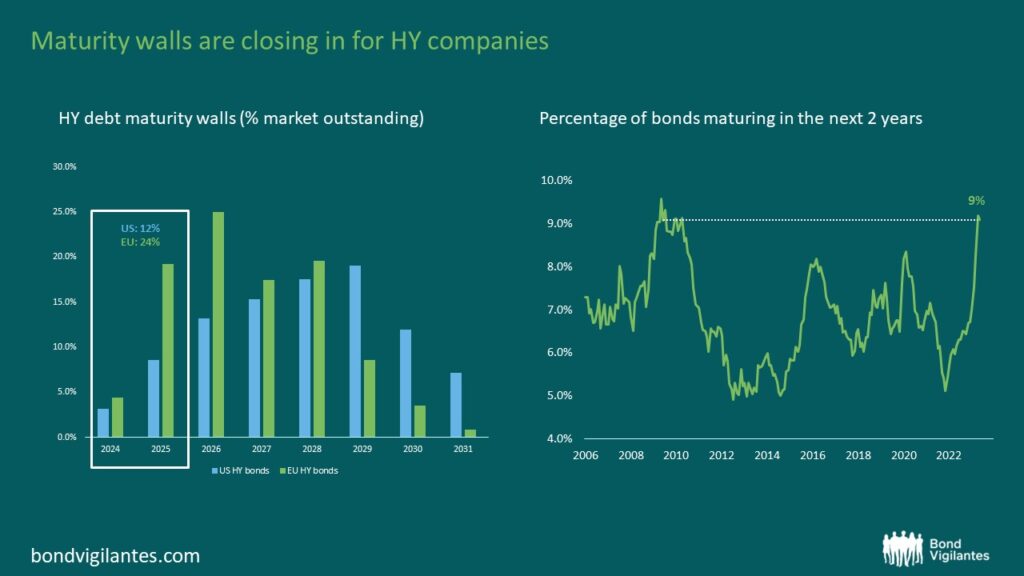

Two converging technical forces have supported HY credit spreads so far: a) the relentless hunt for yield in fixed income and b) a very light issuance calendar as companies have refrained from borrowing amid rising funding costs. Little refinancing in the last few years means maturity walls are now closing in for HY companies. The chart below shows the substantial amount of debt to roll over in the next 2 years with $127bn, or circa 12% of the market’s outstanding debt, being due for US HY companies. In Europe, maturity walls are even steeper, with €97bn of debt (23% of the index) maturing in 2024/2025. Add in 2026 maturities, and the refinancing wall shoots up to just to under 50% of the market. Historically speaking, this is likely to become the largest refinancing effort for HY issuers since the GFC (2008), and while some companies have already begun doing their homework, we expect it to become a key theme in 2024, particularly if base rates and borrowing costs remain elevated.

Source: Bloomberg, BofA Merrill Lynch, M&G (August 2023)

However, contrary to the GFC experience, there are a number of silver linings today that could well soften the impact of such a challenging refinancing environment.

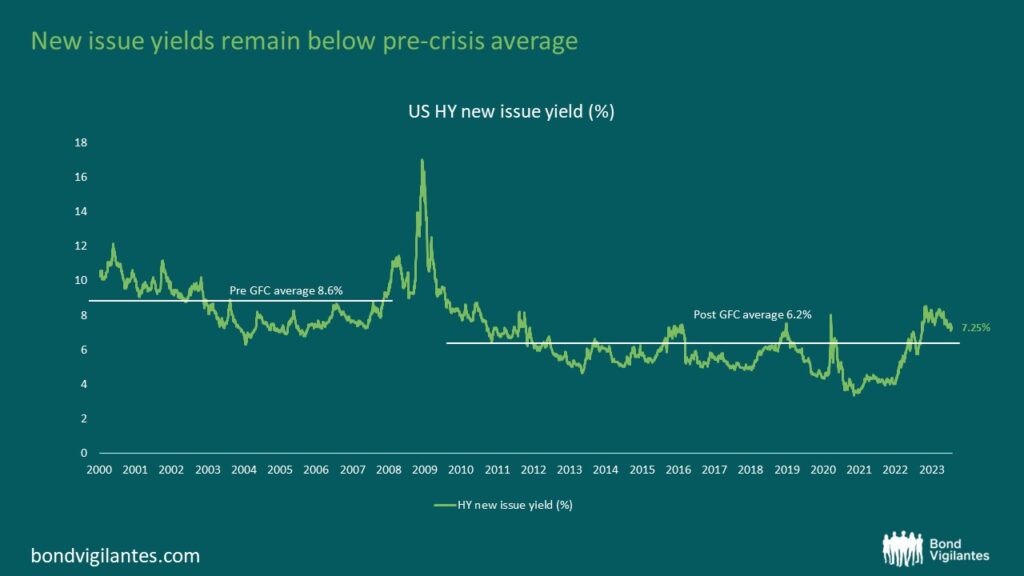

Firstly, as next chart shows, while the recent increase in borrowing costs over the last 18 months has been nothing but steep, new issue yields still remain well below the pre-GFC average. Put in historical context, yields have risen but from an extremely low base. Funding costs of 4-5% are arguably an exception in the recent history of high yield markets. Well-run companies with stable free cash flow (FCF), moderate leverage and healthy interest cover ratios may well be capable of affording the higher bill.

Source: Bloomberg, M&G (2 October 2023)

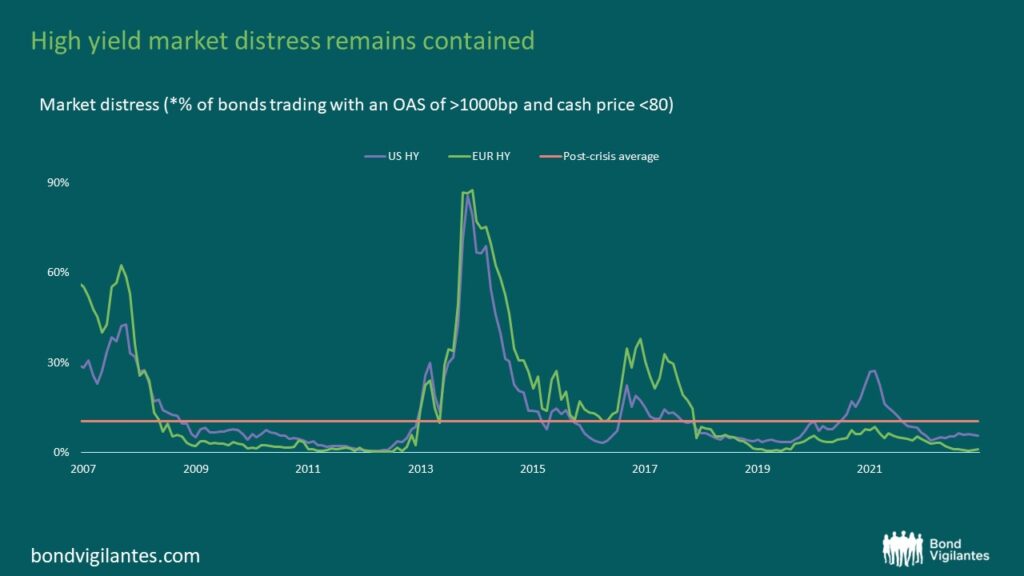

Secondly, albeit less active today, new issue markets remain very much open and functioning for companies to come and refinance. Market distress, usually a good proxy for credits that have lost market confidence in their ability to refinance, remains well below its post-crisis average for both the US and EU HY markets. When compared against past default cycles, current distress levels (7-8%) are not signalling a huge spike of defaults to come, and remain congruent with a soft economic landing.

Source: Bloomberg, BofA Merrill Lynch, M&G (August 2023)

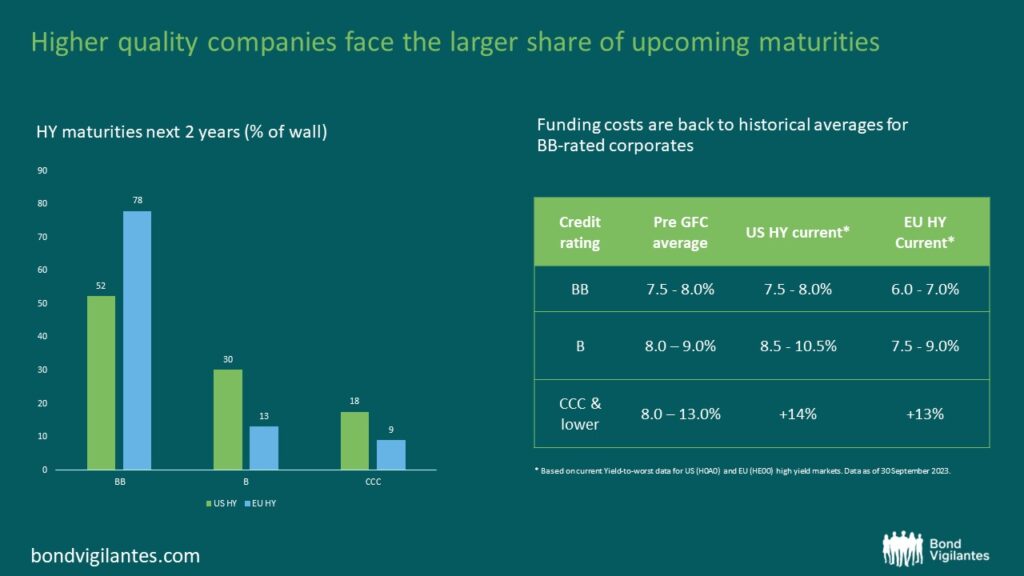

One final point to reflect on is who is set to be most affected by this short-term refinancing pressure. The next chart evidences that it is the higher quality companies (i.e. BB-rated issuers) that face the larger share of maturities coming due in 2024/2025. The BB-community not only tends to have healthier fundamentals, but also benefits from the most benign borrowing costs in high yield markets. As an example, issuing new debt today would cost a BB-rated European HY company about half as much (6.0-7.0%) vs what a CCC-rated issuer would have to pay for borrowing (14%).

Source: Bloomberg, LCD research, BofA Merrill Lynch, M&G (August 2023)

In summary, upcoming debt maturities are likely to increase financing pressures for high yield companies, particularly if elevated interest rates are sustained throughout a simultaneously slowing economy. While weaker credits are indeed likely to struggle to absorb the higher refinancing costs on top of deteriorating fundamentals, it is plausible that higher quality companies remain capable of climbing the steep refi wall. Having said that, doing the credit “homework” becomes all the more essential in the current environment compared to prior default cycles, particularly when it comes to distinguishing the healthier companies with those more at risk of facing refinancing challenges.

The world is coping with some extreme inflationary shocks as we speak. In addition to rising shipping costs and global supply chain disruptions that began last year, the ongoing strength in the labour market and the wealth effect resulting from the booming housing market, we now face the prospect of soaring food prices on the back of the sharp moves in oil and soft commodities triggered by the ongoing Russia/Ukraine conflict.

As a result government bond yields and spreads have had to readjust to rising yields and rising credit risk premia in the last few weeks, which has arguably been a double whammy for fixed income investors. Against this backdrop there’s still ways to mitigate away these risks, particularly in the context of higher inflation and central bank response, one being the High Yield Floating rate note (HY FRNs) market.

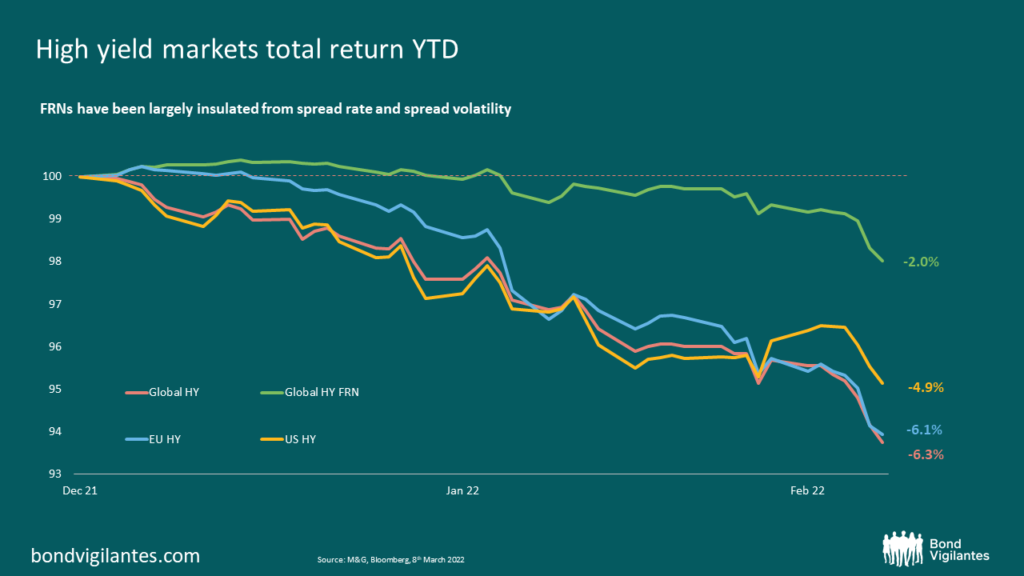

As we have previously discussed, HY FRNs have near-zero duration risk, floating coupons and lower market beta than conventional markets, which make them uniquely well positioned to deal with the current market environment. As shown in chart below this has held true so far this year. While conventional high yield markets have lost over 6% to date, HY FRNs have fared much better outperforming by circa 4%. The key differentiator has indeed been their lower duration and spread beta, which has largely insulated investors from recent volatility.

It’s probably fair to say that high yield assets have been in a bear market since August 2021 when inflationary pressures began to be more aggressively priced in by way of rising government bond yields. The main development in 2022, though, has been the sharp repricing of credit risk which has pushed high yield spreads out of tight ranges and offers once again a reasonably attractive entry point. With yields back around the 5-6% area, the asset class is more likely to warrant above-inflation returns over the medium term.

What’s the potential upside in FRNs today?

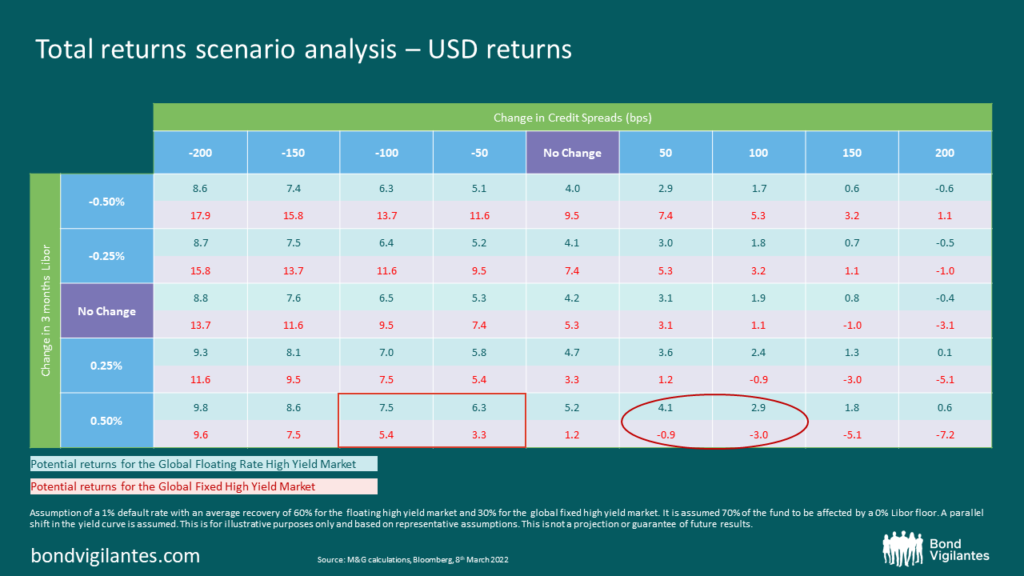

We try to answer this by looking at some total return scenarios for both floating and fixed rate high yield markets. Our analysis is based on changes to spreads and interest rates. For simplicity, we assume a 1% default rate, with an average recovery rate of 30% for the fixed high yield market and 60% for the FRN market due to their higher seniority.

What conclusions can we draw?

- In absolute terms, the risk-reward profile for both markets appears reasonably attractive. Spreads are hovering at around 500bps in the fixed market and 570bps in the FRN market, means a recession is arguably already reflected in prices. At current levels of yield floating rate investors would need to see another 200bps of spread widening before they incur a loss. For fixed rate investors, with higher sensitivity to spread changes, outright losses would come earlier, but still need spreads to widen by at least 150bps. All in all, this still suggests a reasonably attractive risk-reward pay-off for investors, consistent with potentially mid-single digit returns. Non-US dollar investors would need to bear in mind the cost of hedging currency risk.

- In a bullish scenario (rectangle), if bond yields continue to rise and are accompanied by some spread tightening, FRNs would experience a minimal price impact and will likely better protect capital, thanks to their marginal duration. Furthermore, if central banks decide to hike their rates, FRN coupons, which are pegged to short-term rates, would automatically adjust upwards, boosting coupons. Fixed rate high yield, instead, would underperform, seeing a far greater impact from rising interest rates that would significantly reduce any potential returns from carry or spread compression.

- In a bearish scenario (oval), which could involve a further repricing of credit risk due to second order impacts from inflation, the floating market would also play in favour thanks to their lower spread beta. FRNs are half as sensitive to credit risk repricing compared to the fixed rate high yield market, and have historically offered greater downside protection in periods of widening spreads.

The big unknown today remains the medium-term path for central bank response and interest rates. While in the short-term central banks may well prefer to take a cautious stance to deal with possible growth and employment implications arising from the ongoing conflict, the higher levels of latent inflation in the system compared to previous hiking cycles leaves them little time for reflection. Finding the right policy balance to deal with the potential downside risks to growth and higher inflationary outlook will be no easy task.

For the time being, and absent a full-scale recession, HY FRNs remain uniquely well placed to deal with the current environment through the combination of their low duration sensitivity, that protects against rising bond yields, and a reasonably attractive coupon level that will help mitigate the income erosion effect from inflation.

Spanish government bonds have outperformed their European peers so far this year. How has the country changed from being near a European Union bail-out only a few years ago to its present, more solid state? Watch M&G Investment Director Ana Gil explain it.

Last Saturday marked exactly 10 years since Lehman Brothers went bust. Are we still suffering the consequences of the Global Financial Crisis that followed? Had the crisis not occurred, would we have today’s political uncertainty? Watch M&G fund manager Wolfgang Bauer and Investment Director Ana Gil discuss how the clash between growth and political risk are driving markets today, and what opportunities such dynamic might present.

After a couple of months in which central bank policy moves rather than politics have dominated, investors’ attention has recently been pulled back to the political arena. Fund manager Wolfgang Bauer joined me this morning to discuss what Austria’s presidential election result, and Catalonia’s unfolding bid for independence from Spain, mean for government bond and credit markets.

Also –would a decisive Abe victory in Japanese general elections next weekend prolong the country’s monetary policy status quo? Tune in to find out.

This week on BVTV Fund Manager Matt Russell joins in to discuss:

1) Why an interest rate shock could cause carnage in bond markets

2) The duration impact on a credit portfolio

3) Best strategies to hedge against interest rate risk going forward

Tune in for the charts and articles that are making headlines in bond markets.

Join us on BVTV, where this week we discuss:

- Lower oil prices – less of a concern for risk appetite this time around;

- BoE: Keep calm and carry on expecting;

- Traditional drivers for EUR/USD have broken down – more Euro strength to come?

Tune in for our thoughts on the stories making headlines this week.

The Eurovision song contest may be over for another year, but Europe’s capacity to surprise could well continue. Tune in to the latest edition of BVTV, where Anjulie Rusius joined me to discuss:

- European economic surprises on the rise vs a slowing US

- Bank of England Super Thursday: Dovish message but attempts at a hawkish tone

- How much is the ECB tightening its corporate bond purchase programme?

In this week’s edition:

- Bond yields and inflation surprises: waking up to reflation?

- A good start to the year in credit markets

- Record supply in US Investment grade credit

Tune in for the charts and articles that are making headlines in bond markets

In this week’s edition:

- OPEC meeting: impact on bond markets and inflation

- EUR vs USD spread differential widening: is value returning to European credit?

- A busy week ahead for Europe: market reaction post-Italian referendum and ECB meeting

Tune in for the charts and articles that are making headlines in bond markets.