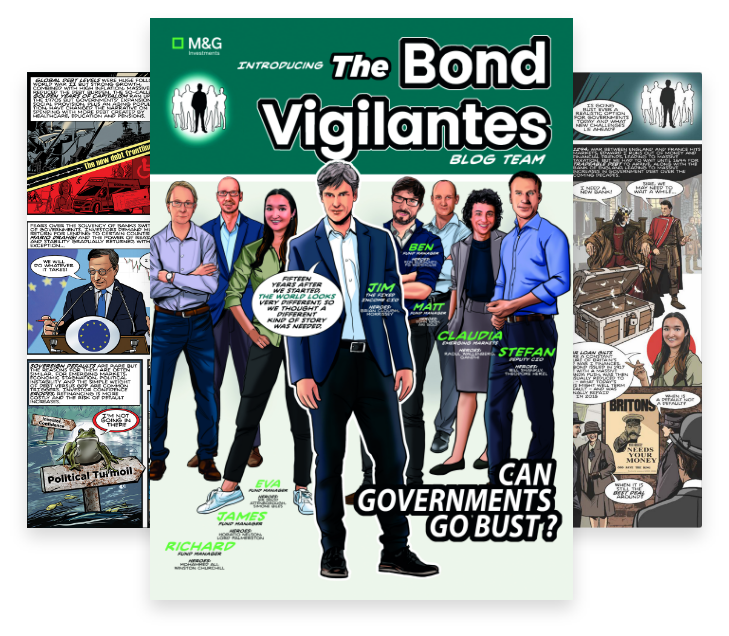

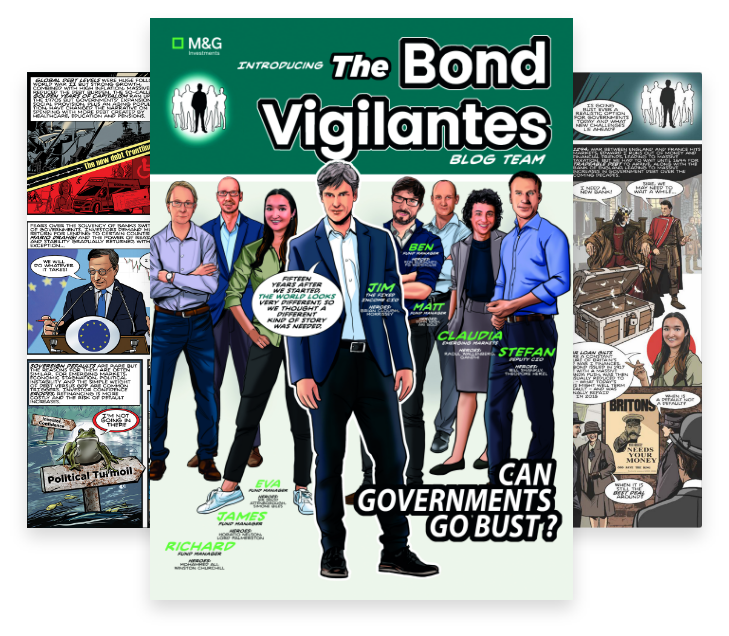

The BV comic

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

LATEST PODCAST

May 2024

If we are all dead in the long term, does it even matter?

By David Knee - 8 May 2024

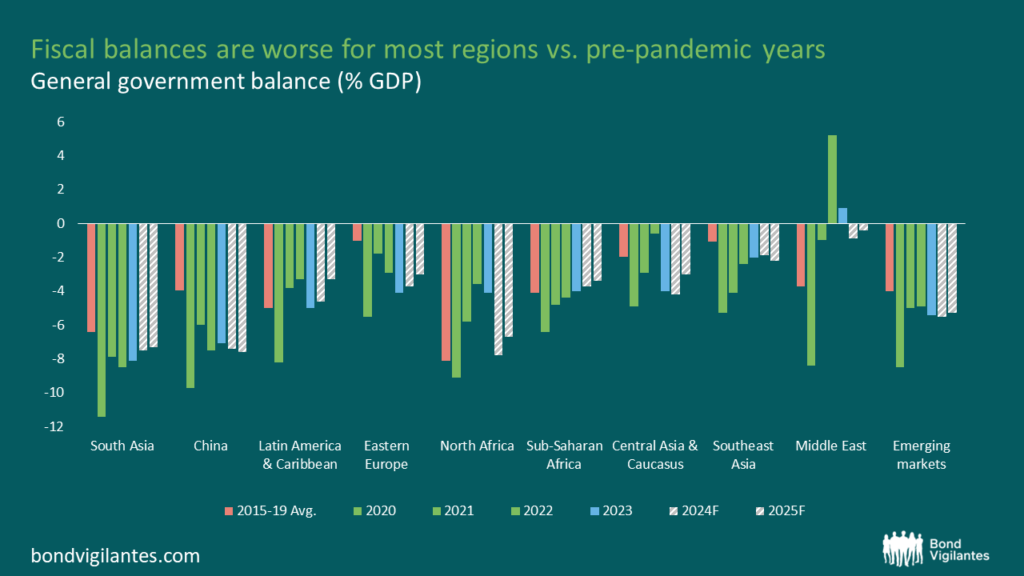

The IMF recently released their latest World Economic Outlook, subtitled “Steady but Slow”, which nearly characterises the prevailing macroeconomic wisdom that global growth is tepid but without drama, and will remain pretty much like this over their five year forecast horizon. The IMF note that growth would have been weaker still if it were not for US fiscal largess, where the deficit is still running at 6% of GDP and expected to remain there in coming years. If Trump returns, it might even accelerate. We…

April 2024

We need to talk about the 61s

By Robert Burrows - 30 April 2024

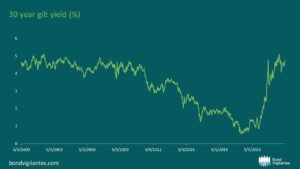

With interest rates having moved meaningfully higher over the last two years, fixed income investing has moved front and centre for investors. A favourite bond has been the low coupon 2061 maturity (UKT 0.5 2061). Why is this?

Gold prices: beyond inflation and real yields

By Robert Burrows - 25 April 2024

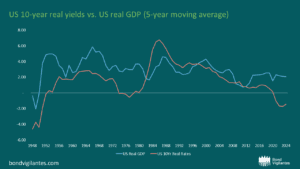

Renowned for its role as a hedge against economic uncertainty and inflation, gold has long captivated investors. One key factor influencing gold’s price is the relationship between real yields and inflation. Over the long term, gold has protected one against the pernicious effects of inflation and remains a powerful diversifier within an investment portfolio.

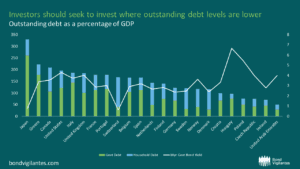

Debt Matters: Why It’s Time to Position Into Countries with Low Outstanding Debt

By Robert Burrows - 18 April 2024

In an era of economic uncertainty and volatility, the importance of managing national debt has never been more evident. Investors seek stability and long-term growth opportunities, so the spotlight turns towards countries with low outstanding debt.

March 2024

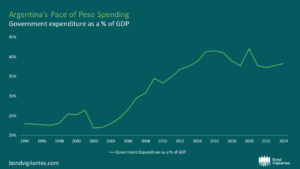

100 Days of Milei

By Michael Talbot - 19 March 2024

As Franklin D. Roosevelt took to power in 1933, the USA had just entered the fourth year of its Great Depression. Faced with such significant economic turmoil, Roosevelt had little choice but to begin implementing structural reforms within a very short timeframe, not just to galvanize the economy, but also to stamp his authority having just been elected to his country’s greatest position of power. Thus, the concept of a president’s ‘first 100 days’ was born.

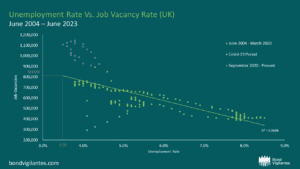

The Great Escape… of UK Unemployment Reporting

By Guest contributor: Alexander Zemek-Parkinson - 18 March 2024

The Bank of England Monetary Policy Committee potentially has a problem: it requires data to make its labour market forecasts and assessments, but the unemployment statistics have become increasingly unreliable. This is because the Labour Force Survey participation rate (on which the unemployment figures are based) has fallen below 50% since 2018 and has been as low as 15% recently[1]. What is the solution to this difficult measurement problem? An answer can be found in the classic war film, The Great Escape.

China: Supportive Policies Aim to Bolster Growth Amid Challenges

By William Xin, Director and Portfolio Manager, Fixed Income Asia - 11 March 2024

Since the onset of the year, Chinese authorities have embarked on strategic measures to stabilize the capital market and bolster economic growth. The People’s Bank of China (PBOC) has taken significant steps, including a 50 basis point cut in the reserve requirement ratio (RRR) – the largest since 2021 — followed by a historic 25 basis point decrease in the 5-year Loan Prime Rate (LPR). These policy actions have significantly boosted market sentiment, as reflected in the recent uplift in the Chinese stock market. These measures also align with our expectation of a supportive policy landscape in China for 2024.

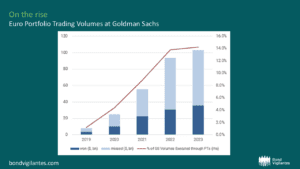

Portfolio Trading – Three key advantages for investors

By Craig Rumbelow - 5 March 2024

Portfolio Trading (PT) has seen a sharp rise in prominence over the last few years, establishing itself as an integral part of today’s world of credit trading. Thanks to improved integrated technology, fixed income dealers have made significant advances from the rudimentary embers of trading lists of bonds on spreadsheets over email. In a PT, a list of bonds is traded on an aggregated weighted average price or spread. This can be executed at any point in time, or against benchmark prices, such as the…