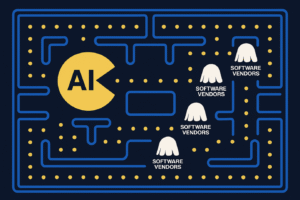

Agentic AI isn’t eating software – it’s feeding market volatility

By David Parsons - 19 February 2026

The sharp sell‑off across software names in recent weeks has prompted questions from investors, many centred on whether the rapid rise of agentic artificial intelligence marks the beginning of a deeper structural shift in enterprise technology. The catalyst was the latest demonstration from Anthropic’s Claude platform, whose new “Cowork” and “Code” capabilities promise to automate tasks that were once firmly in human hands, from drafting documents and synthesising research to generating production‑ready code. Equity markets were quick to draw conclusions, punishing enterprise software companies without…