Lower oil prices for longer? The impact on emerging market oil producers

By Claudia Calich, Gregory Smith and Eldar Vakhitov

Market expectations of global oil prices have shifted several times already in 2020. The year started with short-lived scenarios of potentially higher prices, as tensions between the USA and Iran dominated the headlines. However, as COVID-19 tragically spread, the virus put a clear dent into expectations about global growth. Curfews and efforts needed to contain the virus’ spread hit both demand and supply. First in China, then globally as the virus spread. Expectations about oil prices softened accordingly, with Brent dropping from $60/bbl in late January to close to $50/bbl in early March. At this point, emerging markets were feeling the pressure of slower growth prospects and weaker sentiment as global stock markets sold-off. But there was a much bigger oil move to come.

Saudi Arabia had over the past two years agreed with Russia, and several other non-OPEC producers, to limit production in order to keep oil prices in a range broadly between $50/bbl and $70/bbl. At an OPEC plus meeting on 06 March, Saudi had hoped to secure agreement from Russia, and other oil producers, to make new commitments to hold back on supply. Saudi Arabia had not wanted to do all the heavy-lifting alone. But Russia decided not to support the cuts, and overnight the landscape shifted 180 degrees. Saudi Arabia gave up on the cuts and pledged lower prices and a greater supply of oil. This sent oil prices tumbling down to the mid-30s when markets opened on 09 March.

Brand new scenarios for oil prices were sketched out for 2020 and 2021 by the markets. They had to gauge not only the potential impacts of COVID-19, but also now an oil price war. One scenario involves Saudi’s move provoking Russia to change its stance and agree on cuts, lifting oil prices in the process. But this was not the prevailing view. Instead the idea that oil prices might remain in the 30s over 2020 dominated market thinking.

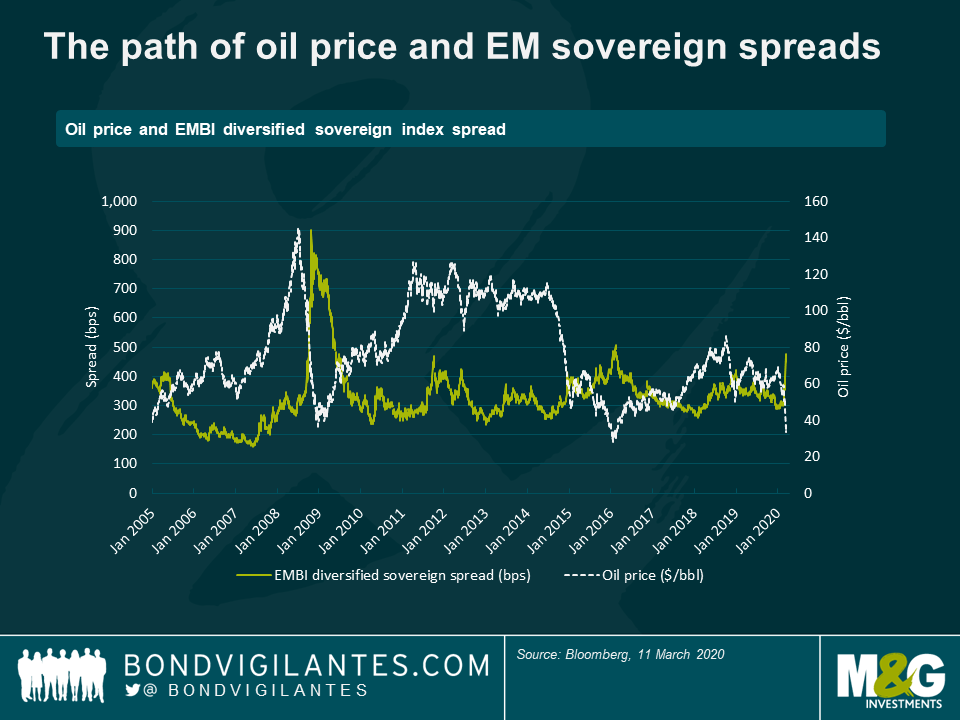

Emerging markets tend to feel strain when global oil prices drop. There is a clear impact on the oil producers. Meanwhile, oil-importers might see some balance of payments pressures easing. However, they also tend to face higher costs of borrowing and the effects of weaker market sentiment. Furthermore, oil importers are more likely to be tourist destinations than oil producers. Hence they are braced for lower FX earnings as COVID-19 travel restrictions limit visitor numbers.

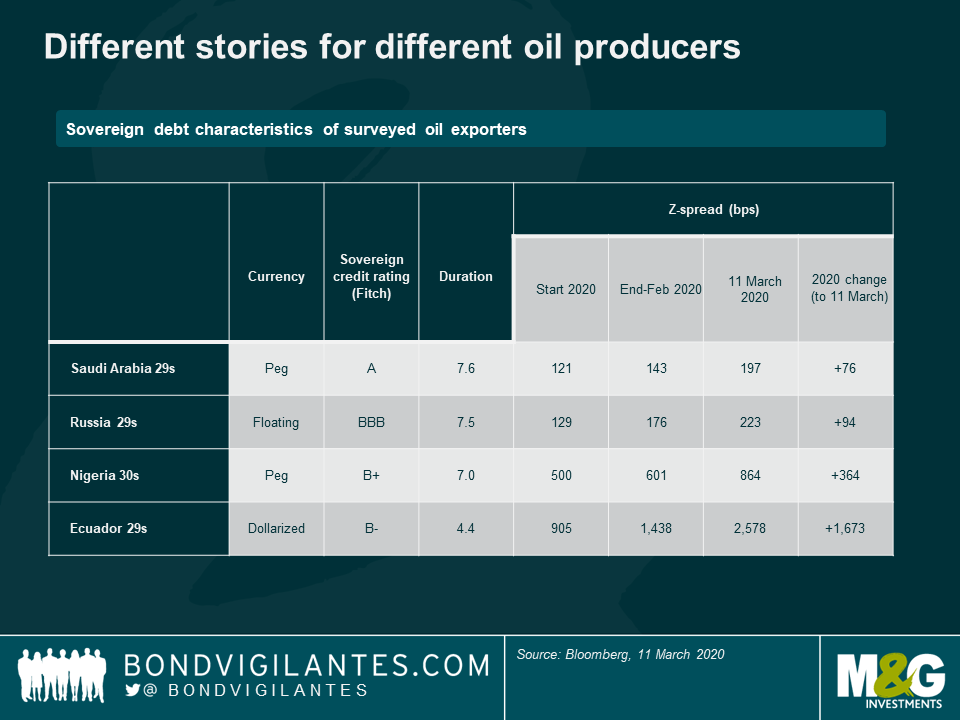

For the oil producers a move of this magnitude requires adjustment, with oil prices as much as $20/bbl below the level on which 2020 budgets were calibrated. Countries with large balance sheets, flush with saved financial assets, look stronger than those without such assets. For others with a weaker balance sheet, it is a matter of how long FX reserves will last at different extents of fiscal and external adjustment. Countries with pegged currencies are likely to need more FX reserves, than those who can adjust their exchange rates. We examine four emerging markets and discuss the impacts of potentially lower oil prices.

Ecuador

Ecuador is one of the most vulnerable countries to a decline in oil prices. As a dollarized economy, it does not have the flexibility of the exchange rate as an adjustment valve. Furthermore, although its debt levels are lower that some other oil exporters (Angola for example), it already had a large fiscal deficit even before oil prices collapsed. While the Moreno administration has had good intentions, complex domestic political dynamics ahead of a 2021 election, with the risk of populist policies returning, have made large fiscal adjustments difficult. The IMF has been very supportive thus far, but the new reality of oil prices mean that the programme assumptions will need to be re-calibrated, and future disbursements may not happen under the original schedule or at all. Should oil prices remain in the 30s for an extended period of time, Ecuador will run into a liquidity crisis. In this uncertain environment, any other potential sources of liquidity (upcoming asset sales, additional funding from China, etc) may not materialize. Ecuador has been one of the worst performers over the last week and the bonds are now pricing a very likely re-structuring in the next 12 months. Should that happen, it would be the country’s third in the last 20 years.

Saudi Arabia

Saudi Arabia’s economy is dominated by oil production. As its riyal has been pegged to the US dollar for decades at the same rate, the government is unlikely to adjust it. But the Saudi Arabia Monetary Authority has amassed a huge amount of reserves, worth close to $500 billion in 2019 (62 percent of GDP). Oil averaging $40/bbl in 2020 could double Saudi Arabia’s fiscal deficit if budget plans are not cut and put the external account under pressure as the current account breakeven oil price is around $50/bbl. Saudi Arabia is a low cost oil producer and its accumulated buffer will help it to weather the storm and maintain its peg. But in the absence of exchange rate adjustment, FX reserves could halve if oil prices remained low until the end of 2021.

Nigeria

Nigeria, along with Angola, faces the largest potential adjustment in the African eurobond space. The Central bank of Nigeria (CBN) has kept the Naira pegged to the US dollar since the last devaluations in 2016 and 2017. The exchange-rate stability has been welcome in 2018 and 2019, enticing foreign investor demand for Nigerian short-term domestic debt. But the big drop in oil prices might put too much pressure on FX reserves—that had already been falling steadily since June 2019—if the CBN tried to maintain the currency status quo. The option of devaluation, in response to lower oil prices, is available to the authorities in 2020 as a means of adjustment. Meanwhile the government has stated its intention to re-work the 2020 budget which was based on $57/bbl.

Russia

Russia’s progress towards economic diversification has been limited in recent years, but an impressive fiscal adjustment has been implemented. The breakeven oil price for the budget fell dramatically to about $45/bbl in 2019 (from $110/bbl in 2013). A budgetary rule has kept discipline, ensuring oil revenues above $42/bbl have accumulated in the National Welfare Fund. This oil fund has reached $170bn (10% of GDP). Government debt is also very low at close to 15% of GDP. Furthermore, in contrast to most oil exporters, Russia has opted for a flexible exchange regime which provides an important avenue of adjustment to lower oil prices. Moves in the Ruble, plus FX reserves worth 18 months’ of import cover, underpin Russia’s resilience which already passed tests when it brushed-off increased US sanctions in 2018.

If Saudi Arabia’s plan is to pressure Russia into a new agreement for oil production cuts, a glance at Russia’s balance sheet suggests it might take a long time, and might end up hurting Saudi Arabia more. In any case, the greatest pressures of lower prices in 2020 would fall on the higher cost oil producers, many of which are in the US.

If a scenario of oil under $40/bbl plays out in 2020, the landscape for the EMBI diversified index oil producers will change massively. The inclusion of the GCC countries in 2019 has shifted the index’s weighting to oil producers from just under 30 percent in 2018 to 37 percent in 2020. If oil prices stick at current levels, 2020 budgets will need to be torn up and redrawn. The necessary adjustment will be substantial, with the countries with better balance sheets and adjustment tools much better placed to weather the storm of lower oil prices, all while grappling with the global impacts of COVID-19.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox