Long dated UK inflation-linked gilts – possibly the most expensive bonds in the world

The new issue of an inflation-linked gilt maturing in 2050 a couple of weeks ago reminded me of an excellent three page paper that Larry Summers wrote in the mid 1980s (see here). In short, Summers invented what he called ‘ketchup economics’ and had a bit of a dig at economists working in the world of finance. Financial economists ‘work only using hard data and are concerned with the interrelationships between the prices of different financial assets. They ignore what seems to many to be the more important question of what determines the overall level of asset prices’. The so-called ketchup economists are much more concerned about ensuring that ‘two quart bottles of ketchup invariably sell for twice as much as one quart bottles of ketchup’ rather than asking themselves what the value of ketchup should fundamentally be.

This inflation-linked gilt maturing in 2050 was issued with a coupon of just 0.5%. It was expected to be an issue of £3-4bn, and seemingly appeared tasty to a number of investors since it was supposed to yield 1 or 2 basis points more than the 2055 IL gilt issue. However demand was large, and the book was £9bn. Ultimately £5bn of the bond was issued, with the bond actually yielding the same as the 2055 IL gilt (and 4bps less than the 2047 IL gilt). We didn’t buy any of it – we thought that the prospect of a total return (if held to maturity!) of 0.5% plus the inflation rate wasn’t particularly good value. In fact, considering that the cost of insuring against the risk of the UK government defaulting over only the next ten years was 50bps (as implied by 10 year UK CDS), the real yield on the bond wasn’t even compensating you for credit risk.

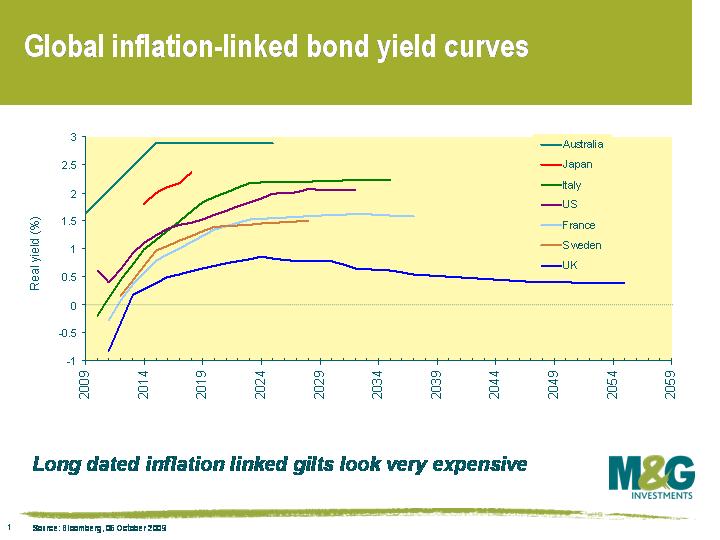

It’s not that all inflation linked bonds are unattractive. This chart shows how UK inflation linked gilt real yields compare to the other major linker markets around the world. So, for example, we thought that last week’s new issue of Australian inflation-linked government bonds maturing in 2025 with a real yield of almost 3% was much more attractive.

So why is the long end of the UK linker market so expensive? It’s basically to do with investors who have been forced to match assets with their liabilities (eg pension funds, insurance companies), and one of the best ways of matching assets with liabilities is with inflation linked bonds. As evidenced by spectacularly low yields on UK linkers, demand is clearly outstripping supply – in fact the yield on the 2050 UK linker finished yesterday at just 0.39%, a record end of day low. A pretty obvious fix to this distortion is for the authorities to issue more long dated linkers, and this does indeed seem to be gradually happening (£750m of the 2042 IL gilt is to be auctioned today, the first tap of this index-linked issue)

There’s another problem with long dated inflation-linked bonds that you’ve got to consider, and that’s the extremely long duration of these bonds. Duration is a measure of the sensitivity of a bond’s price to a change in its yield, or in the case of inflation-linked bonds, a change in the real yield. As can be seen from the chart above, the UK linker market has far more longer dated issues than other linker markets. The UK market in particular is getting longer and longer duration as a result of more and more long dated linkers being issued – the duration on the generic UK inflation linked index has extended out to 14.6 years.

Returning to the 2050 UK linker, the duration of the bond is almost 40 years. What that means is that its performance is going to be influenced much more by changes in the real yield rather than changes in the inflation rate. Real yields would rise if there was a detrimental change in the demand/supply dynamic, perhaps due to much more supply, change in regulations, better funded pension funds, or maybe just a rise in conventional gilt yields due to the unwind of Quantitative Easing (you may be surprised to know that linker yields are actually strongly positively correlated to conventional government bond yields).

The extremely long duration of some of these bonds means that investors could face huge capital losses. If the real yield on the 2050 linker (instantaneously) increases from 0.4% to 1.4%, bond maths says that its price falls from 104 to 72.6. If its yield rises by 200 basis points to 2.4%, its price falls to 51.2. This is certainly possible. Long dated UK real yields were above 2% as recently as 2003, and exceeded 4% in the mid 1990s. Long dated inflation-linked bonds could continue their meteoric rise if demand continues unabated, as seems likely over at least the short term. But for the reasons mentioned above, our UK inflation-linked bond fund has a large underweight to the long end of the UK linker market, and we also have a preference for inflation-linked corporate bonds. If you’re buying UK inflation linked bonds because you’re worried about changes in the inflation rate over the next couple of years, be aware that you may not be as well protected in longer dated linkers as you may have previously thought.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox