Road map of a t-shaped “recession”: where are we now?

We are currently in the throes of the sharpest and largest economic downturn the modern global economy has ever seen. However, as I wrote in March this is very different from previous recessions.

To recap, a recession has three stages:

Stage 1: into recession

A rapid, record collapse in economic growth as normal economic life is dramatically curtailed for public health reasons.

Stage 2: end of recession

A rapid. record jump in economic growth as we lift public restrictions.

Stage 3: post recession

An economy trying to offset new business practices and a collapse in confidence with strong monetary and fiscal stimulus.

Where are we now?

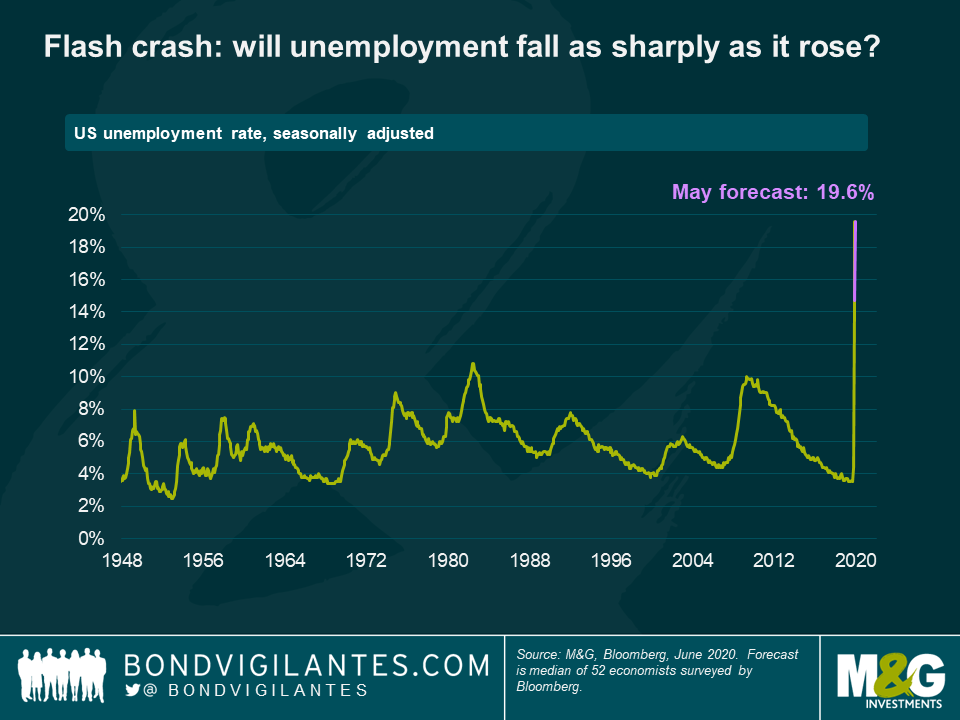

Economic growth has plunged, unemployment has soared, and we are now at an inflection point, at which growth will now be rebounding and then eventually settling on a relatively (to 2020) stable course: as I wrote in my last blog, a Flash Crash t-shaped recession.

Unlike previous recessions, we can understand and explain the timing of stages 1 and 2, as they are a direct result of a simple government policy. Unlike previous recessions, stage 3 will be outside of normal textbook thinking. Indeed, according to textbook economics, are we actually going to have a recession? Bizarrely, the Flash Crash in economic growth means that, from one point of view, this collapse in economic growth may not even be defined as a recession.

The widely-accepted definition of recession is two successive quarters of negative GDP growth. Based on calendar quarters, we will meet the recession criteria easily in 2020, with negative growth in the first and second quarter. If I were to be especially pedantic however, on a rolling quarterly basis the recession definition will simply not have been met. If we assume that full lockdown started on the 1st of March and ends on the 31st of May, then we will have the first negative quarter of growth we need over this three-month time frame. However, we know that the subsequent quarter, from 1st June till the end of August, will be one of record economic growth. Therefore, on a rolling basis, we will not have generated a recession by the end of August. Given the rapid collapse-and-bounce-back nature of this economic slowdown, should it be defined as a recession at all?

Returning to my original blog, this is why the collapse and recovery looks like a t. It is clear that total economic output will be lower at the end of August than the start of the year, with huge consequences. The question for 2020 and beyond is: how high is the bounce to where we draw the horizontal line of the t?

Governments and fiscal authorities around the world have thrown a record amount of fiscal and monetary response at the problem in an exceptionally short time frame. To modify a famous phrase, the authorities’ job has not been to take the jug of alcohol away from the party, but to facilitate one almighty happy hour. While this hair of the dog policy will not fully cure the hangover, the question is: how much will it cure it? This is where we come back to stage 3.

Fiscal and monetary authorities will understandably want to return the economy to its past glories, which suggests we will see continued fiscal and monetary easing. This will conflict with virus-related changes in business practices, and the extent to which individuals’ behaviour (consumer confidence) is altered by this year’s experience. The authorities will continue providing the stimulus antidote to the lockdown programme, fighting against the progress (or hopefully lack of progress) of the virus, and the damage done by such a short, sharp shock and economic downturn to business, consumers and governments.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox