US & UK Inflation: Goldilocks and the bear?

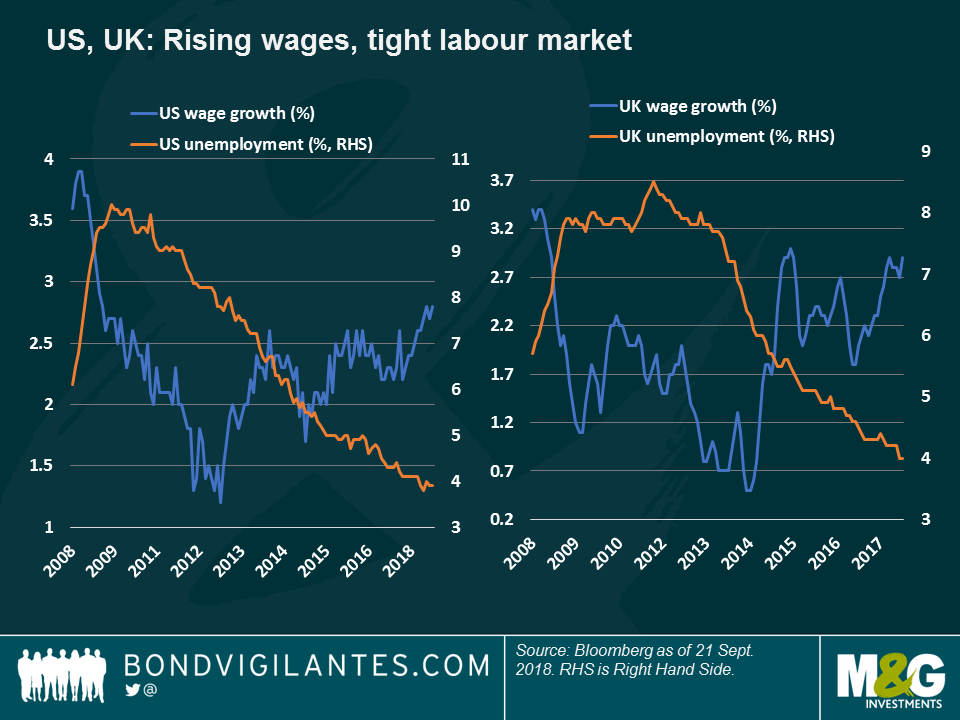

After a decade dominated by extraordinary monetary stimulus that has kept interest rates and consumer prices at bay, the dog that didn’t bark is finally showing signs of life: inflation. As seen on the chart, both US and UK wage inflation have spiked in a tightening labour market – an old textbook recipe for further price increases to come. However, one has to look beyond the headlines to depict the real story – which I see as one of goldilocks and the bear.

Goldilocks – US:

The US economy continues to enjoy a goldilocks scenario, in which the economy is neither too hot to force a sharp rate tightening cycle, nor too cold to slow down corporate earnings. This backdrop allows companies to borrow at relatively low rates, helping them avoid defaults, at the same time that consumers do not lose too much purchasing power due to inflation. This is the dream scenario for many risk-on assets, such as High Yield, and has fuelled the US stock market to one record high after another. Happy days.

This economic sweet spot, however, could be derailed by the ongoing trade wars, which could well get worse before getting any better. While some forecasters say the trade dispute may lead to a slowdown and therefore, lower inflation, I do not share their view because:

- Imports become more expensive: tariffs may automatically increase the price of Chinese imports as Chinese manufacturers pass on the cost to US consumers, leading to higher prices.

- Substitution costs: If US consumers cannot or are unwilling to absorb higher prices, an automatic switch to US-made replacements may be easier said than done: building factories to increase domestic output may be challenging in the present rising rate environment, and also difficult as the US already has a very tight labour market. Trying to hire more workers when the unemployment rate is below 4% may lead to wage pressure, lifting inflation rather than reducing it.

Therefore, I see the Fed continuing to raise rates as planned and despite the recent dovish speech of Fed chair Jerome Powell in Jackson Hole in August.

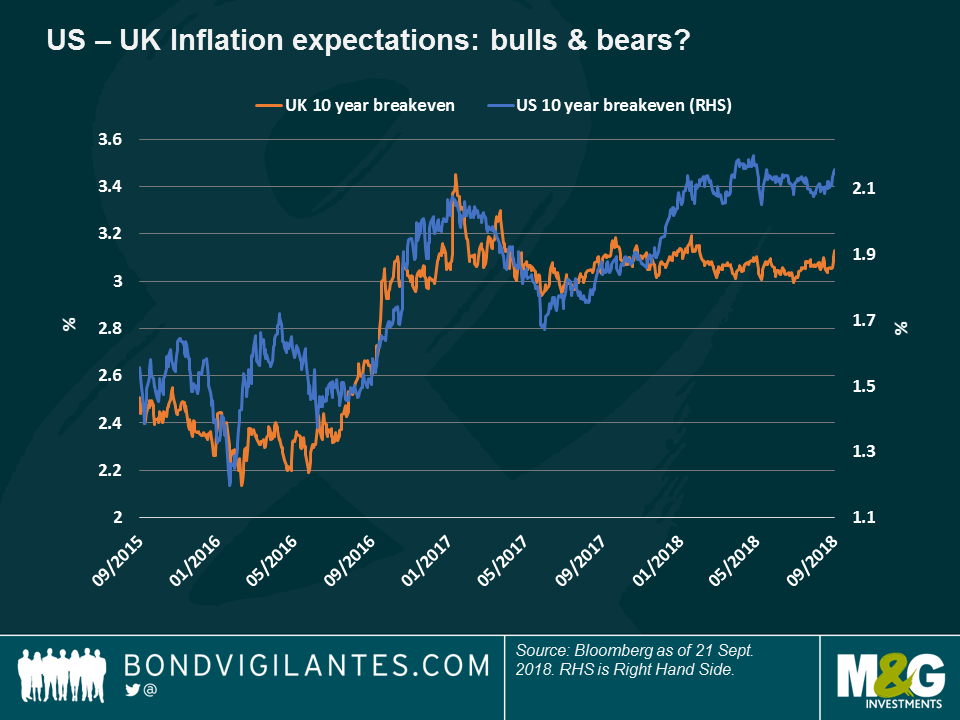

The bear – UK: The picture is a bit cloudier in Britain, even if wage inflation surprised on the upside in July, reaching annualised growth of 2.9%, matching the March increase, and the highest level in 3 years. As shown on the chart, the optimism around UK inflation is not reflected in the market-implied future inflation rate, expressed by the breakeven rate:

Let’s look beyond the headlines to understand why:

- True driver: For once, the Bank of England (BOE) has been right in its forecast: Brexit will lead to higher wages as fewer foreign workers are lured to the country. With less competition, wages may continue to rise. This inflation push, however, might not be sustainable as it is not driven by strong economic output, but by supply and demand dynamics.

- Heat of the moment: General consumer prices came in above expectations in August, up an annualised 2.7%. They were largely driven by clothing, transport and even theatre prices. This happened in one of the hottest months on record, raising questions on whether this push is sustainable or not.

- Housing effect: Britons are enjoying the low rate environment to buy homes, but this could soon change if rates continue to increase. With half of mortgage payers being on a floating rate deal, just two rate hikes could significantly increase monthly payments, causing an economic slowdown and containing inflation. I already warned last year that poorly-timed interest rate hikes could be “overly myopic and pro-cyclical,” damping growth and inflation. Unfortunately, I was right: After the BOE raised rates in November, UK annualised growth fell to 1.2% in the first quarter of this year, the weakest pace since 2012.

- Unemployment – really that low? While the unemployment rate is at the lowest level since 1975, the figure may mask the fact that many Britons would like to work more and they don’t because they can’t. Anecdotally, car maker Jaguar Land Rover recently put its workers on a 3-day week until Christmas. Media reports have indicated that by 2020, the UK may have as many as 1 million agency workers – hardly a position for pay demands.

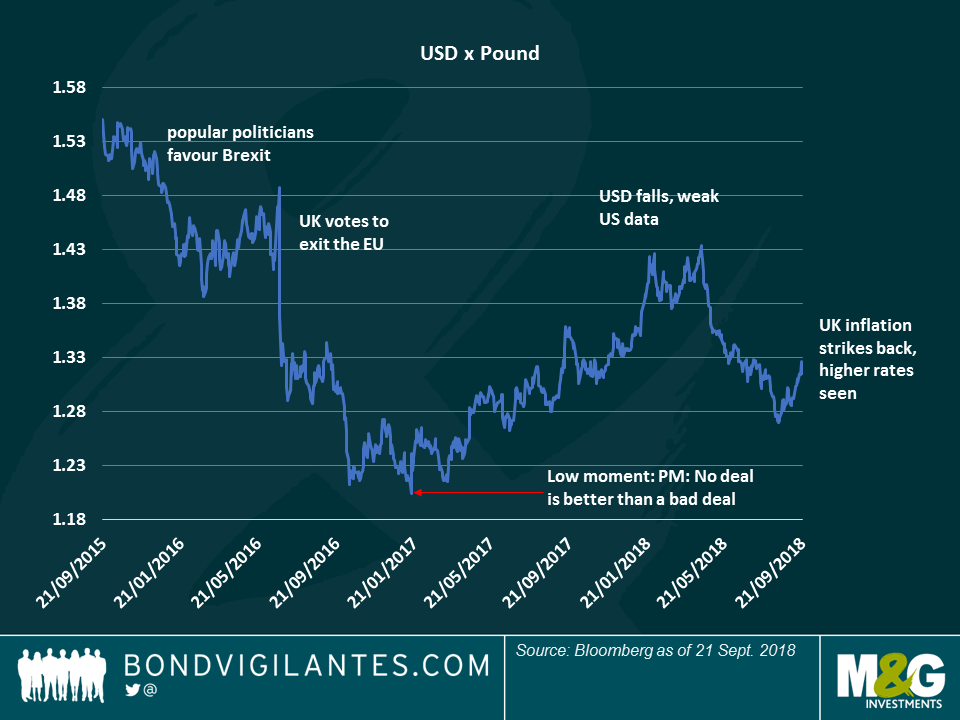

- Currency effect: Brexit uncertainty has continued to weigh on the pound this year, with sterling being down 2.6% against the US dollar since January 1st. This lifts the price of dollar-denominated imported products and, again, questions the sustainability of the inflation push as it may wane as soon as the base-effect disappears.

All the above leads me to think that, despite the recent increase in prices, inflation may end the year at the lower end of 2%, a level more reflective of Britain’s true – and more moderate – economic heartbeat. What could potentially challenge my inflation view? Brexit, of course, whose inflation outcomes seem as binary as the opinions that the subject draws. I envisage two scenarios:

- No inflation please, we are British: a last-minute compromise between Britain and the EU may strengthen the exchange rate up to 1.40 USD per pound, from the present 1.31. This would tame import price growth and contain wage demands, given the deeper integration with the EU.

- Cold Britannia: A hard, no-deal exit could push the exchange rate down to 1.20 USD per pound, a low reached in January 2017 after Prime Minister Theresa May said a no- deal Brexit was a possibility. This would trigger inflation and wage demands.

Which of these outcomes is more likely, depends on one’s views over Brexit. But, as far as inflation goes, the only thing that seems certain is that while in the US inflation is being generated by economic growth, in the UK it largely depends on the Brexit outcome – in which case, it may well end up being a bear. I hope to be wrong again.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox