Quantitative easing – walking on custard

Economic theory is simple – increase the supply of something, and its price should fall. Therefore to increase inflation, reduce the value of money by simply printing it. If this excess money is spent on a limited supply of goods and services, then inflation should pick up strongly. However if the cash is not used,and instead sits in bank vaults or safe deposit boxes, then the inflationary impact should be negligible.

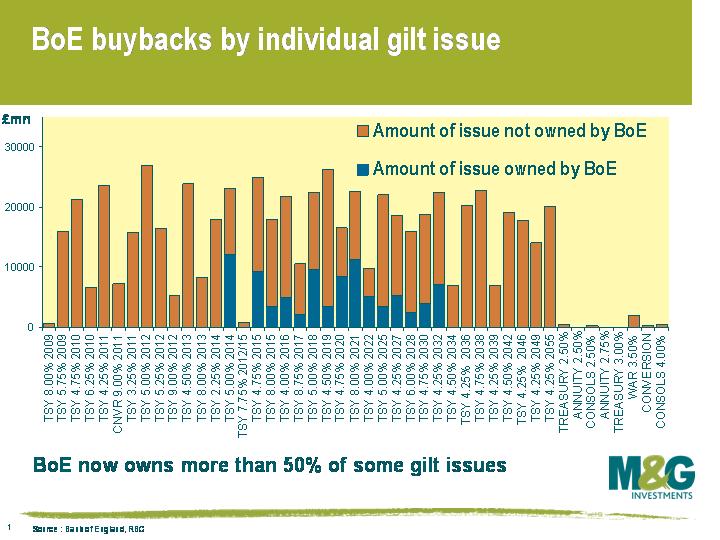

The Bank of England was initially granted permission to buy £150 billion worth of gilts. So far they have made strong progress and have bought a total of £107 billion in the last three months. In order to put that in context, £107bn equates to over 15 percent of the gilt market, a quite extraordinary number. In some individual gilts they own over 50% of the issue (see attached chart). This has the effect at least in the short term of moving gilt prices higher and yields lower, relative to where they would otherwise be.

The scale and pattern of these purchases has important implications for bond investors. As part of its operations, the BoE has been excluding short dated gilts (generally owned by overseas central banks) and ultra long gilts (generally owned by pension funds). The propensity of overseas central banks to recirculate cash into spending is low, while pension funds are facing a funding crisis that would be damaged further by long yields falling since this increases the present value of their liabilities. This focus of the BoE’s programme has therefore been on the middle of the curve. Gilts that have been included in the buyback basket have, for obvious reasons, traded expensively compared to ineligible gilts, distorting individual issues and the gilt curve.

This experiment is coming to the end of its first phase. £150 billion was originally approved, of which the Bank has said it would do an initial £125 billion. In tomorrow’s monthly monetary policy meeting, Monetary Policy Committee (MPC) members will be discussing the effectiveness of the policy so far, including whether to use their last £25 billion. It’s widely expected that they will do so – but more interesting will be the issue of whether they will ask permission from the Treasury to do more than the originally permitted £150 billion, and continue the experiment with unconventional policy.

Has the QE experiment worked so far? Sadly for the MPC, the effectiveness of quantitative easing is hard to measure, especially given the dramatically altering financial background. Presumably QE on this scale is a new intellectual challenge for the authorities. The aim of the policy is to use unconventional measures to hit the 2% inflation target in 2 years time, and presumably it is one that works with a lag, just like traditional interest rate driven monetary policy. We always say that traditional monetary policy takes about nine months to hit the real economy – if QE is similar (and who knows whether it is or not) then we wouldn’t expect to see any impact until December this year.

Does the committee continue with the unconventional policy measures until they work, or do they think the policy of QE isn’t having much effect? The crux of the problem they face, is that – in theory – providing liquidity should be inflationary, but the whole point of experiments is to see if theory works in reality. Liquidity has been added, but the effect might not be as expected. Liquidity in these conditions might not behave as you would expect. Is the value of money going to sink in a pool of excess liquidity or is it walking on custard?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox