Brave new world: the impact of the pandemic beyond 2021

Summary: The last year was a tumultuous one: the pandemic has resulted in significant changes to everyday life, and this has naturally led to dramatic price action in markets. We have discussed the t-shaped recession and its shorter term effects several times in the past. Here I will explore what I believe to be the most significant long term differences to the outlook in 2021 compared to how the world looked at the start of 2020.

Politics

The biggest political consequence of the pandemic was the change in the political direction of the United States. The US economy weakened dramatically in an election year and Trump went from being the favourite to suffering a narrow loss. This, combined with previous elections, has led to a dramatic shift to the policy outlook in the United States. We now have a US political system that is determined not only to spend its way out of recession, but to spend to change the long term outlook for society.

Energy

The collapse in the oil price was an understandable reaction to the collapse in the economy last year, and was particularly accentuated by the nature of lockdown and the background trend away from fossil fuels. February last year ended with a particularly disorderly OPEC meeting: the cartel had fallen apart with obvious implications for the short and long term price of oil. However, the shock to the system provided by the collapsing oil price has led to an increase in production discipline within OPEC; in fact, the collapse in price also encouraged the US administration to work hand-in-hand with OPEC to put a line under the collapsing oil price. The price shock also stymied private sector supply in the medium term as capex and exploration plans understandably were cut. We now have a more disciplined cartel, with less likely challenge from new entrants.

Central banks

Central banks have been amazingly proactive over the past year. Their actions worked substantially well in limiting the economic damage caused by the various restrictions imposed to fight the virus. The central banks have not only embarked on a cyclical response, but in my view have begun a more structural change in their raison d’être. This is best typified by the Fed, which has quietly adjusted its mandate to become more focused on employment goals than inflation targeting. This is a change being echoed by other major central banks. The central banks want to escape the zero bound so they can again have room to react in case of a future downturn – this is best achieved by creating inflation.

Eurozone

As a loosely configured federal state but with a less well-established link between government and the central bank than that of other major economic blocks, the Eurozone has more difficulty in responding to the pandemic. The main permanent change last year was the development of the centrally-funded, jointly-issued “Euro” debt issued in response to the pandemic. This jointly-guaranteed issuance, the proceeds of which will be directed to members of the union that need it, is a huge step towards confronting the fiscal transfer issue created by the political and economic development of the European Union.

Brave new world

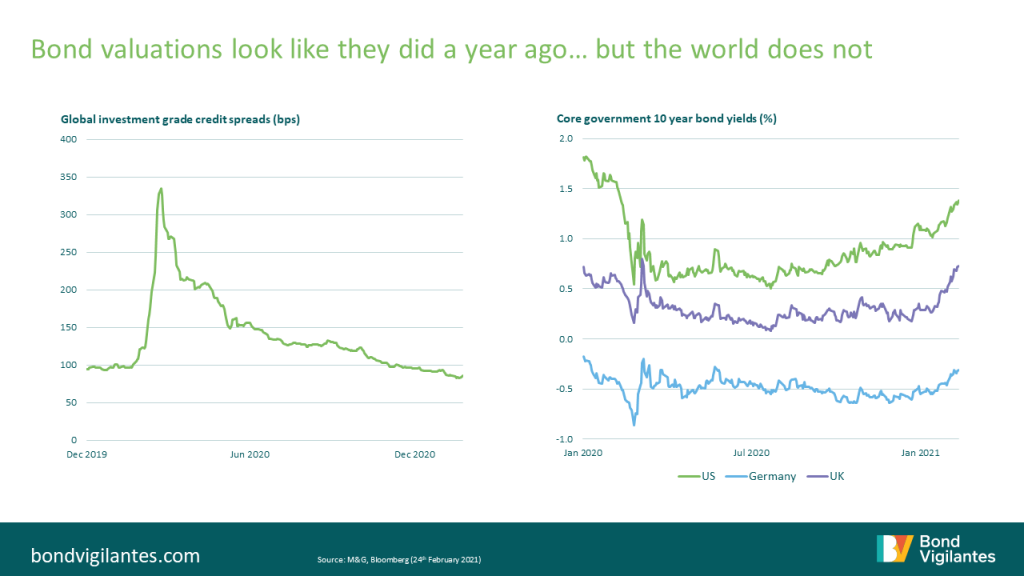

Many things are largely unchanged in the bond world compared to where we were last year: bond yields are still close to the zero bound, while global investment grade credit spreads ended 2020 almost precisely where they began. What has changed is the broad economic and political outlook. Looking beyond the huge potential economic rebound in 2021, the four major changes above all point towards structurally higher growth and higher inflation than we would have expected at the start of 2020, and to longer term changes ahead.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox