5 reasons why US inflation will remain elevated

Last week’s Consumer Price Index (CPI) report showed that inflation in the US rose by the most in over four decades. The Consumer Price Index accelerated to 8.5% in March, while core CPI was 6.5%. According to many economists, this will likely represent the peak for inflation and starting next month we should see a deceleration in the inflation rate (the “base effect” will clearly play a big role here).

While it is plausible to expect that inflation in the US has finally peaked, I don’t think it is time to get too excited about it. The year-on-year change in inflation might start to trend lower, but inflationary pressures remain very elevated and as a result, inflation won’t fall as quickly as Central Banks may think/hope.

Here are 5 examples of underling inflationary pressures which, to me, suggest inflation will likely be very sticky on the way down.

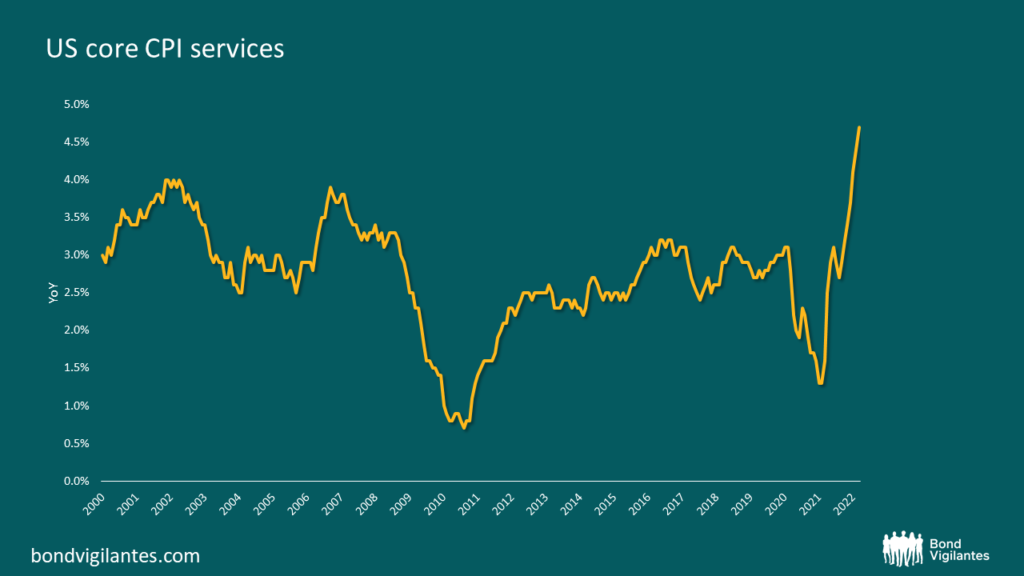

1. Core CPI services: This is the stickiest part of the CPI basket and it is still rising fast. Rents play a big role here. Due to the way rents are calculated, rent inflation acts with a lag and tends to be very sticky. As a result, rents will likely remain elevated for rest of 2022. Currently rents are growing at 5% year-on-year and given they represents c. 40% of the core CPI index (which includes both goods and services), this already gives you a 2% contribution to core inflation (i.e. in order to go back to the Fed’s inflation target we will need to see 0% inflation from all other categories. Highly unlikely!)

