Why aren’t bund yields negative again?

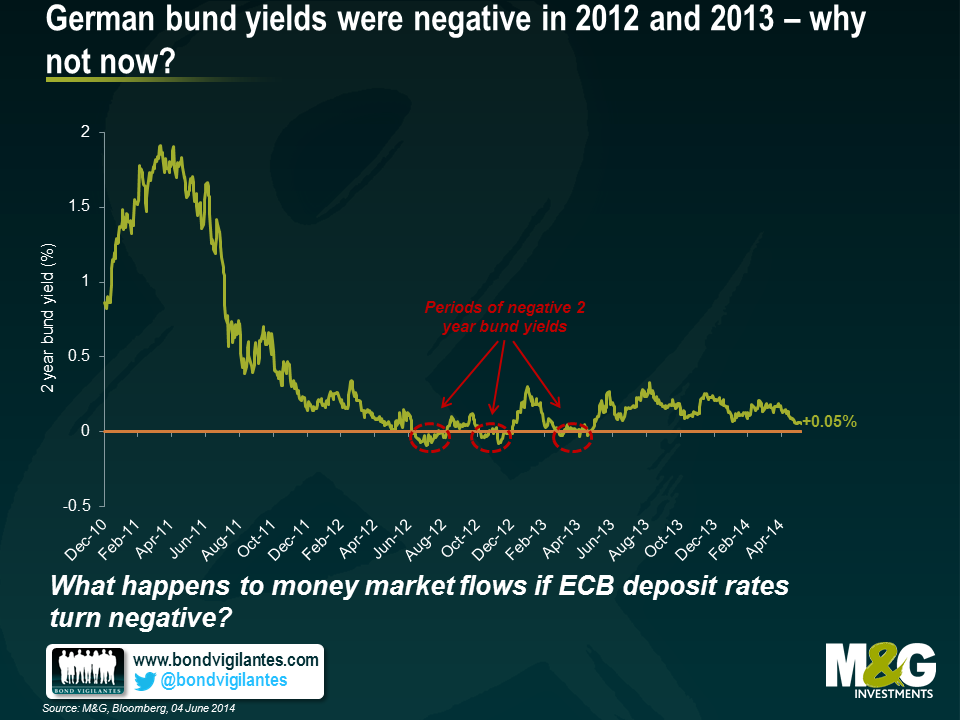

Whether or not you believe that the ECB moves to full government bond purchase quantitative easing this week (and the market overwhelmingly says that it’s only a remote possibility) the fact that German bund yields at the 2 year maturity remain positive is a bit surprising. The 2 year bund currently yields 0.05%, lower than the 0.2% it started the year at, but higher than you might have expected given that a) they have traded at negative yields in 2012 and 2013 and b) that the market’s most likely expected outcome for Thursday’s meeting is for a cut in the ECB’s deposit rate to a negative level.

The chart below shows that in the second half of 2012, and again in the middle of 2013, the 2 year bund yield was negative (i.e. you would expect a negative nominal total return if you bought the bond at the prevailing market price and held it to maturity), hitting a low of -0.1% in July 2012.

Obviously in 2012 in particular, the threat of a Eurozone breakup was at its height. Peripheral bond spreads had hit their widest levels (5 year Spanish CDS traded at over 600 bps in July 2012), and Target2 balances showed that in August 2012 German banks had taken Euro 750 billion of “safe haven” deposits from the rest of the euro area countries (mostly from Spain and Italy). So although the ECB refinancing rate was at 0.75% in July 2012 compared with 0.25% today, the demand for German government assets rather than peripheral government assets drove the prices of short dated bunds to levels which produced negative yields.

This time though, whilst the threat of a euro area breakup is much lower – Spanish CDS now trades at 80 bps versus the 600 bps in 2012 – the prospect of negative deposit rates from the ECB might produce different dynamics which might have implications for short dated government bonds. The market expects that the ECB will set a negative deposit rate, charging banks 0.1% to deposit money with it. Denmark successfully tried this in 2012 in an attempt to discourage speculators as money flowed into Denmark out of the euro area. Whilst the ECB refinancing rate is likely to remain positive, the cut in deposit rates might have significant implications for money market funds. David Owen of Jefferies says that there is Euro 843 billion sitting in money market funds in the euro area, equivalent to 8.5% of GDP. But what happens to this money if rates turn negative? In 2012, when the ECB cut its deposit rate to zero, several money market fund managers closed or restricted access to their money market funds (including JPM, BlackRock, Goldman Sachs – see FT article here). Many money market funds around the world guarantee, or at least imply, a constant or positive net asset value (NAV) – this is obviously not possible in a negative rate environment, so funds close, at least to new money. And if you are an investor why would you put cash into a money market fund, taking credit risk from the assets held by the vehicle, when you could own a “risk free” bund with a positive yield?

So whilst full blown QE may well be months off, if it ever happens, and whilst Draghi’s “whatever it takes” statement means that euro area breakup risk is normalising credit risk and banking system imbalances, the huge amount of money held in money market funds that either wants to find positive yields, or is forced to find positive yields by fund closures, makes it a puzzle as to why the 2 year bund yield is still above zero.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox