2017: a whole new ball game

It’s fair to say that, back at the start of 2016, few would have predicted we would end the year with president-elect Trump readying himself to move into the White House, and the British establishment at loggerheads over the form (hard? soft? somewhere in between?) that the country’s departure from the European Union should take. Add to this the odds of Leicester City winning the English Premier League, and one bookmaker was quoting potential winnings of £12.5 million on a stake of just £5. Even with sterling’s recent weakness (the currency is down 14% versus the US dollar, year to date, as I write), a return like that is hardly to be sniffed at.

Following a bear market in 2015 for many parts of the bond markets, 2016 has been more positive overall, despite significant volatility. As ever, central bank moves have proven pivotal. Since the US Federal Reserve (Fed) hiked interest rates in December 2015 – the first time in almost 10 years – it has held fire, although a December 2016 hike is now virtually priced in. At the other end of the scale, the European Central Bank (ECB) chose to extend its asset purchase programme in March, while the UK also opted for further monetary stimulus – along with a rate cut – in August, as it changed course to counteract the perceived negative impact that the Brexit vote would have on the country’s economy.

Meanwhile, spreads on investment grade credit and high yield bonds have tightened, the latter substantially. High yield defaults remain elevated compared to recent years, although this has been skewed by energy sector issuers. A gradual increase in the oil price should in any case reduce some of the pressure on these names. And after a torrid 2015 for emerging markets, the asset class experienced a far more positive ride in 2016, at least until Donald Trump’s victory in November.

Bond markets give clear reaction to Trump

A sharp sell-off in government bonds was among the key reactions in financial markets to the US election result, although it is as yet unclear whether this is just another blip, or the start of a more sustained move back towards ‘normal’ yield levels after years at close to historic lows.

Importantly, with the Republican Party in control of both the Senate and the House of Representatives, president-elect Trump should have the political power to advance his headline economic policies of significant infrastructure spending and big cuts in corporation tax. We should expect follow-through on trade protection measures as well, starting with his stated intention to withdraw the US from the Trans-Pacific Partnership on his first day in office. The repatriation of some immigrant workers and Trump’s border wall is also likely to stay on the agenda.

For bond investors, it’s a cocktail that adds up to increased government borrowing and firmer inflation prospects.

Trumponomics: the new Reaganomics?

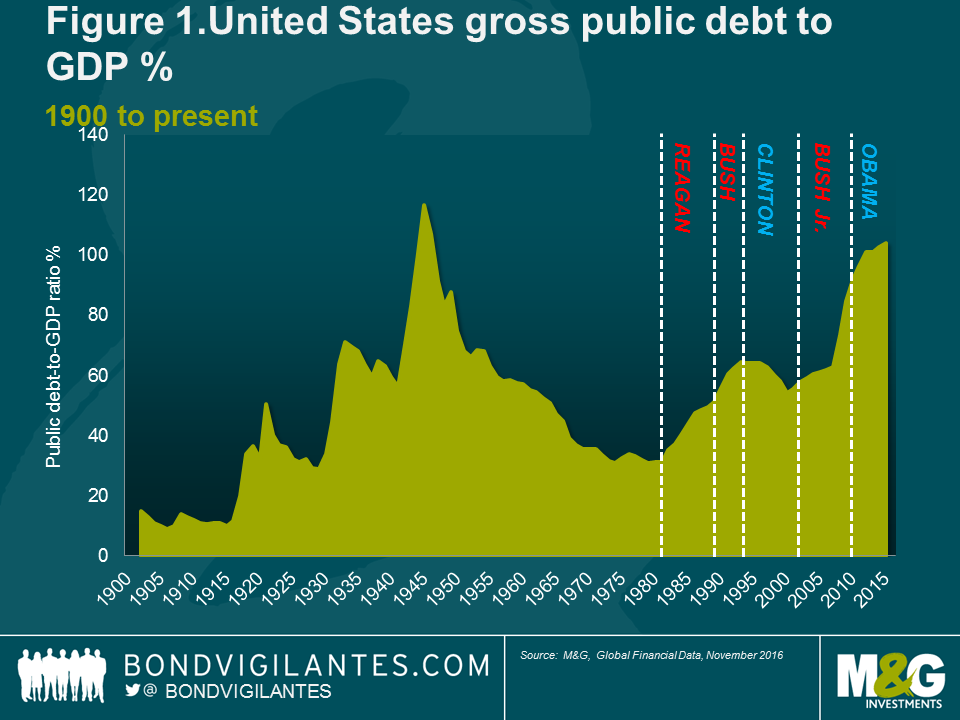

Much has been made of the similarities between the situation facing Donald Trump in 2017, and that confronted by Ronald Reagan when he took office in 1981. Back then, Reagan inherited a sluggish economy and inflation approaching 15%. His initial answer to this was the Economic Recovery Tax Act, which contained significant tax cuts (including across-the-board cuts in individual marginal income tax rates, as well as various business taxes), lower government revenues, and a reduction in government welfare spending. As a result, US Treasury yields climbed to all-time highs, with the yield on five-year US Treasuries peaking at 16.3%. And this was in an era when the debt-to-GDP ratio was just 30%, a far cry from the level of nearer 100% that president-elect Trump is inheriting today (see Figure 1).

As a result, the concern is that Trump simply doesn’t have the fiscal headroom that Reagan did to proceed with Trumponomics without spooking the markets. From an inflation perspective, the increased fiscal stimulus that he proposed on the campaign trail is expected to support the upward signals that were already building as result of a tightening labour market and rising oil prices. The US is near, or even at, full employment now – again, in notable contrast with the backdrop that Reagan picked up back in the 1980s. Should Trump engage in an out-and-out trade war, the impact on inflation could be even more pronounced, with tit-for-tat trade tariffs pushing up the cost of imported goods. His pronouncements on immigration are also relevant here: the potential repatriation of workers could decrease the supply of labour and give some support to wage growth.

Against such a busy scenario, governments that borrow too much typically watch their bond yield curves steepen, as we saw from the US Treasury market’s behaviour in the weeks following the election result (see box ‘A return of the Bond Vigilantes’?).

A further concern for bond investors is Trump’s willingness to consider ‘haircuts’ as a means of managing government debt. My personal view is that while US Treasury investors have a lot to weigh up, they shouldn’t yet worry about a default from the US government. Here’s what Trump actually said:

“No. I don’t want to renegotiate the bonds. But I think you can do discounting, I think, you know, depending on where interest rates are, I think you can buy back. You can – I’m not talking about with a renegotiation, but you can buy back at discounts, you can do things with discounts. …I would refinance debt. I think we should refinance longer-term debt.” – Donald Trump, 10 May, 2016.

The end of globalisation?

Trump’s victory and the UK’s vote in favour of Brexit are two of the biggest challenges in recent years to the global economic status quo. One of the main outcomes is a renewed debate about the impact of globalisation on the developed world.

On the issue of trade, the move by rich countries to locate manufacturing hubs offshore and the associated loss of jobs in rich nations have both been identified as negative consequences of free trade by populist politicians.

In order to assess the impact of globalisation on low- and middle-income households, analysts have used the ‘elephant curve’ (see Figure 2), which shows how average household incomes have grown between 1988 and 2008 for each part of the global income distribution, from the poorest on the left to the global top 1% on the right.

The chart shows that incomes for the poorest half of the world – typically those in emerging markets, in particular emerging Asian economies – have grown as fast as those of the world’s richest 1%. However, incomes for the lower middle class of the developed world (between around the 50th and 80th percentiles) have at best stagnated. As a result, it highlights how many have missed out on the much-vaunted benefits of globalisation, and helps explain the rise of nationalism across the developed world.

However, one of the economists who created the chart has suggested that his research has been misinterpreted. Branko Milanovic, a leading scholar on income inequality, has suggested the problem isn’t trade itself, which has lifted hundreds of millions out of extreme poverty. It’s that countries don’t design policies to support those that suffer as a result of lowering trade barriers. According to Milanovic: “Trade and globalisation are forces for good. The problem is that in many instances globalisation is implemented in a way that makes the playing field slanted in favour of the rich. Also, the gains from globalisation are never likely to be even for all the participants.”

Of course, the rise of populist movements is too complex to be explained by a single graph. There are many other factors at play, including protest votes on existing government policy, and issues connected with immigration. The key question that economists now face is assessing the impact that a more inward-looking US will have on the global economy. If countries begin to renege on trade agreements and begin to raise tariffs, we may see countries enter into a vicious circle of action and reaction, which would ultimately lead to a contraction of global growth. In this environment, everyone loses.

Regardless of the trend towards growing dissatisfaction with globalisation, it would be extremely difficult for advanced economies to reverse it now. Those that turn inward may be temporarily successful in boosting growth through growing private and public debt levels, but ultimately risk deep recession as inflation and unemployment begins to rise. An increase in borrowing today by consumers and governments is merely stealing growth from the future. For bond markets, this could lead to a renewed focus on the creditworthiness of government bonds, the traditional ‘risk-free’ asset, resulting in higher yields in the not-too-distant future.

A return of the Bond Vigilantes?

“I used to think if there was reincarnation, I wanted to come back as the president or the Pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody.”

Regular readers of our Bond Vigilantes blog will recognise this quote, from Clinton administration adviser James Carville back in 1993.

The term ‘bond vigilantes’, coined by US economist Edward Yardeni 10 years earlier, came into being to describe Ronald Reagan-era deficits and resulting US Treasury market revulsion. The term refers to the bond market’s ability to serve as a restraint on a government’s ability to overspend or borrow: investors can sell bonds, pushing yields upwards, in protest at what they see as inflationary policies.

After years when inflation was in the wilderness and austerity rather than fiscal stimulus has been in vogue, is now the time that we see bond investors start to flex their muscles once again?

The technology revolution: electronic money

Policy makers and economists, such as Harvard professor Ken Rogoff, have made elegant arguments for the benefits of a cashless society. In his latest book, ‘The Curse of Cash’1, Rogoff proposes to eliminate most paper bills. Rogoff’s argument is that in a world of negative interest rates, consumers would prefer to hoard cash than pay to save their money with a bank, thereby reducing the effectiveness of monetary policy. Denmark, Sweden, and Norway are already considering moving to a cashless economy, while the European Central Bank has ended the production of the €500 banknote.

Forcing more transactions into the banking system would make tax collection easier and reduce the size of the black market. This was the main motivation behind India recently banning 500 and 1,000 rupee notes. Rogoff argues that a large proportion of cash in circulation goes to paying off-the-book transactions and wages. Phasing out large banknotes would make it harder to transport large sums of cash, or to store in safe deposit boxes.

The ability to push interest rates deep into negative territory may become more important for central banks, particularly if their respective economies enter into a recession. As consumers react by spending rather than saving, it is hoped the economy would return to growth and interest rates and inflation would be able to rise to manageable levels again.

As well as encouraging large portions of the economy to hold cash, the other problem with negative interest rates is the destabilising effect that it has on the banking sector. The World Bank has pointed out that negative rates can erode bank profitability by narrowing interest-rate margins. Perversely, some banks in Switzerland have been raising mortgage rates as they attempt to make profits. In addition, pension and insurance companies are struggling to meet their long-term obligations in this ultra-low interest rate world.

Arguably, we have now reached the limits of what monetary policy can do. It is time for central bankers to pass the baton on to governments to inject money into ailing economies. In the immediate future, a larger investment role for the state appears warranted. Arguments around banning cash and moving to electronic money are a sideshow – it is now time for a deeper analysis of what role governments can play in stimulating economic growth.

The technology revolution: a workless society

The move to a cashless society is one example of the impact that technology may have on our day-to-day lives in the not too distant future. Many books have been written on the subject in recent years. One of the best to come out in 2016 is Economist editor Ryan Avent’s ‘The Wealth of Humans’.2

With the digital technology revolution arguably the most important since the industrial revolution, we are gradually moving away from a world in which regular paid employment is the norm towards one in which robots take over both white as well as blue collar jobs.

Avent suggests that a redistribution of wealth through a new form of social contract will be needed in order to avoid major societal unrest. But how might wealth be shared fairly, and how could we balance the fact that offering citizens an attractive, guaranteed income in lieu of work will likely encourage immigration?

Avent is optimistic that, over the long run, this empathy can lead us to an expanded sense of who deserves to share in our wealth. As he says, we should see technology as an “enormous natural resource” with all sharing in the benefits. However, as Brexit and the US elections have proven, such empathy currently seems to be in short supply.

1 Kenneth S. Rogoff; The Curse of Cash; Princeton University Press, Princeton, New Jersey, 2016.

2 Ryan Avent; ‘The Wealth of Humans: Work, Power, and Status in the Twenty-first Century; St Martin’s Press, 2016.

Austerity and inequality: not just an Anglo Saxon problem

Nowhere have the subjects of fiscal austerity and rising inequality been as relevant as in Europe today. Stubbornly high unemployment rates combined with declining living standards have contributed to rising levels of civil and political instability over the past year. Populist and nationalist parties have been able to capitalise on this phenomenon and raise massive amounts of support from exasperated European citizens.

