The dramatic rally in US high yield bonds since the end of September saw yields reach lows of 4.6% earlier this month, the US high yield index’s lowest level since 2000. Yields have risen modestly since then but remain very tight: 4.9% at the time of this writing. The US high yield bond spread over risk-free government bonds has narrowed close to its pre-Covid level (see chart below), a trend which has accelerated over the last few weeks following the US election result and news of positive vaccine trials. Both pieces of news had a dramatic effect across high yield markets.

The biggest reaction was concentrated in Covid-sensitive issuers such as airlines, cruise lines and casinos, but the news was also felt more broadly across the asset class: 29 out of 32 US high yield sectors were trading with spreads higher than their pre-Covid levels at 30 September; now that figure is just 15. Issuers within the energy and healthcare sectors were notable beneficiaries of the election outcome as the threat of a “blue wave” subsided. President-elect Biden’s legislative programme, which included healthcare reform, clean/renewable energy proposals and potential restrictions on drilling on federal land, will have a hard time getting through a divided Congress.

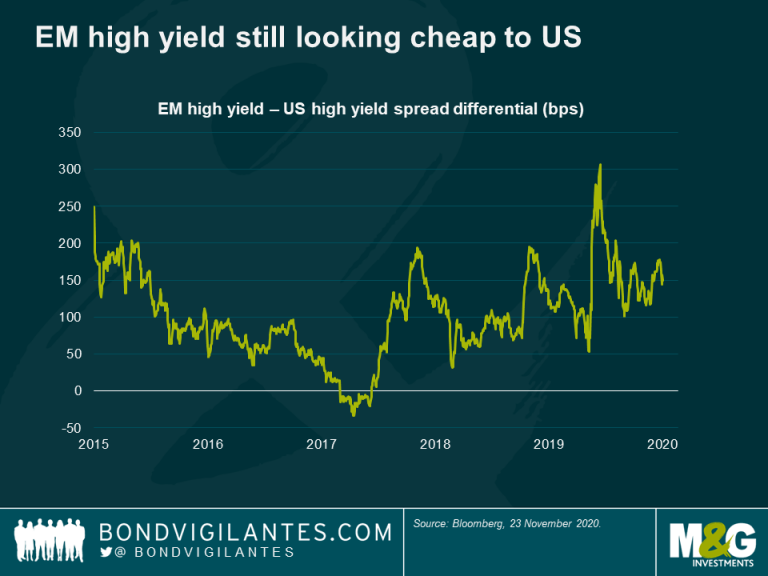

In credit spread terms, the US high yield market is now looking expensive relative to its peers in Europe and emerging markets. Emerging market high yield in particular still offers some value in my opinion. Here, high yield spreads remain elevated versus the US due in part to the weaker central bank firepower available in emerging markets. The chart below highlights the current spread pickup for investing in EM high yield versus US high yield.

Looking at the overall picture of global high yield credit, most investors would agree that valuations now look expensive compared to historical levels, especially given the backdrop of dramatically rising infections in the US and the threat of stricter lockdowns and rising unemployment everywhere else.

Even after the rally, there remain several powerful supportive technical factors which high yield investors ignore at their peril. Demand for higher-yielding debt remains robust and the asset class is experiencing strong fund flows (albeit lower than in investment grade). A further tailwind is the supply of new issuance, which now looks relatively constrained following a record-setting summer of issuance as companies built up liquidity buffers and refinanced debts, leaving a more limited forward issuance calendar. The loan market has also seen a resurgence, which is taking borrowers away from the bond markets and further constraining supply. We must also remember that $171bn of investment grade bonds fell into the US high yield market after being downgraded by the rating agencies. These so-called fallen angels expanded the index by 21% and are (by-and-large) higher quality than average, which supports tighter spreads.

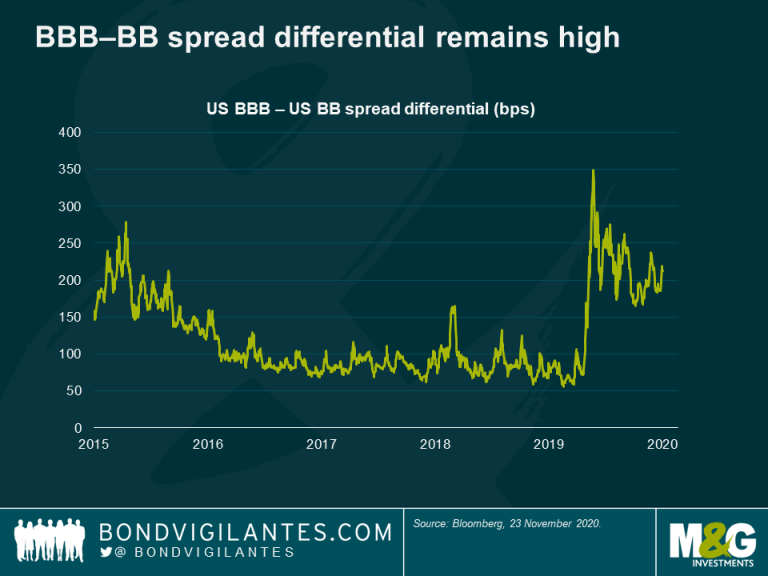

Also, while valuations might be difficult for high yield fund managers to stomach at the moment, the asset class still offers a degree of relative value. For example, while the spread differential between BBBs and BBs has compressed somewhat since the peak of the crisis, it is still materially wide versus historical levels (see chart below). In a world of $17 trillion of negative-yielding bonds, the 4-5% yield offered by high yield can look attractive to investors outside the traditional investor base, potentially drawing more participants to the market and leading to further spread tightening.

Lastly, the U.S. government (however divided) and the Federal Reserve proved over the spring and summer that they are prepared to do “whatever it takes” to support the economy and markets. From massive fiscal stimulus to bond purchases (including high yield), they provided enormous support which has helped businesses survive and markets recover. There is some concern about whether there will be another round of stimulus given a still-divided Congress. However, I am of the mindset that further support and stimulus will be delivered if it proves necessary on the back of accelerating lockdowns. The size and scope of the stimulus will be debated, but I believe that none of the current president, the president-elect, the Senate or the House will want to “own” the stimulus not being done and have a side-lining of the recovery on their shoulders.

The current environment poses a dilemma for high yield investors given tight valuations with the backdrop of the ongoing pandemic and resulting economic turmoil, with the prospect of more damage to come. Do they de-risk in light of these pending threats and ignore the strong technical forces noted above, potentially missing out on the continued rally? Do they de-risk anyway on expectations that, despite strong technicals, the market has come too far too fast and is due a correction after which they can reinvest? Or do they rotate into Covid-exposed names such as airlines and leisure companies where bonds have rallied but are still meaningfully cheaper than before the crisis, banking on the success of the vaccines and a near-term return to normality?

My belief is that technical factors will probably dominate the less attractive valuations from here. Yes, there are obvious risks to the downside but, as we learned over the summer, the technical forces mentioned above (federal stimulus in particular) are too strong to ignore. The greater risk in my view is not to be invested in a high-yielding, income-producing asset class with a stimulus-lined path out of the Covid crisis that is now clearer than before. In the meantime, as always, there are single names and sectors that have run too far in my view (e.g. gaming) and sectors too that are now much more investible (e.g. airlines) but, for the high yield market in general, there could well be further upside form here.

Last week, the U.S. Federal Communication Commission (FCC) announced the results of the latest $20 billion, 600Mhz spectrum auction. Communication companies were bidding for spectrum over which they provide wireless services to their customers. The largest bids came from wireless mobile operator, T-Mobile USA, which spent $8 billion, and U.S. satellite TV provider DISH Network, which spent $6.2 billion. While the auction itself was not particularly noteworthy, this auction was viewed by industry followers and participants as a potential catalyst for wider U.S. telecom and media consolidation. If an acquisition spree is about to occur in the sector, this could have significant implications for bond investors.

Cable consolidation is mostly driven by achieving cost synergies. However, a potential merger wave is not only about synergies. Many of these companies see the strategic importance of offering a full spectrum of services and content to their customers, thereby capturing as much of a customer’s spend as possible, be it via a subscription model or on-demand services. The idea is to achieve triple-play penetration, which refers to when a single provider can bundle a customer’s voice, video and internet services in one offering. Providers also recognise the strategic benefit of adding mobile service/connectivity to their offerings, called quad-play-penetration. Consequently, not only could we see further cable consolidation, but cable operators may look to acquire wireless providers and vice-versa.

Telco and cable companies are also exploring owning their own media content to pipe through the distribution channels that they have established with their customers. AT&T’s recent proposal to buy Time Warner Inc. (and its content creators like HBO, Warner Brothers Studios, etc.) being the most recent example of this vertical integration. It’s all about offering a full suite of communication and content services in one attractive, cost efficient (for the company anyway) bundle to the customer.

These are only a few of the potential strategies that are being contemplated across the TMT universe. Our TMT analysts here at M&G compiled the following diagram that highlights the myriad of potential combinations. The diagram, of course, is purely hypothetical, at least for now, but it highlights the scale and complexity of potential scenarios across the various sub-sectors of the broader industry.

If a merger wave occurs, the implications for bond holders could be significant as well as nuanced. With enterprise values of tens-of, or even hundreds-of-billions of dollars, the purchase prices of many of these assets will be considerable. Any potential acquisition will likely come with a meaningful debt component, meaning a new supply of bonds for a market that already holds a lot of these companies’ bonds. Telecom, Cable and Media companies account for 19% of the Bank of America U.S. High Yield Index including five of the index’s top eleven issuers. These same sectors account for 8% of the U.S. Investment Grade Index. Any additional issuance from these entities is likely to pressure the prices of existing bonds.

For example, the most widely anticipated tie-up surrounds the #3 and #4 wireless operators in the U.S., T-Mobile and Sprint. Whilst not arguing for or against the merits or the likelihood of a combination, such a transaction could have a big impact on the U.S. high yield market. Sprint and T-Mobile are the #1 and #11 issuers in the index with $25 billion and $12 billion respectively in bonds outstanding. Given their weighting in the index many (if not most) high yield investors are likely to be invested in either (if not both) T-Mobile and Sprint. With enterprise values of $65bn for Sprint and $78bn for T-Mobile, one should expect material debt issuance to partly fund any potential transaction. Further, a potential deal could be constructed to preserve T-Mobile’s higher Ba3/BB ratings to the benefit of Sprint’s existing bonds, whereas a more aggressive deal (i.e. a larger debt component) in-line with Sprint’s B3/B ratings could pressure T-Mobile’s existing bond prices.

Further, should an investment grade company acquire a high yield company, the upside for holders of the high yield bonds could be significant whereas the holders of the investment grade bonds could see their bonds weaken if the company decides to tolerate some degree of credit deterioration in order to make a strategic acquisition. Similarly, should a high yield company pursue an investment grade company; downside risk would be prevalent for holders of the investment grade bonds.

The cable and telecom industries in the U.S. are champing at the bit to consolidate and integrate. The recent spectrum auction effectively placed a moratorium on M&A in the space as the industry waited for last week’s auction results. Under a Trump administration, market speculation is that the regulatory authorities’ position on M&A in the sector will soften considerably. With this most recent auction in the books and what is considered to be a consolidation-friendly administration, we may be on the cusp of an M&A feeding frenzy among cable, telecom and media companies which will have significant implications for bond investors.

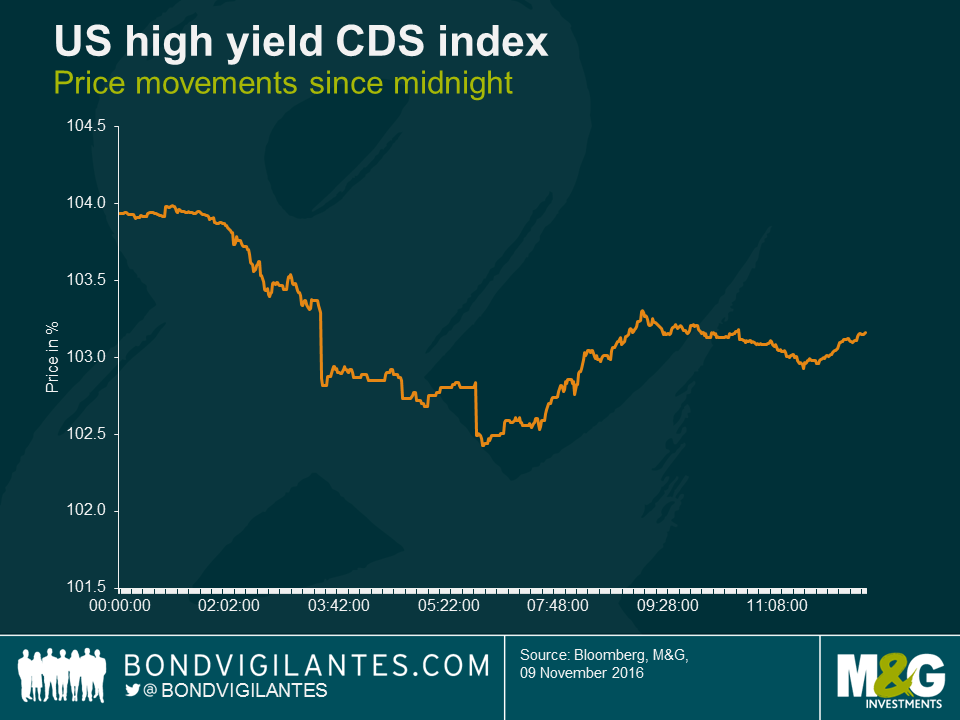

As James mentioned this morning the European high yield markets’ response to the Trump election victory has been fairly benign. The U.S. high yield market, as one would expect, has been a bit more pronounced, although not as severe as European equities or S&P futures. The U.S. CDX Index, a CDS index of U.S. high yield issuers much like Europe’s iTraxx Crossover, initially dropped nearly two points or 1.3% but has since recovered, currently down about half a point or 0.5%.

We will have to wait for the U.S. market to open fully to see how this will play out over the course of the day, but it’s worth noting that individual sub-sectors will react differently to the result. We would highlight health care as one sector in particular to keep an eye on. The Trump victory will likely create volatility both positively and negative in this sector.

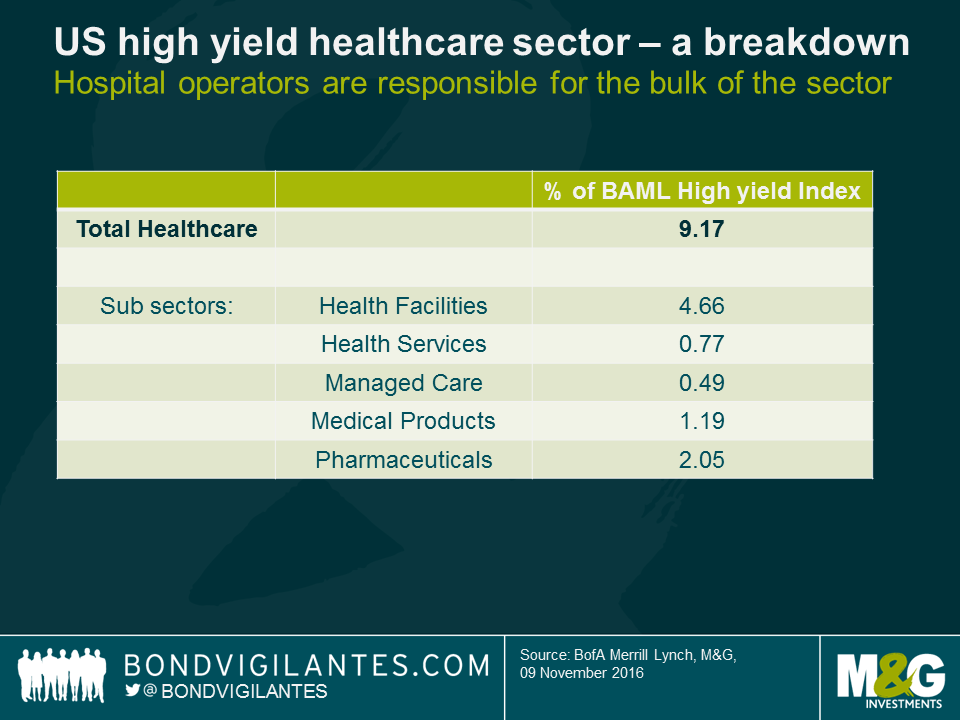

With a Trump presidency and Republican Congress there will undoubtedly be renewed calls for the repeal of, or at least significant adjustments to, the Affordable Care Act (ACA) or Obamacare. This could lead to negative pressure on hospital operators, which make-up a meaningful percentage of the broader U.S. high yield index (nearly 5% of the Bank of America U.S. High Yield Index). Theoretically, these operators could see an increase in the number of uninsured patients under such a scenario. In addition, the uncertainty about the future of the ACA could lead to negative pressure on U.S. managed care companies. Although the majority of these companies are investment grade, there are a handful of high yield issuers that could be affected.

Conversely, it is expected that there will be less pressure on drug pricing and costs under a Trump administration and Republican congress. This could serve as an uplift for high yield specialty drug manufacturers in particular. Further, there is likely to be bi-partisan support for the faster approval of generic drugs, which would benefit generic manufacturers, albeit to the potential detriment to branded manufacturers.

Trump has also called for direct price negotiation of Medicare Part D drugs, and for drug re-importation, which could translate into modest negatives for pharmaceutical manufacturers. These policies have not been a focus of Trump’s campaign and are not anticipated to gain much traction in Congress.

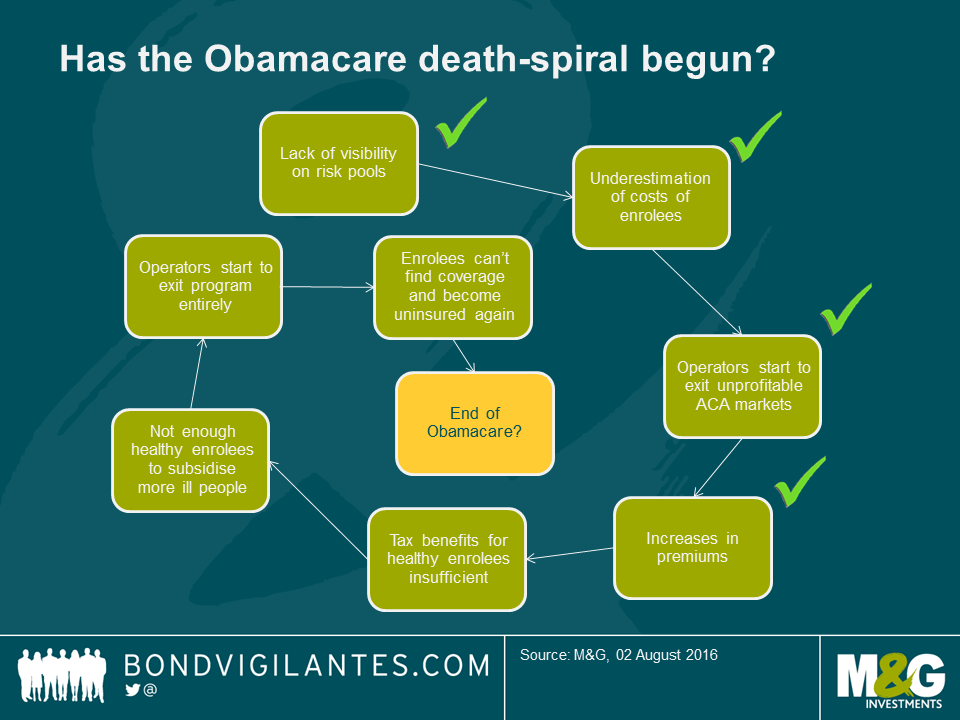

As the rhetoric of the U.S. presidential race heats up over the summer campaigning months, one topic we are likely to hear much on is health care. Health care in the U.S. is always a highly charged political subject, and now even more so with extra scrutiny on prescription drug prices and continued debates over the Affordable Care Act (ACA) or Obamacare. Obamacare is deeply unpopular with the Republican Party and Republican Party candidate Trump has called for its repeal if he is elected. We don’t want to discuss the politics of Obamacare, but could it fall over on its own?

Last week Humana (HUM), a large U.S. health insurance company, announced that it was exiting individual ACA insurance plans it was offering in eight states citing unprofitability. This follows United Health Group (UNH), another large health insurer, who announced in April they were exiting ACA plans in most states it operates in for similar reasons.

These ACA plans were one of the key mechanisms by which Obamacare sought to extend health coverage to the uninsured. Under the ACA, private health insurance companies like HUM and UNH offered coverage to the uninsured who would face tax penalties if they did not enrol (although in most cases they received tax credits to offset the cost of their premiums). However, the legislation mandated that insurance companies could not ask enrollees any medical history questions and they had to accept all enrollees, including those with pre-existing conditions. As such, the program was criticised on the basis that without knowing how sick the people enrolling in the plans were, it would lead to an insurance death spiral, i.e., not enough healthy enrollees subsidising the care of those actually filing claims.

A couple of large insurers exiting the program does not portend that a death spiral is imminent, or even likely, but it is a worrying sign and recently many companies have announced meaningful premium increases in their ACA plans. Politico’s Blog, The Agenda, sums up the issues facing the program nicely.

Death spiral or not, if more and more companies exit ACA plans or if enrollees drop coverage on their own due to rising premiums (and just pay the tax penalty), it’s possible that there would be a spike in the uninsured population at least in the near-term. The knock-on effect could impact U.S. for-profit hospital operators who were significant beneficiaries of ACA enrolment. With more patients having health insurance than previously, this reduced hospitals’ bad debt burdens and aided their profitability. Should that trend reverse these operators could face earnings headwinds.

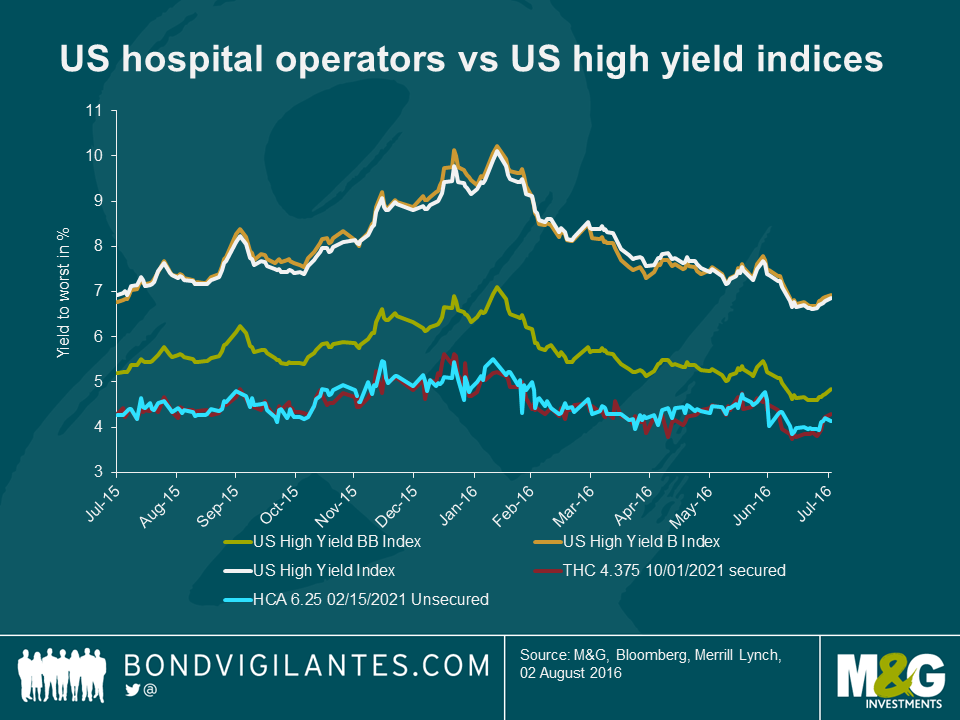

This matters to high yield bond investors as health facility companies’ bonds represent a meaningful 5% portion of the Merrill Lynch Bank of America U.S. High Yield Index. And with over $43 billion in bonds outstanding, the bonds of just the top three hospital operators HCA Inc., Community Health Services (CYH), and Tenet Healthcare (THC) are the 2nd, 10th and 23rd largest issuers in the index, representing over 3% of the Index, meaning that they are likely widely held among investors.

These companies’ bonds have always been considered reasonably safe heavens as investors liked the defensive characteristics associated with health care companies in general. As such, these bonds typically trade inside the broader indices.

If investors start growing concerned about the earnings headwinds these companies could be potentially facing, they also need to weigh up if they are being adequately compensated at these levels. Now add to the mix the political rhetoric of the campaign and the impact on bond volatility. Surely if Trump surges in the polls, uncertainty surrounding the future of Obamacare will intensify regardless of what is happening with the ACA plans, and this could lead to volatility in not only hospital company bonds but many related health care companies as well such as insurers and pharmaceutical companies.

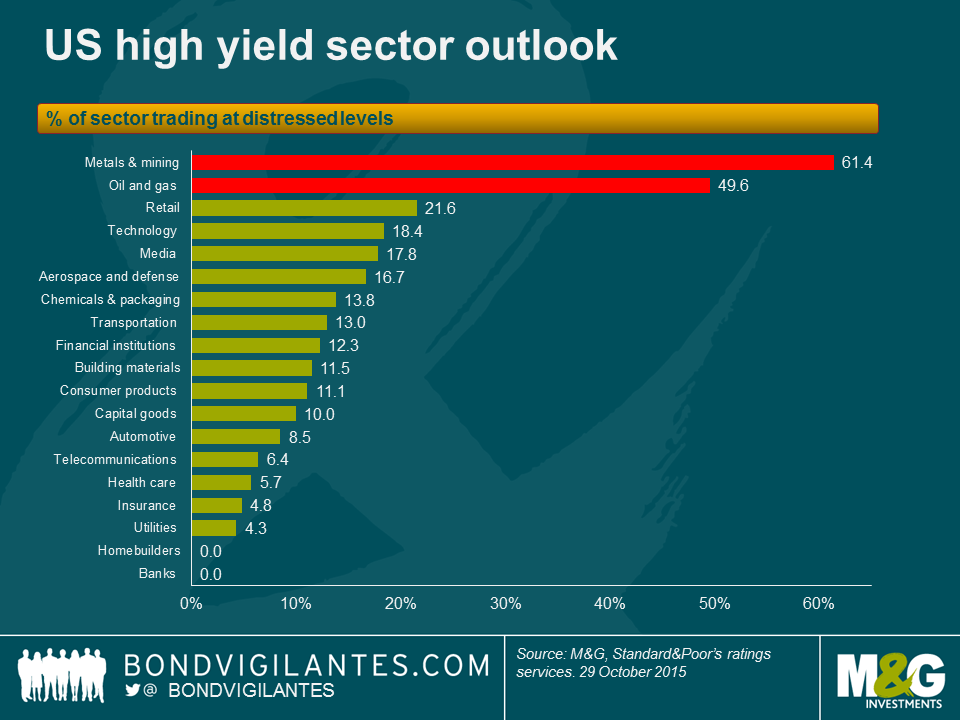

The fact that commodity-related sectors, like metals & mining and energy, are the highest-yielding and worst performing sub-sectors this year in the broader high yield Index is no surprise. There is a high degree of distressed credits in these sectors suffering on the back of the current low commodity price environment. S&P recently released its summary of sectors with the highest distressed ratios (or the percent of each sectors’ issuers whose bonds have option-adjusted spreads (OAS) greater than 1,000) and, unsurprisingly, metals & mining and energy are on top of the list with distressed ratios of 61.4% and 49.6% respectively.