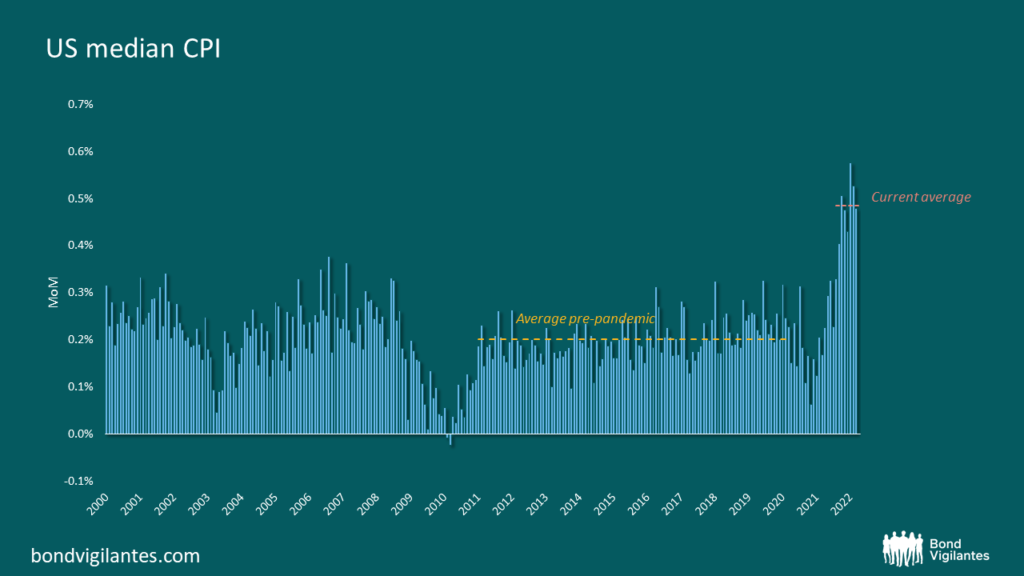

2. Median CPI: Median CPI removes the outliers and as a result is a cleaner measure to capture underlying inflation trends. Pre-Covid, month-on-month median CPI was rising at approx. 0.2%, which is consistent with annual inflation slightly above 2%. More recently, median CPI has been around 0.5% month-on-month, suggesting we have reached a new equilibrium consistent with 6% year-on-year inflation.

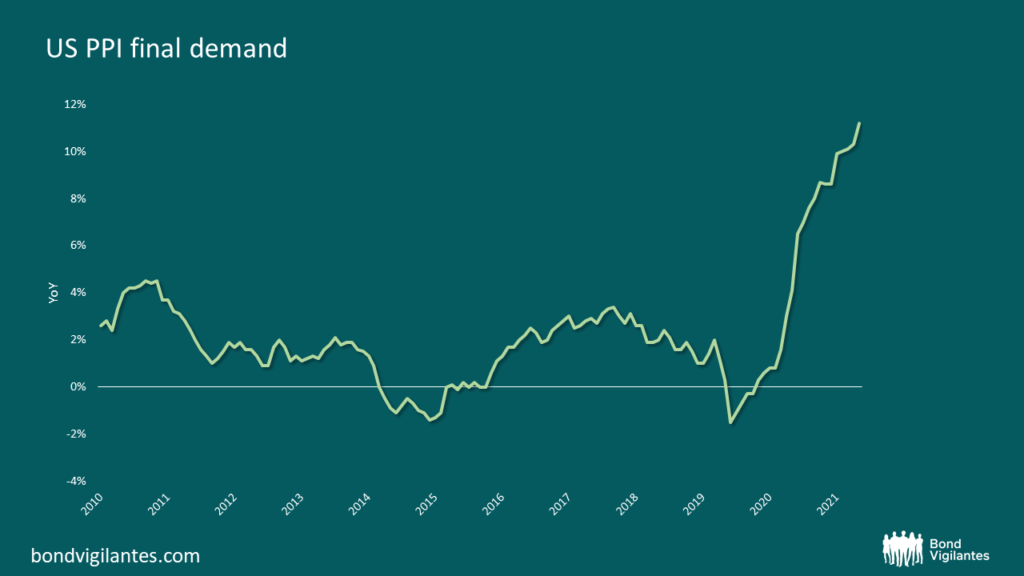

3. PPI final demand: Last week’s Producer Price Index surprised to the upside, suggesting lots more inflation is still in the pipeline.

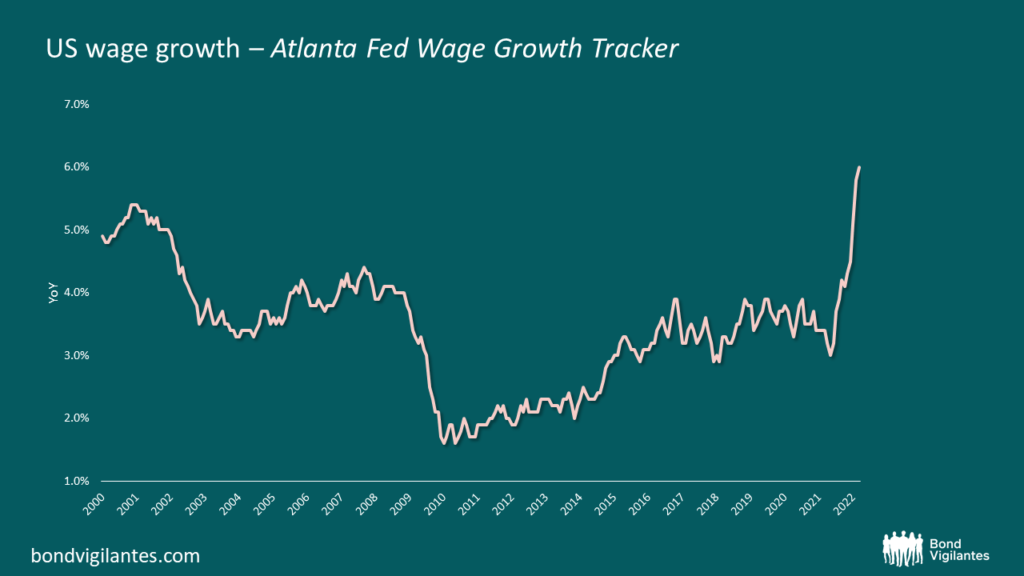

4. Wages: High inflation combined with a tight labour market is resulting in a sharp increase in wages. Higher wages tend to maintain inflation higher, as consumers have more money to spend, while companies keep rising prices to reflect the higher cost for labour.

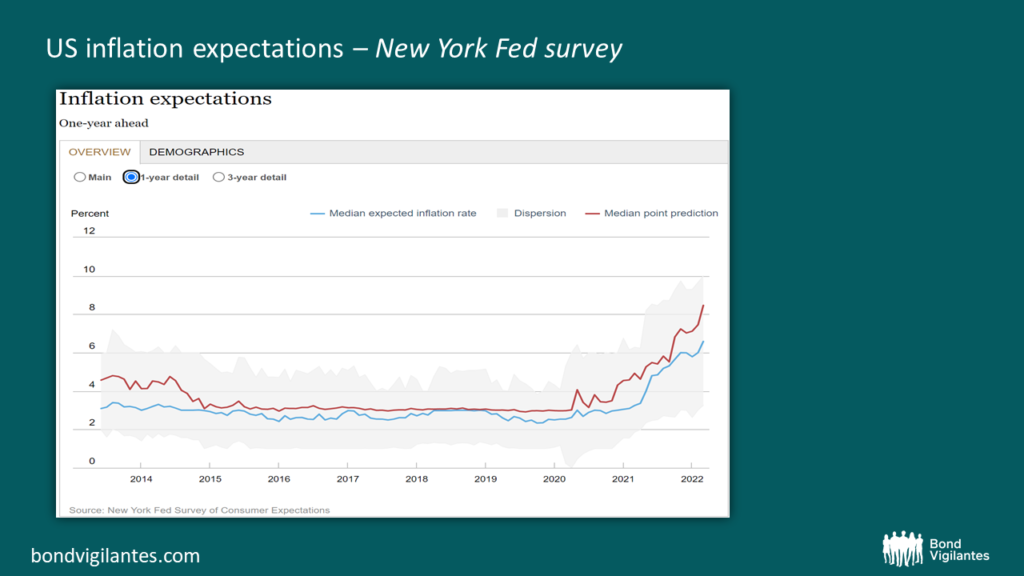

5. Inflation expectations: Households’ and firms’ expectations of future inflation can be key determinant of actual inflation. If households expect higher inflation going forward, they will ask for higher wages. If companies expect higher inflation, they will raise prices. Inflation expectations have risen significantly since mid-2021. The chart below (produced by the NY Fed) shows consumers’ inflation expectations 1 year from now – now at the highest level since the series was introduced.

The inflation genie is now out of the bottle and it is going to be very hard to put him back in. The amount of money thrown at the economy after the pandemic has resulted in a sharp increase in prices and there is nothing in the data that suggests this increase is about to quickly reverse. Inflationary pressures remain elevated and while it is possible that inflation has finally peaked, we should not expect a swift return to normality. Inflation is now embedded in the system and we will likely reach a new equilibrium, which in my view, is well above where Central Banks are currently targeting. Clearly Central Banks have the tools to control inflation and bring it back to target, but using those tools will likely result in a recession, something Central Banks are not keen to engineer.

Inflation has probably peaked, but inflationary pressures are still high and Central Banks are taking baby steps to fight the inflation genie. Don’t expect a swift return to normality.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.