The BV comic

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

LATEST PODCAST

April 2024

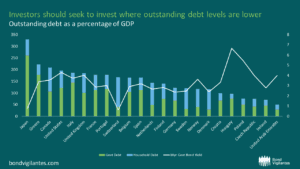

Debt Matters: Why It’s Time to Position Into Countries with Low Outstanding Debt

By Robert Burrows - 18 April 2024

In an era of economic uncertainty and volatility, the importance of managing national debt has never been more evident. Investors seek stability and long-term growth opportunities, so the spotlight turns towards countries with low outstanding debt.

March 2024

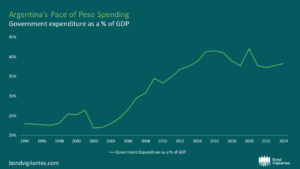

100 Days of Milei

By Michael Talbot - 19 March 2024

As Franklin D. Roosevelt took to power in 1933, the USA had just entered the fourth year of its Great Depression. Faced with such significant economic turmoil, Roosevelt had little choice but to begin implementing structural reforms within a very short timeframe, not just to galvanize the economy, but also to stamp his authority having just been elected to his country’s greatest position of power. Thus, the concept of a president’s ‘first 100 days’ was born.

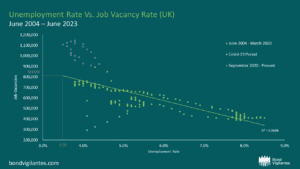

The Great Escape… of UK Unemployment Reporting

By Guest contributor: Alexander Zemek-Parkinson - 18 March 2024

The Bank of England Monetary Policy Committee potentially has a problem: it requires data to make its labour market forecasts and assessments, but the unemployment statistics have become increasingly unreliable. This is because the Labour Force Survey participation rate (on which the unemployment figures are based) has fallen below 50% since 2018 and has been as low as 15% recently[1]. What is the solution to this difficult measurement problem? An answer can be found in the classic war film, The Great Escape.

China: Supportive Policies Aim to Bolster Growth Amid Challenges

By William Xin, Director and Portfolio Manager, Fixed Income Asia - 11 March 2024

Since the onset of the year, Chinese authorities have embarked on strategic measures to stabilize the capital market and bolster economic growth. The People’s Bank of China (PBOC) has taken significant steps, including a 50 basis point cut in the reserve requirement ratio (RRR) – the largest since 2021 — followed by a historic 25 basis point decrease in the 5-year Loan Prime Rate (LPR). These policy actions have significantly boosted market sentiment, as reflected in the recent uplift in the Chinese stock market. These measures also align with our expectation of a supportive policy landscape in China for 2024.

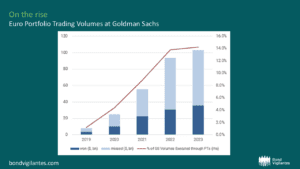

Portfolio Trading – Three key advantages for investors

By Craig Rumbelow - 5 March 2024

Portfolio Trading (PT) has seen a sharp rise in prominence over the last few years, establishing itself as an integral part of today’s world of credit trading. Thanks to improved integrated technology, fixed income dealers have made significant advances from the rudimentary embers of trading lists of bonds on spreadsheets over email. In a PT, a list of bonds is traded on an aggregated weighted average price or spread. This can be executed at any point in time, or against benchmark prices, such as the…

February 2024

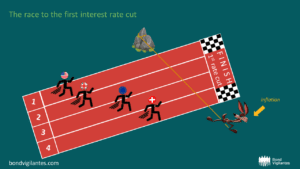

The interest rate cutting race – Ready, set, go!

By Mario Eisenegger - 26 February 2024

As we step into 2024, inflation figures have significantly decreased from their peaks, and inflation is continuing to make progress towards central banks’ inflation targets. With current interest rates kept in place, real policy rates are beginning to pose constraints on economies. Consequently, there is an anticipation of substantial interest rate cuts by major central banks in the developed world this year, opening the door for additional volatility in bond markets.

2024 The Year of the Wood Dragon: Breathing Fire into the Asian Credit Market

By Asia Fixed Income Team - 23 February 2024

The Chinese zodiac, a 12-year cycle that assigns animal signs to each lunar year, is a cornerstone of cultural tradition, intertwining with the five basic elements (wuxing 五行) of Metal (jin 金), Wood (mu 木), Water (shui 水), Fire (huo 火) or Earth (tu 土), to form a complex 60-year cycle. On February 10th 2024, we transitioned from the Water Rabbit to the year of the Wood Dragon.

The Traitors – can a game of human psychology draw parallels with bond markets?

By Eva Sun-Wai - 5 February 2024

After last week’s final of the second series of ‘The Traitors’, I have had endless conversations about the human psychology behind the decisions made; how the show could be a reflection of many elements of our society; and about how winning the game requires the most delicate balance of popularity, strategic thinking and perfect timing. I also couldn’t help thinking about how the show links to bond markets and behavioural finance when thinking of some of the shows’ key themes – herd mentality; deviating from…

Japan, the steep climb that’s about to flatten out

By Robert Burrows - 1 February 2024

The yield curve in Japan is reaching intriguing levels. The Bank of Japan (BoJ) has remained resolute, maintaining an ultra-accommodative monetary policy in a world aggressively hiking interest rates to stem inflation.