What might surprise some is that the retail sector comes in third place, with a 21.6% distress ratio, despite the US economy being in decent shape with job creation and lower gas prices freeing up more disposable income.

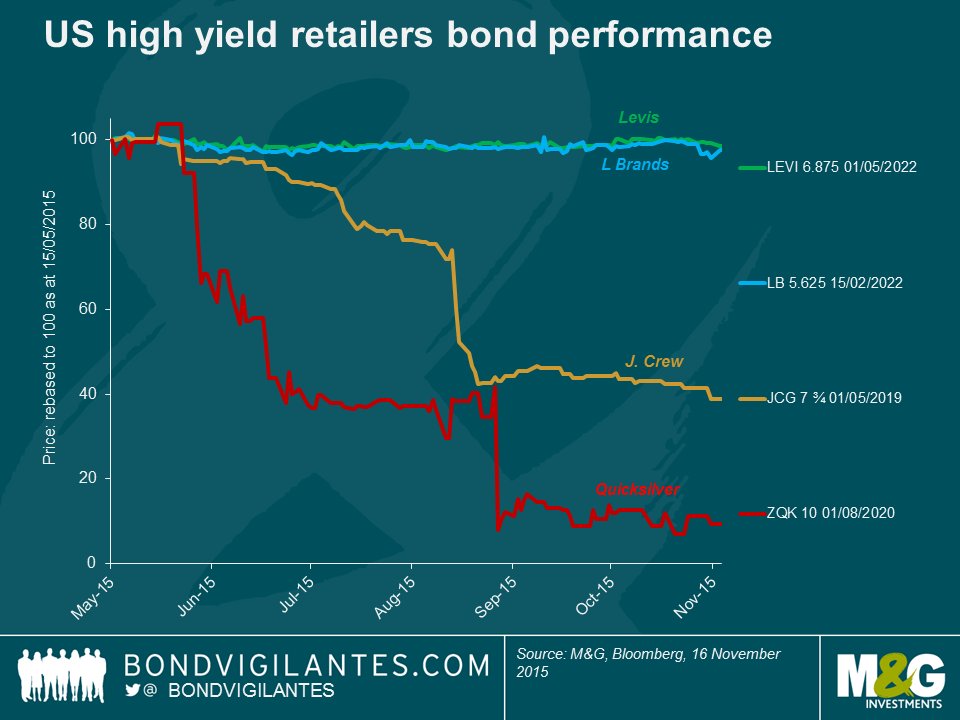

This is mostly due to a number of highly distressed individual names skewing the picture, because the balance of the sector trades at levels closer to, or even within, the broader high yield index. The table below provides a snapshot of a few of the “haves” and “have nots” within the sector and illustrates the importance of avoiding potential pitfalls.

It’s true that the move to e-commerce has played a role in hampering retail traffic and sales through the traditional venues, which most of these retailers operate (shopping malls, big box stores etc.), but many of these wounds have been self-inflicted. Some management teams got promotions and/or fashion seasons wrong and others changed their business model in a way that alienated their customers.

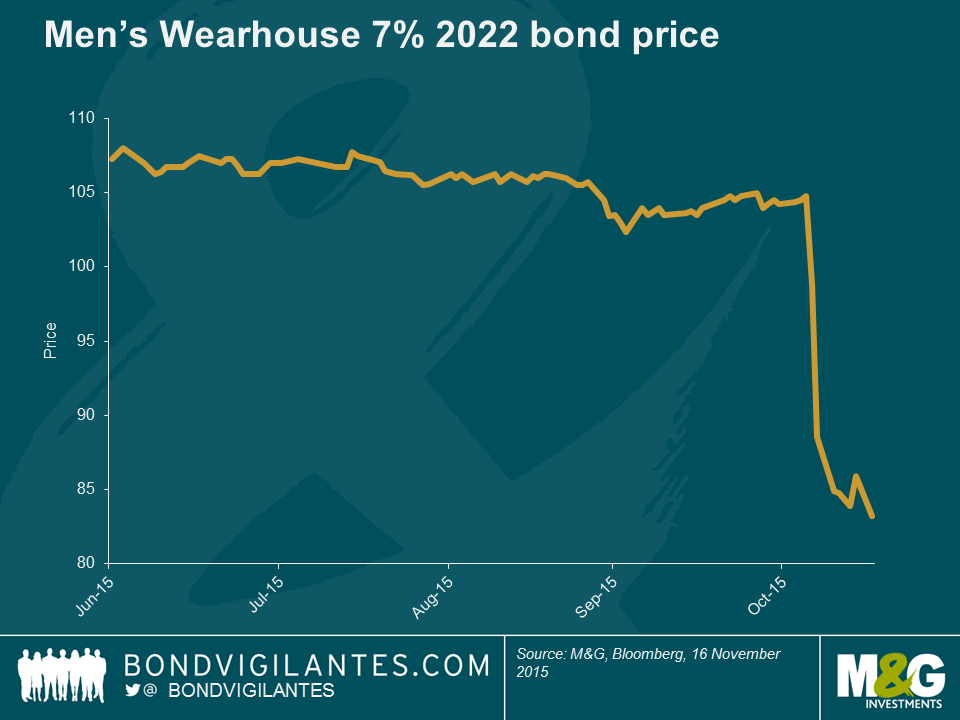

Men’s Wearhouse, a specialty retailer focused on men’s suits and accessories, is the latest example of the latter. The company’s stock has plummeted nearly 50% since October and its 7%, 2022 bond dropped approximately 20 points following the company pre-announcing disappointing Q3 results, which took the market by surprise.

The culprit was lower-than-expected sales of its Jos A. Bank (JAB) label, which Men’s Wearhouse acquired last year for around $1.5bn. JAB was famous for a promotion where customers could buy one suit and get three free. Upon acquiring JAB, Men’s Wearhouse pledged to do away with the promotion. The size of the resulting drop in sales caught management, by its own admission, by surprise. In a classic example of a company getting away from what its core customer demands: the three-for-one promotion was more vital to JAB’s prospects than management recognized.

More examples include J Crew Group (JCG), which suffered by making changes to its core style, leaving its existing customer base alienated; or in retail parlance, it committed a “fashion miss”.

In the case of Quiksilver (ZQK), management lost control of its wholesale channel, leading to deep price discounting and brand damage. Plus, ZQK had an unsustainable capital structure (i.e. too much debt) and despite new management efforts, the company filed for U.S. Chapter 11 protection in September.

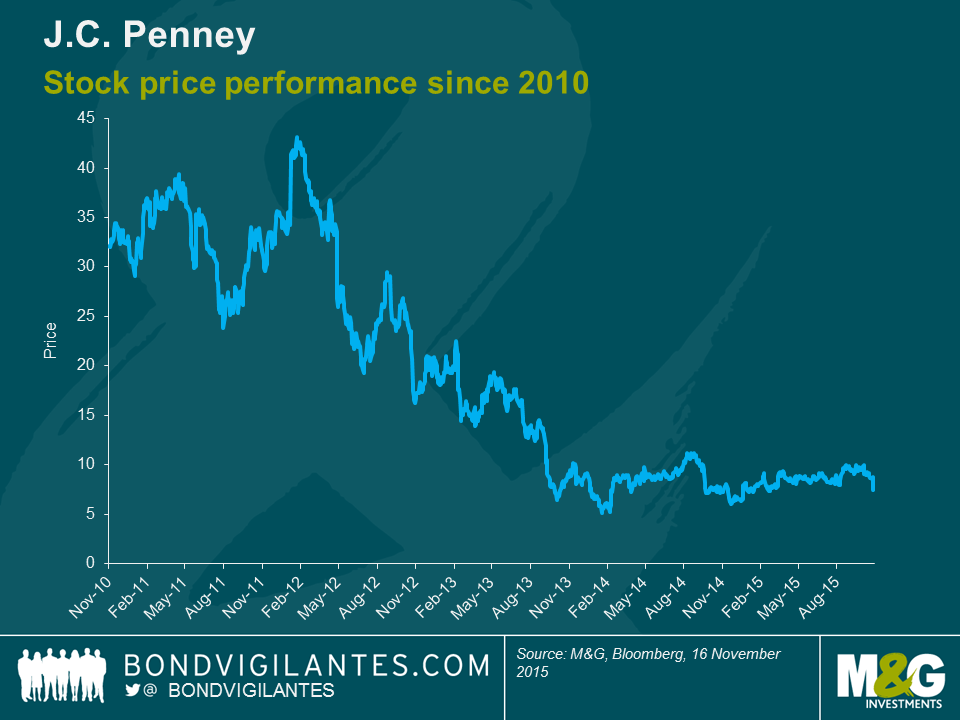

JC Penney (JCP), a big box department store, was already suffering from structural shifts such as e-commerce when it started altering its core business model by introducing a “store-in-a-store” concept. This meant that individual brands (Martha Stewart is one famous example) were given virtual stores within JCP’s existing stores. Although this concept wasn’t entirely ground-breaking, JCP has been around since 1902, and this concept didn’t strike a chord with its longstanding conservative customer base, who viewed JCP as an old-school, traditional, discount retailer. Opinions remain mixed on the long-term prospects of JCP, but this demonstrates that recovering from strategic mistakes, especially when coupled with structural changes, can take many years.

NB we are highlighting JCP’s equity rather than the company’s bonds as the company has re-financed and restructured its capital structure over this time period. Subsequently, the equity performance gives a cleaner illustration of how JCP’s attempts to recover have lingered for years as it tries to repair its brand and regain customers.

And the list goes on. Other distressed retail names with more than $400m in bonds outstanding include BI-LO Holdings, Claire’s Stores, Jo-Ann Stores, The Bon-Ton Department Stores, The Gymboree Corp and Toys R Us.

Men’s Wearhouse’s 2022 bond is now yielding 10.6%, or +872 bps on an OAS basis, as the market is trying to determine/gauge whether the company can recover. So not truly distressed as per S&P’s definition, but not a million miles away.

Now, Men’s Wearhouse may rebound quickly, which means this sell-off could represent a buying opportunity if one believes in the company’s prospects and its ability to regain customers. Or its troubles may linger as sales and customers erode further, in which case investors need to be prepared for the long haul and assess if they are being adequately compensated for the elevated risk of the business going forward and how likely they consider the possibility of a debt restructuring.

In either case, this example highlights the peril of strategic mistakes damaging what was otherwise a well-performing business. It also highlights a theme we have commented on frequently – the importance of credit research and stock selection, as investors need to be cognizant of not just credit risk profiles and credit ratios, but also idiosyncratic and business model risk profiles.

Disclosure: M&G funds hold L Brands 5.625 2022 and Levis 6.875 2022 bonds and JC Penney equity

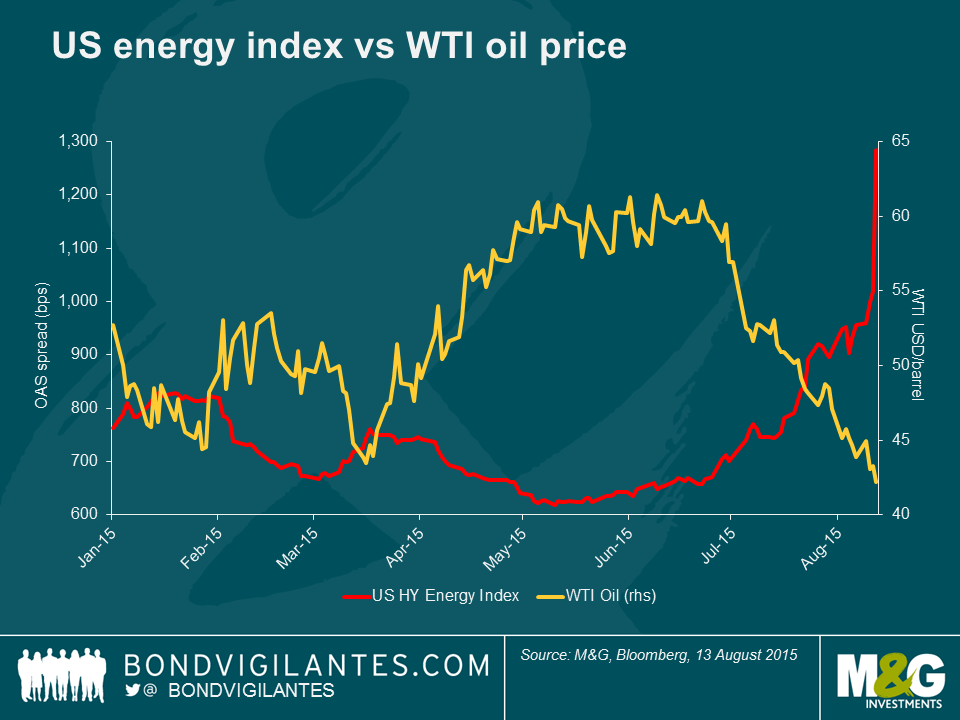

U.S. high yield energy bonds have sold off recently, virtually reversing their Q1/Q2 rally. The main culprit is, again, oil prices. The recent re-re pricing in oil has led to energy bonds trading at levels worse than the last time oil sold-off at the beginning of 2015. In fact, the BAML U.S. high yield energy index this week reached its widest levels (in terms of spreads) since April 2009 at 1019 bps.

While oil prices were trending lower throughout 2014 on slow global growth expectations, the sharp decline in late 2014 was prompted by OPECs decision to not curb production. Oil prices recovered briefly in Q2 as U.S. production cuts were expected to stabilise supply and support prices in the latter part of the year. So what has prompted oil to sell-off this time around? Well, global growth remains subdued and China’s outlook has worsened. Additionally, the devaluation of the yuan will exacerbate the pressure on commodity prices. Plus, U.S. production cuts have not been enough to offset unexpected supply from the Middle East including Iraq, while Saudi Arabia and Kuwait both posted record production levels last month. Oil prices also moved lower on the anticipation of new supply from Iran next year (estimates as high as 900k/bbd) on the back of sanctions potentially being lifted following the recent, tentative, nuclear accord.

There are a few reasons why high yield energy bonds have sold off more dramatically this time around.

Firstly, several energy companies that issued bonds secured by their assets (called Second Lien bonds) in Q1 and Q2 to extend their financial liquidity profiles have seen these bonds underperform massively. This has scared investors to the extent that this potential source of funding is effectively closed to other companies that would benefit from additional liquidity. This has had a knock-on effect on investor sentiment, with investors even abandoning bonds of companies that were not expected to need this additional liquidity.

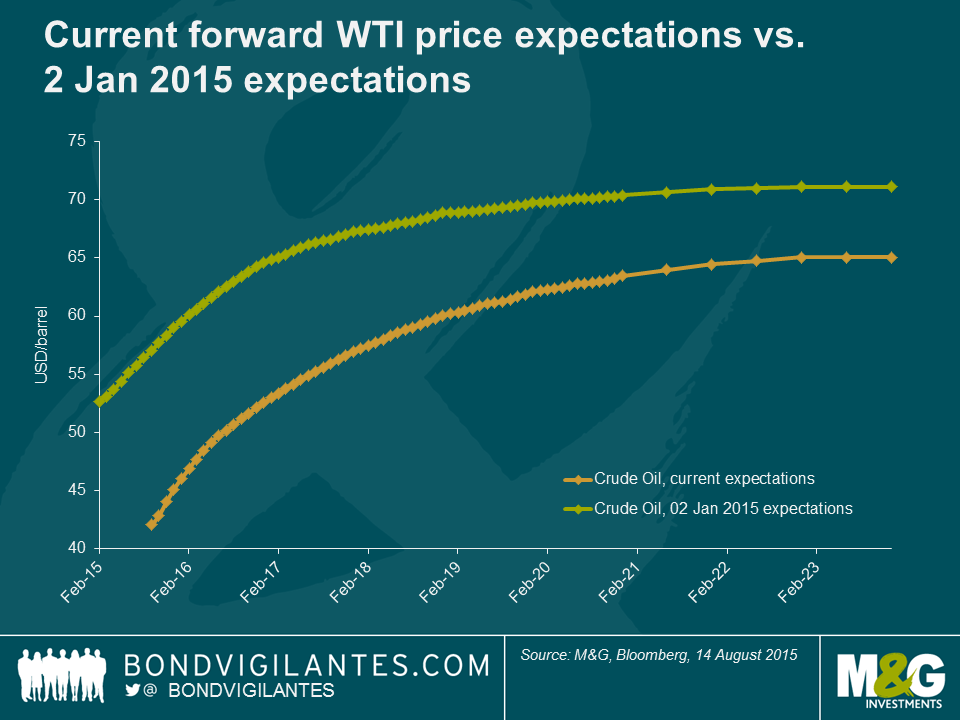

Secondly, the forward oil curve has flattened. Previously, the market was expecting a fairly robust rebound in prices in the second half of 2015 and 2016; now forward price expectations are more subdued. With many companies well-hedged for 2015 they were effectively insulated from the drop in oil prices and had time to wait for the oil price environment in improve. However, hedges eventually roll-off and the sector as a whole is, generally speaking, less-hedged in 2016. This suggests that companies will have to operate in a low-cost environment longer-than-previously expected without the benefit of hedges which is likely to impair earnings and stretch liquidity.

Finally, with the Second Lien market basically closed barring a rebound in WTI, this places greater burden on companies RBLs (Reserve Backed Lines – their asset-backed bank credit facilities) to provide liquidity. These RBLs are re-valued by the companies’ bank groups generally in October; and a lower forward curve suggests that the borrowing capacity of these facilities will be trimmed precisely at the time that earnings and cash flow are under additional pressure, stretching companies’ liquidity profiles.

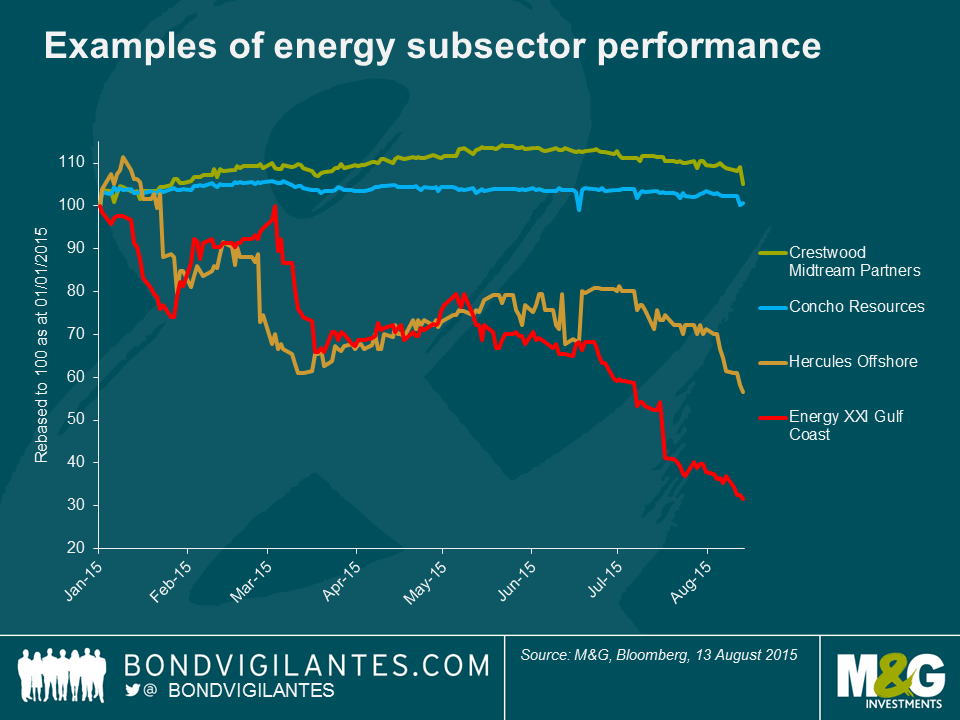

Now to be fair, the market hasn’t punished all companies indiscriminately. Service providers, offshore producers and highly-indebted exploration & production (E&P) companies have sold-off more dramatically than stable midstream (pipeline) and E&P companies with sound balance sheets and low operating costs.

The following demonstrates the price action of a few of the bonds within these individual subsectors:

- Crestwood Midstream Partners – stable pipeline company

- Concho Resources Inc. – E&P company with solid balance sheet:

- Hercules Offshore, Inc. – an offshore service provider

- Energy XXI Gulf Coast, Inc. – an offshore, Gulf of Mexico E&P company

So how should bond investors approach this space? With energy-related bonds accounting for 13.5% of the broader U.S. high yield index (off from its’ peak, but still the largest component of the index), it is difficult for investors to completely avoid the energy sector. Shunning it entirely now may result in missing out on any eventual recovery.

Despite the carnage, there is still some opportunity for patient investors to capitalise on those names that have been too severely punished and are likely to survive what now looks to be an extended low oil-price environment. In particular, investors should focus on:

- Low-cost operators capable of continuing profitable production levels at sub $50 (or even lower) WTI prices.

- Producers in good basins (the quality of basin is important as well as its location which limits transport costs).

- Manageable debt levels with limited or no near-term maturities and low financial leverage vis-à-vis earnings.

- Solid financial liquidity – solid cash levels and ample borrowing capacity from bank groups. Note, not all companies are stretched in terms of their liquidity and several were shrewdly proactive during the Q2 recovery in WTI to enhance their liquidity profiles through borrowings, extending maturities and even issuing equity.

- Dry powder regarding cost cuts – virtually all companies have cut costs, some more so than others. Those companies that have cut less but have the capacity to cut more without too severely affecting production levels have some flexibility to manage the lower price environment.

- Midstream operators with a high percentage of fixed-fee, take or pay contracts with investment grade counterparties are better insulated to manage the low-price environment.

- Identify possible M&A opportunities. The sector is ripe for consolidation and there have been a few examples of high yield companies being bought by investment grade companies to the delight of those companies’ bondholders. Rosetta Resources, for example was bought by investment grade rated Noble Energy, Inc. Similar to bond investors, investment grade companies will look at high yield operators in good basins, with low production costs and solid reserves. Investment grade companies will also look at vertically acquiring distribution and refining assets such as pipeline partners that they already have arrangements, joint ventures or similar relationships with. The chart below highlights the bonds of Regency Energy Partners which is being bought by investment grade rated Energy Transfer Partners.

We continue to avoid the service and offshore companies as, despite the extremely low prices, the risk of further downside is still high and bond volatility will be exacerbated by the entrance of aggressive, distressed investors playing in these bonds.

Will oil prices recover? It’s hard to say, but probably not in the near-term; China data, supply levels and the forward price curve suggests that oil prices will remain depressed for some time. One potential positive catalyst could be if the Iranian nuclear deal fails to pass the U.S. Congress (a real possibility), but this is likely to have only a moderate impact on oil prices given the relatively small impact on worldwide production/supply levels.

An overriding theme for U.S. high yield energy companies in the current oil price environment is having sufficient financial liquidity (cash, bank credit, etc.) to cover their obligations as earnings come under pressure due to low oil prices. Maintaining liquidity until oil prices recover will be paramount for energy companies to survive, even for those names that aren’t especially levered. It is likely that most energy-related companies will see a marked increase in financial leverage (and subsequently financial risk) over the coming months due to the depressed oil price environment.

A key source of liquidity for these companies is via their asset-backed bank credit facilities (or more specifically, reserved based lines or RBLs, which are tied to an individual company’s proved reserves, mostly oil and natural gas). These RBLs are often covenanted and most are revalued every six months by the bank group providing the RBL. Obviously lower oil prices means the value of most companies’ reserves have declined and RBLs will be adjusted accordingly, affecting credit availability.

The revaluation of RBLs will be kicking off soon, plus many Exploration & Production (E&P) companies are expected to test their covenant levels even if there is a modest recovery in oil prices. It is our belief that most bank groups will be supportive during the spring review season. Furthermore, we believe most companies will have success obtaining covenant relief as banks are keen to give their clients ample runway to navigate the current commodity price environment.

Last week, U.S. E&P company EXCO Resources, announced that it was granted covenant relief from its bank group in exchange for a c.20% reduction in its RBL. EXCO’s bank group lowered the company’s borrowing base to $725 million from $900 million. The revised agreement also removed the existing total leverage ratio covenant (essentially a cap on total financial leverage imposed by the bank group) until Q4 2016 when it will be re-instated at 6.0x debt-to-EBITDA (a measure of a company’s indebtedness compared to its earnings) with this level gradually decreasing to 4.5x by Q1 2018.

The banks were not entirely altruistic as the revised facility added a senior secured leverage covenant of 2.5x (limiting the amount of leverage allowed where the banks are positioned in the capital structure) and an interest coverage ratio of 2.0x to still ensure the banks have an avenue to re-negotiate the RBL should circumstances deteriorate materially worse-than-expected.

This is encouraging news as it supports our thesis that banks will be supportive of their E&P clients, especially since EXCO was not a distressed or massively over-levered company (relatively speaking) – EXCO’s net leverage as at Q3 2014 was c.3.5x debt-to-EBITDA, but it was widely anticipated that this leverage measure would go much higher in 2015 at current oil prices. The 20% reduction in the RBL is also consistent with our expectations that most companies will see moderate but manageable RBL reductions. It does not mean the company is in the clear as the operating environment is still extremely challenging, but the relaxing of the covenant gives the company some breathing room to navigate with less worry about breaching covenants or running out of liquidity in the near-term. The market has reacted positively to the news as EXCO’s 2018 USD bond is trading up 7 points (it was trading at 68 prior to the announcement).

While not necessarily a precedent (other more-distressed companies have successfully renegotiated their covenants), the EXCO news is encouraging as it demonstrates bank group support for the sector as we expect similar circumstances with numerous U.S. high yield E&P companies over the coming weeks and months. With a number of high yield energy bonds trading between 60 and 90, there is value to be had and opportunities to invest in the sector as long as one can understand and identify those companies with sufficient liquidity and/or those likely to be supported by their bank groups.