A vintage year for high yield issuance?

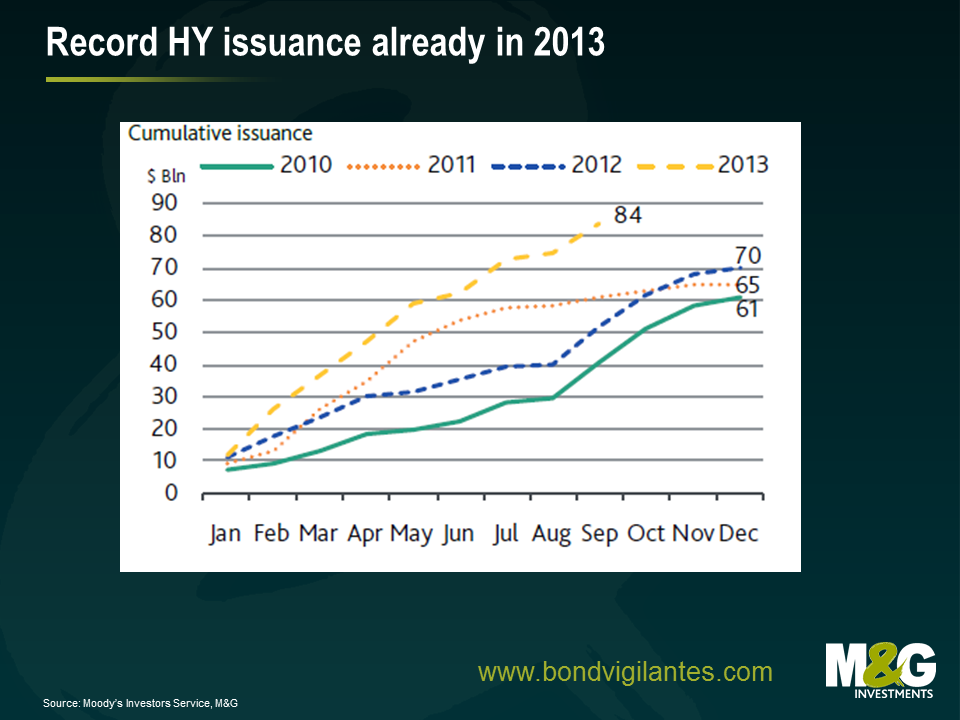

Much like fine wines, we believe that the year in which a bond is issued is an important factor in shaping its inherent character. The right climate in the markets, like the right weather conditions in the Gironde, can influence the nature of a security for better or for worse. 2013 is already a record year for the new high yield issuance in Europe (see the chart below). But will 2013 be one of the great vintages, or will investors just end up with a bad taste in their mouth and a nasty hangover?

First of all, let us consider the conditions in which the current crop of deals has been grown. By and large, it’s been fairly benign this year. With a brief hiccup in the summer, the market has enjoyed promises of excess liquidity from all the major central banks, the Eurozone has shown the first green shoots of stabilisation and default rates have remained low. Happy days then? For issuers and their investment bank advisers, yes, but for investors looking for future returns this is not the case. The perfect conditions for investors to invest capital is when the storm clouds are on the horizon, there is the sniff of panic in the air and only the juiciest of yields from the highest quality issuers can tempt people to part with their cash. In these times, the power rests with the buyers and the risk premiums extracted can be very attractive.