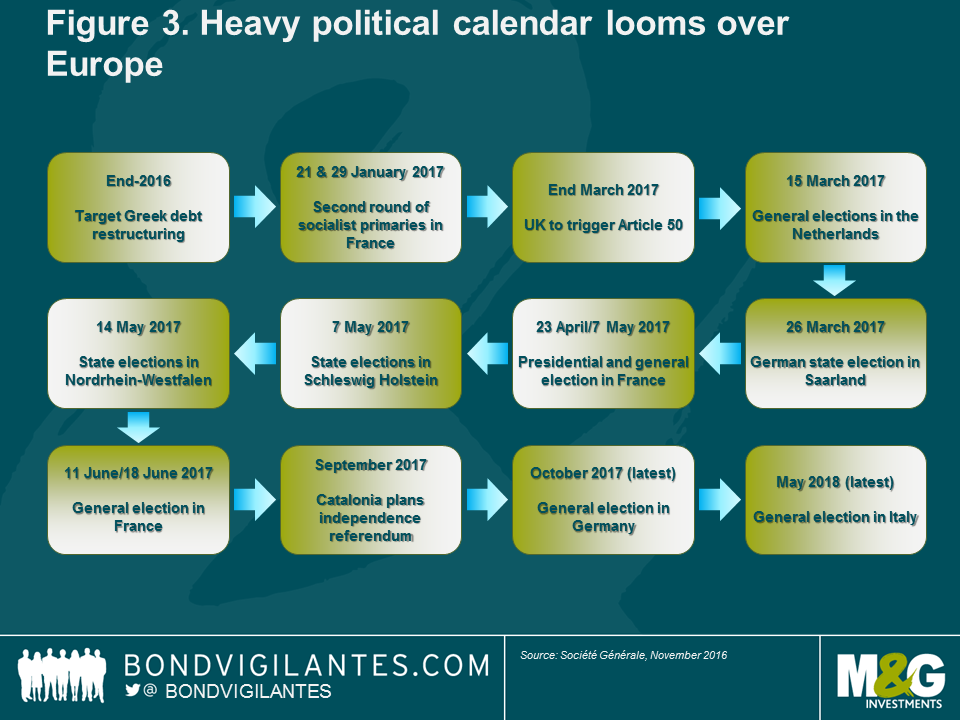

In Spain, for example, a caretaker government had to be put in place after two consecutive presidential elections failed to designate a clear winner. France will also face an important political test when it holds its presidential election in spring 2017. National Front leader Marine Le Pen will be trying to take advantage of the positive momentum she has built up to sweep her party to its first victory. While this would require a vast – and unlikely – swing from voters, recent events remind us that the rise of anti-establishment parties globally is not one to be underestimated. Equally, traditional polling methods seem to struggle to capture the swing to the hard right that is underway. These mounting pressures could not come at a worse time for Europe, whose 2017 political schedule looks particularly packed (see Figure 3).

The extra difficulty for Europe is that its capacity to boost growth and employment via increased public and infrastructure spending and tax cuts is more limited than other economies, for two main reasons. First of all, high levels of debt (Europe has an average debt-to-GDP ratio of 90% versus the 60% target of the Stability and Growth Pact) are forcing most European countries to rein in spending rather than increase it. Second, not having the ability to print money at an individual country level in the European Union (EU) requires each member to demonstrate even more fiscal discipline for the union to remain viable.

For those mainstream European political parties wishing to claw back votes from their more extreme rivals, the challenge is therefore as follows: to improve the living standards of hundreds of millions of Europeans, while preserving the EU’s balance sheet. This can only be achieved by implementing the right mix of pro-growth structural reforms, but some tough times could still lie ahead.

2017 and the Trump effect

As we’ve already noted, Trump’s election has led many to speculate that the US is likely to shift to a highly expansionary budget policy. Proposed fiscal measures include a reduction in the corporate tax rate to 15% and a decline in the top rate of household income tax from 39.6% to 33%. Trump has also proposed a large increase in infrastructure spending (he likes building walls) and large increases in the defence budget.

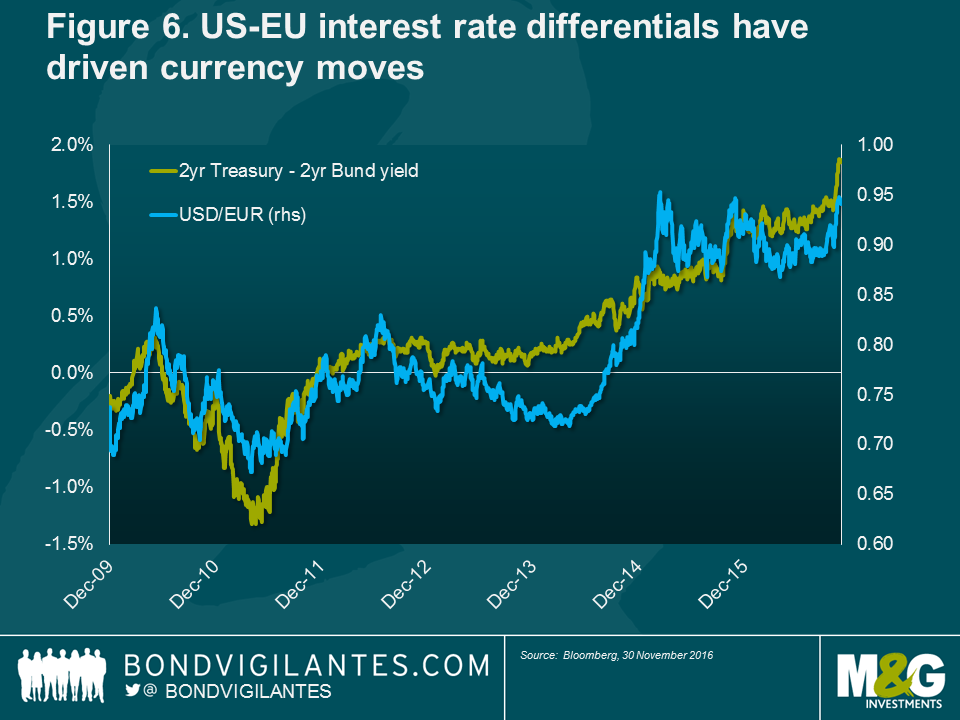

Bond investors are worried that this will further boost already rising inflation. In response, the Fed may be forced to hike interest rates, which could, in turn, lead to a further appreciation of the US dollar. While Fed chair Janet Yellen has stated her intention to remain in post until the end of her four-year term in early 2018, Trump could slam the Fed for hiking rates and putting a brake on his economic growth plans in this environment.

The yen and euro appear particularly vulnerable given the continued expansionary stance of monetary policy set by the Bank of Japan (BoJ) and ECB, respectively. The BoJ’s transition to yield-curve targeting ensures that real yields will drop as inflation picks up, implying that financial conditions will turn increasingly loose as the recovery progresses. There are good reasons to be cautiously optimistic: after all, despite a triple whammy of feeble domestic demand, weak commodity prices, and a stronger yen, Japanese inflation measures are showing early signs of bottoming out. The Japanese government has also approved an economic stimulus package of roughly 5.5% of GDP.

The BoJ’s move to yield-curve targeting is not a new monetary policy development. In 1942, the Fed and US Treasury agreed to cap the long-term US Treasury yield at 2.5%, the 7- to 9-year yield at 2%, and the 1-year rate at 0.875%. The caps on long-term interest rates were never formally announced, perhaps to avoid embarrassment in case the policy proved unsuccessful. The US authorities pursued a policy of yield-curve targeting until 1951, when the Fed became openly frustrated with the constraints on monetary policy associated with the commitment to support yields on government securities and pushed for an end to the policy.

In the UK, Chancellor Philip Hammond’s Autumn Statement confirmed that there will be no budget surplus, there will be looser fiscal rules and lower tax receipts due to weaker average earnings and lower household consumption. In my opinion, the UK government is probably – prudently – holding back some fiscal ammunition in anticipation of the eventual triggering of Article 50 and the two-year negotiating period with the EU.

Europe’s QE dilemma

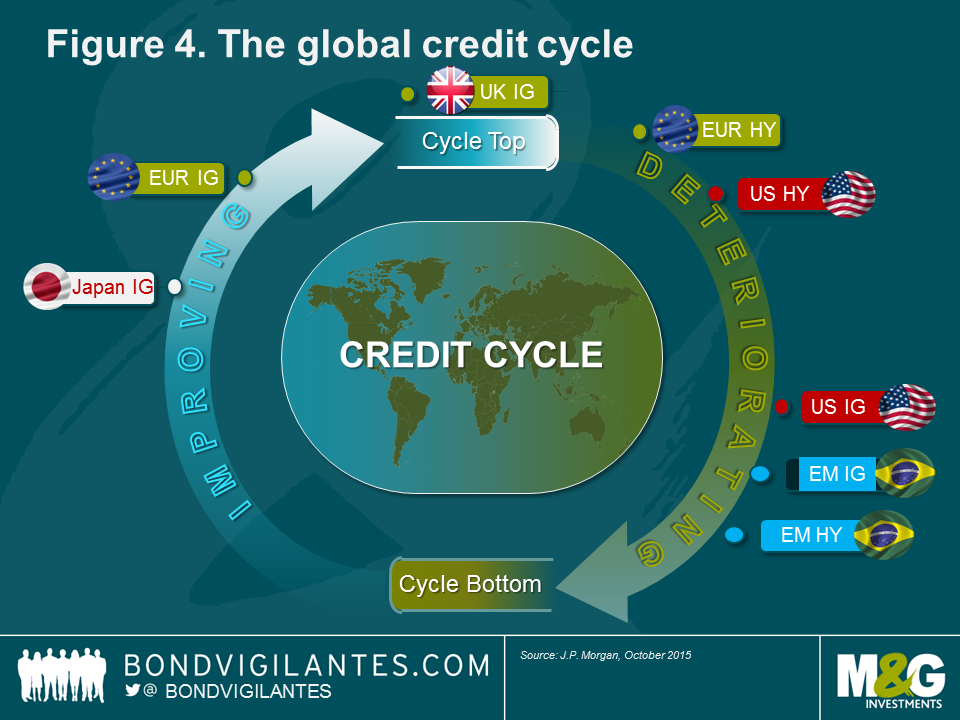

The ECB’s announcement back in March that it would extend its asset-purchasing programme (known as the Corporate Sector Purchase Programme or CSSP) to include investment grade (IG) non-bank corporate bonds only served to highlight the divergent fortunes of the US and Europe (see Figure 4).

The flexibility of the programme, together with its broad purchase scope, which is spread widely over a large number of bonds across all IG ratings, curve buckets and sectors, largely took the market by surprise, and resulted in an immediate and significant tightening of credit spreads. This was not only the case for potentially eligible corporate bonds, but also for the broader European corporate bond markets, including the lower end of the IG risk spectrum.

One key implication of the move is that, with it, the ECB formally became a new, large and price-insensitive player in Europe’s corporate bond market. As such, the ECB has provided strong technical support for European credit, putting a floor under prices and driving down bond yields further. Over US$10 trillion of global sovereign debt is now trading with negative yields and until relatively recently, corporate bonds had been a notable exception to this phenomenon. Recent policy moves from the ECB and other central banks have been the primary drivers of interest rates going into negative territory.

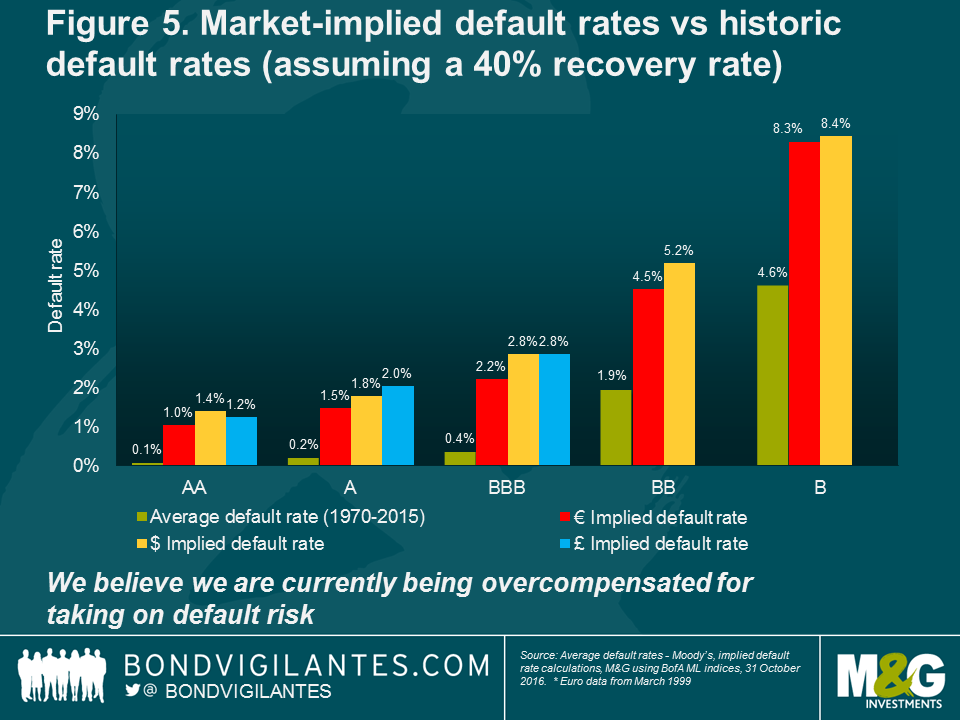

A deliberate consequence of quantitative easing (QE) is known as the portfolio rebalancing effect, where private investors, looking to generate positive returns, have been increasingly forced to take on greater amounts of credit risk in order to do so. For many investors, this has meant having to move down, and especially out, along the credit curve in their hunt for positive yielding bonds. Nonetheless, we believe that we are still currently being overcompensated for taking on default risk both across the US dollar, sterling and euro credit markets, and across the ratings spectrum (see Figure 5).

The return of supply is another effect induced by the CSPP. European corporate bond issuance had fallen to very low levels in the months preceding the programme. Since then, markets have witnessed a strong recovery in primary market activity on both gross and net supply levels.

Looking into 2017, market sentiment remains fragile. The yield advantage of US Treasuries over German government bonds is near all-time highs (see Figure 6). A similar story is playing in the corporate bond market. The more the ECB continues putting downward pressure on European corporate bond yields, the greater scope for investors to move away towards the relatively more attractive yields available in the US corporate bond market.

Equally, the sharp market fluctuations of 2013’s ‘taper tantrum’ and 2016’s ‘bund tantrum’ episode (which followed a Bloomberg article suggesting that the ECB was considering winding down bond purchases) offer a useful reminder of how major market corrections can take place in a short period of time. As credit markets have become increasingly complacent, the risk of asset price corrections remains high and may well be amplified by the particularly intense European political agenda ahead.

Back in March, when the CSPP was launched, Europe’s economy was in outright deflation. Since then, monthly inflation in Europe has shown a modest improvement thanks to the recovery in global commodity prices. While this is still far from the ECB’s target of close to but below 2%, the recent stabilisation in energy prices could provide temporary support to consumer prices. Over the coming months, the ECB will be closely monitoring inflation expectations to assess any further need for monetary accommodation. While the Bank may seek to continue CSPP beyond September 2017, it could also decide to end it if the path of inflation were to look consistent with its inflation aim.

Emerging markets: all bad news?

Donald Trump’s victory has a number of wide-ranging implications for the emerging markets. At first glance, the result is clearly negative, given the potential risks from factors such as increased trade protectionism, large fiscal expansion, anti-immigration measures, and uncertainty in terms of foreign policy. Many emerging market bonds and currencies almost immediately reflected their concern. The Mexican peso, which had served as a bellwether for the fluctuating fortunes of Clinton and Trump during the election campaign, due to the country’s proximity and deep economic ties to the US, depreciated some 10% in the immediate aftermath of the result. If Trump is able to impound all remittance payments derived from illegal wages, El Salvador and Honduras will face a negative economic headwind given these countries have a high share of unauthorised remittances versus GDP.

However, as is often the case, the impact of a Trump presidency will not be felt uniformly across the emerging markets. There are several key emerging countries that are relatively closed economically, such as India and Brazil, which will prove relatively insulated from developments in the US.

Elsewhere, markets in Eastern Europe, such as the Czech Republic, Hungary and Romania, are much more dependent on Europe than the US for their exports. Meanwhile, Russia may benefit if the US starts easing financial sanctions against it, and the ruble rallied in the immediate aftermath of the election result.

At the same time, much attention will be focused on US relations with China. As the biggest foreign holder of US government debt, China may look to reduce its holdings to prevent its currency from depreciating too rapidly versus the dollar (see Figure 7). Any imposition of trade tariffs or move by the US Treasury to name China as a currency manipulator will be the key events to watch out for.

Although US Treasury yields have so far risen sharply since the US election result, we expect yields to gradually edge higher in a more modest and gradual manner. For a number of emerging markets, this prospect is less challenging than it might have been in previous years, as they have improved current account deficits and adjusted to having lower overall levels of US dollar-denominated debt.

However, as is always the case for all asset classes, and the emerging markets in particular, much will depend on the newsflow as we go into 2017, and on whether it turns out to be a year as full of surprises as 2016 has been.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox