The financial sector has understandably been a hot topic over the past few years and is a subject we’ve blogged about at great length. Given the constant newsflow around the sector, and of course due to popular demand, Ben Lord and Stefan Isaacs recently joined forces with Jeffrey Spencer, a senior member of our financial institutions credit research team, to share our current views.

We thought these two teleconferences would be of interest for our readers as Jeffrey uncovers the truth behind some common misconceptions about the state of the banking system.

From a fundamental research perspective, Jeffrey analyses a range of issues, including the extent to which banks have de-levered, their reliance on wholesale funding as well as the challenges they are facing in raising capital.

Our fund managers took this opportunity to restate their views about financials from a more macroeconomic and sector allocation perspective.

There are two versions, similar to each other, but one is aimed at a more European audience, whilst the other is slightly more UK focused.

Enjoy!

Financial Teleconference: UK Call: http://mediazone.brighttalk.com/comm/mandg/be63cbb3aa-28085-2783-30958

Financial Teleconference: Euro Call: http://mediazone.brighttalk.com/comm/mandg/80430385fb-27989-2783-30927

Hi everyone, I’m the new guy on board. I started at M&G last week but the rest of the team is already working really hard to find me a ridiculous nickname.

Yesterday morning, I saw a familiar face in the news. My macroeconomics professor at LSE, Christopher Pissarides, had just won the Nobel Prize in economic sciences (jointly with Dale Mortensen and Peter Diamond). On top of being an exceptional scholar, I have to say that he is also a very good teacher and a very humble and approachable person, sometimes laughing at his own basic arithmetic mistakes while lecturing.

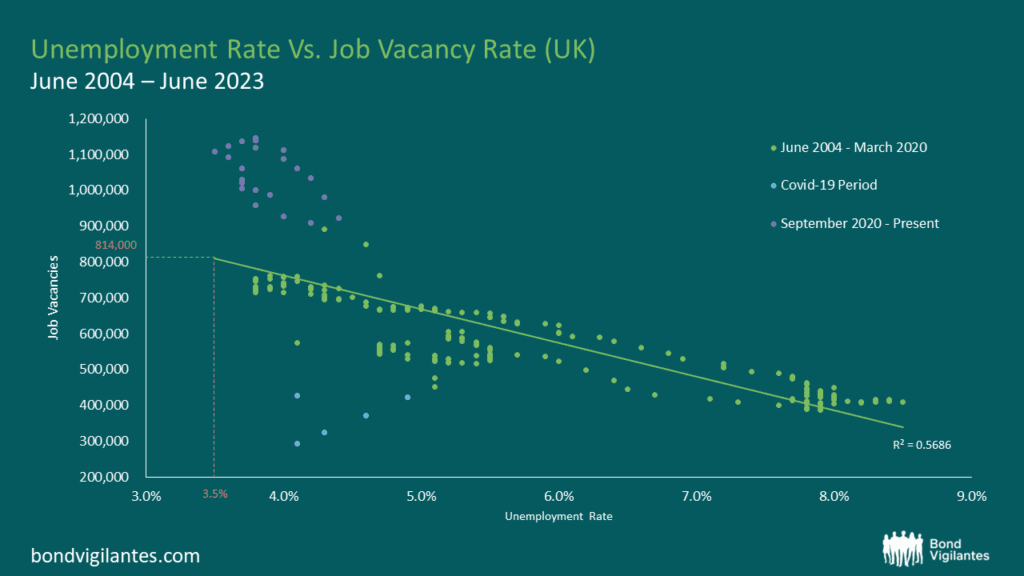

The search and matching theory that the laureates developed models how we end up with outcomes where unemployment persists even though there are job seekers willing to work for a wage that employers are willing to pay.

This theory on the frictions in labour markets is of particular interest in today’s economic environment. The post-recession unemployment rate in the US (9.6%) and the EU (10%) shows little sign of improvement and raises concerns about the speed of recovery. As Carmen and Vincent Reinhardt pointed out in their research looking at historical slowdowns, in the decade after an economic crisis in a developed country, growth remains lower and unemployment higher than its pre-crisis level. This implies that part of the cyclical components of the recession becomes structural.

The centre-piece of the search and matching model, the matching function, intuitively suggests that if the duration of unemployment is large there will be more mismatching in the labour market:

M = m . U n. V n-1

Where M is the number of matches, U is the number of unemployed workers, V the number of vacancies and m and n are constants. Note that m has a negative relationship with the duration of unemployment (falling when the average duration of unemployment rises).

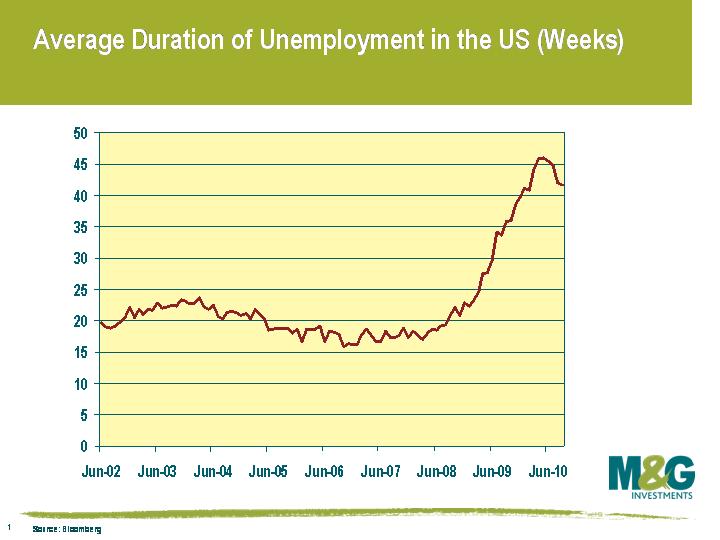

This leads us to think about the problem of the duration of unemployment, which has risen dramatically since the beginning of the crisis, from an average of 17.3 weeks in December 2007 to 41.7 weeks in September 2010.

The central message Pissarides shared with the world on the day he received the Noble prize is clear: “One of the key things we found is that it is important to make sure that people do not stay unemployed too long”.

The central message Pissarides shared with the world on the day he received the Noble prize is clear: “One of the key things we found is that it is important to make sure that people do not stay unemployed too long”.

Long term unemployment is one of the major factors explaining the persistence in the unemployment rate as workers lose their skills and knowledge, and above all their motivation. Pissarides argues that government subsidies should be used to help companies to hire people back and benefits should be accompanied with conditions that encourage people to find a job much quicker. These policies may help to reduce the so called frictions. The Fed is aware that QE is too blunt an instrument to directly address current employment distortions – but with no political consensus for fiscal action, I fear that Pissarides’s message will go unheard. In other developed economies, austerity measures are likely to include cuts in government subsidies rather than increases, which risks letting unemployment become entrenched.