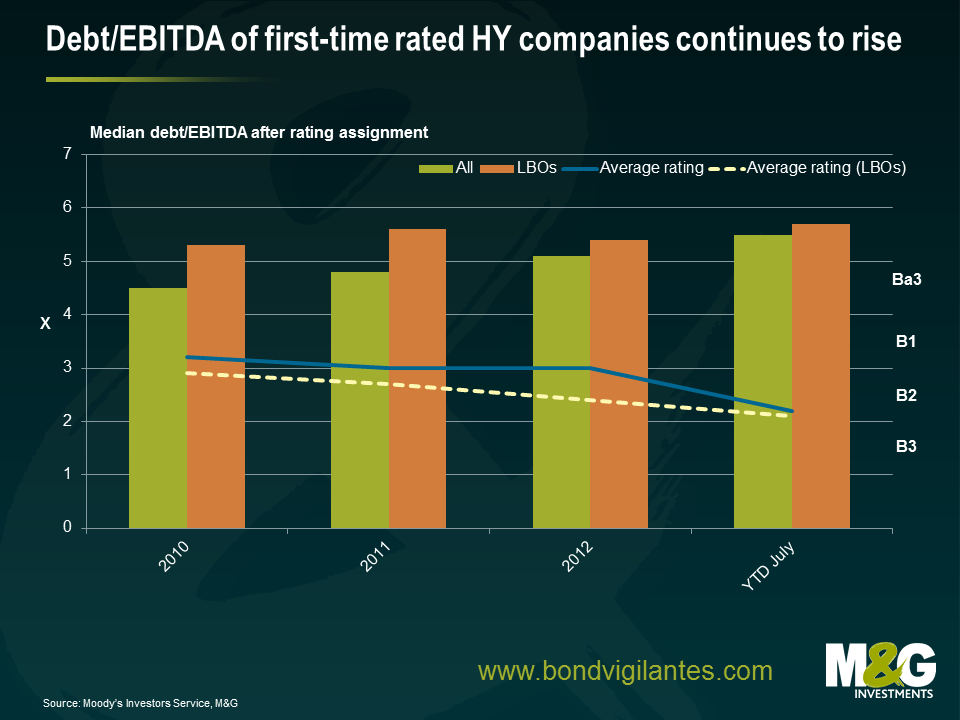

In contrast, we can see from the chart below that in today’s sunny climes a) the quality of issuance has been deteriorating (measured by credit rating and leverage) b) structural features such as weaker legal covenants*, optional coupons and subordination are becoming more common and c) given the market has been strong, the coupons and hence future returns investors can expect has greatly diminished. Valuation, as always, is at the heart of it all.

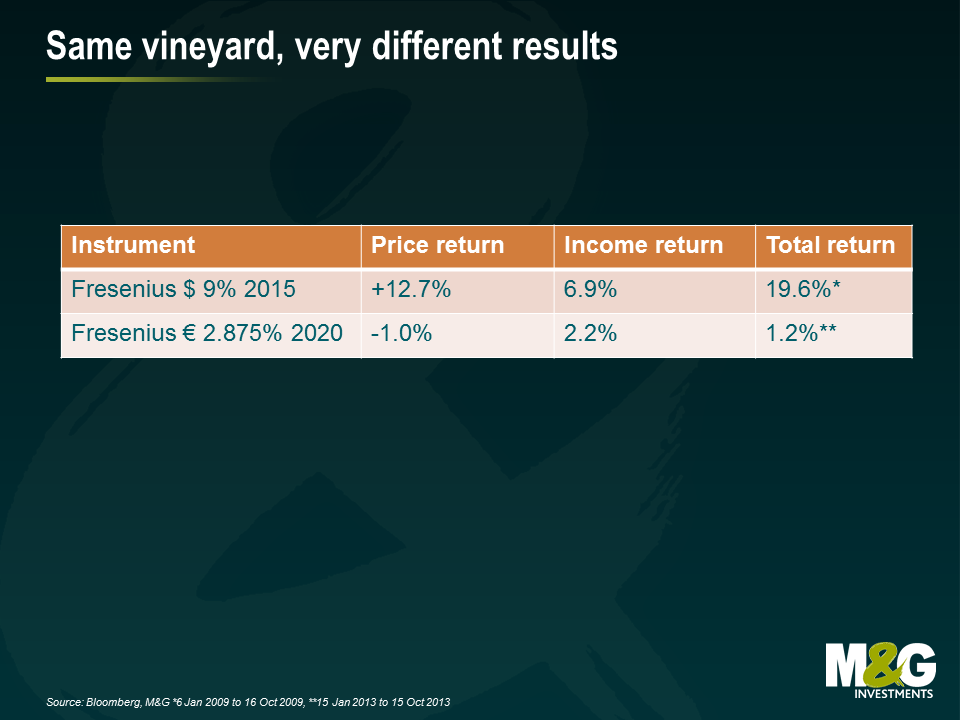

Take for instance, the respective returns experienced by two bonds issued by German healthcare provider Fresenius (one issued in 2009, the other issued in 2013). The USD 9% 2015 bond issued in the vintage year of 2009 performed admirably over the first nine months of its life. In contrast, the EUR 2.875% 2020 bond issued in January 2013 has been far less fruitful for investors. Products of the same vineyard, but with some very different results.

Of course we are not comparing like for like; 2013 is not 2009, but it illustrates the importance of market conditions and your starting point for valuations when it comes to assessing prospective returns.

There is a silver lining, however. The wave of new issuance is good for the long term development of the European high yield market. More bonds and issuers means more depth and more diversification. There is also greater scope for differentiation between different fund managers as the investment universe grows. The stock selection decision is becoming ever more important.

Nevertheless, whereas the quantity of the 2013 vintage is beyond dispute, we believe its quality is somewhat dubious. The 2013 crop is arguably more Blue Nun than grand Bordeaux.

*One new development has been the introduction of “portability”. A standard high yield covenant obliges the issuer to buy back all bonds at 101% of face value in the event the business is sold. This protects bondholders from an adverse outcome in the case of unexpected M&A. Exceptions to this are now being introduced into the legal language governing the bonds allowing issuers to be bought or sold without the obligation to redeem their bonds – allowing a so called “portable capital structure”. We do not like this dilution of bondholder rights.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox