Some quick thoughts on Italy after yesterday’s regional elections

Italy currently has a “yellow-red” government

Conte is the Prime Minister supported by 5 Star Movement (yellow) and the left party (red). Prior to this government there was a “yellow-blue” government led by Conte and supported by 5 Star movement (yellow) and the right party with Salvini (blue).

Over the last couple of years there have been 2 significant changes

- The right-wing parties doubled their consensus: Lega (with Salvini) went from just above 15% to just above 30% and it is now by far the biggest party in Italy. Fratelli d’Italia, which is allied with Lega, also doubled its consensus results going from 5% to 10%.

- 5 Star Movement seems to have collapsed: they went from being the first party to now have only 15% consensus and they are still falling in the most recent polls. In addition to this, last week Luigi Di Maio (their leader) resigned.

Here is a snapshot of the opinion polls in Italy (from March 2018 until today):

What happened yesterday?

Yesterday we had regional elections in Emilia Romagna and Calabria. The former was crucial for the stability of the current Government as Emilia Romagna is a big region and has been historically dominated by the left party. A Salvini win here could have created a big challenge for the already very fragile “yellow-red” Government and an higher probability of early elections. This didn’t happen: the left coalition won with 51% votes vs 44% of Lega.

My takeaway from yesterday

While the result in Emilia Romagna has been seen as positive by the market as it decreased the probability of early elections, the current Government remains fragile and unlikely to continue as it is until the next general election (which is in 2023). I say this because:

- Salvini continues to gain consensus: while it is true Lega lost in Emilia Romagna, they managed to get 44% of the votes in a region which has long been stronghold of the Italian Communist Party! Moreover, towards the end of last year Salvini won (by far) in Umbria, a region which historically has been led by the left party

- The 5 star movement is losing its strength and yesterday’s regional elections confirmed this trend: in Emilia Romagna they got less than 5% and in Calabria they went from being the most voted party in 2018 to not even have enough votes to enter in the Regional Council. On the other hand, Salvini undoubtedly won in Calabria.

- Fratelli D’Italia, which is allied with Salvini, continues to gain popularity: yesterday’s elections confirmed this trend

Valuations

2 considerations:

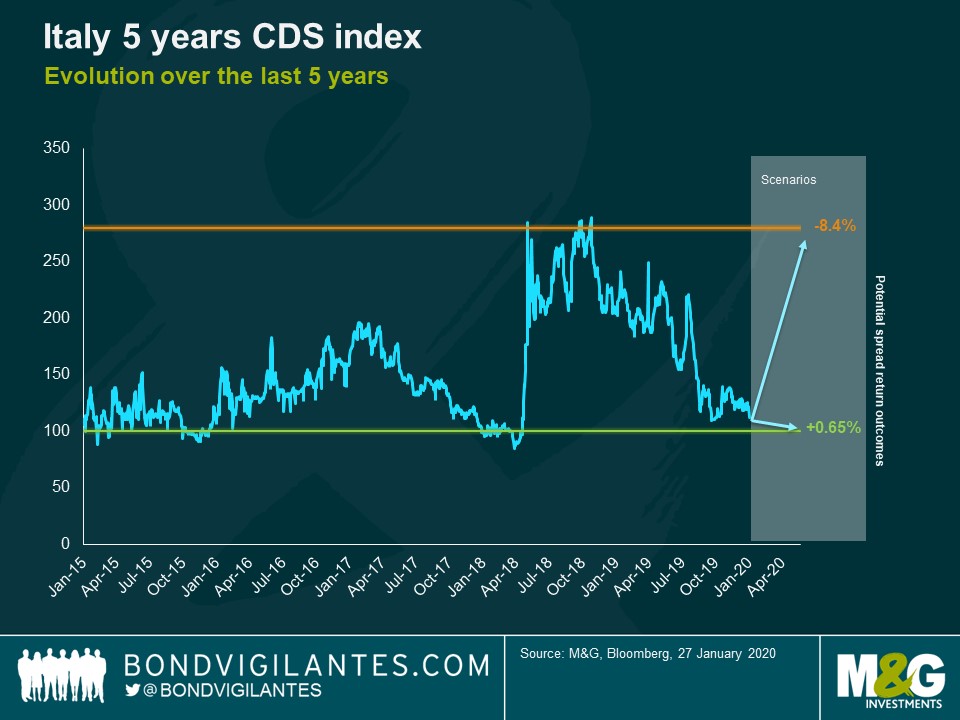

1. Spreads tighten a bit this morning on the back of yesterdays’ results. Currently the ITA 5y CDS is trading with a spread of 113bp: this is very close to the low range of the last 5 years (see chart below) and quite far from the highs of last year. If spreads were to reach the low range levels (100bp), the 5y CDS could return +0.65%. On the contrary, if spreads move back close to the highs seen last year, the index could lose north of 8%.

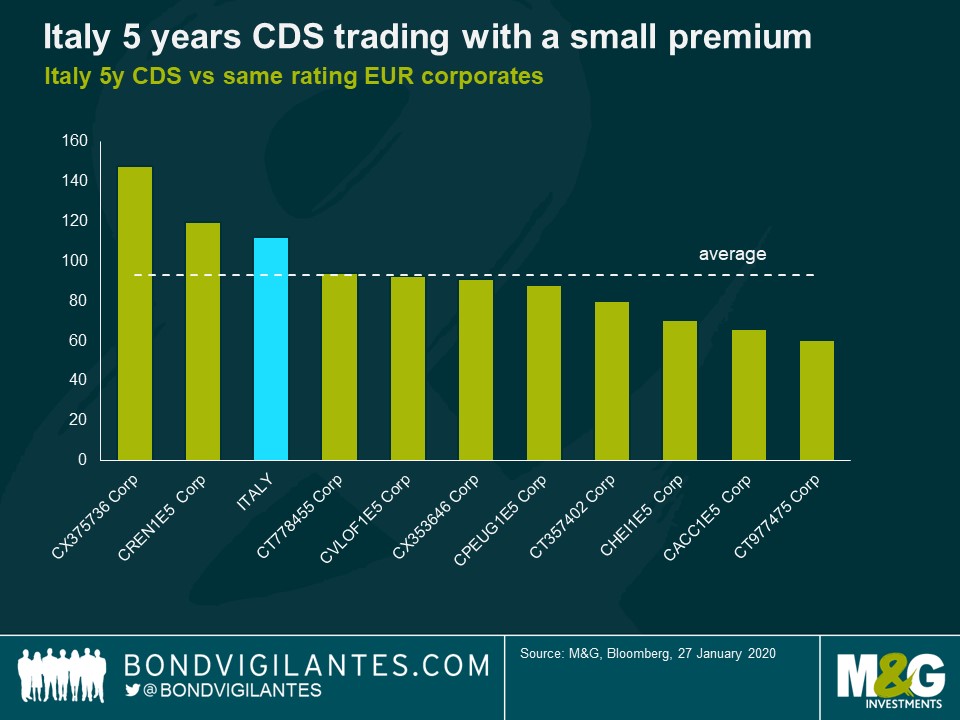

2. Italy is rated BBB- by Moody’s. When compared to other 5y CDS names with the same rating, Italy seems to pay a little premium: currently trading 20bp above average BBB- (see below)

Yesterday’s results were a small positive for credit spreads, but they don’t change the trend we have seen over the last couple of years. The current government will remain under pressure from the rising popularity of the right party on one side and from the fall of the 5 Star movement on the other side. Currently Italian bonds are trading with a little premium, but the market is not fully pricing in the political risk.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox