Interest rates to fall? Not by much, if you believe the bond markets

Continental European economic data has held up reasonably well so far. Consumer and business confidence has been reasonably robust in countries such as France and Germany, although retail sales numbers released earlier this week were weaker than expected. The big problem for the euro area has been a worrying rise in inflation (European inflation reached 3.5% in March, the highest rate in 16 years and well above the 2% target), and this has meant that European bond markets have erased the rate cuts that were priced in only a few months ago.

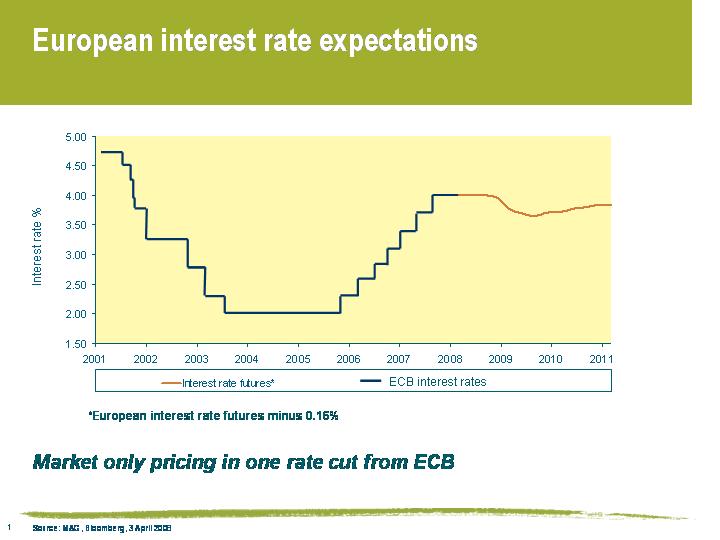

As this chart shows, European bond markets are now pricing in just one 0.25% rate cut* from the ECB, and this isn’t expected to occur until spring 2009.

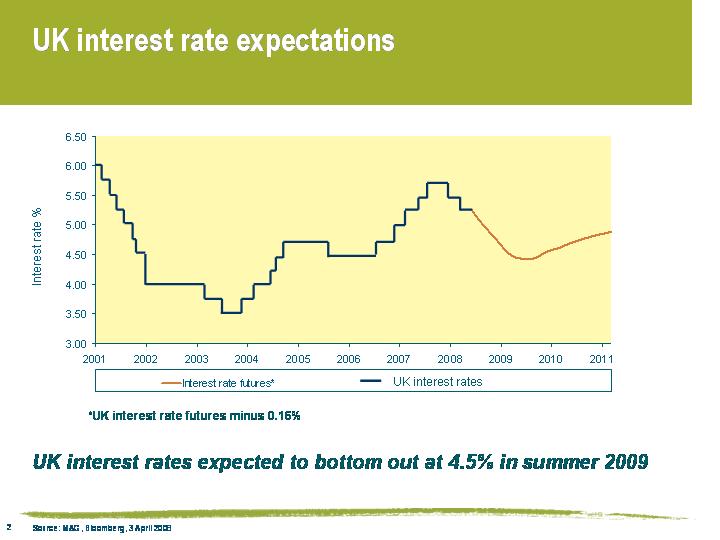

The UK bond market is being a little more aggressive, with three 0.25% rate cuts fully priced in by June 2009. This is because UK inflation is more under control that in Europe (prices in February were 2.5% higher than they were a year earlier), and because the UK economy is looking very vulnerable (figures from Nationwide show that UK house prices have fallen five months on the trot).

Do the UK and European bond markets’ expectations look reasonable?

If you believe that the effects of the credit crunch will be contained in the US, and that inflationary pressure will remain (or get worse), then yes. But if you buy into our view that economic growth is set to weaken (possibly dramatically), and that inflationary pressure will subside (see Jim’s recent article here), then good quality bonds look rather attractive right now.

*Historically approximately 0.16% has needed to be subtracted from UK and European interest rate futures to arrive at implied interest rate expectations. However, recent distortions in the money market have made interest rate futures analysis a little less reliable, particularly over the very short term. The market may therefore be pricing in slightly more in the way of rate cuts than mentioned above.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox