Anthony Doyle’s Panoramic Outlook

The yield-dampeners – will interest rates inevitably rise when QE ends?

Speak to the majority of investment strategists and economists in the world today and most will tell you that now is not the time to buy fixed income assets, particularly government bonds. Most will point to the low level of interest rates, suggesting that bond yields can only go one way and that is up. After the ‘taper tantrum’ of 2013, many predict that the catalyst for a sell-off in fixed income assets could be the end of quantitative easing (QE) by the US Federal Reserve (Fed). At the current pace of tapering, the Fed’s QE experiment is due to cease in October this year.

In this latest issue of our Panoramic Outlook series, I present an alternative view to the consensus thinking that interest rates must inevitably rise. To do this, I investigate a number of dynamics in fixed income markets that have surprised investors during this period of extraordinary monetary policy. There are a number of possible reasons to suggest that the market may not see a material increase in bond yields when the Fed finishes QE. Firstly, given the fragility of the global economic recovery and high level of debt in the US economy, it is unlikely that interest rates will return to pre-crisis levels, limiting the potential downside to fixed income assets. Secondly, there are some powerful structural deflationary forces which are helping to keep inflation low. Finally, a strong technical factor – the global savings glut – is likely to remain supportive to fixed income assets as is firm demand from large institutional pension funds and central banks.

The current state of play

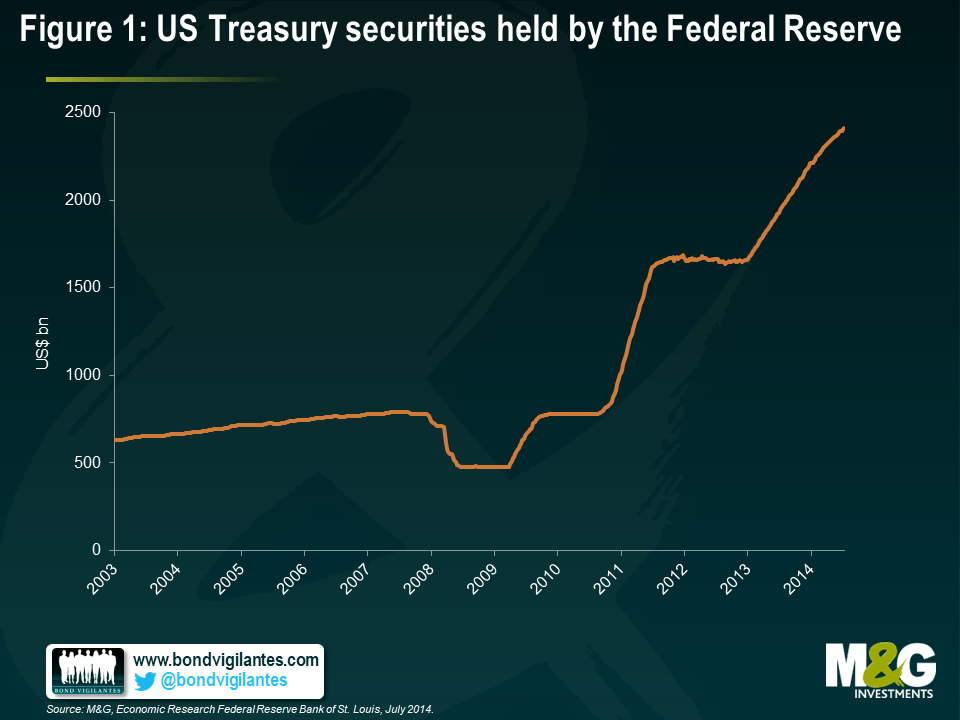

Over the course of 2014, Fed Chair Janet Yellen and the Federal Open Market Committee (FOMC) have continued to slow the pace of its large-scale asset-purchase programme. The four rounds of QE have undeniably had an impact on bond yields, with the Bank of International Settlements estimating1 that the five-year forward 10-year rate is around 90-115 basis points lower than it would otherwise be. Today, the Fed owns around $2.4 trillion of US government debt, as shown in figure 1.

The question that markets are grappling with right now is what will happen when this huge source of demand for US Treasuries, namely the US Federal Reserve, steps away from the market?

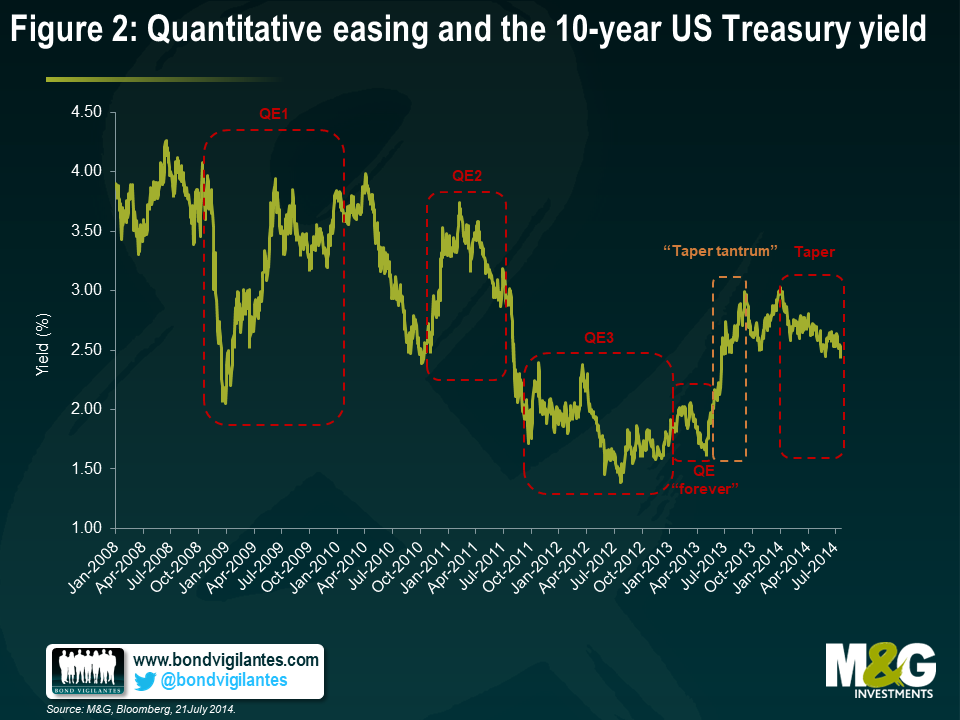

Looking at the past behaviour of 10-year US Treasury yields does not provide great insight into the future path of yields. For example, as shown in figure 2, the 10-year Treasury yield fell by around 175 basis points during QE1 before rising back up to pre-QE levels. At one point during QE2, yields increased by around 125 basis points before falling back to the 3% level. During QE3, the 10-year yield fell by around 20 basis points. In 2013, markets threw a ‘taper tantrum’ following the then-Fed Chairman Ben Bernanke’s testimony to Congress and yields increased by over 100 basis points. This year, as the Fed has gradually reduced asset purchases, yields have actually fallen by around 50 basis points. It is too simplistic to suggest that the behaviour of bond prices is simply a function of whether the Fed is doing QE or not. There must be other forces at work in the bond market.

Government bond yields – lower for longer?

It is a valuable exercise to attempt to identify the other forces at play in the US government bond market. Could government bond yields possibly stay lower for longer, continuing to surprise the consensus?

As the world’s largest and deepest government bond market, US Treasuries represent the risk-free rate of return. That is, the interest an investor would expect from an absolutely risk-free investment over a period of time. The risk-free rate acts as an anchor for other fixed income assets such as investment grade and high yield corporate bonds. At this point in the economic and credit cycle, there appears to be what I call three key yield-dampening forces (or ‘yield-dampeners’) at work that investors should be aware of.

Yield-dampener 1: the Fed funds rate will remain at a low level for a long time to come

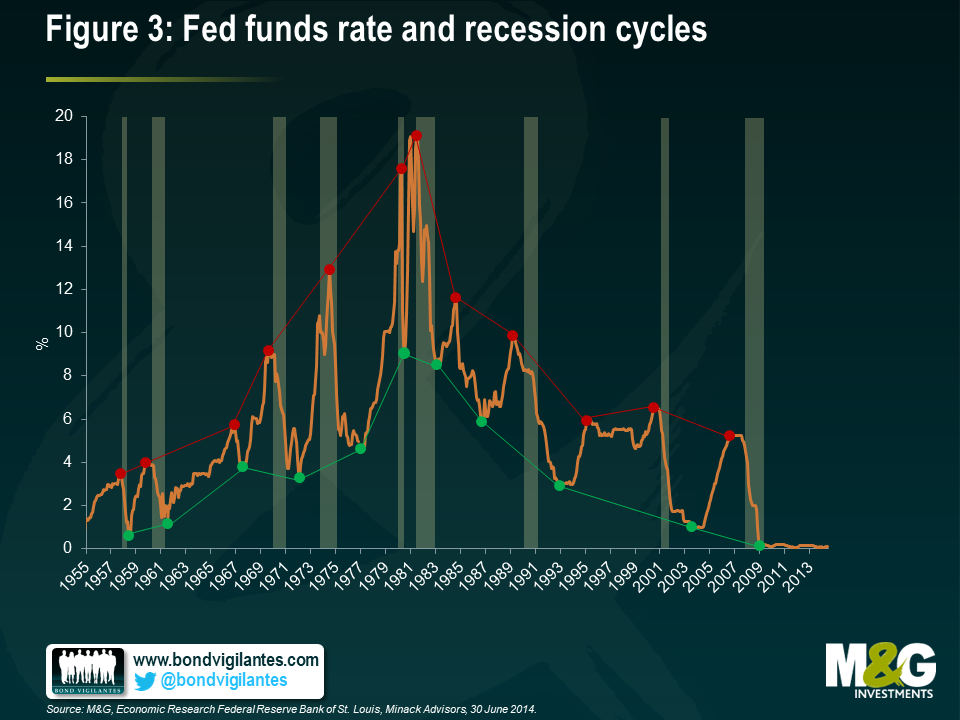

Nominal US interest rate cycles have exhibited progressively lower peaks and troughs over the past 30 years (see figure 3). There are a number of reasons for this. Firstly, declining inflation was an important contributor to the fall in interest rates. Secondly, the move to make central banks independent of their respective governments was a significant step in achieving credibility. Thirdly, the adoption of an inflation-targeting or price stability approach to monetary policy was also important in anchoring inflation expectations for both consumers and the market.

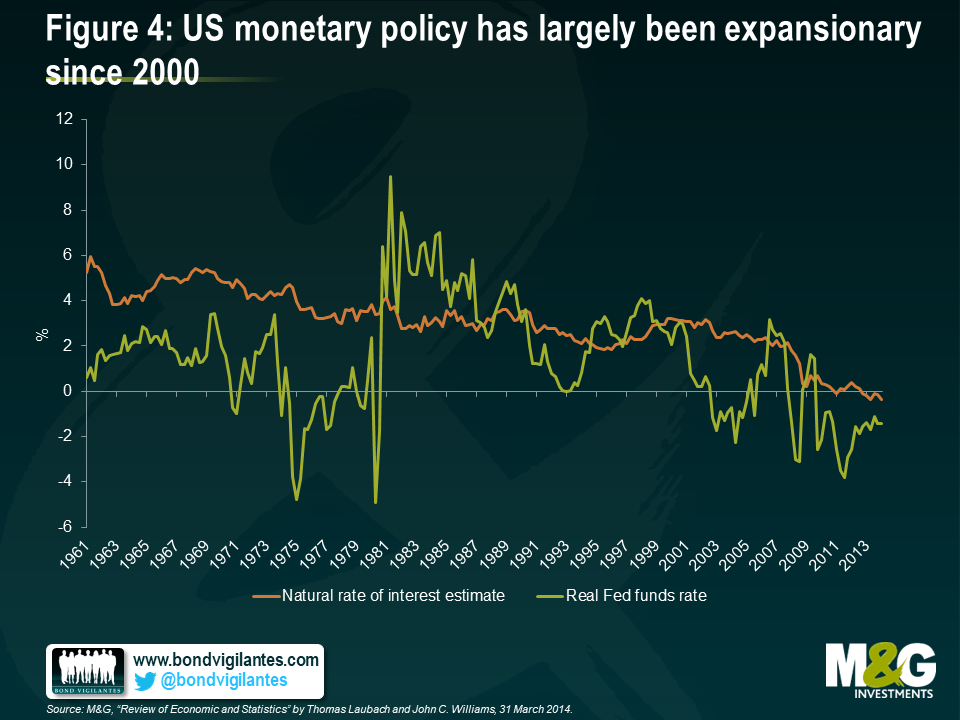

The most important insight we can gain about the Fed funds rate is whether it is helping to stimulate or restrict economic growth. Broadly speaking, monetary policy can be seen as expansionary if the policy rate is below the natural rate of interest (the rate consistent with output being at its potential), with the gap between the rates measuring the extent of the policy stimulus.

The problem for economists is that the natural rate of interest is unobservable, but it can be tracked with a model2 that identifies the interest rate that would prevail when output is at its potential. Using a model developed by economists at the US Federal Reserve, a current estimate of the natural rate of interest is just -0.4% (see figure 4). The estimate has largely trended lower since the 1960s. Apart from a couple of brief periods over the past 15 years, the real interest rate has been below the natural rate of interest, indicating an expansionary setting of monetary policy. This has encouraged the build-up of debt and risk-taking behaviour.

Nominal US rate cycles have moderated over time as leverage has grown within the US economy. This will likely continue for the current cycle, suggesting a much lower peak in interest rates than experienced during previous tightening cycles. The high levels of leverage mean that it will require fewer and more gradual rate hikes to dampen economic activity. As a result, the Fed will not have to step on the brakes as hard as it used to in order to slow down the economy and guard against inflation. The world is addicted to low interest rates, meaning that rate cycles over the next decade could consist of fewer rate hikes.

Think of an elite marathon runner in his prime. He would inevitably have a low level of body fat compared with the average person. In retirement, given the lower levels of physical activity and less focus on diet, our marathon runner puts on weight (a lot of weight). With the lack of training and increase in body size, the runner inevitably slows down and cannot compete at the same level that he used to.

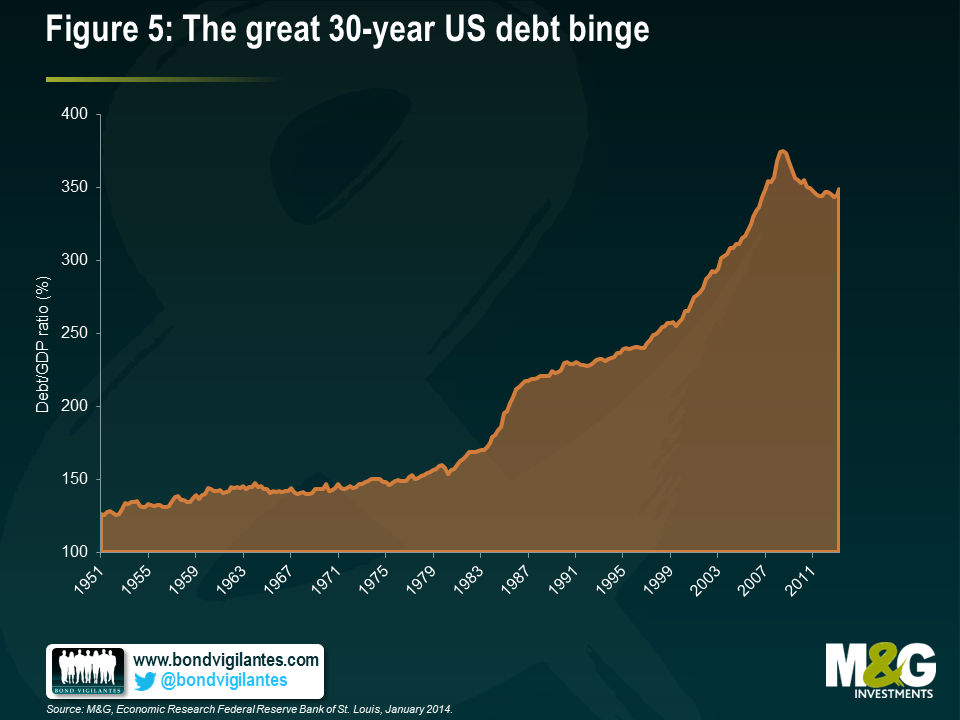

This analogy is useful in describing the US debt binge at all levels of the economy – households, corporates, banks and government. Total debt to GDP stands at around 350% as shown in figure 5. For more than a generation, governments, consumers and companies were able to borrow with impunity, knowing that persistent inflation would inflate away their debts. Today, not only are these economic agents trying to fight their way out of this debt morass, deflation could increase the real value of what they owe. Economists call this paradox ‘debt deflation’. The US economy cannot work off the excess leverage that has built up over a period of 30 years unless interest rates remain low.

Despite some moderation in recent years, the deleveraging that has occurred in the US economy is not enough. These high levels of debt are sustainable only because interest rates are at levels not seen since the 1950s. To use our runner analogy, we would not expect our retired and overweight marathon runner to compete at the level he once used to. US companies, households, banks and even the government cannot cope in a world of much higher interest rates without the economy plunging back into recession. Interest rates and yields may rise from current levels, but they are unlikely to return to pre-crisis levels.

2Thomas Laubach and John C. Williams, Measuring the Natural Rate of Interest

Yellen has her own monetary policy rule book

Economists and markets are still getting used to having Janet Yellen as Fed Chair. Having worked in the Fed system and the White House for a combined 16 years, reviewing her long academic career and research papers can provide an interesting insight into her thoughts on the conduct of monetary policy.

Yellen has written a number of papers with her husband George Akerlof, an American economist and winner of the Nobel Prize in Economics in 2001. Yellen’s most-cited paper, “The Fair Wage – Effort Hypothesis and Unemployment”3, builds a model in which the amount of effort that a worker puts into their job depends on the difference between the wages they are getting paid against their perception of what is a ‘fair wage’. The hypothesis is that the bigger the difference, the less hard the worker works.

Another paper written with Akerlof, and perhaps the most relevant paper for monetary policy, was written in 2004. In “Stabilization Policy: A Reconsideration”4 the authors conducted a review of the existing literature, disagreeing with Milton Friedman’s view that countercyclical policy cannot affect the average level of unemployment and output. Again, Yellen has focused on the labour market, coming to the conclusion that being unemployed in a recession is worse than being unemployed when times are good. The authors conclude that “there is a solid case for stabilization policy and that there are especially strong reasons for central banks to accord it priority in the current era of low inflation”. This is a marked difference from the Alan Greenspan-led Federal Reserve, which was hesitant to raise interest rates in the face of a boom, but quick to reduce rates when the economy entered into recession.

The next paper, “Waiting for Work”5, was written in 1990, again authored with Akerlof and economist Andrew Rose, focuses on a phenomenon known as ‘lock-in’. The authors find that “workers who are laid off in a downturn rationally wait to accept jobs until business conditions improve. Workers voluntarily remain unemployed in recessions if they gain through waiting for permanently higher wages which are available in the new jobs which appear during expansions”. Yellen, Akerlof and Rose proved that workers hired in booms “lock-in” higher wages whereas workers hired in busts suffer lower wages. This partly explains why Yellen expects the participation rate to pick up in the future as workers increasingly believe the US economic recovery will last.

In Janet Yellen, the US Federal Reserve has appointed a very strong academic economist who has focused on the key economic resource of labour for a large part of her academic career. Much like Ben Bernanke who was a pre-eminent expert of the US Depression before joining the Fed and saw the economy through the dark days of the credit crisis, it appears that Janet Yellen might be in the right place at the right time to lead the FOMC. In terms of the Fed’s dual mandate of price stability and full employment – provided inflation behaves – Yellen will likely prefer to keep monetary policy accommodative. This was highlighted in Yellen’s most recent Congress Testimony, where she stated “My own expectation is that, as the labour market begins to tighten, we will see wage growth pick up, some to the point where nominal wages are rising more rapidly than inflation, so households are getting a real increase in their take home pay. If we were to fail to see that, frankly, I would worry about downside risk to consumer spending.”

Arguably there are now three key economic indicators to watch. Inflation, unemployment and wage growth. Without wage growth, it is unlikely that Chair Yellen would be calling for a rate hike any time soon. The FOMC has a new monetary policy rule book.

3Akerlof, George A and Yellen, Janet L, The Fair Wage-Effort Hypothesis and Unemployment. The Quarterly Journal of Economics, May 1990.

http://www.jstor.org/discover/10.2307/2937787?uid=3738032&uid=2&uid=4&sid=21104376303467

5Akerlof, George A, Rose, Andrew K and Yellen, Janet L, Waiting for Work. NBER Working Paper Series, June 1990.

http://www.nber.org/papers/w3385.pdf

Yield dampener 2: weak economic data and structural deflationary forces

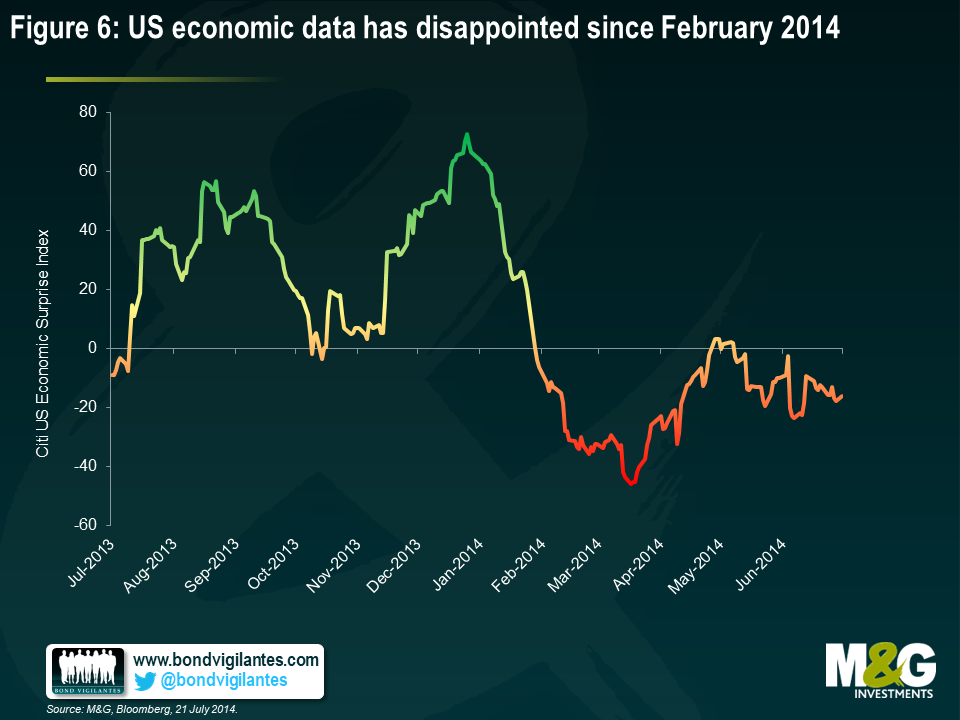

Arguably, the greatest force causing rising bond prices has been a falling inflation premium that investors place on owning government debt. The performance of long-dated government bonds this year suggests that buyers believe inflation will remain at current levels (or lower) for a long time to come. This is to be expected given that the economic data has largely underwhelmed economists’ forecasts since February, as shown in figure 6. The Fed has continually stated that the pace of monetary policy tightening is data dependent. Many have blamed poor weather for the run of weak data but it seems that the Fed is justified in its dovish stance for now.

When determining the inflation outlook, it is important to acknowledge that there may be structural deflationary forces at play in the global economy. These include debt deleveraging, globalisation and technological advances that result in large productivity gains. Given these structural forces, there is a strong case for examining the Japanese fixed income experience as it may provide some insight into the future behaviour of G7 bond yields.. See The ‘Japanification’ of Government Bond Markets for further insight.

The ‘Japanification’ of government bond markets

Back in the late 1980s, Japan was a shining example for the rest of the world in the eyes of many economists. Most saw a clear edge in Japan’s competitiveness relative to the US across a broad range of high-tech and manufacturing mass-produced tradable goods. Japan had recovered from the devastation of World War II and its economy was producing year after year of solid growth.

At the time it was argued that the Japanese work ethic was far superior to that of the West. This would likely lead to substantial benefits in labour productivity. In addition, Japan’s high savings rate and slow population growth would give the economy an edge in an increasingly globalised world. Of course, Japan’s proximity to China and the Far East would give it access to a vast pool of workers to which it could outsource lowly skilled and low-paid jobs. This would allow the Japanese economy to specialise and benefit from its large pool of highly educated workers.

Unfortunately for the Japanese economy, the reality turned out differently from the confident forecasts. Today, the economy is around 40% smaller than observers predicted back in the late 1980s, having grown at a very slow pace over the last two decades. Japanese individuals and companies have spent much of the past 30 years working off the debt that they accumulated during the 80s. Banks saddled with bad debts refused to lend, preferring instead to buy Japanese government bonds.

Recognising the economic malaise, the government offered new stimulus plans through higher public spending, although with little impact on the real economy. This resulted in government debt-to-GDP ratio increasing from around 70% in the late 80s to over 200% today. The central bank eventually chipped in as well, reducing interest rates to zero and implementing QE in 2001.

So what are the lessons that fixed income investors can learn from the Japanese experience?

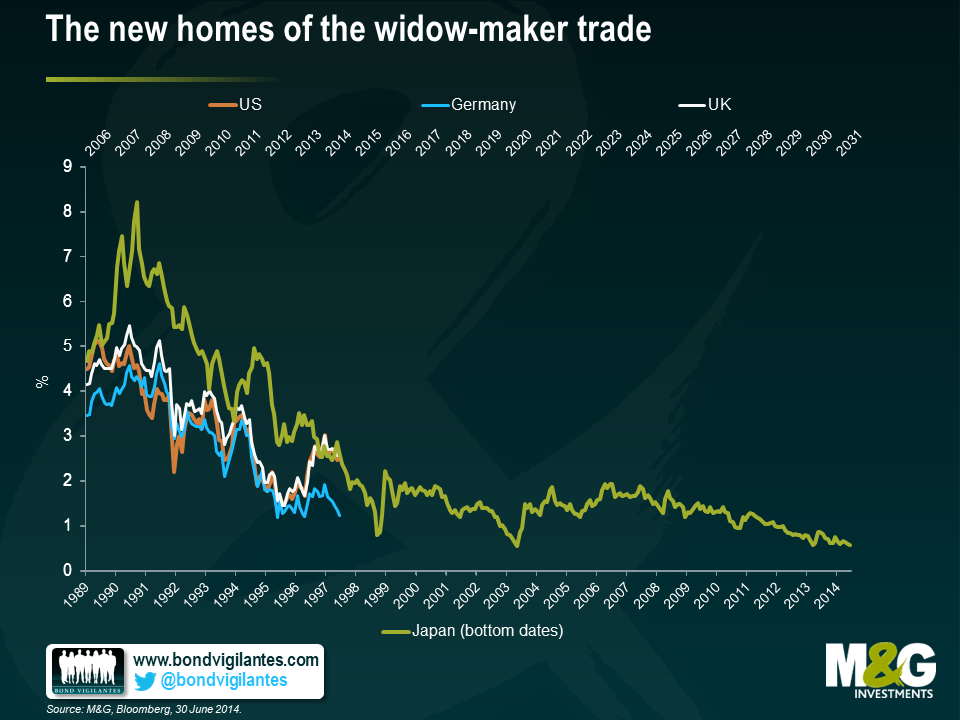

For investors, one trade that has always lost money, over any reasonable time period, has been the shorting of Japanese government bonds (JGBs). This trade, unique in its consistency, developed its own name: “the widow maker”. Over the past 24 years, JGB yields have fallen relentlessly from a peak of around 8% in 1990 to around 0.62% today. Despite the great monetary experiment of “Abenomics”, the widow maker is alive and kicking.

History might not repeat itself but it does rhyme. As shown in the accompanying chart, US, German and UK government bonds yields are following an eerily similar path to JGBs in the early 90s. The question has to be asked: is shorting developed market government bonds the new widow-maker trade?

Yield dampener 3: the global savings glut

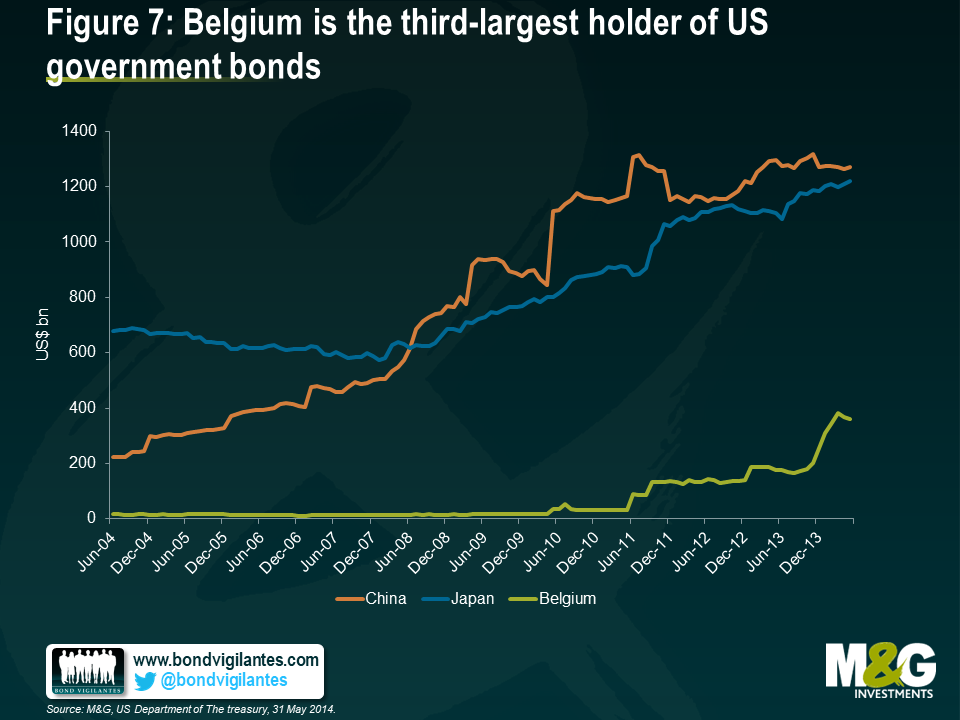

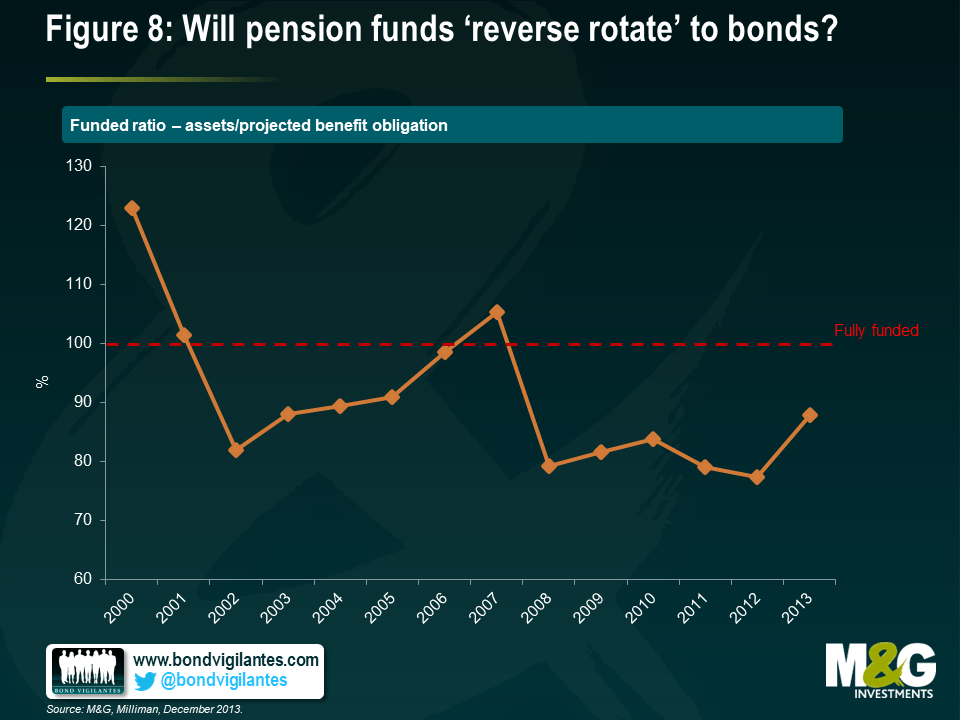

Another reason that investors are surprised by the fall in yields this year despite the reduction of Fed purchases is because of the strong ‘technical’ support for the asset class. This is often difficult to identify in advance and is much harder to measure than economic variables such as unemployment or inflation. Some of the strong technical support for US Treasuries is illustrated in figures 7 and 8.

Low yields on government debt during the last rate hiking cycle bamboozled the then-Fed Chairman Alan Greenspan. It was his successor, Ben Bernanke, who presented a plausible explanation in 2005. By his reckoning, falling government bond yields and the inverse yield curve was being caused by a ‘global savings glut’.

Bernanke proposed that a decade-long development of global savings was the result of a combination of strong technical factors. Firstly, the strong saving motive of ageing developed nations such as Germany and Japan was an important factor. Secondly, Bernanke proposed that the developing world was changing from being a net user to a net supplier of funds in international capital markets. The proceeds of war chests of foreign reserves that the emerging economies had built up in response to earlier crises were being used to buy US Treasuries and other assets.

Figure 7 represents the major foreign holders of US Treasuries: China, Japan and Belgium. That’s correct; Belgium – a small country with a population of 11 million – is the third-largest holder of US government bonds. However, it is highly unlikely that Belgium is buying all those bonds, and some have speculated that the increase in holdings over the past eight months reflects the secret buying trends of other countries using Brussels as a financial centre. It could be China, it could be central banks, it could be the fact that Euroclear (the custodial service provider) is based in Brussels. Or it could be none of the above. What we do know, is that demand for US Treasuries has accelerated in 2014. The global savings glut has not disappeared.

Another strong tailwind for fixed income markets is blowing due to the fact that both equities and fixed income assets have had such a great run over the past couple of years. Both public and private pension plans are now better funded and are increasingly looking to lock in their gains before volatility begins to pick up again.

The managers of defined benefit schemes would like to lead a cautious life. It is vitally important that they make enough money to honour the promises they have made to their employees. For this reason, their allocation to safer assets – like fixed income – has historically been quite high.

Many schemes were over-funded around the start of the millennium, meaning defined benefit managers could sleep well at night. This changed after the financial crisis in 2008, when the returns of the equity allocation of many funds nose-dived into negative territory. The memories of that episode have remained fresh, with many managers vowing to de-risk their portfolios if they ever got back to fully-funded status.

Fortunately for the employees of the biggest companies in the US, many pension schemes are now clawing their way back to being 100% funded (see figure 8). The Milliman 100 Pension Funding Index – which represents the funded status of the 100 largest corporate defined benefit funds in the US (around $1.5 trillion of assets) – showed that the funded ratio rose to 87.3% at the end of 2013 from 77.3% a year earlier, representing a deficit of $193 billion. The increase in the funded ratio during 2013 was the largest percentage gain ever experienced in the 14-year history of the Milliman survey.

We would expect that as pension plans get ever closer to being fully funded, pension managers will continue to ‘reverse rotate’ out of equities and into fixed income and focus on liability-driven investing strategies to ensure future payments are met.

Will government bond yields move higher from current levels or will the “yield-dampeners” limit the damage?

It appears that the question of where yields move from current levels is more complex than first meets the eye. This reflects the uncertain and experimental nature of unconventional monetary policy such as QE programmes. Given this uncertainty, it is a useful exercise to question the market consensus that yields must rise.

It is very much possible that those looking for yields to rise back to pre-crisis levels when QE ends may be disappointed. Be wary of the yield-dampening forces at play in the US treasury market. In addition, the ‘yield-dampeners’ could easily be applied to the UK or European government bond markets, potentially providing a useful lesson for the future path of yields. This will impact the attractiveness of other fixed income assets such as investment grade and high yield corporate bonds. Arguably, ultra-low cash rates and a stable interest rate environment for government bonds would provide a solid base for corporate bond markets as investors continue to seek positive real returns on their investments.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox