January was a shocker. European high yield fell by 4.6%, the worst month since July 2002. This is particularly alarming considering that there weren’t actually any defaults. Meanwhile the US high yield market fell by a more modest 1.4%, not as bad as last November, but still the worst January since 1990.

Much of the weakness in high yield can be attributed to the sharp falls in equities, because the two markets are fairly closely correlated. The DAX fell by 15% in January, while the S&P 500 fell by 6%. The underperformance of the DAX no doubt has something to do with the underperformance of European high yield.

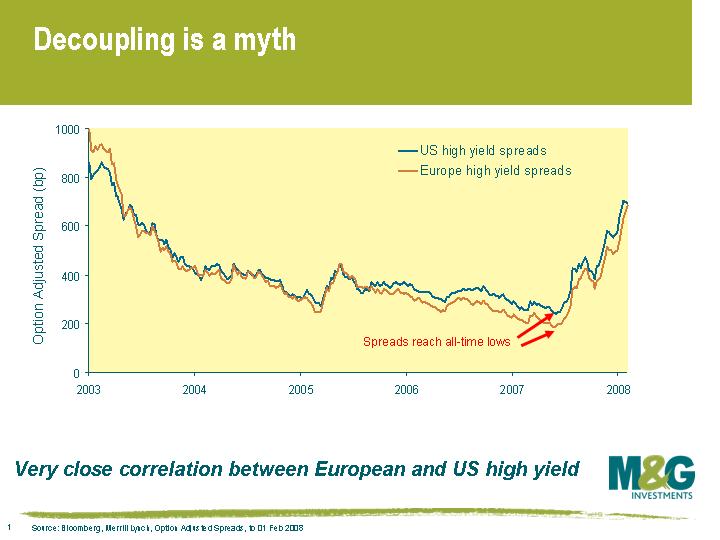

European underperformance was probably also due to the European high yield market having got slightly out of synch with the US in 2006-07. As the chart shows (click chart to enlarge), US and European high yield spreads have historically tracked each other very closely. In 2006-07, however, US high yield spreads crept above European high yield spreads, and the European high yield market had a bit of catching up to do.

European underperformance was probably also due to the European high yield market having got slightly out of synch with the US in 2006-07. As the chart shows (click chart to enlarge), US and European high yield spreads have historically tracked each other very closely. In 2006-07, however, US high yield spreads crept above European high yield spreads, and the European high yield market had a bit of catching up to do.

Sentiment in the high yield market remains poor, and the lack of risk appetite and the drop in demand for high yield bonds has meant that there has not been any issuance in the European high yield market for six months on the trot. However, European BB rated bonds now yield 5.5% over government bonds, and having contended for some time that high yield was an expensive asset class, I believe we have now reached levels that can be described as fair (or dare I say it, ‘attractive’) value.

Monoline insurers have become a very hot topic, and worries about their demise have made financial markets very jumpy. MBIA, the world’s largest monoline insurer, yesterday posted a Q4 loss of $2.3bn. Ambac, the second biggest monoline insurer, posted a Q4 loss of $3.3bn last week, and Fitch ratings agency reacted to cutting Ambac’s credit rating from AAA to AA (this is a very significant event – see below). Before explaining what’s going on with monoline insurers, it’s worth explaining what monoline insurers actually do.

The first thing a monoline insurance company needs is a AAA rating (ratings agencies need to be convinced the company has a solid business model, cutting edge risk systems, and sufficient capital for the risks inherent in the business). Then, the monoline insurance company insures a bond holder against the risk of the bond defaulting. If the bond defaults, the monoline insurer continues to pay the coupons of the defaulted entity as if the bond had not defaulted. The monolines’ reward for taking this risk is that they receive a slice of the coupon or interest payments that the bond holder receives. The monoline’s guarantee means that the bond is now effectively AAA rated, even if it may only have been single-A rated originally.This process is called ‘ wrapping’.

Monolines started off by wrapping US municipal bonds, local authority bonds or single company bonds. Munis and local authority bonds are attractive to wrap, because they offer a premium over US treasuries (they’re not explicitly guaranteed by the US government, and are often rated A and BBB). But as the monoline industry got more competitive and corporate bond spreads tightened, most monolines became more aggressive. Rather than just focusing on quasi-government bonds, monolines started wrapping ever more exotic bonds, to the point that some monoline insurers began wrapping structured credit exposed to the crumbling US sub-prime mortgage market.

That is really how we have ended up where we are today, in a pretty perfect vicious circle: as structured finance deals are downgraded, their monoline backers have to write down losses and themselves get downgraded. The wrapped CDO holder is now really no better off than the unwrapped CDO holder (in fact he’s worse off, as he’s paid away an insurance premium to the monoline at every coupon date!)

Monolines very quickly need an injection of capital from somewhere, otherwise they will be downgraded. And if they are downgraded, their business models cease to function (some lower rated monolines do exist, but only by insuring junk bonds rather than AAA rated bonds – after all, who would buy insurance on a AAA rated wrap when the insurance company itself is only ‘A’ rated?).

If the monoline insurers collapse, then investment banks will be in even deeper trouble than they are today. Many investment banks have bought protection from the monolines so that they can hedge structured credit exposure on their own balance sheets in order to insulate themselves from making losses. But if the monolines go bust, then the investment banks are left with a worthless insurance contract, and a whole lot more exposure to structured credit and sub-prime.

It’s not just the investment banks that would be in trouble. Monolines guarantee about $2.4 trillion worth of bonds with their AAA rating, and if the monolines are downgraded, then hundreds of thousands of other bonds would be downgraded too. This would spark a wave of forced selling from investors such as pension funds, and then we would see (yet another) wave of writedowns from the investment banks.

Do we think that the monoline business model will return to its operating state prior to the current crisis? Absolutely not. They are too highly levered, they don’t have enough capital for a AAA rating, and they don’t have enough capital to provide sufficient protection to investors. Their reputations are in tatters. But will they be allowed to fail totally? We don’t think so, because there are plenty of bond holders that have a very clear motivation to ensure that the monolines don’t disappear. In a rather bizarre twist, it looks like the investment banks are going to have to club together and rescue the companies from which they’ve bought insurance. If you like analogies, it’s a bit like taking out insurance on your home, only to find that when your house burns down, you have to give the insurance company a load more money to stop it from going bust.