The 2000s were the slowest decade of population growth in the US since the Great Depression. The first set of state population counts for 2011 revealed that there has been no change to this trend. The US experienced the lowest annual population growth rate in 2010-11 since 1945.

William H. Frey concludes that the weak labour market in the US appears to have slowed down immigration to the US and to have led to a decline in birth rates. What is more, the baby boomers have passed their prime years for childbearing, affecting the natural increase of population. He has also observed a slow down of internal migration within the US as a consequence of fewer job opportunities across the country. Furthermore, the housing sector in the US is still under water. It remains difficult for a large share of the population to sell houses and raise capital. That makes it unaffordable for many Americans to pursue job opportunities elsewhere in the country.

What could follow economically from this demographic trend? Lower population growth will lead to an increase in the dependency ratio. More people will live on state pensions, and government spending on health care will increase. At the same time fewer workers will pay taxes and, consequently, negatively affect government revenues. The talent pool of skilled workers will shrink which might decrease economic competitiveness. Companies might have to pay higher wages due to lesser competition in the labour market. In the end, it could incentivise companies to look into outsourcing production or relocating business, which would also decrease government revenues.

It is fair to say though that this demographic trend of lower population growth might turn out to be only a relatively short episode in US history, just like after the Great Depression. The US economy might also prove to be able to maintain its high level of competitiveness and to continue to sufficiently attract talent as well as to improve productivity.

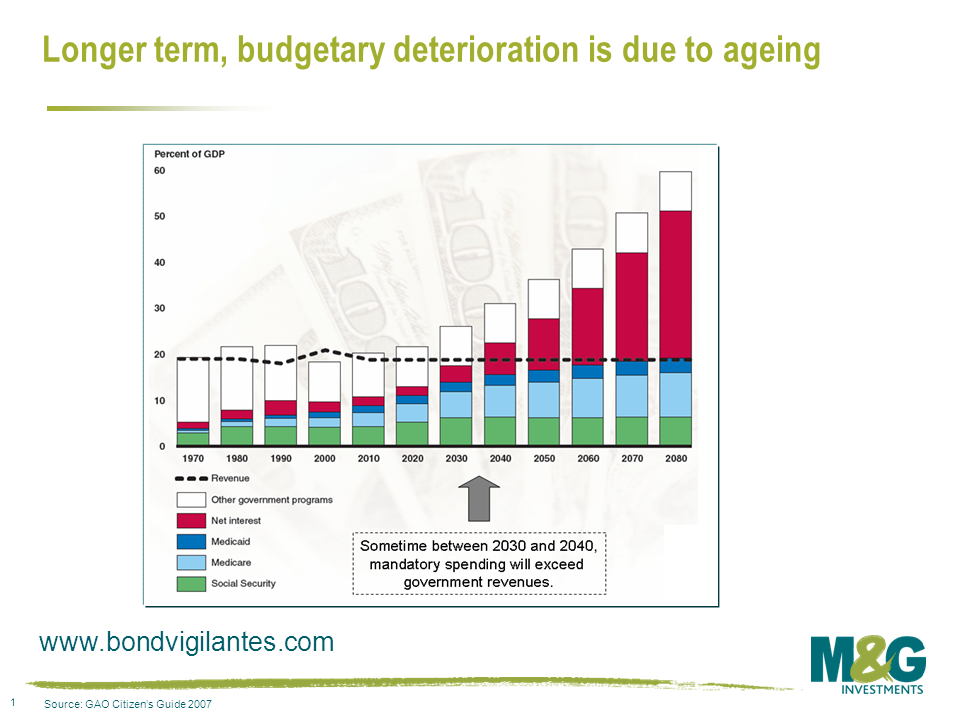

If not, government spending and/or tax benefits might need to be increased to support the economy and to maintain the current standard of living. Costs for social security and healthcare will inflate significantly at the same time. The negative impact on the US debt dynamics is striking. According to an estimate from 2007 that was available to us, mandatory spending composed of contributions to Medicare, Medicaid and social security as well interest payments will exceed government revenues between 2030 and 2040. This estimate stems from a time before the financial and sovereign debt crises corrupted US politics as well as the economic prospects of many US citizens.

What we also have to bear in mind is that potential GDP growth is traditionally considered being a function of population growth and productivity growth. I leave it open for debate how likely it is that future productivity growth will offset the lower population growth. In a gloomy scenario, lower population growth could prove to be not only the consequence of economic struggle, but also its future catalyst.

When I listen to my colleagues or read the English papers, the general consensus is that the Germans don’t like the Euro and don’t want to fund Greece’s bail-outs anymore. Whilst you can hardly argue against this overall impression of German public opinion, the feed-through from that to the German political landscape hasn’t necessarily reflected that popular view. In Finland and the Netherlands, Eurosceptic sentiment has created opportunities for increased political mandates for populist right-wing parties which emphasise national interests over the European “project”. But that hasn’t been the German electoral trend.

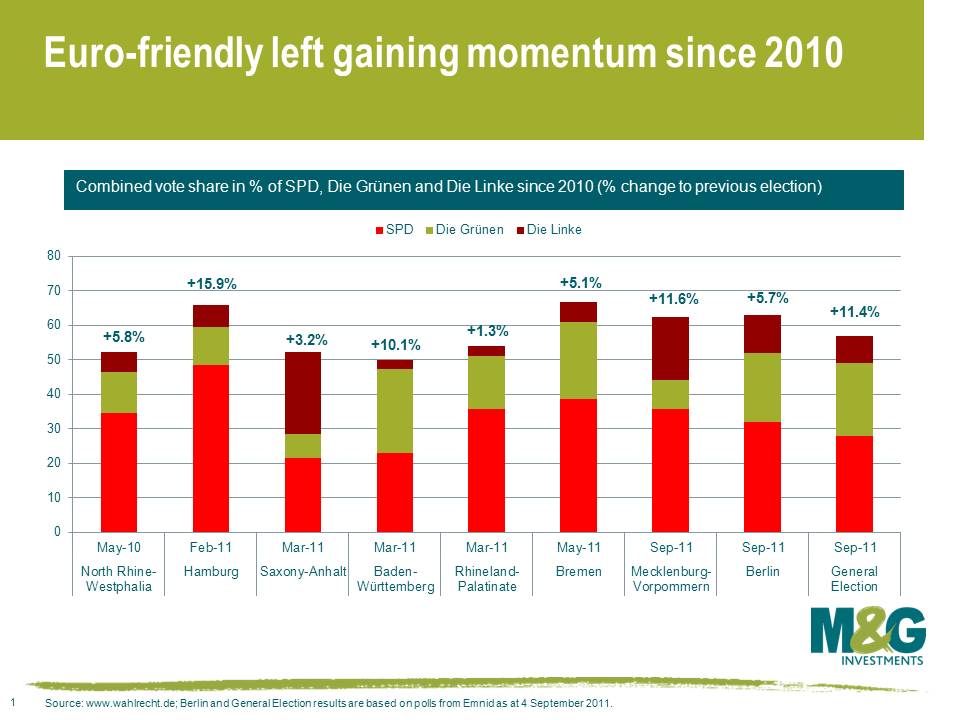

The German federal state election results since 2010 reveal that German voters have made a considerable move to the left. In the chart below, we combined the vote share of the three main parties on the left of the political centre – Sozialdemokratische Partei Deutschlands (SPD), Die Grünen (Green Party) and Die Linke (The Left) – and added recent poll results for the Berlin election (18 September) and the general election trend. The combined vote share of these parties is in all elections above 50%, and even above 60% in Hamburg, Bremen, Mecklenburg-Vorpommern and Berlin. This signifies a clear shift in political sentiment, as the comparison with the previous election results shows.

There are three significant implications of these results. First of all, the centre-right coalition parties have lost the majority in Germany’s upper house (“Bundesrat”). That is, this body will have to achieve compromise across party lines until the next major federal state elections which are not due before 2013. As the Bundesrat is meant to vote on legislation regarding European Union affairs, it is not difficult to see that recent complaints about too little involvement in the EFSF reforms will lead to more consultation with the Social Democrats and the Greens. Given the coalition government’s recent struggle to find a common position in the Euro crisis, this might not reassure the markets of a strong and clearly unified German position.

Secondly, if voters were aiming at a strengthening of Eurosceptic voices, they will be disappointed in the future. The Social Democrats and the Greens tend to be in favour of European integration and were both strong supporters of the Euro when they were in government. Even The Left, who are less enthusiastic about the Eurozone, don’t fundamentally challenge Germany’s membership.

Finally, we should keep this recent electoral trend and those two implications in mind when we are debating whether Germany is going to leave the Eurozone or going to chuck anyone else out of the inner circle. I get the feeling that the pro-Euro political powerbase in Germany is often underestimated abroad.

On Monday Warren Buffett stated “our leaders have asked for ‘shared sacrifice'”. But when they did the asking, they spared me….whilst most Americans struggle to make ends meet, we mega-rich continue to get our extraordinary tax breaks.” (click here for the NY Times op-ed).

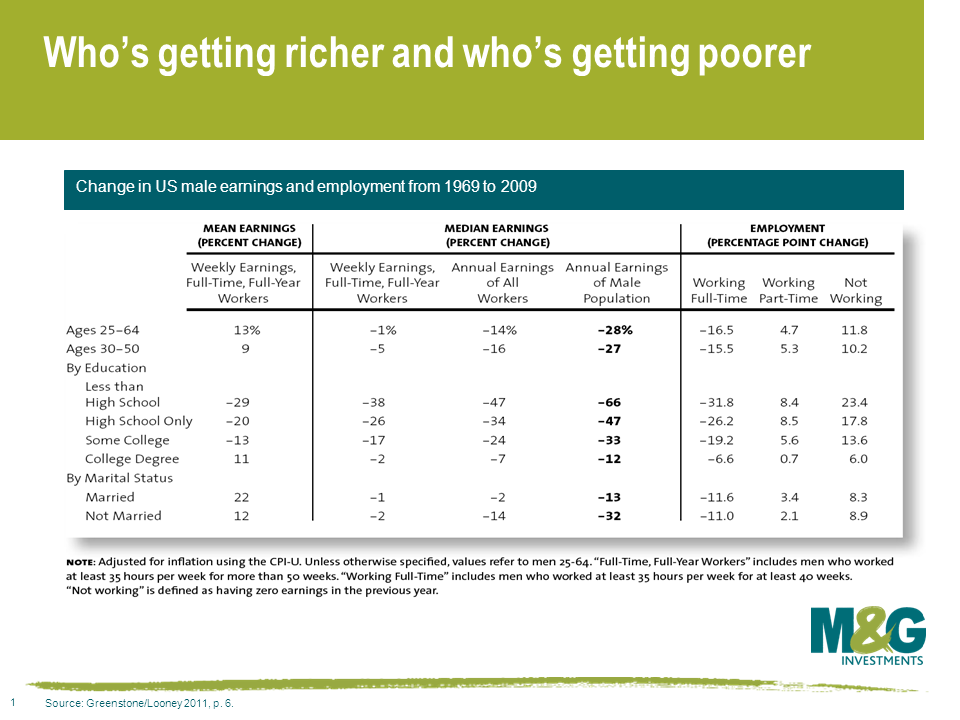

We’d just been looking at the chart below, so the timing of his commentary was good. Whilst mean US male weekly earnings are up 13% in inflation adjusted terms since 1969, this is highly skewed by high earners getting a disproportionate share of the economic gains of capitalism (and government intervention in capitalism!). The median, which measures the middle person in the distribution, has actually fallen by 28% over the same period. At the same time full time employment has fallen by 16.5% for men.

This lack of burden share is also well illustrated by Stephen von Worley’s breakdown of the relative U.S. income tax burden over time. Three observations are striking in this context. First, the tax burden was comparatively high in the 1950s and 1960s when the U.S. public debt stayed flat at relatively low levels. Secondly, the Bush administration lowered the tax burden across income levels at a time when the federal debt level had already been at historically high levels. We know how the story has continued. Finally, Buffett and his peers benefitted disproportionately from the Bush administration’s fiscal policy.

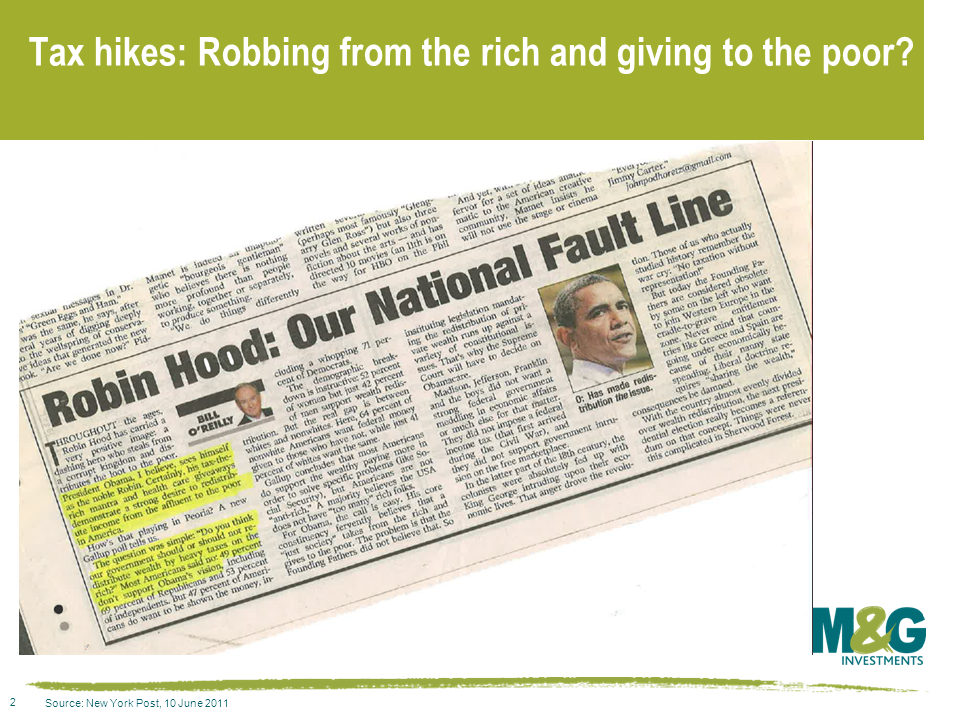

Interestingly, Jim tore out this newspaper article from the New York Post last time he was in the States. The commentator, Bill O’Reilly is famously right wing, and tries to avoid the real, and obvious conclusions of the survey – whilst it’s true that 49% said “no” to the question “do you think our government should redistribute wealth by heavy taxes on the rich?” (a fairly biased question to start with), 47% said “yes, heavy taxes please”. It makes the Republican’s refusal to even consider tax rises as part of the disastrous debt ceiling negotiations look not just suicidal from a credit rating standpoint, but even undemocratic.